Crypto MarketCap Analysis..!!- Total MarketCap

Holding the Key Support in 3d Chart & Just Like Bitcoin, It's Also Forming Descending Channel.

If Bitcoin Price Jump from 7k Support then Total MarketCap will Automatically Grow & Follow the BTCUSD.

- ALTS_MarketCap

On the Other Hand, ALTS MarketCap is Forming Bullish Wedge Pattern in Bigger Time frames & I Think Q1 2020 Will be Bullish Year For ALTS too.

ALTS Need Some Strong Volume For Wedge Breakout & Growth.

- Bitcoin Dominance

On The Other Hand, Bitcoin Dominance is Also Increasing after Wedge Breakout & Now Holding the Key Support, (70%)

If Support Broken Then We Could See Some Growth in ALTS in Coming Days,

Some Bitcoin Updates..!!

Please like, subscribe and share your ideas and charts with the community!

Wedge

Ripple | Holding the Bottom Support ..!!XRP/USD (Update)

Ripple price is still struggling to gain momentum and declining below $0.1920 against the US dollar.

In Bigger TF Chart, XRPUSD Is Forming Wedge Pattern & Holding Bottom Support As well.

Recently, Ripple (XRP) Hits 27-Month Low & Now holding the Bottom Support.!!

Ripple’s price action in 2020 will largely depend on the movement in Bitcoin’s market.

For instance, the 2020 Bitcoin halving event is expected to drive the price to highs above $20000. The correlation between the assets will impact XRPUSD into a bullish rally and could pull the price to levels above $1.0.

However, I still believe 0.9$ is a very conservative price for XRP.After Wedge Breakout.

Ripple Regulation..!!

Ripple has particularly struggled with regulation for its XRP cryptocurrency, especially in the United States.

The Securities and Exchange Commission (SEC) is torn between categorizing XRP as a security token or leave it to ride along as crypto.

However, XRP has gained traction in the United Kingdom, which recently referred to it as crypto, just like Ethereum.

Many experts and enthusiasts believe that unclear regulations for the industry are stifling innovation.

Ripple Future and Growth

Ripple is often regarded as the future of cryptocurrencies in terms of technology infrastructure as well as mainstream adoption.

Armed with its flagship products: RippleNet and xRapid the network is set to be the bridge between cryptocurrencies and the traditional banking system.

More importantly, Ripple believes that it will soon overtake SWIFT to become the preferred cross-border money transfer platform.

SWIFT has its own share of struggles that are dealing with including long processing time and unreliability.

On the other hand, Ripple as mentioned above already has signed partnerships with more than 200 banking institutions.

Besides, this number is expected to grow with the current expansion to the Middle East and the Asian regions.

Ripple’s XRP demand in the future will mainly come from banks as adoption increases supported by the need to send money across the border faster, reliably and a low cost.

Please like, subscribe and share your ideas and charts with the community!

Ethereum | 2020 Will be Bullish Year For Ether..!!What is Ethereum.??

Ethereum is an open source, public, blockchain-based distributed computing platform and operating system featuring smart contract functionality. It supports a modified version of Nakamoto consensus via transaction-based state transitions.

Ether Milestones

Late 2013 - Ethereum White Paper released by Vitalik Buterin.

July/August 2014 - Ethereum Crowdfunding to fund development.

30th July 2015 - Public launch (Version 1, codename “Frontier”) with 72 million coins pre-mined to support development.

October 2015 - First Ethereum Improvement Proposal (EIP-1) lays out the rules for governance and community consensus.

14th March 2016 - First “stable” release (Version 2, codename “Homestead”) with updates to security, transaction processing and pricing.

June 2016 - The DAO hack.

20th July 2016 - ETH/ETC Hard Fork.

16th October 2017- Version 3 (codename “Metropolis: Byzantium”) with updates to the Ethereum Virtual Machine and smart contracts.

2017 - Ethereum Smart Contracts enable the funding of many crypto-currency projects via Initial Coin Offerings (ICOs).

December 2017 - Cryptokitties brings out scaling problems in Ethereum, with the network being congested and transactions being delayed.

28th February 2019 - Version 3.5 (codename ”Metropolis: Constantinople”) implementing zk-SNARKS borrowed from ZCash.

ETH/BTC (Update)

Now Let's Take a Look on Ether Technicals, In Bigger Chart (Monthly) Forming a Wedge Pattern & I Think 2020 Will Be Bullish Year For Ether.(If Follows my Plan)

ETH/USD (USD Pair)

Just like BTCUSD , Ether is Also Moving inside the Descending Channel (Downtrend) in Daily TF Chart.

Recently Tested the Lower Channel Line & Now Bouncing up Towards the Key Resistance (144), Just like BITCOIN .

It's Decreasing the Volume since 25th June Top & Now I Think It's Time For Reversal..(Major Indicators ( MACD & RSI ) Are Also Turning Bullish )

Now If Key Resistance Broken in Coming Days Then ETHER Will be Back in Uptrend & It Might Test (195) Resistance.

In 3D & Weekly Chart, It's Forming Bullish Wedge Pattern as well ..

Please like, subscribe and share your ideas and charts with the community!

RISING WEDGE/ENDING DIAGONAL PATTERN. How to Trade it...Rising Wedge

A Rising Wedge is a chart pattern within the context of an uptrend composed of two upward sloping and converging trendlines connecting a series of higher swing/pivot highs and higher swing/pivot lows.

Rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two rising trend lines. It is considered a bearish chart formation which can indicate both reversal and continuation patterns – depending on location and trend bias. Regardless of where the rising wedge appears, traders should always maintain the guideline that this pattern is inherently bearish in nature.

HOW TO IDENTIFY A RISING WEDGE PATTERN:

~ Establishing Downtrend.

~ Rising wedge consolidation formation

~ Linking higher highs and lower lows using a trend line assembling towards a narrowing point.

~ Confirm divergence between price and volume may also be used.

~ Look for break below support for short entry.

HOW TO TRADE THE RISING WEDGE PATTERN:

All Details are labelled in the Chart..

What is an ascending broadening wedge? (Educational, Example) An ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern). It is formed by two diverging bullish lines.

An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. The upper line is the resistance line; the lower line is the support line.

Each of these lines must have been touched at least twice to validate the pattern.

NB: a line is said to be "valid" if the price line touches the support or resistance at least 3 times.

This implies that the ascending broadening wedge pattern is considered valid if the price touches the support line at least 3 times and the resistance line twice (or the support line at least twice and the resistance line 3 times).

An ascending broadening wedge does not mark the exhaustion of the buying current, but the sellers’ ambition to take control. The divergence of the two lines in the same direction (increase in price magnitude) informs us that the price continues to increase with movements that are increasingly high in magnitude. The buyers manage to make the price rebound on the support line but lose control after the formation of a new highest point. The lowest point reached during the first correction on the ascending broadening wedge’s support line forms the support. A second wave of increase then occurs with more magnitude, signalling the loss of buyers' control after a new highest point. A third wave is formed afterwards but buyers lose control again after the formation of new highest points.

During the formation of an ascending broadening wedge, volumes do not behave in any particular way but they increase strongly when the support line breaks.

Eduational: Example of a descending broadening wedge. A descending broadening wedge is bullish chart pattern (said to be a reversal pattern). It is formed by two diverging bullish lines.

A descending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines . The upper line is the resistance line; the lower line is the support line.

Each of these lines must have been touched at least twice to validate the pattern.

NB: a line is said to be "valid" if the price line touches the support or resistance at least 3 times.

This implies that the descending broadening wedge pattern is considered valid if the price touches the support line at least 3 times and the resistance line twice (or the support line at least twice and the resistance line 3 times).

A descending broadening wedge does not mark the exhaustion of the selling current, but the buyers’ ambition to take control. The divergence of the two lines in the same direction (increase in price magnitude) informs us that the price continues to fall with movements that are increasingly low in magnitude. The sellers manage to make the price rebound on the resistance line but lose control after the formation of a new lowest point. The highest point reached during the first correction on the descending broadening wedge’s resistance line forms the resistance. A second wave of decline then occurs of more magnitude, signalling the sellers' loss of control after a new lowest point. A third wave forms afterwards but the sellers lose control again after the formation of new lowest points.

During the formation of a descending broadening wedge, volumes do not behave in any particular way but they increase strongly when the support line breaks. source:Centralcharts

This is why the SPX is overdue for at least a 2.50% pullbackThe equity markets in the US have been moving really well through highs like its nobody's business, however as they continuously progress the moves get shorter and the pullbacks non-existent. Recent a 1.5-2 year wedge in formation was broken to the upside which indicates a bull trend continuation. Usually, the pop above the broken resistance will revert at least temporarily to the broken level before moving higher. This isn't a crash and recession call to all-time lows rather an opportunity to identify a potential retrace before a larger pop.

The facts are, the volume on this whole break higher has been terribly low, no one wants to buy a market at all-time highs and no one wants to sell because they want more profit.

Its been 2 months with just 1 red week and that red week was insignificant. The pullback brings the price down to the wedge break and previous highs at least 2.50% lower than the price right now. From there, there will be 2 catalysts that bring price higher.

1. A lot of big money is waiting for an "in" on the long side of the market and when deemed cheap enough will bid up the market by strong buying.

2. The Fed is still pumping A LOT of money into the economy at abysmally low rates.

"rising wedge" with VWAP for supportReference/training*

not an ideal situation. Example here is to demonstrate consequences of low volume at support area. ( horizontal, Vwap, MA, EMA etc)

Background was late into an uptrend

High volume points located into higher prices creating rejection

Test at VWAP returns highly diminished strength/demand.

Tricky fake out attempt back into trading range with subsequently violent rejection back out.

If you are having issues interpreting volume, think of it as peaks and valleys.

Vally at support is generally a weak support

Vally at resistance is generally a weak resistance.

EURAUD Entry On A Retest - Wedge PatternEURAUD price broke diagonal wedge support. Diagonal support line now becomes diagonal resistance because price broke and closed below the diagonal level.

WAIT FOR THE RETEST OF THE DIAGONAL LEVEL.

Enter on the retest at level 1.63084 with a market execution order or sell limit order. Exit at the next horizontal support resistance line for Take Profit. Exit at 1.61072.

Note: There is confluence when diagonal support resistance line intersects with horizontal support resistance line. A higher probability trade set up for the wedge pattern in using "intersections."

Dominance : Elliot wave perspective and road map to 50%Hello Fellas, Happy Monday and I hope that this week could be the a better week for another trading journal for all of you. Current bitcoin movement is still in play with my previous analysis and perspective, beside bitcoin is still moving in the consolidation area whether it is on short term or long term perspective. That's why a few days ahead i will be more concern with the dominance and market capitalization of this crypto industry. I will frequently give you an update about this highlighted factor that keep the crypto space on its balance. Here we start the analysis!

So, on this chart, I try to make a long term projection for the bitcoin dominance possible movement in the future. Remember that you don't have to be worry even if the bitcoin dominance will melt however to lower level or bitcoin itself which will decrease value a lot lower than current level. The decreasing of bitcoin dominance will become another stepping stone of bitcoin's future. The decreasing in bitcoin dominance will make the crypto space more healthier and the money inflow in this industry will spread out evenly between 1 coin to another. This thing especially will indicate a decrease of manipulative number, even for the institutional level, it will be harder to manipulate the price of crypto. More evenly the fund distributed, more healthier this market will be.

I see that the current movement of bitcoin'd dominance will melt however to lower level. I see a losing momentum as well on current level of dominance. Based on the technical analysis, it looks like the previously bullish falling wedges could be the first leading diagonal on higher structure. I expect an ABC zig za corrective wave to the down side and I expect the dominance will stay at around 50% level. It has a lot of reason for the dominance to be at those level.

Thank you and enjoy your Monday.

The Insider and systematic dumpHello fellas, here is my opinion about bitcoin based on the dominance side of the crypto market. I hope you enjoy this technical analysis!

The daily chart for Bitcoin dominance shows that Bitcoin is fighting hard to retain its dominance of the cryptocurrency market. Recently, Bitcoin dominance broke out of a falling wedge and found temporary support on the 50% fib retracement level. However, I believe that this level won't hold from further decline. traders need to be very careful here as this is not the time to be bullish.

It is premature to say that this move to the upside has come to an end. We are certain that a decline is going to follow sooner or later but short term further manipulation could be around the corner. We recently saw Bitcoin pump by more than 43% in two days. There have been times when we have seen similar pumps in the altcoin market follow soon after. I wouldn’t discount the possibility that this could be one of those times which is why it is not a good idea to be short on the altcoin market just yet. However, despite what happens short term, Bitcoin is ready to decline below $8,000 and it could happen in a matter of days.

The cryptocurrency market is in trouble and insiders have known this for a long time. They have been dumping systemically but as more and more retail investors begin to catch up with what is really happening, they are now in a rush to get out of their positions. This is why we have seen such naked manipulation in the past few days that shook out most of the retail bears and got the bulls really excited. The bulls are still quite excited and expecting further. The Fear and Greed Index is still in the neutral zone but traders could soon get even more optimistic with another fake out. In my opinion, it is very likely that we might see another fake out near term

Triangles are awesome: a great exampleHello, I just posted an idea on why I don't like taking breakouts, I mostly do double bottoms on support, but I really loooooove Bit. Connnneeeect. Er I mean triangles.

And as a support and resistance "expert", I know when to buy or not (well sometimes). I got a idea of when they are probably not going to hold much longer, and you see, from one strategy it can open towards another one indirectly. Not good to short at resistance and you got a great pattern right under it? Might as well buy.

If I think shorting at a resistance is a losing strategy, then why not flip it on its head and go the opposite direction?

Looking quickly at some examples, not even S/R or EW, just the pattern, I can eyeball the smelly ones and potentially good:

I probably already made an idea on this, but let's go over it again :)

And guess where it went? Like a fing magnet!!!

Actually this one was really easy to spot, I even remember posting about it.

I don't think I took it and I think it was because I was afraid of being in mid july, I just decided to avoid the mid july to mid august period entirely. Have to take a break at some point anyway.

So unless you are a c**t like me, you have a brain therefore was bullish on gold rather than nonsense like Bitcoin, I really see no reason not to buy this if that's your timeframe and you trade gold (and didn't have other correlated trades going on...).

This is the kind of thing that you have to practice as so to be able to spot more easilly.

I want to look at agri, they're basically what extends most, more than anything else, and they have made so many people rich quick and famous.

This is where people get absolutely massive winners in short periods. Especially when they keep adding to their winner.

Warren Buffet had a massive winner with coca-cola, and people that bought Bitcoin in 2011, but that took a couple of years.

Here we are talking of a few days or weeks to get an absolute insane ripper.

I heard that once a future traded up to limit for 26 days straight, not sure what it was. Lmao I imagine anyone being short there XD RIP.

(trading up to limit means the price goes up the maximum that the CME will allow at which point trading is halted for the day...)

This is ok:

Well anyway, I know there are some nice formations in FX & hard commodities, and also Bitcoin, apart from that I don't really know.

There might be in other markets, but I just stick to what I know.

In any case it is something to look at backtest and if it works add to the list of tools.

BNB doesn't deserve this levelHello fellas, welcome back to our podcast. This will be a very interesting podcast during this week! BNB is having my attention here. a lot of concern and update will be covered here. Let's do it.

Looking at the white trend line, it has been holding the price since August 2017 which means a 2 years trend line! And specifically, the price is coming very close to this trend line right now. Whenever I see the price moves like this and coming close to this trend line, I firmly believe that the price MUST respect this kind of trend line with a bounce.

My above statement is coming align with current pattern that I found on the market, we can easily deduce during the drop recently that the price is forming a bullish falling wedge which will always end up bullish. In my opinion, the APEX of the wedge is near and I believe that we will get the confirmation very soon to enter the long position.

Keep watching boy!

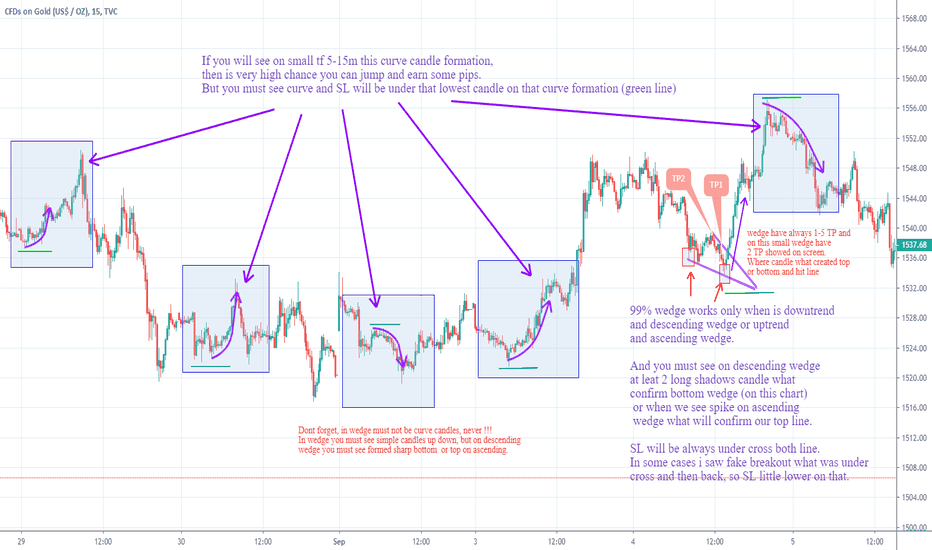

Curves and wedgeFor all please look at this for i created for learn

If you will see on small tf 5-15m this curve candle formation,

then is very high chance you can jump and earn some pips.

But you must see curve and SL will be under that lowest candle on that curve formation (green line)

99% wedge works only when is downtrend

and descending wedge or uptrend

and ascending wedge.

And you must see on descending wedge

at leat 2 long shadows candle what

confirm bottom wedge (on this chart)

or when we see spike on ascending

wedge what will confirm our top line.

SL will be always under cross both line.

In some cases i saw fake breakout what was under

cross and then back, so SL little lower on that.

wedge have always 1-5 TP and

on this small wedge have

2 TP showed on screen.

Where candle what created top

or bottom and hit line

Elliot wave count, 5th wave could be truncated : short term biasHello fellas, once again I provide you my analysis about bitcoin. without further chit chat, let's get to the point.

Here it is my detailed elliot wave count on bitcoin. Right after the call of bearish rising wedge or we can call it a leading first wave diagonal, we've seen a really huge up trend push form the bulls. I will label this moves as the 3rd wave going up on bitcoin on my short term view which has just finished, This means that current price is at the 4th wave phase which is the correction wave for wave 3. Based on elliot waves rules and guideline, we can easily deduce that the 4th wave could end up on fibonacci levels whether it is on 23.6 , 38.2 , 0.5 or the golden pocket as long as the price doesn't drop more than a wick of the 1st wave territory. The wave 4 trade is usually the most tricky wave that occur between the others wave so we have to be cautious.

yes, there is a possible moves of one more waves up which will be labeled as the wave 5. But, I want you all to remember that even the wave 5 can be truncated which can make a lower high comparing to the wave 3 and considering the current price is trending just below the upper line of the huge channel (green dotted line) this truncated wave 5 could occur too.

As of now, I am still on my long position and I use the white support trend line on smaller timeframe as the guideline. If the price breaks this support trend line, I will switch my long position into short and try to catch the wave 4. But, If this trend line can hold, I do believe that the price will touch at least the previous high.

Bitcoin - Dynamic Candlestick Patterns ~ 8/26/19I focus on providing live education and support to those interested in trading, Cryptocurrencies, and Blockchain technology. You will learn charting techniques, technical analysis, and the most popular cryptocurrencies for trading. My content is ideally suited for beginner to intermediate level traders.

Signature of perfectionist buyers to trade a small reboundFor those who still wonder by what miracle chart analysis can work well, here's a proof:

Such proofs, I often see and they are an integral part of my publications, but I had not yet had the idea to dedicate a small Tutorial, and this proof is perfect for its simplicity and its obvious!

It is simply a question of proving that Chartism is neither a science nor divination or pure chance.

In technical analysis , there is especially a strong psychological dimension to study, interpret, and try to anticipate or at least use to his advantage.

This proof is an ascending channel that is anything but the product of hazard: a whale (market maker) or a set of individuals (I did not check the order book because it doesn't matter) traced a bullish trend resistant between the two recent peaks as you can see in white on my graph, then reported a parallel (you have the dedicated tool "Parallel Channel" to do the same in Tradingview), adjusted on the bottom of my graph: and he has (they have) placed their (their) purchase order very exactly on this parallel during the dump of the Rising Wedge of my previous publication (here in dashed for reminder), which also coincides with the expected target of this pattern of reversal (return bearish to the base of the wedge ).

The perfection of the pattern with this rebound leaves no room for doubt: it was not the result of chance, which gave the opportunity to anticipate and enjoy it with the interesting probability that there is a greater number of Long trades on the same simple track as on a direct continuation of the dump without rebound.