W-pattern

My journey in trading, experiences, ups and downs.

Hello everyone:

In this video (all talking in this one) I am gonna talk about my trading journey and experiences. All the ups and downs that I have been through in hope to give new and experienced traders a honest raw example of a trader’s journey.

Of course everyone learns and absorbs information differently, and I am sure there are people out there who didn't have to go through the way I did, but I thought sharing my journey would help some of us who are still struggling to find consistency in trading.

So, a little bit about my trading journey:

Beginning Stage

-Not profitable the first 2+ years, gone through the roller coaster ride of a trader’s journey

-Start with S.R and indicators. Does work and makes profit, but doesn't suit my personality.

-Was not consistent, some weeks in profit, some months in losses

-Made all the mistakes, wanted to give up and quit many times.

-Had negative trading emotions, mindset, and no idea on trading psychology

-Not following the trading plan, no risk management

-Over trading, over risking, revenge trading

-Emotional when I miss out potential runs of the market

-Blame the market on my losses

Turning Stage:

-Did not give up

-Admit all my mistakes, work on them, change them.

-Truthy admit you are in control of your trading account, not the market, strategies, mentors or other external factors

-Put in the time and effort, understand that this is something it can be your career for the next 30 years, what is it to you to put in a few years of hard work ?

Acknowledge the market will evolve and change, and we need to adapt as a trader

-Understand trading is a probability game, not right or wrong. I can be wrong, and won't affect my emotions.

-Want to be the "house" rather than a "player" in a casino setting,

-Learn about price action and structures.

-Have no problem missing trades and profits, understand the abundance of opportunities in trading

-Follow my trading plans, make goals, back testing, forecasting, journaling

-Acknowledge my expectations in trading,

3:1 RR, 15-20 trades, 1% risk per trade, 35-40% strike rate (higher strike rate requires less R:R). Looking for consistent growth of accounts and capital

-Understand once you are consistent, there will be more opportunities and investors who are willing to let you trade

-Continue to have a humble attitude in trading and market

-Continue to learn and grow

So I hope I answer most of the questions that you have asked, but if you have additional questions on my journey and anything else, let me know below. :)

Thank you

CAD/JPY: Broke The Breakout Pattern To The Downside This's EntryThis is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

GOLD (XAUUSD) - more upside probable. This is an update on the daily time frame for gold. Things have changed.

I see some sort of continuation pattern developing creating probability for the upside. Note carefully my disclaimer below.

For every probability estimate in one direction there is always a residual probability for the opposite direction (- this is why we have stop-losses which must always be affordable).

For the record - and just in case - I never predicted that Gold was gonna crash. This doesn't mean it can't crash. What I said on a previous occasion was that 'Gold could be in trouble' and yes it could still be in trouble even if it punches north.

Disclaimers : This is not advice or encouragement to trade securities. No predictions and no guarantees supplied or implied. Heavy losses can be expected. Any previous advantageous performance shown in other scenarios, is not indicative of future performance. If you make decisions based on opinion expressed here or on my profile and you lose your money, or miss opportunity, kindly sue yourself.

EUR/USD: Triple Tops With +470 Pips Target Ready To Enter Now This is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

NZD/JPY: H&S Pattern With +200 Pips Profit Available now This is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

AUD/CAD: New Analysis H&S Pattern With +210 Pip Profit Watch NowThis is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

NZDCAD potential bearish reversalon WEEKLY: price is trading around a strong support/resistance zone in red so we will be looking for objective sell setups on lower timeframes.

Keeping in mind that price can still go up to test our brown trendline to get more liquidity to be able to push downward.

on M30: we are waiting for an objective below our lower orange trendline last swing standing to sell.

or waiting for the right shoulder to form and then enter on the head and shoulders neckline break downward.

Pattern Triangle - How to find? how to use in a right way?Triangle is one of the most populat pattern. A lot of traders are trying to use, but mostly thay can not find it, or are drowing it in a wrong way. In this video I am searching patterns with you and also will give you most important principals for trading with it.

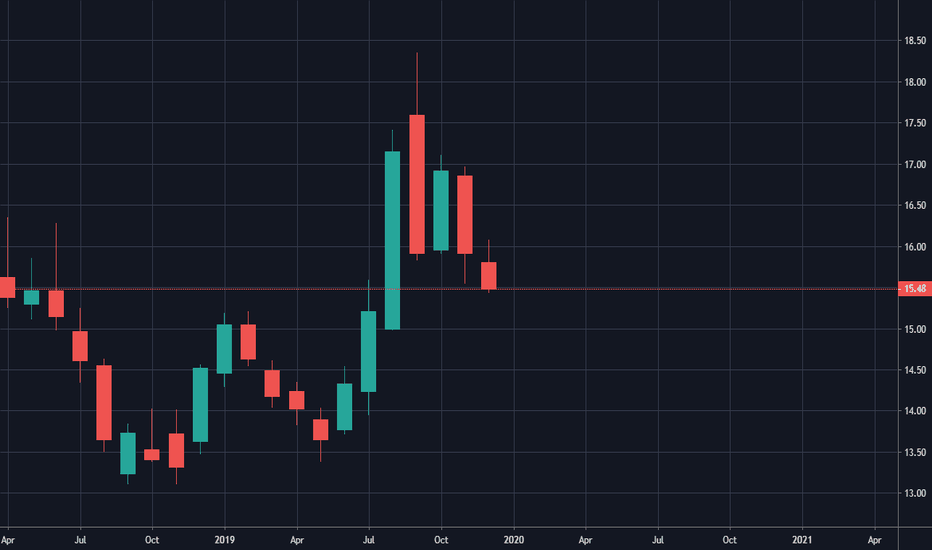

SLV Long Bull flag on monthly chart Monthly Chart shows a very nice Bull Flag for SLV A long stock play can be done if I want to hang onto the stocks for a few months. The length of the flag pole shows about a $3.5 move, so an option about half way up that move with the expiration of March would also work. In fact. I'm looking at the decently16 s priced strike that expires on March 31 2020

a Debit spread can also be done if i also sell the 17 strike on the same expiration That would make the cost of the spread at the current market price $21 with a profit potential of $79

How to 4x your money in 2 months with 3 Ascending TrianglesDear traders & everyone who is learning Technical Analysis!

In this video I'm going to show you how to recognize a core bullish trend & play Ascending Triangles. It would have given you amazing profits in the case of VFF.

Have fun watching! ;)