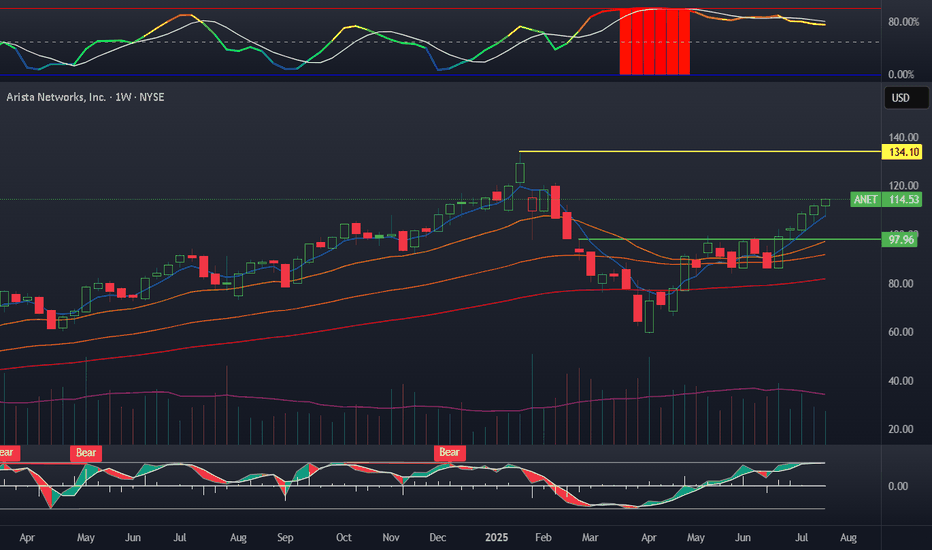

ANET - Rebounds from EMA 50ANET - CURRENT PRICE : 148.00 - 149.00

Technical Rationale:

1. Rebound from Key Moving Average Support

The stock price has rebounded strongly from the 50-day EMA, which has acted as a dynamic support level throughout the uptrend. This rebound indicates renewed buying interest at a technically sig

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.67 USD

2.85 B USD

7.00 B USD

1.04 B

About Arista Networks, Inc.

Sector

Industry

CEO

Jayshree V. Ullal

Website

Headquarters

Santa Clara

Founded

2004

ISIN

US0404132054

FIGI

BBG000N2HDY5

Arista Networks, Inc. engages in the development, marketing, and sale of cloud networking solutions. Its solutions include EOS, a set of network applications, and Gigabit Ethernet switching and routing platforms. Its product categories include Core, Cognitive Adjacencies, and Network Software and Services. The company was founded by Andreas Bechtolsheim, David Cheriton, and Kenneth Duda in November 2004 and is headquartered in Santa Clara, CA.

Related stocks

Arista Networks is forming a clear double-top patternArista Networks NYSE:ANET is forming a clear double-top pattern on the daily chart, signaling a potential short-term trend reversal after a strong uptrend.

Price has broken below the neckline near $134, confirming weakness and putting the next major support zone around $121.65 in focus.

If buy

ANET: watching for more downside in coming weeksPrice action suggests a potential lower high formation. I’m watching for immediate downside into the 125–115 support zone in the coming weeks.

Chart:

Previously:

On upside momentum (Sep 28):

Chart:

www.tradingview.com

On bullish structure (Aug 27):

Chart:

www.tradingview.com

$ANET | AI Catalyst Meets Technical BreakoutNYSE:ANET | AI Catalyst Meets Technical Breakout

Arista Networks (ANET) is setting up for a potential breakout backed by strong fundamentals and AI momentum.

🔹 Technical Setup

Price holding support at $133–136 zone.

Clear structure of higher lows; volume spikes confirm institutional activity.

ANET eyes on $137.66-141.38: Double Golden fibs trying to TOP itANET continues its strong uptrend from April lows.

It hit a Double Golden zone that is proving its strength.

This "Ultra-High Gravity" zone will slow if not TOP the wave.

.

Previous Analysis that caught a BOTTOM:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

====================

$ANET: Breakout candidate in price discovery mode. Arista network is a mid-cap semiconductor stock with expertise in Ethernet based network equipment’s and designed for AI workloads. It equipment’s combined with its superior software stack is well designed for this current AI based bull run we are experiencing in the market. During the April 2025 vo

Arista Networks (ANET)_Cloud Fabric for AINYSE:ANET Price has respected the support line around $94–97, which was previously a breakout zone and now serves as a solid foundation for a potential upward move. Volume Profile shows strong interest in this range, confirming its importance.

Technical view:

• Rebound from support at $94.36 (July

ANET top tomorrowSame pattern as April 2019. Chart tops out, drops really hard, market decides to not pay shorts and rebounds incredibly strongly. Chart forms new high which eliminates the shorts and gets the market thinking bull bull bull and then it proceeds to sell off. I think the top for ANET will happen tomorr

ANET new positionStarted a feeler position in ANET today with 110 shares. Sold a low delta covered call and added a CSP on the monthly a bit lower. I believe this will be the range of interest here. I wanted to slowly diversify a bit away from small caps as I have made a lot on the risk account the last two years. A

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ANET is featured.

Female-led stocks: Who rules the world?

34 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of ANET is 138.04 USD — it has increased by 0.47% in the past 24 hours. Watch Arista Networks, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Arista Networks, Inc. stocks are traded under the ticker ANET.

ANET stock has fallen by −16.41% compared to the previous week, the month change is a −15.77% fall, over the last year Arista Networks, Inc. has showed a 35.85% increase.

We've gathered analysts' opinions on Arista Networks, Inc. future price: according to them, ANET price has a max estimate of 185.00 USD and a min estimate of 140.00 USD. Watch ANET chart and read a more detailed Arista Networks, Inc. stock forecast: see what analysts think of Arista Networks, Inc. and suggest that you do with its stocks.

ANET reached its all-time high on Oct 30, 2025 with the price of 164.94 USD, and its all-time low was 3.28 USD and was reached on Feb 9, 2016. View more price dynamics on ANET chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ANET stock is 3.16% volatile and has beta coefficient of 2.21. Track Arista Networks, Inc. stock price on the chart and check out the list of the most volatile stocks — is Arista Networks, Inc. there?

Today Arista Networks, Inc. has the market capitalization of 169.56 B, it has decreased by −14.56% over the last week.

Yes, you can track Arista Networks, Inc. financials in yearly and quarterly reports right on TradingView.

Arista Networks, Inc. is going to release the next earnings report on Feb 16, 2026. Keep track of upcoming events with our Earnings Calendar.

ANET earnings for the last quarter are 0.75 USD per share, whereas the estimation was 0.72 USD resulting in a 4.48% surprise. The estimated earnings for the next quarter are 0.75 USD per share. See more details about Arista Networks, Inc. earnings.

Arista Networks, Inc. revenue for the last quarter amounts to 2.31 B USD, despite the estimated figure of 2.26 B USD. In the next quarter, revenue is expected to reach 2.37 B USD.

ANET net income for the last quarter is 853.00 M USD, while the quarter before that showed 888.80 M USD of net income which accounts for −4.03% change. Track more Arista Networks, Inc. financial stats to get the full picture.

No, ANET doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Nov 10, 2025, the company has 4.41 K employees. See our rating of the largest employees — is Arista Networks, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Arista Networks, Inc. EBITDA is 3.69 B USD, and current EBITDA margin is 42.93%. See more stats in Arista Networks, Inc. financial statements.

Like other stocks, ANET shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Arista Networks, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Arista Networks, Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Arista Networks, Inc. stock shows the buy signal. See more of Arista Networks, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.