Wave Analysis

JPYUSD H1 Analysis Today: Consolidation Under Weak HighJPYUSD H1 Analysis Today: Consolidation Under Weak High, Buy-the-Dip Strategy Toward 0.00656–0.00658 (Fibonacci, EMA, RSI)

On the JPYUSD H1 chart (ICE), price is trading around 0.006519 after a strong bullish run and a corrective pullback. The market is now forming a tight consolidation and rebuilding bullish intent toward the marked Weak High zone near 0.00656–0.00658. The structure suggests a typical sequence: range → higher low → push into liquidity above.

Bias: Cautiously bullish, with best opportunities coming from pullbacks into support rather than chasing the breakout.

Market Structure (H1)

The prior leg was clearly bullish, followed by a corrective drop.

Current price action shows stabilization and re-accumulation (small candles, controlled swings).

The blue projected path indicates a step-up move aiming for the Weak High liquidity above.

Key risk: If price loses the current range floor and closes below it, the market may rotate into the next demand band.

Key Resistance Levels (Targets / Sell Reaction Zones)

R1: 0.00654–0.00656

First resistance inside the upper consolidation band.

R2: 0.00656–0.00658 (Weak High liquidity)

Main liquidity target. Expect a sweep/spike and potential pullback.

R3: 0.00660

Psychological level above the weak high; only relevant on confirmed breakout.

Key Support Levels (Buy Zones)

S1: 0.00651–0.00650

Immediate intraday support (current base). If it holds, bullish continuation stays valid.

S2: 0.00648–0.00647

Secondary support from the prior corrective low region.

S3: 0.00645–0.00644 (Main demand zone)

The grey band on your chart is the most meaningful demand area for a deeper pullback entry.

Fibonacci Levels (Practical Pullback Map)

Apply Fibonacci to the most recent bullish impulse (from the last clear swing low into the top area near 0.00656–0.00658):

38.2% pullbacks often react around 0.00650–0.00649

50% around 0.00648

61.8% around 0.00646–0.00645, aligning with your main demand band

This confluence supports a clean plan: buy at the first shallow pullback, scale if the market dips into deeper discount.

EMA + RSI Filters (Execution Quality)

EMA (H1, suggested EMA20/EMA50)

Bullish continuation is strongest when price reclaims and holds EMA20 after pullbacks.

EMA50 is the “trend health” filter: holding above EMA50 supports the re-accumulation → push higher scenario.

RSI (14)

Best long confirmations:

RSI holds the 40–50 region and turns up

RSI breaks back above 50 while price breaks a minor swing high

Watch for bearish divergence near 0.00656–0.00658 if price spikes and fails to hold.

Trading Plans (Entry, Stop Loss, Targets)

Plan A: Buy Pullback Into S1 (Preferred If Support Holds)

Entry trigger

Price dips into 0.00651–0.00650 and prints bullish confirmation (H1/M15 rejection wick, bullish engulfing, or break of a minor swing high).

Stop loss

Below 0.00648 (under the local structure floor).

Targets

TP1: 0.00654–0.00656

TP2: 0.00656–0.00658 (Weak High)

TP3: 0.00660 (only if breakout is confirmed)

Plan B: Buy Deep Discount at Main Demand (Best R:R Setup)

Entry trigger

Price reaches 0.00645–0.00644 and shows a strong reaction (long lower wick, bullish engulfing, reclaim EMA20).

Stop loss

Below 0.00643.

Targets

TP1: 0.00648

TP2: 0.00651

TP3: 0.00656–0.00658

Plan C: Breakout Long (Only With Confirmation)

Entry trigger

H1 closes above 0.00658, then retest holds 0.00656–0.00658 as support.

Stop loss

Below the retest low.

Targets

0.00660+, trail by EMA20 or structure.

Invalidation (When the Bullish Bias Weakens)

Multiple H1 closes below 0.00648, especially if price fails to reclaim EMA20 on rebounds.

A clean breakdown into the lower demand band with weak recovery behavior.

Summary

JPYUSD H1 is consolidating beneath a clear Weak High at 0.00656–0.00658. The clean approach is:

Buy pullbacks at 0.00651–0.00650 (shallow) or 0.00645–0.00644 (deep demand) with confirmation

Treat the Weak High as a liquidity zone where spikes and reversals can happen

What does GOLD know?

The last analysis on gold was correct in that the rise did happen and I had talked about it, but this rise went far beyond my expectations. As a result, in my view, the last analysis is now invalid.

When I zoom out on the chart, I really see that the rise has been extraordinarily strong. However, in the most recent correction that started from 4381 (the red box), there is clear price similarity with the b-d-f-h waves.

From my perspective, there are three possible scenarios:

1- Either a new pattern is unfolding that is quite rare and we can’t always expect to see such a pattern.

2- The recent correction starting from 4381 (red box) should be considered an X wave, in which case gold’s rise could still continue.

3- We might still be inside wave-(i) of (E), which is extending — one of those exceptions I mentioned earlier regarding Diametrics and Symmetricals that you’re aware of. In this case, the maximum price gold could reach would be around $6900.

One interesting point that comes to mind:

From experience, whenever we have more than 2 scenarios on the table, it usually means we are in the middle of a strong rise and the move is likely to continue!!!! These are extremely confusing conditions, and if you’re feeling the same way, know that you’re not alone. What does gold know that it’s rising at such speed?? The most probable trigger these days, with all the news around, could be the potential conflict/war between Iran and the US!!

Honestly, at these price levels, I have no recommendation to buy or even sell because the rise has been huge, fast, and violent. In my opinion, if you want to enter, do it with small capital only, and never forget to set a stop-loss.

Good luck

NEoWave Chart

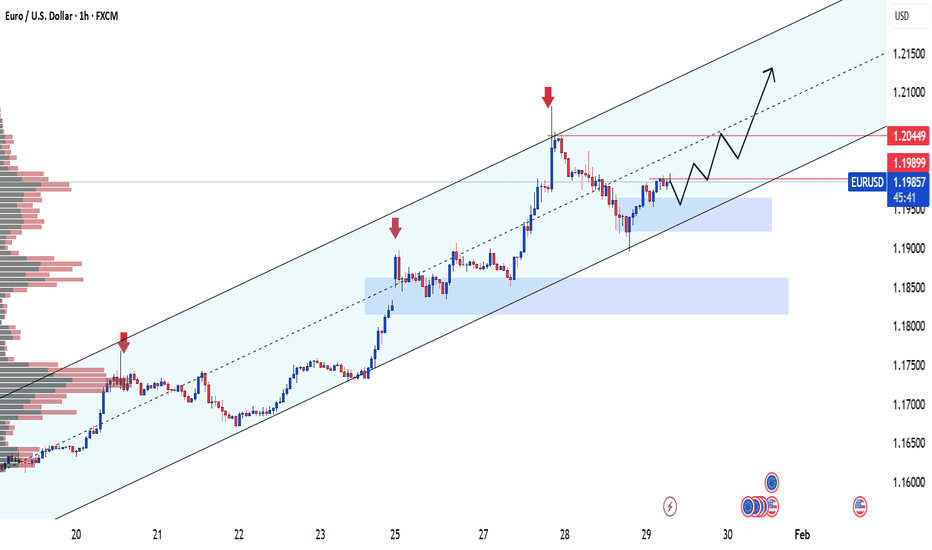

EURUSD H1 Analysis Today: Price Stuck Below 1.2050 SupplyEURUSD H1 Analysis Today: Price Stuck Below 1.2050 Supply, Key Support Zones to Watch (Fibonacci, Trendline, EMA, RSI)

On the EURUSD H1 chart, price printed a strong bullish impulse into the 1.2050 area, then rotated into a corrective structure. The market is now trading around 1.1953, showing a typical “retrace + reprice” phase under a major resistance band. With a Weak High still resting above, the current environment favors selling rallies into resistance and buying only at confirmed demand zones.

Market Structure H1

The larger leg is still bullish (strong impulse up), but the current phase is a correction/range under supply.

The blue swing path suggests one more attempt to retest 1.2050, potentially a liquidity sweep toward the Weak High, followed by a larger pullback.

A clean shift bearish becomes more probable if price fails repeatedly under 1.2000–1.2050 and starts closing below the recent corrective lows.

Key Resistance Levels (Sell Zones)

R1: 1.2000–1.2015

First reaction zone where pullbacks often fail during correction.

R2: 1.2045–1.2055

Major supply / prior swing top. Expect strong selling pressure and wick-heavy rejection.

R3: 1.2090–1.2100 (Weak High liquidity)

If price spikes above 1.2050, this is the “stop-hunt” zone to watch for reversal signals.

Key Support Levels (Buy Zones)

S1: 1.1965–1.1935

Intraday support pocket. If it breaks cleanly, the next demand becomes important.

S2: 1.1865–1.1840 (Main demand zone)

This grey zone is the most attractive “buy the dip” area if the larger bullish leg is still respected.

S3: 1.1750–1.1725 (Deep support)

Only relevant if the correction expands aggressively.

Fibonacci Levels (High-Probability Reaction Points)

Use Fibonacci on the major impulse leg (from the base of the rally into the 1.2050 top). Practical levels:

0.382 aligns near the 1.1940 area (price is already reacting around this region).

0.5 aligns near 1.1905 (often the “fair value” retrace).

0.618 aligns near 1.1870, which overlaps the 1.1865–1.1840 demand.

This overlap (Fibo + demand) is why 1.1865–1.1840 is the most important support for continuation buyers.

Trendline Read (Corrective Channel Logic)

The post-top decline describes a controlled corrective slope, not a panic sell. In these conditions:

Price often retests the supply (1.2050) once more before the correction completes.

If the retest fails (lower high + rejection), the market typically seeks the next liquidity pool below (1.1935 → 1.1865).

EMA + RSI Filters (Avoid Low-Quality Entries)

EMA (H1)

If price reclaims EMA20 and holds above it, the market is attempting to rotate back to the top of the range.

If price stays heavy below EMA20 and starts describing lower highs, rallies become better sell opportunities.

EMA50 is the “trend health” line. A sustained break below EMA50 increases odds of a deeper pullback into S2/S3.

RSI (14)

After the impulse, RSI is cooling. Watch for:

Bearish divergence if price revisits 1.2050 with weaker RSI → stronger short case.

RSI holding above the midline during pullbacks → supports the bullish continuation scenario.

Trading Plans (With Clear Stop Loss and Targets)

Plan A: Sell the Rally Into Supply (Preferred in Current Range)

Entry: 1.2000–1.2015 (aggressive) or 1.2045–1.2055 (best) with rejection candle / lower-high confirmation

Stop Loss: Above 1.2100 (if targeting the Weak High sweep) or above the rejection wick

Take Profit:

TP1: 1.1965–1.1935

TP2: 1.1865–1.1840

TP3: 1.1750–1.1725 (only if momentum accelerates)

Plan B: Buy the Dip at the Main Demand + Fibonacci Confluence

Entry: 1.1865–1.1840 after bullish confirmation (engulfing / strong wick / break of minor swing high on M15–H1)

Stop Loss: Below 1.1825 (keep it below the demand base)

Take Profit:

TP1: 1.1935–1.1965

TP2: 1.2000–1.2015

TP3: 1.2045–1.2055

Plan C: Breakout Long (Only If Confirmed)

Entry: H1 close above 1.2055, then retest hold of 1.2045–1.2055

Stop Loss: Below the retest low

Take Profit: 1.2090–1.2100, then trail by structure/EMA20

Summary Outlook

EURUSD is currently in a corrective range below 1.2050, with a Weak High overhead and clean demand zones below. The most practical approach today is:

Sell rallies into 1.2000–1.2050, especially if RSI shows weakness

Buy only at 1.1865–1.1840 with confirmation, where Fibonacci and demand align

GBPNZD Will Move Higher! Long!

Take a look at our analysis for GBPNZD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 2.276.

The above observations make me that the market will inevitably achieve 2.296 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

coincoin has failed to hold support

the way I see it is simple

coin will fall if btc falls

I'm not a bull on btc so my thesis would be that we will have more downside to come.

with 200% gains from April, it wouldn't

surprise me to see coin fall to support at 120 giving it a 60-70% drop from the high in October.

it's now or continuation to the next support!

SOL — unfinished business belowSOL still feels unfinished.

Price tagged the HTF bearish C (the gray box).

Yeah, it bounced a bit. But that’s it.

No structure flip.

No real strength.

Just more bearish sequences stacking .

That’s not a bottom. That’s a pause.

Below that gray zone sits another HTF bearish C .

And the last pink sequence still has its C wide open . Untouched.

We just reacted from the BC .

That move looks corrective to me. Reset energy, not reversal.

So I’m still leaning bearish.

As long as price keeps failing to protect highs, these pops are noise.

The magnet is still lower.

If structure flips and starts holding above, I’m out. Simple.

Until then, downside makes more sense.

Not financial advice. Just my read.

STABLEUSDT QUICK ANALYSIS (1H)BYBIT:STABLEUSDT (1H) respected a well-defined ascending trendline before launching into a strong impulsive rally (~52%), backed by heavy trading volume ($106M)—a clear sign of strong buyer interest. The move is now followed by a healthy pullback, not a trend breakdown.

Price is currently retracing into a high-confluence demand zone at $0.02257 – $0.02171, aligning with prior structure and trendline support.

With only 17.6B of 100B tokens in circulation, price remains highly reactive to order flow—holding this zone favors continuation higher, while a breakdown could open the door for a deeper retracement.

🎯 Key Levels

Entry Zone: ~$0.02255

Demand Zone: $0.02257 – $0.02171

Stop Loss: $0.02105 (below structure & demand)

Upside Targets:

🏹 Target 1: $0.02560

🏹 Target 2: $0.03005

USD/JPY BULLS ARE GAINING STRENGTH|LONG

USD/JPY SIGNAL

Trade Direction: long

Entry Level: 152.456

Target Level: 153.874

Stop Loss: 151.519

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Gold Near 5600: Pullback to 5300 Before Next Liquidity Run AheadXAUUSD | Intraday Smart Money Plan – H1

Gold is trading inside a strong bullish structure after a clean upside expansion and BOS on H1. Price recently rallied into the 5,550–5,600 region, where momentum started to slow and candles showed hesitation. This typically signals liquidity delivery at highs rather than fresh institutional buying.

From an SMC perspective, price is deep in premium. Smart Money often uses these conditions to distribute and rebalance before deciding on continuation. The chart shows a clear H1 imbalance (FVG) and a defined buy zone below, suggesting unfinished business on the downside before any sustainable push higher.

Hot Macro Drivers Today

Gold remains highly reactive to:

• Ongoing Fed rate-path uncertainty and rate-cut timing debate

• Mixed U.S. data creating USD volatility

• Persistent geopolitical risks supporting safe-haven flows

These themes keep the higher-timeframe bias bullish, but intraday flows show rotation and liquidity engineering rather than straight-line continuation.

Market Structure & Liquidity

• H1 structure bullish with confirmed BOS

• Liquidity swept near recent highs

• Clear FVG left below current price

• Defined demand zone around 5,302–5,300

• Logic: Premium distribution → Discount reload → Potential continuation

Smart Money seeks efficient pricing, not emotional breakouts.

Key Trading Scenarios

🔴 Premium Sell Reaction (Short-term)

Zone: 5,600–5,602

SL: 5,610

Confluence:

• Psychological 5,600 handle

• Prior liquidity objective

• Slowing momentum near highs

Expectation: rejection here can drive price into FVG / buy zone.

🟢 Discount Buy Reaction (Primary Setup)

Zone: 5,302–5,300

SL: 5,290

Confluence:

• H1 demand + prior structure

• Liquidity sweep potential

• Ideal Smart Money reload area

Buy only after bullish confirmation on lower timeframes.

🟢 Continuation Targets

Upside: 5,600 → 5,630 external liquidity

Valid after a proper discount reaction and shift in order flow.

Invalidation

Strong H1 acceptance and hold above 5,610

→ Signals direct continuation without deeper pullback.

Expectation & Bias

• Not a FOMO environment

• Liquidity comes before direction

• Rejection = rotation

• Acceptance = continuation

• Execution > prediction

Gold is at a decision point:

Will price mitigate the H1 imbalance and tap 5,300 liquidity first — or accept above 5,600 and run external liquidity?

XAUUSD 15m Elliott Wave impulse in late-stage development

🚀 Wave (3) delivered strong expansion

🔄 Wave (4) shallow bullish consolidation

📈 Price advancing into Wave (5) toward 5660–5730 zone

⚠️ Momentum divergence signals rising exhaustion risk

🎯 Monitoring for post-Wave-5 corrective pullback opportunity

#Gold #XAUUSD #ElliottWave #MarketStructure #SmartMoney

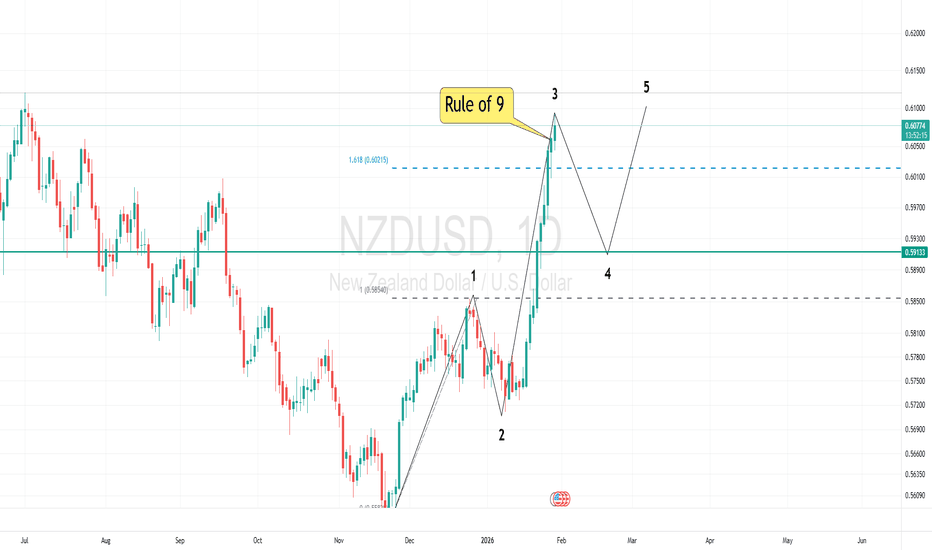

NZD/USD - Heard of the rule of nine? NZD/USD - Heard of the rule of nine? It dictates that after 9 positive or nine negative daily candles in succession, we see a correction in the other direction. From a technical viewpoint, we can be analysed as in an extended 3rd wave. This will often lead to a generous reversal. Support is seen at 0.5913.

NZD/USD - Heard of the rule of nine? NZD/USD - Heard of the rule of nine? It dictates that after 9 positive or nine negative daily candles in succession, we see a correction in the other direction. From a technical viewpoint, we can be analysed as in an extended 3rd wave. This will often lead to a generous reversal. Support is seen at 0.5913.

Gold Pullback or Extension? Smart Money Sets the Trap Near HighsXAUUSD | Daily Smart Money Plan – H1

Gold keeps its bullish structure intact after a strong impulsive leg, but the current price action shows hesitation just below the recent highs. After a clean BOS and aggressive expansion, price is now trading in premium, where buy-side liquidity has already been delivered. The chart suggests Smart Money is no longer chasing higher prices, but managing positions through rotation.

Macro backdrop today remains hot:

Markets are digesting fresh volatility around U.S. data expectations, shifting Fed rate-cut timing, and persistent geopolitical tension. These factors continue to support gold as a safe haven, but intraday execution shows rebalancing behavior, not blind continuation. Headlines may move price fast — liquidity decides where it settles.

Rather than exploding higher, price pulled back from the highs and left a clear imbalance (FVG) below, signaling unfinished business before any sustained continuation.

Market Structure & Liquidity Context

Higher-timeframe bias remains bullish

Strong bullish BOS confirms trend strength

Short-term pullback forms after liquidity delivery at highs

Clear H1 imbalance + buy zone below current price

Market logic favors premium → discount → continuation

➡️ News creates volatility, but Smart Money seeks efficiency

Key Trading Scenarios

🔴 Sell Reaction at Premium (Short-term rotation)

Zone: 5,265 – 5,275

SL: Above 5,300

Confluence:

Buy-side liquidity already tapped

Momentum slows near highs

Rejection here favors a dip into imbalance before continuation

🟢 Buy Reaction at Discount (Primary Long Setup)

Zone: 5,170 – 5,168

SL: 5,160

Confluence:

H1 imbalance mitigation

Prior structure support

Ideal Smart Money reload zone after pullback

🟢 Continuation Target

Upside Objective: 5,300 – 5,310

Next external liquidity pool

Target only valid after discount reaction + confirmation

Invalidation

Strong H1 acceptance above 5,300 without mitigation

Would signal direct continuation, skipping deeper rebalance

Expectation & Bias

This is not a FOMO breakout environment

Liquidity comes before direction

Rejection = rotation

Acceptance = continuation

Execution > Prediction

💬 Will gold respect the H1 imbalance near 5,170 before attacking 5,300 — or will Smart Money surprise with direct acceptance at the highs?

USD/JPY sits mid-range; rallies to be sold and dips to be boughtAlthough USD/JPY posted net daily gains yesterday, breaking the sequence of three negative performances, all price action was confined to Tuesday's range (152.09 to 154.88). This candle is known as an indecisive inside Harami.

The support is located at 151.03.

On the upside, we have resistance at 155.76. We also have the gap open at 155.73.

Conclusion: we are analysed as a trading mid-range. Look for dips to be bought, and rallies to be sold

DXY – we have the completion of a bearish 5-wave count

DXY – we have the completion of a bearish 5-wave count. That should indicate that we see a correction to the upside. I have two support levels. 95.82 and 95.72. Resistance is currently located at 97.28. As long as the swing low remains intact, I remain bullish

EUR/USD Regains Momentum and Eyes a Fresh Bullish PhaseThe EUR/USD pair is trading positively around the 1.1980 level during Thursday’s session. The U.S. dollar remains under pressure against the euro, as ongoing uncertainty surrounding U.S. economic policy continues to support a deeper recovery in EUR/USD. The near-term objective is to retest and break above the previous high near 1.205, paving the way for a continuation of the broader uptrend.

Later on Thursday, markets will focus on the Eurozone Consumer Confidence report and the U.S. Initial Jobless Claims data. Until the Federal Reserve provides clearer guidance on the 2026 interest-rate path, or the Eurozone demonstrates a more convincing economic recovery cycle, any further upside in EUR/USD is likely to develop gradually rather than aggressively.

Gold Continues To Set An Impressive Historic RallyHello everyone,

let’s take a look at today’s gold price action.

In the latest move, gold continues to rally aggressively, breaking all previously recorded highs. For the first time, the precious metal has surpassed the $5,500 level and is currently extending gains around $5,525, up more than $100 since the start of the session.

This powerful advance is being driven by strong safe-haven demand amid persistent geopolitical tensions, economic uncertainty, and a weakening U.S. dollar. In addition, central banks and sovereign wealth funds are increasingly rotating away from U.S. Treasury bonds and into gold, further reinforcing the bullish trend.

From a technical perspective, the short-term outlook for XAU/USD remains clearly bullish. The absence of a confirmed new peak suggests that upside momentum has not yet been exhausted. For risk management purposes, waiting for a pullback to confirm support before adding long positions may offer a more prudent approach.

🎯 Near-term target: the $5,550 – $5,600 zone.

What’s your view on gold’s trend from here?

Share your thoughts in the comments.

TOMCL PROBABLY IN WAVE ' 3 ' OR ' 5 'TOMCL is most probably in wave 3 or 5

Our preferred wave count suggests that lesser wave 4 has finished and wave 3 or 5 have started which might take price toward 68 & above.

Alternately, we might still be in wave 4 which will further extend downwards taking price toward 44 level or will keep unfolding as sideward movement.

Break above 55 will target 57.20 level and if the momentum continues will further target 68 & above levels

We are trading this aggressively and are already active in this trade, however we do suggest to stick to the trade setup for better results.

Trade Setup:

Entry level: 55

Stop loss: Will update once trade gets active

Target:

T1: 68.95

T2: 77.50

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

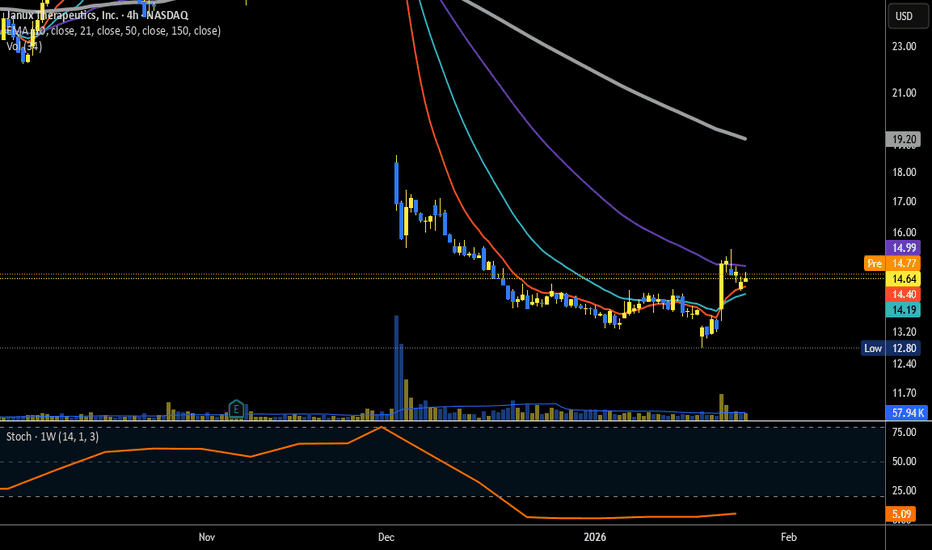

Janux Therapeutics, Inc. (JANX)Janux Therapeutics, Inc. while still a loss making company JANX entered into an exclusive license and collaboration agreement with Bristol-Myers Squibb to develop and commercialize a novel tumor-activated therapeutic targeting a validated solid tumor antigen. the pipeline (R&D) and funding makes JANX a darling. i will be buying when market opens at around 14.64 and a tight SL at 14.10 (will re-enter again if SL activated as W3 the strongest of elliot waves seems to be unfolding) - upside potential is 30.00+....and then 100.00+