ChatGPT On Apple iPhone, Make Or Break Data For Stock Market Ahead

To gain an edge, this is what you need to know today.

Make Or Break Data Ahead

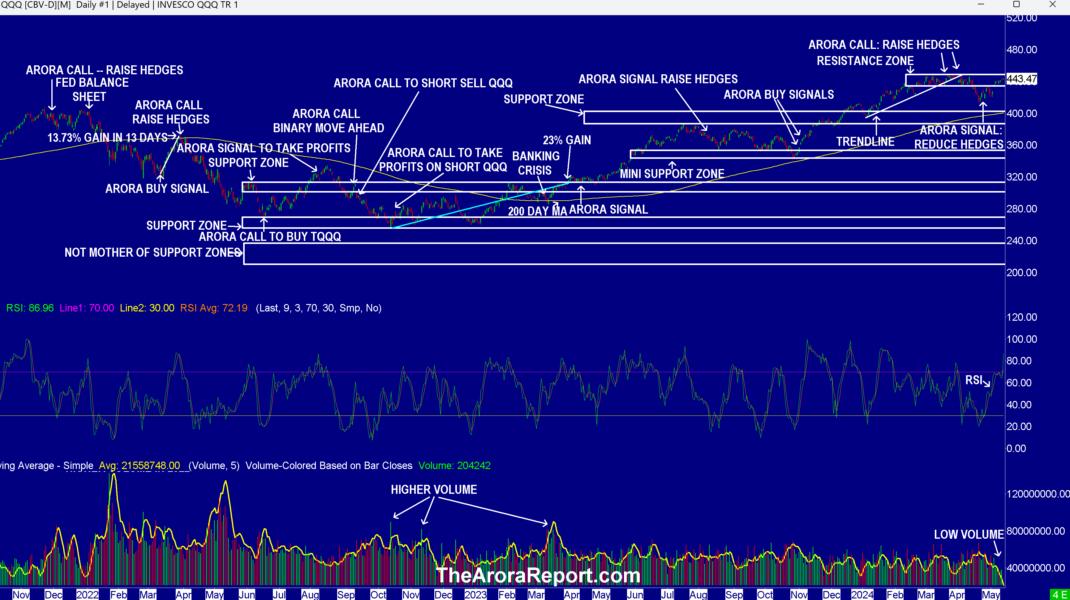

Please click here for an enlarged chart of Invesco QQQ Trust Series 1 QQQ.

Note the following:

- The chart shows QQQ is in the resistance zone.

- The chart shows that the rally is on low volume, indicating a lack of conviction.

- The chart shows that RSI has jumped and is now overbought. RSI indicates that the stock market is now vulnerable to the downside if the macro data goes against the market.

- The chart shows Arora calls to raise hedges near the top and the Arora call to reduce hedges near the bottom. When hedges are used over a long period of time, they can add significant amounts to your returns and significantly lower your risks. If you do not hedge, you can simply adjust cash. Please see the “Protection Band And What To Do Now” section below.

- Consumer Price Index (CPI) and Producer Price Index (PPI) are ahead –these pieces of data are make or break for the stock market. Here is the consensus:

- 0.3% for headline PPI

- 0.2% for core PPI

- 0.4% for headline CPI

- 0.3% for core CPI

- Wall Street is positioned for inflation data to cool and the stock market to break out of the resistance zone shown on the chart.

- Prudent investors need to be aware that if the data goes against Wall Street’s positioning, the stock market reaction to the downside can be severe due to positive positioning.

- Apple Inc

AAPL is reportedly in talks with OpenAI to put ChatGPT on iPhones. This is creating positive sentiment in the market. On the surface, this is negative for Alphabet Inc Class C

GOOG and Alphabet Inc Class A

GOOGL.

- As a proof positive of the speculative sentiment in the stock market rapidly increasing ahead of the key data, the meme crowd is back. They are running up video game retailer GameStop Corp

GME. To some degree, this is reminiscent of the start of the last meme crowd craze which ended in tears for the meme crowd.

- Artificial intelligence stocks are getting a boost on reports that Arm Holdings PLC - ADR

ARM is developing new artificial intelligence chips

Magnificent Seven Money Flows

In the early trade, money flows are positive in AAPL, Amazon.com, Inc.

MSFT, NVIDIA Corp

NVDA, and Tesla Inc

TSLA.

In the early trade, money flows are negative in GOOG and Meta Platforms Inc META.

In the early trade, money flows are mixed in S&P 500 ETF (SPY) and QQQ.

Momo Crowd And Smart Money In Stocks

The momo crowd is buying stocks in the early trade. Smart money is inactive in the early trade.

Gold

The momo crowd is buying gold in the early trade. Smart money is inactive in the early trade.

For longer-term, please see gold and silver ratings.

The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust

SLV.

Oil

The momo crowd is buying oil in the early trade. Smart money is inactive in the early trade.

For longer-term, please see oil ratings.

The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Bitcoin is seeing buying along with the rise in speculative sentiment.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of seven year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.