A Big Move Is Brewing on ULTRACEMCOPrice has pulled back into a major HTF reaction area, the same zone that previously triggered strong upside legs. Daily structure is slowing down right at this level, showing early signs of base-building.

On the 1H chart, I’m watching for a deep retest around 11,300 followed by a strong 1H closing confirmation. That’s the point where momentum usually shifts. If this plays out cleanly, the broader upside path opens near 13,000 — the next area where price previously stalled. Price might reverse back at 12,300 but I'm expecting the exit near 13,000

As long as the current base holds, this remains a high-probability swing continuation setup.

Below this zone, short-term structure weakens — above it, the larger trend can resume.

Stay Updated. Keep following for more trading insights and opportunities. Also please drop a comment what is your level for NSE:ULTRACEMCO

Best regards,

Alpha Trading Station

Multiple Time Frame Analysis

EURGBP (EG) - Bullish | HTF Distribution & Midterm AccumulationHigher Time Frame Bias

On the broader picture, EURGBP maintains a clean bullish structure. Price is currently within range, recently distributing from premium and now re-established in accumulation territory. During this process, price absorbed breakout traders, trend traders, swing participants, retail funnels, algos, and institutional orders as it engineered higher-time-frame liquidity.

Midterm Structure

Midterm is awaiting directional shift.

• Once the midterm correction aligns and confirms, focus will shift to lower-time-frame footprints for execution

• Expectation: internal liquidity sweeps will prepare price for the next leg higher

Lower Time Frame Execution

• Execution is conditional on confirmation of midterm correction

• Look for footsteps and displacement validating continuation

• Only enter once top-down alignment is fully confirmed

Targets & Context

• Anticipate correction expansion feeding into higher-time-frame highs, breaking past prior premiums

• Key levels are the accumulation zone and internal liquidity points

Mindset

Patience is the key.

Tracking is the edge.

Following price footsteps through this top-down process ensures precision before participation.

02.02.26 BTCUSD Chart AnalysisThere exists:

- The previous days' high and low,

- A fair value gap,

- A breaker Block.

Price is currently heading towards internal range liquidity in the form of the daily fair value gap.

From there, I believe price will head for external range liquidity which could be either the previous days high or the previous days low.

If Price is bullish, I believe price will retrace to the discount bullish fair value gap, respect it by closing within the range, create a stop hunt on the lower time frame, retest and expand bullishly.

Lets see,

Cheers.

CADJPY (CJ) - Bullish | Advanced HTF & Midterm MappingHigher Time Frame Bias

CADJPY remains bullish, printing clear higher highs / higher lows. Price recently expanded, moving through a distribution phase, then swept midterm internal and external liquidity, as well as higher-time-frame external liquidity, while mitigating a deeper HTF order block with a professional wick tap.

Midterm Structure

Midterm shows a bullish footprint step, forming a clear bullish formation.

• Sell-side liquidity is expected to be swept next

• Internal sweep will absorb early participants

• Once the midterm order block is fully mitigated, buy power is re-accumulated for continuation

Price is building a bullish courtyard, setting up the next leg of delivery within the correction phase.

Execution & Tracking

• Focus on tracking HTF and midterm liquidity footprints, not forcing entries

• Price must take out current buy-side liquidity due to the HTF mitigation

• Look for the midterm footstep confirming sweep of sell-side liquidity, signaling push toward external highs

Mindset & Edge

Patience is the key.

Tracking is the edge.

I will remain active in my mind throughout the week, monitoring and marking price footprints for alignment before execution.

AUDJPY (AZ) - Bullish | HTF Distribution & Midterm AlignmentHigher Time Frame Bias

The higher time frame is bullish, printing clear higher highs / higher lows. Currently, price sits in a distribution phase of the market cycle. The expectation is for a bearish rotation to provide a sweep of internal liquidity, gathering misled early participants before price continues upward.

Midterm Structure

On the midterm, price is generating bullish power within a bearish footprint model.

• Internal liquidity (inducement) is likely to be hunted first

• Protected low sits beneath the inducement, aligning with the midterm order block

After the sweep into the midterm order block, price will need to hold and confirm on lower time frames before realigning bullish.

Lower Time Frame Execution

• Look for displacement + change of character confirming the midterm order block

• Wait for bullish alignment within the correction phase of the market cycle

• Execute only when confirmation aligns; otherwise, no trade

Key Levels

• Price is near premium, approaching external highs that matter

• Midterm order block near price is the key structure being respected

• Internal liquidity is being hunted; protected low is a reference for risk management

Mindset

Patience is the key.

Tracking is the edge.

I stay active in my mind throughout the week, monitoring price and marking its footprints as the market delivers.

USDJPY (UJ) - Bullish | HTF Continuation FrameworkHigher Time Frame Bias

USDJPY remains bullish, printing a clear higher high / higher low structure on the higher time frame. Price recently removed midterm internal inducement, then engineered expansion into external liquidity, while mitigating a refined higher-time-frame order block aligned with bullish continuation.

Price then delivered a professional sweep, holding the higher-low structure while clearing breakout traders, trend followers, and higher-time-frame stops, confirming strength rather than distribution.

Midterm Structure

From a midterm perspective, price initially printed a change of character, then realigned bullish. After the current midterm expansion completes, expectation is for price to distribute, forming new internal liquidity, before rotating back into a fresh midterm order block.

This rotation is viewed as structural maintenance, not reversal.

Location & Context

• Higher time frame remains discounted, seeking higher prices

• The last higher low (blue structure) is a key HTF level being respected

• Midterm structure is currently bullish

• The protected low is the lower low sitting beneath the higher low within the visible structure

• External inducement is mapped but not assumed — price must define it

Execution Plan (Lower Time Frame)

Lower-time-frame interest is conditional and reactive:

• Wait for a pullback signaling loss of momentum

• Mark up newly presented internal inducement

• Look for displacement + change of character into the midterm order block

• Require bullish realignment confirmation before execution

No confirmation = no trade.

Mindset

Patience is the key.

Tracking is the edge.

Follow price and mark its footprints as it delivers.

GBPUSD (GU) - Bullish | HTF Liquidity NarrativeHTF Bias (4H / 2H)

GBPUSD maintains a bullish market structure, printing consistent higher highs and higher lows on the 4H. Price is currently trading in premium, with major higher-time-frame sell-side liquidity resting near 1.33443. This liquidity aligns with the prevailing bullish structure and remains the primary objective for price.

Market Narrative

Current price action reflects distribution mechanics within a bullish context, not reversal. Any downside movement is viewed as corrective, intended to rebalance price and absorb opposing orders before continuation. The expectation is for price to rotate lower into accumulation territory, followed by renewed bullish delivery toward higher-time-frame liquidity.

30M Structure

On the 30M, price is showing a narrow bearish phase within the broader bullish trend.

• The low beneath the midterm order block remains protected

• The initial bullish internal structure low is inducement and remains vulnerable

Once inducement is addressed, focus shifts to midterm order block mitigation (orange zone) aligned with HTF direction.

5M Execution Plan

Execution remains conditional and reactive:

• Wait for midterm order block mitigation

• Require displacement and structure confirmation

• Order block must hold to validate long continuation

No confirmation = no participation.

Targets

Upon completion of internal delivery, upside targets remain the higher-time-frame external highs, with primary focus on the sell-side liquidity resting above.

Mindset

Patience is the key. Tracking is the edge.

Let the market deliver — no assumptions, no forcing.

British Pound - Never Trust Relative Equal LowsIt's More Obvious With GBP In Comparison To EUR When You Compare Both Prices To Each Other.

Euro Has Been Moving Whilst GBP Is The 'Sick Sister', Trailing Slowly Behind.

I Favour GBP Rather Than EUR As The Obvious Draw On Liquidity Is Evident.

1.36357 Is The 1st Price I Am Targeting Going Into The Middle Of This Week.

Polygon (POL) to print Green Quarter 1, 2026 - February 26The above 3 day chart identifies a number of resistances, the first two are expected to be tested before mid-April 2026.

Following the 50% correction from early January, price action now finds itself on past support, 10 cents. Isn’t it fascinating sellers selling into support after a 50% correction? That’s emotion for you.

The 2nd resistance shall be the most challenging. If it breaks and confirms support, expect the full Elliott wave structure to print by July.

The resistances are a combination of market structures as identified from higher timeframes and significant Fibonacci levels. Confluence is the super power of TA, rather than an influencer on Youtube blurbing the next FED meeting dates.

Is it possible price action continues to correct? Sure.

Is it probable? To be technical, 10% at this time.

Ww

=====================================

Disclaimer

You know what’s coming. This isn't advice. I'm not your financial advisor, just some idiot who drew a line on a screen. Cryptocurrency is a famously sensible and stable marketplace for wise, stable people. Obviously.

Polygon could moon. It could also become a digital ghost town where your money haunts a blockchain graveyard. I don't know. I'm just here for the colourful squiggles. If you bet your rent on this and lose it, that's your tragic sitcom. I won't be playing the laugh track.

Do your own research. Don't be a plum.

Short trade Pair: BTCUSD

Bias: Sell-Side

Date: Sun 1st Feb 2026

Session: NY Session AM

Entry: 77,873.26

Target: 70,607.88 (−9.33%)

Stop: 78,210.51 (+0.43%)

RR: 21.54R

Target Logic:

HTF liquidity + value re-pricing + structural support magnet

BTCUSD Sell-Side trade idea (1D / NY Session AM),

🧠 Market Sentiment — BTCUSD (Sell-Side Bias | HTF + NY AM)

Market sentiment is bearish-to-risk-off, with Bitcoin operating in a macro distribution phase following a prolonged expansion cycle. Price action shows failure to sustain above prior value and HTF resistance, with rallies increasingly sold into rather than accepted. The daily structure reflects weak upside follow-through, suggesting that bullish momentum has transitioned into exhaustion and re-pricing lower.

On the 5-minute timeframe, sentiment is bearishly aligned, confirming lower-timeframe acceptance of sell-side delivery within a broader HTF distribution context.

Price action shows compression beneath prior resistance, with multiple failed attempts to reclaim the premium / 0.75–1.0 PD Array. Each rally is being sold into, indicating that upside is functioning as liquidity for short positioning, not continuation.

Key 5-minute sentiment signals:

Lower highs forming beneath intraday resistance

Buy-side liquidity induced and absorbed above minor highs

Bearish displacement following each sweep

Price respecting discount PD Arrays (0.25–0.50) as magnets

This behaviour reflects active distribution, where market participants fade strength rather than defend dips.

Bitcoin - Will Bitcoin recover?!Bitcoin is below the EMA50 and EMA200 on the four-hour timeframe and is in its descending channel. Bitcoin's upward correction towards the specified supply zones will provide us with its next selling opportunities.

It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and compliance with capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand range.

By the end of January 2026, Bitcoin once again moved into the spotlight of global investors. However, instead of establishing a decisive bullish trend, the market entered a consolidation phase accompanied by downward-leaning volatility, a development that is well supported by on-chain metrics and fundamental indicators.

One of the most significant fundamental signals during this period has been related to on-chain activity and Bitcoin’s supply structure. Recent data show that illiquid Bitcoin supply—coins that are highly unlikely to be spent—has reached historically elevated levels, approaching record highs. This indicates that Bitcoin holders are increasingly inclined toward long-term holding, avoiding selling at current price levels. Such behavior reflects structural confidence in the asset and can contribute to reinforcing a price floor.

At the same time, Bitcoin balances on exchanges have declined, suggesting a reduction in potential selling pressure—an important factor that can help prevent sharp drawdowns during consolidation phases.

Whale accumulation data further reveal that large market participants retained a substantial portion of their Bitcoin holdings throughout 2025, while retail investors showed a greater tendency toward short-term selling.

Bitcoin’s pullback toward the $75,000 level caused the market value of Strategy’s digital asset holdings to fall below the company’s average purchase price for the first time in several months. Led by Michael Saylor, Strategy is one of the world’s largest Bitcoin holders, owning 712,647 BTC at an average acquisition cost of approximately $76,000.

While this situation carries psychological significance, it has limited financial implications. None of Strategy’s digital assets have been pledged as collateral. As a result:

There is no liquidation pressure;

No bank can force the company into a mandatory sale;

Strategy retains full discretion over whether to sell or continue holding its Bitcoin.

Strategy currently carries approximately $8.2 billion in convertible debt, with its first major maturity not occurring until the second half of 2027. The company has multiple options, including refinancing, converting the debt into equity, or redeeming it outright. This financing structure has previously been implemented successfully by other companies and is considered a proven model.

XAU/USD 02 February 2026 Intraday Analysis H4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed as per analysis dated 22 January where I mentioned price to print bearish CHoCH to indicate bearish pullback phase initiation.

Price is now trading within an established internal range.

Intraday expectation:

Price to react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 5,602,225.

Note:

The Federal Reserve’s renewed easing cycle, alongside a weaker U.S. dollar and persistent geopolitical tensions, continues to drive volatility in the gold market.

Traders should remain cautious and adjust risk management strategies to navigate sharp price swings.

Additionally, gold pricing is highly sensitive to U.S. policy under President Trump, where tariff measures, fiscal uncertainty, and shifting geopolitical strategy amplify market repricing risks and reinforce safe‑haven demand.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Price has printed according to analysis dated 30 January 2025 where I mentioned, in alternative scenario, price could print a bearish iBOS as all HTF's require a pullback.

This is exactly how price printed.

Price has since printed a bullish CHoCH to indicate bullish pullback phase initation.

Price is currently contained within an established internal range.

Intraday expectation:

Price trade up to either M15 supply zone, or premium of 50% internal EQ before targeting weak internal low, priced at 4,402.380.

Note:

Gold continues to exhibit elevated volatility as markets digest the Federal Reserve’s ongoing dovish tilt and persistent global geopolitical tensions.

With uncertainty remaining a dominant theme across global risk assets, traders should prioritise disciplined risk management, as abrupt price swings and liquidity pockets may become increasingly common.

Furthermore, recent tariff announcements from President Trump, particularly those directed at China, have added another layer of instability to the macro landscape. These policy developments have the potential to intensify market turbulence, heighten risk‑off flows, and trigger sharp intraday reversals or whipsaw‑like behaviour in gold.

M15 Chart:

RegimeWorks Trade Idea — AUDUSD (Context-First Scenario Map)1) Regime Context (Higher-Timeframe)

AUDUSD is currently interacting with a key decision band on the daily structure, where price has recently pushed into a zone that matters for directional follow-through. The area marked POI aligns with a 61.8% Fibonacci retracement level, making it a high-relevance area for reaction if price rotates lower.

RegimeWorks framing: this is a context zone — not a signal. Directional permission comes from how price behaves at the decision levels.

2) Execution Context (1H Structure)

On the 1H timeframe, a Head & Shoulders structure has formed, and price has broken below the neckline at:

Neckline / decision level: 0.69798

Price is now drifting back toward that neckline, which sets up a clean “retest decision” situation.

3) Primary Scenario (Bearish Continuation — If Retest Rejects)

If price retests 0.69798 and fails to reclaim it (i.e., rejection / inability to hold above on 1H closes), then the breakdown remains structurally valid and a continuation move becomes plausible.

Path of least resistance (scenario):

Retest neckline → rejection → rotation lower

Downside interest shifts toward the POI zone, which also matches the 61.8 daily Fib retracement area

RegimeWorks interpretation: neckline rejection = “permission” for further downside within this scenario map.

4) Alternate Scenario (Breakdown Failure — If Neckline Reclaims)

If price reclaims 0.69798 and begins holding above it on closes, the breakdown thesis weakens and the move below the neckline may have been a false break / sweep.

Implication (scenario):

Reclaim + acceptance above neckline can open the door to mean-reversion back into the prior range/structure.

RegimeWorks interpretation: reclaim = “permission removed” for the bearish continuation thesis.

5) Key Levels

Decision / neckline: 0.69798

Downside objective zone (if rejection holds): POI (61.8 Fib confluence on daily mapping)

RegimeWorks Disclaimer

This is a RegimeWorks scenario map — not an instruction, not advice, and not a prediction. It outlines possible paths based on structure + confluence. Price can invalidate either scenario quickly; always wait for your own confirmation criteria before acting.

ETH: Monthly level. Possible pause before the next moveHi traders and investors!

The price is approaching the monthly level at 2,111.89.

Most likely, this will at least temporarily slow down the further decline.

The target within the monthly range is 1,385.05.

Profitable trades!

This analysis is based on the Initiative Analysis (IA) method.

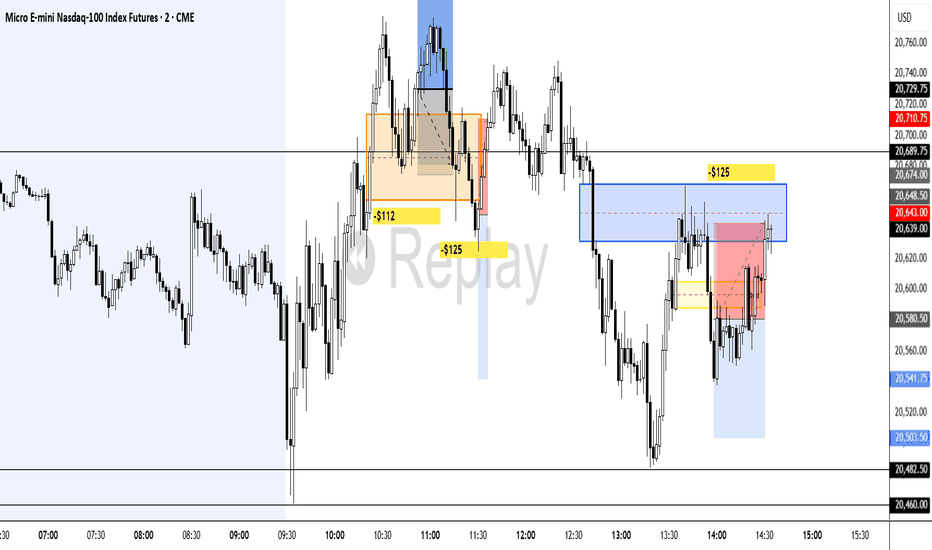

MNQ Daily Analysis - Friday February 28 2025let an awful two day stretch/a Friday turn a solidly profitable week into unprofitable.

0-3 / -$362

---------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis - Thursday February 27 2025tunnel vision day with suspect decisions and trade management.

0-2 / -$207

--------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis - Wednesday February 25 2025solid. 1-1-1 / +$97

------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis - Tuesday February 25 2025 part 2good day that was close to being great.

2-1-2 / +$326

All 1 MNQ trades.

------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis - Tuesday February 25 2025 part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis - Monday February 24 2025tried to stay patient, but wasnt perfect.

1-1 / +$69.

All 1 MNQ trades.

------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.