Will USDJPY Continue to Sell? Swing Trade Analysis Hey Rich Friends,

Happy Monday. I do think that USDJPY may continue to sell this week. This is only my technical analysis. Please check the news and cross reference the indicators you have on your own chart.

Here are the bearish (sell) confirmations that I see:

- Previous structure was broken to the downside with Friday's large red candle. On Monday, the candle also closed red. The break and retest to the downside is a sell confirmation for me.

- There is bearish confluence on the weekly, daily and H4 charts

- The stochastic is facing down, the slow line (orange) is above the fast line (blue) and one or both lines have crossed below 20. These are all bearish confirmations for me.

Additional information:

- You can wait for the newer structure to be broken again to confirm the sell.

- I will be using previous lows as my sell stops and TPs and previous highs for SL.

Only take trades that make sense to you.

Peace and Profits,

Cha

Multiple Time Frame Analysis

Long trade 📈 EURJPY — Buy-Side Sentiment Analysis (15-Minute)

Observed: Mon 26th Jan 2026

Session: London AM

Time Reference: 6:00 am (NY time)

📌 Trade Details

Entry: 186.241

Take Profit: 187.418 (1.86%)

Stop Loss: 185.954 (0.14%)

Risk–Reward: 12.89R

🟢 Directional Bias

Buy-side reversal → continuation:

Price action indicates a completed sell-side run, followed by institutional absorption and a controlled transition back into bullish order flow.

🧠 Market Sentiment Overview

An extended bearish leg engineered downside liquidity

Sell-side liquidity swept clean into the 182.00 handle

Aggressive rejection from the lows signals sell-side exhaustion

Buyers stepped in decisively → sentiment flipped from risk-off to accumulation.

🧩 Structural Context

Bearish structure completed its objective (equal lows / sell-side pool)

Sharp displacement higher confirms local bullish BOS

The market transitioned from deep discount back toward equilibrium

Structure now supports mean reversion higher, not continuation lower.

📊 Volume Profile & Value

Heavy volume absorption at the lows

Value began migrating higher post-sweep

Acceptance above in the raday value confirms a bullish auction response

🟦 PD Arrays / Fair Value Gaps

Multiple bullish FVGs formed on the impulse from the lows

Entry aligns with discount mitigation inside bullish inefficiency

No clean inefficiencies left below → downside fuel largely removed

⏱️ Session Behaviour

London AM delivered the true low of the move

Classic session profile:

Asia consolidates → London sweeps → expansion follows

NY continuation his ighly probable if the structure holds

🎯 Trade Logic

Sell-side liquidity fully taken

The market showed immediate bullish displacement

Pullbacks are shallow and supported

Buyside liquidity resting above prior highs acts as a magnet

⚠️ Invalidation Criteria

Failure to hold above the reclaimed structure

Bearish displacement back into discount

Acceptance below post-sweep low

Until then, buy-side bias remains valid.

🧾 Summary

EURJPY shows buy-side sentiment following a completed sell-side liquidity sweep and strong bullish displacement. Absorption at the lows and acceptance back above the value support mean reversion toward premium liquidity.

XAU/USD 27 January 2026 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

As per analysis dated 22 January where I mentioned price could potentially continue bullish is how price printed.

CHoCH positioning has again been brought closer to current price action and is denoted with a blue dotted line.

Price is trading within an internal low and fractal high.

Intraday expectation:

Price to print bearish CHoCH to indicate bullish pullback phase initiation. Thereafter price to react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 5,111.510.

Alternative scenario: Price could potentially continue bullish.

Note:

The Federal Reserve’s renewed easing cycle, alongside a weaker U.S. dollar and persistent geopolitical tensions, continues to drive volatility in the gold market.

Traders should remain cautious and adjust risk management strategies to navigate sharp price swings.

Additionally, gold pricing is highly sensitive to U.S. policy under President Trump, where tariff measures, fiscal uncertainty, and shifting geopolitical strategy amplify market repricing risks and reinforce safe‑haven demand.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed according to yesterday's analysis dated 26 February by printing a bearish CHoCH, to indicate, but not confirm bearish pullback phase initiation.

Price is currently trading within an established internal range.

Intraday expectation:

Price to trade down to either M15 demand zone, or discount of 50% internal EQ before targeting weak internal high, priced at 5,111,510.

Alternative scenario: Price could potentially print a bearish iBOS as all HTF's require pullback.

Note:

Gold continues to exhibit elevated volatility as markets digest the Federal Reserve’s ongoing dovish tilt and persistent global geopolitical tensions.

With uncertainty remaining a dominant theme across global risk assets, traders should prioritise disciplined risk management, as abrupt price swings and liquidity pockets may become increasingly common.

Furthermore, recent tariff announcements from President Trump, particularly those directed at China, have added another layer of instability to the macro landscape. These policy developments have the potential to intensify market turbulence, heighten risk‑off flows, and trigger sharp intraday reversals or whipsaw‑like behaviour in gold.

M15 Chart:

NZDJPY: Bullish Outlook Explained 🇳🇿🇯🇵

NZDJPY is going to rise more after a confirmed bullish change of character

on an hourly time frame.

I expect a bullish movement at least to 92.485 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

S&P 500 - High Probability Bullish PlayLow Resistance Liquidity Run Throughout Monday's Price Action.

Down Close Candles Supports Bullish Narrative

In Line With Bullish Play For Nasdaq Called 4 Days Ago (Still Active Trade Setup)

$6,997 In The Cards

$7,036 All-Time Highs Is Final Terminus

Beneficial For Short-Term Traders

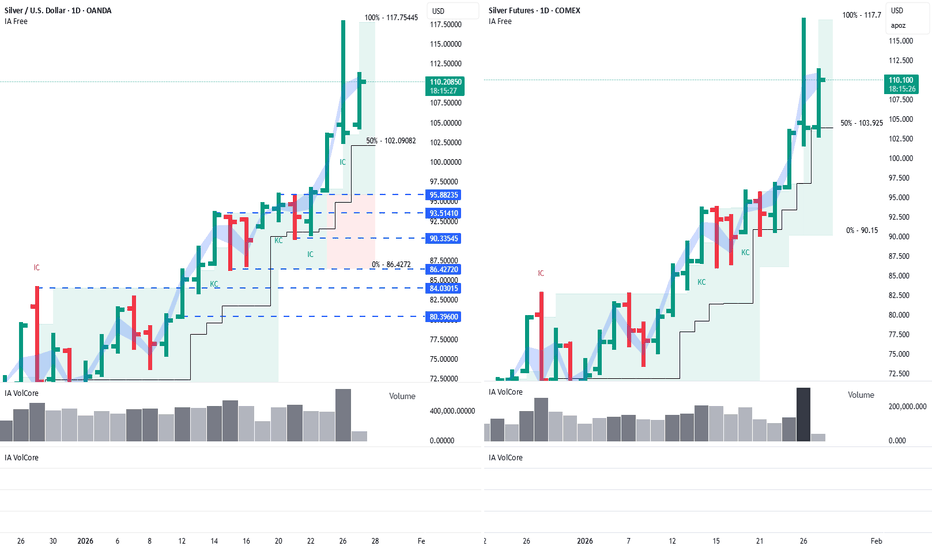

Silver: Record volume —consolidation and correction likelyHi traders and investors!

On January 26, trading volume on OANDA reached an all-time high — such volume has never been recorded there before. On COMEX futures, a higher volume occurred only twice, once in 2020 and once in 2021.

Considering this volume and the structure of the daily candles (with the main volume accumulated in the upper part of the range), there are reasons to believe that the price is close to a high, where the market may enter a phase of consolidation, followed by a correction.

Based on the CFD chart (on the left), two potential correction zones can be identified:

First correction zone: 96–90

Second correction zone: 86.5–80

Profitable trades!

This analysis is based on the Initiative Analysis (IA) method.

WTI: False breakout above the range — seller priorityHi traders and investors!

On the 4-hour timeframe, a false-breakout pattern has formed above the upper boundary of the range.

The chart shows that key volume was accumulated above the range high (highlighted by the blue band), after which the price returned back into the range.

The seller initiative is currently active. The initiative target is 59.068, which aligns with a daily level, adding confluence to the scenario.

In the current context, it makes sense to look for short (sell) patterns.

Profitable trades!

This analysis is based on the Initiative Analysis (IA) method.

BITCOINI believe Bitcoin is brewing up a couple of big moves for this year. However, I also think that it's going to trick a lot of people before the true move takes place.

I analyze four "main charts" for directional bias, and I use the others as fillers. Currently, I'm getting half & half with my bias, where two is telling me bear and the other two is leaning towards bull. The two smallest TFs is bear at the moment, and I'm viewing that as a precursor for what's to come in the future.

In my opinion, Bitcoin's price must bleed before the next bull run takes place. Price action is near not only the daily low, but it's hovering over the current weekly & monthly low, too! I would like to see the bulls takeover on the daily and weekly TFs in order for price to rally to the highs, but only for it to run into huge bear barriers.

Bear Barriers:

1. Monthly IMB (untouched)

2. 3M wick (untouched)

3. Bear range ($130K - $160K)

4. S/R ($122,100K)

If the bears do come into the market around the $130K - $160K range, I'm anticipating a massive drop in price around $40K - $60K. Sounds crazy right?! I have my reasons why, but I'll keep it close to the chest until things starts to unfold with this crypto.

In conclusion, I'm currently stuck in the middle with my bias until the two smallest TFs flip back to bull, but price can throw a curve ball and demolish the monthly low to turn it bear... we shall see how this plays out, and I'll share my thoughts as it progress.

MRNA Story - On A Smaller ScaleIn continuation of the previous idea, I wanted to cover the shorter time frame move on $NASDAQ:MRNA.

Really, this is a more simple analysis as the base is clearly set on the weekly chart. I should note I have analyzed the consolidation on the 2-Week time period. The 2-Week time period does also give a range expansion signal, but for a more detailed look I am showing the 1-Week time period.

With the current base, and a measure of this consolidation range (from low to high), a first target of $42.76 can be obtained. If the trend continues in a really strong fashion, a second target of $68.17 would look to be hit. Sometimes when an explosive move like this happens, a retest of the mode can occur like in the example path shown below. However, just as the continuation of this trend remains to be seen, so does any retest of this move. Make bets accordingly.

Whether the trend continues, and how strong it remains, of course is yet to be determined. But this analysis allows for educated guesses to be made and positions to be taken.

Best of luck to all of us who are entering positions and looking for continuation of this trend reversal play.

Pasting the regular weekly chart (no path) here:

Enjoy,

Reagen

XAUUSD - Post London Session, Pre New York (Jan 26)Gold finally broke above 5000 this morning.

Asia session:

Price opened with a gap up into 5015 and continued higher, pushing into 5092 to form the Asia high before pulling back into the 5050 support area.

London session:

Price broke above the Asia high and extended into 5111, but was rejected and fell back below. Since then, it has been ranging between 5075 and 5096.

Heading into New York, here’s what I’m watching:

• A clean break and close above 5097 would open the door toward the 5115 area.

• A break and close below 5078 would shift focus to the 5055–5058 support zone.

• Momentum remains strongly bullish, but there are large gaps and price is extended, so patience and confirmation are key.

• A loss of the 5055–5058 area would expose the 5030 support next.

Let price come to the levels. No rush, no FOMO - clean structure first.

Eurusd just got outside of the consolidationOn w

After a really long consolidation, seem that the market finally got outside of the range but

is it going to stay bullish or is gonna reverse?

who gonna win in the end? the bulls or the bears?

To be honest, i do have no idea, but in the video i have explained 2 scenarios i am looking to trade, so... watch it all

AUDCAD - BullishPrice is pushing higher with rising volume, and for now I’m simply watching the show. I expect sell-side liquidity to be taken as price works toward midweek objectives.

If bears step in and bring price back into discounted territory, I’ll shift focus to how it distributes and forms a corrective structure. Otherwise, I’m content sitting on my hands and letting price do the work.

Nothing forced.

Patience is key. Tracking is the edge. Let’s go.

USDCAD - BullishFrom my perspective, higher-timeframe structure has flipped, with sellers taking control. Price has shown a clear shift in market character, breaking the prior major higher low and establishing downside intent.

From here, I’m watching for a strong HTF lower high to form, which would keep price aligned toward continuation to the lows. Until that develops, I’m simply reading the tape and tracking behavior.

Nothing forced.

Patience is key. Tracking is the edge. Let’s go.

LONG ON AUD/JPYThe Jpy Index pushed up on Friday but is now starting to retrace/pullback/correct or fall.

We have a nice choc (change of character) from down to up on AJ on the 15min timeframe.

I expect price to drop first to 106.392 then rise.

This is a buy limit order. I will be looking to catch 100-200 pips.

NZDJPY Market OutlookMarket cycles and price patterns tend to repeat across global financial markets. For patient traders with a keen eye, these recurring structures often create opportunities for asymmetric risk-reward trades.

During 2024 and into 2025, the Japanese Yen strengthened significantly against major global currencies. A combination of rate hikes, tariff pressures, and heightened geopolitical risk weighed heavily on risk-sensitive currencies, pushing the New Zealand Dollar lower against the Yen.

This sustained decline in NZDJPY created a clear market imbalance in the 94–95 price region—an area that price had not fully mitigated during the selloff. Historically, NZDJPY has displayed a recurring behavioral pattern:

a sharp impulsive decline, followed by a slow and extended corrective recovery, and eventually another leg lower.

April 2025 marked the conclusion of the bearish impulse and the beginning of a corrective bullish phase. Since then, price has been gradually recovering, consistent with prior corrective structures observed on this pair.

At present, NZDJPY appears to be targeting the 95–97 zone to complete the mitigation of the previously formed imbalance. This area represents a critical decision point. Should price complete the correction as expected, the broader structure favors a continuation lower, with downside targets aligned toward the fair value gap near the 78 handle.

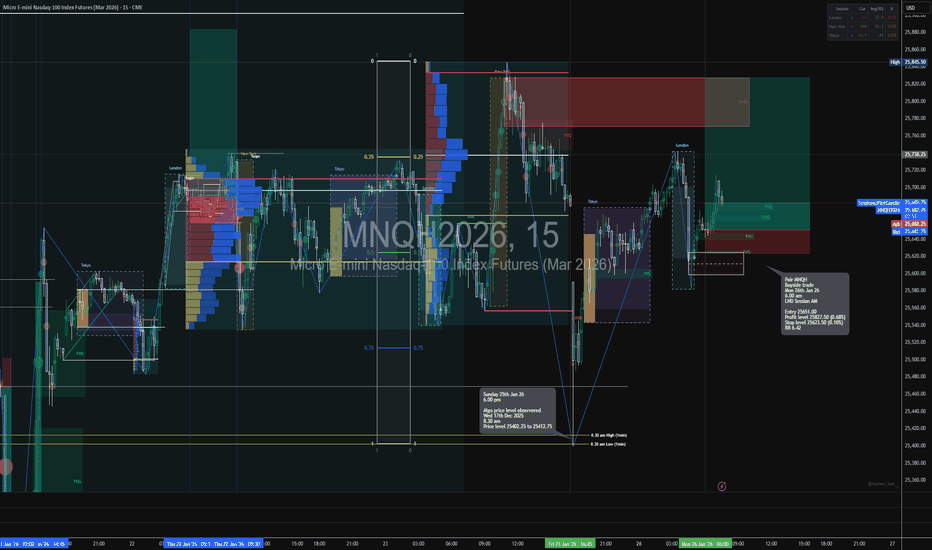

Long trade

Trade Details

Entry: 25,651.00

Take Profit: 25,827.50 (0.68%)

Stop Loss: 25,623.50 (0.10%)

Risk–Reward: 6.42R

🟢 Directional Bias

Buy-side continuation:

The market shows acceptance back above intraday value following a sell-side liquidity purge, indicating bullish order-flow control.

🧠 Market Sentiment Overview

Early session weakness engineered sell-side liquidity

Sharp rejection from the lows confirms sell-side absorption

Subsequent impulsive moves higher signal institutional accumulation

This is a re-accumulation after a stop-run.

🧩 Structural Context

Sell-side liquidity swept below the Asian range

Immediate displacement higher created a bullish BOS

Price transitioned from discount → equilibrium → premium

Structure supports continuation higher, not mean reversion lower.

📊 Volume Profile & Value

Reclaim of intraday POC / value low

Acceptance above the value confirms a bullish auction

Volume shifts higher → value following price.

🟦 PD Arrays / Fair Value Gaps

Entry aligned with a bullish FVG inside discount

Clean mitigation followed by continuation

No inefficient gaps left below → downside fuel reduced.

⏱️ Session Behaviour

London AM delivered the liquidity sweep + reversal

Follow through into NY, the overlap is likely.

classic London manipulation → NY expansion profile.

🎯 Trade Logic

Sell-side liquidity cleared early

Market reclaimed value with displacement

Buyers defended pullbacks aggressively

Buyside liquidity resting above prior highs.

⚠️ Invalidation Criteria

Failure to hold above the reclaimed value

Bearish displacement back into discount

Until then, buy-side bias remains intact.

🧾 TradingView-Ready Summary

MNQH shows buy-side continuation following a sell-side liquidity sweep and strong bullish displacement. Acceptance above value and clean FVG mitigation support further upside expansion.

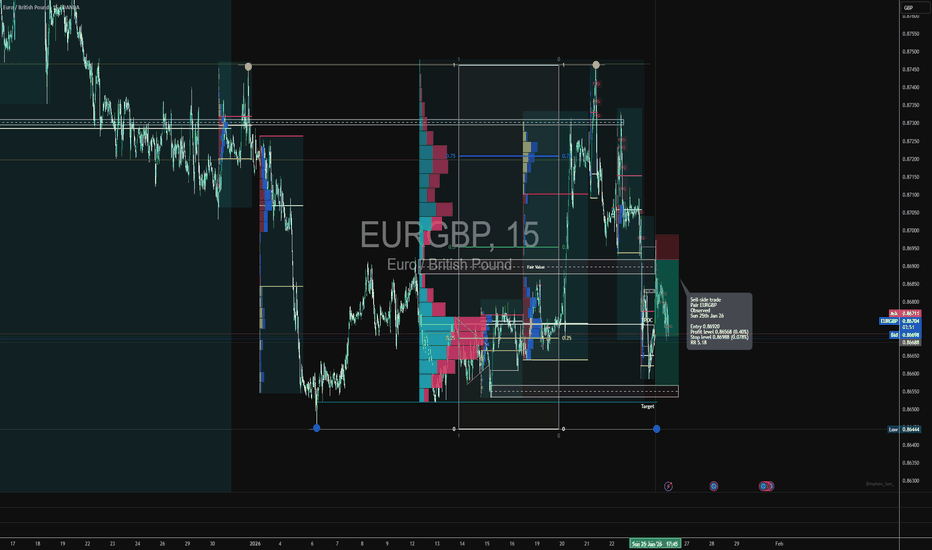

Short trade

Trade Details

Entry: 0.86920

Take Profit: 0.86568 (0.40%)

Stop Loss: 0.86988 (0.078%)

Risk–Reward: 5.18R

🔴 Directional Bias

Sell-side continuation: Price action confirms a bearish intraday narrative, with downside liquidity acting as the dominant draw.

🧠 Market Sentiment Overview

Bullish attempts were absorbed, not accepted

Buyers failed to hold above fair value → transition back into discount

Market sentiment shifted from responsive buying → aggressive selling

This is a distribution into weakness, not a healthy pullback.

🟦 Fair Value / PD Array Confluence

Entry aligned with fair value/equilibrium zone

Rejection from ~0.50–0.75 range confirms premium sell

Clean displacement away from value supports continuation.

⏱️ Session Behaviour

Sell-side expansion aligns with thin liquidity conditions. No impulsive reclaim back into range

We assume this indicates smart-money distribution and not stop-run noise.

🧩Structural Context

Prior range high sweep (buyside liquidity) failed

Subsequent lower high formed beneath key intraday resistance

Breaking back below the fair value confirmed bearish order-flow control.

🎯 Trade Logic

Liquidity run completed on the upside. The market failed to sustain acceptance above the resistance. Sellers stepped in aggressively at value. Downside liquidity remains unswept → natural price magnet.

⚠️Invalidation Criteria

Sustained acceptance back above the value / POC

Strong bullish displacement reclaiming prior highs

Until then, sell-side bias remains valid.

🧾 Summary

EURGBP shows clear sell-side sentiment following a failed buyside sweep and rejection from value. Acceptance below POC confirms bearish order flow, with downside liquidity acting as the primary driver.

Long trade

15min TF overview

Pair: XRP

Bias: Buy-Side

Date: Sun 18th Jan 2026

Time: 7:00 PM

Session: NY Session pm

Execution TF: 15-Minute

Model: Liquidity Mitigation → Expansion

🟥 EXECUTION & RISK

Entry: 1.8551

Stop Loss: 1.8417 (tight invalidation below demand)

Take Profit: 2.4148 (premium liquidity objective)

Risk–Reward: 41.77R

Sentiment & Market Narrative — Buy-Side Bias

Market sentiment at the time of entry was decisively bullish, with XRP transitioning from a distribution phase into an expansion phase following a prolonged consolidation period.

Price had already completed a higher-timeframe markdown and re-accumulation, evident through compression, declining volatility, and repeated defence of discounted price levels. Sell-side liquidity had been sufficiently mitigated, reducing the downside incentive and shifting the market’s draw toward buy-side objectives that rested above prior highs.

From a session perspective:

Tokyo and London sessions maintained a tight range, absorbing residual sell pressure.

New York PM acted as the expansion catalyst, breaking internal structure and confirming bullish intent.

The entry occurred in a discounted region, aligned with a balanced price range and internal inefficiencies, providing optimal asymmetric conditions. The shallow stop placement reflects strong underlying demand, while the projected upside targets premium liquidity pools and higher-timeframe inefficiencies.

Broader sentiment supported risk-on continuation, with price behaviour suggesting smart-money positioning ahead of a larger impulsive move rather than reactive short-covering.

BTCUSDTTRADING SCENARIOS ANALYSIS

MARKET DYNAMICS

Bitcoin showing strong institutional accumulation with clear bullish

structure across multiple timeframes. 1w timeframe displays massive

bullish OB (62737.20-48888.00) with 36.39% volume, indicating major

smart money positioning. Recent price action: 4-candle bullish rally

from 90469.70 to 96828.10 (+6.96%) with BOS confirmations on 8h

(94555.00) and 4h (94760.30). Current price at 96828.10 is 90.5% into

24h range, suggesting short-term overextension. Triple OB confluence

at 89-90k zone (1w/8h/4h) provides strong institutional demand. Price

broke above 8h core cluster (96345.75) and currently testing 4h

cluster lower boundary (99100.88). Multi-timeframe bias neutral (0%

strength) indicates consolidation phase, but higher timeframe

structure (1w/1d) remains bullish. ATR at 2453.98 (2.53%) shows

healthy volatility for position sizing.

RISK FACTORS

1. Price overextended at 90.5% of 24h range - pullback likely before

continuation

2. Bearish FVG confluence at 112330.93 (1d/8h/4h) creates resistance

zone 16% above current price

3. 1d bearish OB at 126208.50-123018.50 with 30.20% volume caps upside

at +28.7%

4. Recent bearish candle on 1d timeframe shows profit-taking after 4-day

rally

5. Multi-timeframe bias neutral (0%) indicates lack of immediate

directional conviction

6. 4h timeframe shows bearish structure bias with recent BOS at 98888.80

7. Low volume on last 1d candle (60026.83) compared to rally average

(169k-200k) suggests weakening momentum

RECOMMENDED TRADING APPROACH

--- ENTRY ZONE STRATEGY ---

The optimal entry zone spans 89242.00-94413.40, with the sweet spot at

92258.00 (bottom of 1d bullish FVG). This range represents a critical

institutional demand confluence: (1) 1w Bullish OB (62737.20-48888.00)

with massive 36.39% volume showing major accumulation, (2) 8h Bullish

OB (90790.00-89242.00) with 19.03% volume as nearest demand, (3) 4h

Bullish OB (90790.00-89242.00) with strongest 50.19% volume, and (4)

1d unmitigated Bullish FVG (94413.40-92488.00) created during recent

rally. The cross-timeframe cluster at 88472.06 (1w/8h/4h confluence

with 19.33 total strength) anchors this zone. Positioning strategy:

Set limit orders in layers - 30% at 94413.40 (FVG top), 40% at

92258.00 (FVG optimal/8h FVG bottom), 30% at 89242.00 (OB bottom/swing

low). This captures institutional retest while managing risk if price

doesn't retrace fully. Current price at 96828.10 is 4.48% above

optimal entry, requiring patience for pullback.

--- TRIGGER LEVEL ---

Trigger level at 92488.00 represents the BOTTOM of the 1d bullish FVG

(94413.40-92488.00) and aligns with the 8h bullish FVG bottom

(94413.40-92258.00). This is NOT a breakout level - it's a RETEST

confirmation point. Expected price action: Wait for price to retrace

from current 96828.10 and CLOSE BELOW 94413.40 on 4h timeframe,

confirming entry into the FVG retest zone. Ideal trigger: 4h candle

closes between 92258.00-94413.40 with bullish rejection wick (showing

demand), then enter on next candle open. Alternative aggressive entry:

Price touches 92488.00 with strong bullish engulfing on 1h/4h. DO NOT

chase current price - wait for institutional retest of demand zone.

The 1d FVG remains unmitigated, making this a high-probability retest

target.

--- INVALIDATION CONDITIONS ---

Scenario remains valid above entry as long as price stays above

86355.00. However, if price fails to retrace into entry zone

(89242.00-94413.40) and instead breaks above 99100.88 (4h cluster

center) with strong momentum, consider this a missed opportunity - DO

NOT chase. Re-evaluate if price reaches 102509.10 (4h bearish FVG)

without retest, as this indicates stronger-than-expected momentum that

bypassed institutional demand zone.

EXACT invalidation: 4h candle close below 86355.00 (4h swing low from

index 367). This level sits below the triple OB confluence zone and

represents structural breakdown. Additional invalidation: Close below

87688.00 (4h swing low from index 265) on 4h timeframe with volume

spike suggests bearish CHoCH forming. Partial invalidation: Wick below

89242.00 that closes back above is acceptable (liquidity sweep), but

close below 89242.00 on 4h reduces probability to 50% - tighten stop

to 87688.00.

Critical structural invalidations: (1) Bearish CHoCH on 4h breaking

below 89242.00 with 2+ consecutive closes, (2) 8h timeframe forms

bearish BOS breaking 89242.00 swing low, (3) 1d timeframe closes below

91011.00 (previous day's low), creating lower low and negating bullish

structure, (4) Higher timeframe conflict: 1w closes below 86760.00

(recent swing low), invalidating entire bullish thesis. Monitor 4h

retracements: if price retraces beyond 61.8% of recent rally (below

91252.50) without bullish reaction, structure weakens significantly.

--- POST ENTRY MONITORING ---

• 94760.3: 4h BOS level and recent swing high - first resistance after

entry

→ Action: Monitor for clean break above with volume. Failure to

break suggests ranging - consider partial profit at entry +2%

• 98888.8: 8h bearish BOS level and 4h historical resistance - key

breakout point

→ Action: CRITICAL: 4h close above this level confirms bullish

continuation. Move SL to breakeven. Rejection here may cause

retest of entry zone

• 99100.88: 4h cluster center with 13.2 strength - major resistance

zone

→ Action: Strong resistance. Watch for consolidation 96k-99k. Break

above with volume targets 102k. Failure may trigger pullback to

94k

• 102509.1: 4h bearish FVG bottom - institutional supply zone entry

→ Action: Expect initial rejection. Clean break confirms strong

momentum. Move SL to 94760.30 and take 40% profit at TP1

(107211.50)

• 107211.5: TP1 - 1d swing low / 8h swing high confluence with 2.8

cluster strength

→ Action: Take 40% profit. Major liquidity zone. Monitor for

rejection or consolidation. Break above targets 111959.50

• 111959.5: TP2 - 1w swing high and 1d BOS level - institutional

resistance

→ Action: Take 30% profit. Strong resistance. Monitor 1d timeframe

for bearish reversal patterns. Break targets 124k

• Entry confirmation: Look for volume spike (>100k on 4h) when price

enters 89-94k zone, indicating institutional buying

• Breakout validation: Volume must exceed 150k on 4h when breaking

98888.80 (8h BOS) to confirm continuation

• Momentum divergence: If price makes higher highs above 99k but 4h

volume declining (<80k), warns of exhaustion - tighten stops

• 1d timeframe: Monitor daily volume - sustained rally needs >150k

daily volume. Drop below 100k suggests consolidation incoming

• Relative volume: Compare current 4h volume to 20-period average.

Break above 98888.80 needs 1.5x average volume minimum

• Bullish: 4h closes above 98888.80 with strong body (>60% of candle

range) and volume >150k

• Bullish: Price consolidates 96k-99k for 2-3 days then breaks above

99100.88 with volume expansion

• Bullish: 1d timeframe forms bullish engulfing above 97932.10 (recent

high) with volume >180k

• Bullish: 8h forms higher low above 94760.30 then breaks 98888.80 -

confirms uptrend continuation

• Strong bullish: Price gaps up through 99100.88 on 1d open,

indicating institutional FOMO - targets 107k directly

• Bearish: 4h forms lower high below 96988.00 with bearish engulfing -

warns of distribution

• Bearish: Price fails to break 98888.80 after 3+ attempts, forming

triple top - exit 50% position

• Bearish: 1d closes below 95375.20 (previous day close) with volume

>150k - bearish CHoCH forming

• Bearish: 4h breaks below 94413.40 (FVG top) with volume spike -

retest failed, exit remaining position

• Critical bearish: 4h closes below 92488.00 (entry trigger) -

immediate exit, structure compromised

• Scale 1 (40% position): TP1 at 107211.50 when price closes above

102509.10 on 4h - locks 16.3% gain from optimal entry

• Scale 2 (30% position): TP2 at 111959.50 when price closes above

107211.50 on 1d - locks 21.4% gain, total 37.7% realized

• Scale 3 (30% position): TP3 at 124545.60 or trail stop at -8% from

highest high after 111959.50 break - targets 35% final gain

• Alternative: If price consolidates at 107k-112k for >5 days,

consider taking 50% profit and trailing stop to 102509.10

• Risk management: Never let winner turn to loser - if price returns

to entry +5% after reaching TP1, close remaining 60% position

• Initial SL: 86355.00 (4h swing low) - risk 6.79% from optimal entry

at 92258.00

• After 98888.80 break: Move SL to breakeven (92258.00) - eliminates

risk, locks breakeven

• After 102509.10 break: Move SL to 94760.30 (4h BOS) - locks minimum

2.71% gain

• After TP1 (107211.50): Move SL to 99100.88 (4h cluster) - locks

7.42% on remaining 60%

• After TP2 (111959.50): Move SL to 105399.60 (4h bearish OB) - locks

14.25% on final 30%

• Trailing stop: After 111959.50, use 8% trailing stop from highest

high on remaining position

• 1w: Monitor weekly close - must stay above 90964.40 (recent low) to

maintain bullish structure. Close below 86760.00 invalidates entire

setup

• 1d: Check daily for bearish CHoCH - close below 95375.20 warns of

reversal. Bullish continuation needs daily closes above 96828.10

• 8h: Key timeframe for momentum - must see BOS above 97932.10 within

3-5 candles after entry for confirmation

• 4h: Primary management timeframe - all stop adjustments based on 4h

closes. Monitor for bearish CHoCH below 94760.30

• 1h: Use for entry timing only - look for bullish rejection wicks at

92258.00-94413.40 zone on 1h for precise entry

BNBUSDT M15 HTF Supply Reaction and Bearish Continuation Setup📝 Description

BNB has pushed into a short-term premium zone after a corrective bounce and is now showing hesitation below a 15-minute Fair Value Gap. The recent upside move lacks strong bullish continuation, and price is reacting from a supply-aligned area, increasing the probability of a downside rotation.

________________________________________

📉 Signal / Analysis

Primary Bias: Bearish below the 15m FVG and intraday highs

Preferred Setup:

• Entry: 872.61

• Stop Loss: Above 874.33

• TP1: 870.90

• TP2: 868.10

• TP3: 864.90

________________________________________

🧠 ICT & SMC Notes

• Price reacting from 15m FVG in premium

• Weak bullish follow-through after mitigation

• Internal buy-side liquidity already tapped

• Downside targets aligned with BPR and lower imbalance zones

________________________________________

📌 Summary

As long as price remains capped below the 873–874 resistance area, the bearish continuation scenario remains favored. Current price action suggests a corrective pullback has likely completed, with expectations of a rotation toward lower liquidity pools.

________________________________________

🌍 Fundamental Notes / Sentiment

No strong bullish catalyst is currently present for BNB, and broader crypto sentiment remains vulnerable to short-term pullbacks. This environment supports mean-reversion and liquidity-driven downside moves rather than sustained upside continuation.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Watch out level 80 on RIVER !The uptrend appears increasingly extended after a prolonged impulsive move, with price trading far above the value area indicated by the volume profile.

Short-term price action shows slowing momentum and smaller candle bodies, suggesting buyer fatigue. Still, the structure remains technically valid as long as the 80 level holds as support. This zone aligns with a prior resistance-turned-support area and a visible low-volume gap, making it a key control point.

A firm defense could lead to consolidation before continuation higher.

However, a breakdown below 80 would likely trigger a deeper retracement, potentially rotating price back toward the 50 region.

AUDJPY: Your Plan to Buy 🇦🇺🇯🇵

AUDJPY is consolidating on a key daily horizontal support.

To buy with confirmation, wait for a bullish breakout of the underlined intraday

horizontal resistance.

An hourly candle close above 106.86 will confirm a violation.

A bullish movement will be expected to 107.36 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.