Predictions and analysis

... Covered Zebra. Comments: A variation on one of the bearish assumption setups I described over the weekend. (See Post Below). Here, the September 15th 351/2 x 359 is the Zebra aspect, which functions as synthetic short stock. This is, in turn, "covered" by an additional short put so the entire setup has the delta metrics of a covered put (short stock,...

With the DIA at fairly long-term overhead resistance, I thought I'd set out how I'd potentially take a bearish assumption directional shot using a defined risk options setup where the max loss is known from the outset. There are several ways to go about this: 1. Short Call Vertical Buy the September 15th 351 call and sell the September 15th 346 call, resulting...

... for a .20 credit. Comments: This is about as "it didn't work out" as it gets ... . Paid a 9.85 debit to get in; .20 debit to close; 9.65 ($965) loser.

We just finished 1-5 Elliot wave and waiting to complete ABC correction we forecast that finish of ABC correction will be around 356 zone, since there is a strong demand zone and we can see institutional candle in a lower time frames. Entry: 356 Invalidation: 330 Target: 470 Ratio: 4.38

WTI is the highest it's been in a very long time ... . You can naturally play /CL directly or use USO Here, I would buy 2 x the 72's in July and sell the 62, with the result being a break even where the stock is currently trading. I would go longer-dated in this particular case to allow shale to get back in the game, U.S. production to increase somewhat toward...

Pictured here is a July 16th 416/432 Put Ratio with twice the number of contracts on the long side as on the short which I can either do as a standalone directional shot or (in this particular case) a hedge against a portfolio that is longer than the net delta of this particular setup. Here's how it's constructed: Start out by (a) looking to buy 2 x (or some...

Ever seen a "Brazilian Zebra"? Pictured here is an ITUB (35/76) Zero Extrinsic Back Ratio Spread (hence the colorful acronym, "ZEBRA") in the Brazilian financial, ITUB. Since Zebras are high delta directional plays, they're seen as synthetic stock substitutes and can be deployed both on the call side (long), as well as on the put side (short), with the general...

Unconfirmed double bottom. It needs to get over $243.33 for confirmation. RSI broke down the trend and 59.48 will be the resistance. If you find my charts useful, please just leave me a "Like" thx

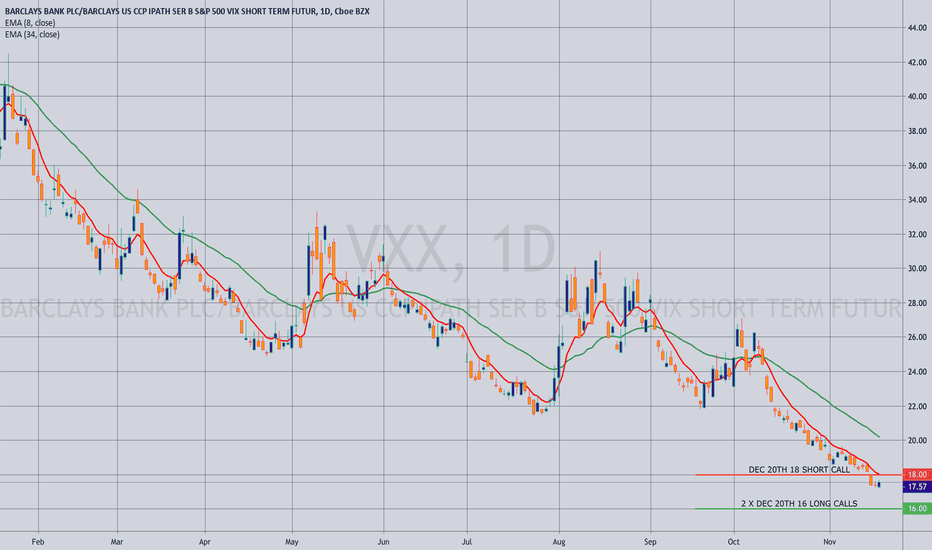

With VIX hovering around 2019 lows, re-upping with another "Zebra" ... . Metrics: Max Profit: Undefined Max Loss: $221/setup Break Even: 15.23 Delta/Theta: 85.16/-1.07 Notes: There are several different ways to look at this trade: (a) as a long call vertical + an additional long call; (b) long calls, the cost of which is cut by selling a short against; or (c)...

I've dicked around long enough waiting to put something on at or near VIX lows, and I like this particular setup here, although I obviously didn't catch things at VIX lows. Metrics: Max Profit: Undefined/Infinite Max Loss: 3.03 ($303) Break Even: 17.51 versus 17.57 spot Delta: 98.9 Theta: -.83 Notes: With the classic "Zebra", you're looking for a setup in which...