I Think GE Aerospace is BrilliantThis is one of my favorite companies on the market. I really have a deep fascination for aviation and all things, planes. Naturally it makes sense for me to have exposure to the sector. I do not have many companies in my portfolio but I'm going to share my reasons for why I have been buying GE stock

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.55 USD

6.54 B USD

38.70 B USD

1.05 B

About GE Aerospace

Sector

Industry

CEO

H. Lawrence Culp

Website

Headquarters

Evendale

Founded

1878

ISIN

US3696043013

FIGI

BBG0032FLJ75

GE Aerospace is an American aircraft company, which engages in the provision of jet and turboprop engines, as well as integrated systems for commercial, military, business, and general aviation aircraft. The firm's portfolio of brands includes Avio Aero, Unison, GE Additive, and Dowty Propellers. It operates through the Commercial Engines & Services and Defense & Propulsion Technologies segments. The Commercial Engines & Services segment is involved in the design, development, manufacturing, and servicing of jet engines for commercial airframes, as well as business aviation and aeroderivative applications. The Defense & Propulsion Technologies segment offers defense engines and critical aircraft systems. The company was founded by Thomas Alva Edison in 1878 and is headquartered in Evendale, OH.

Related stocks

GE heads up at $305.12: Golden Genesis fib may give DIP to reBuyGE flew through all of our mapped targets (see idea below)

Now at a possible top by Golden Genesis fib at $305.12

Look for a Dip-to-Fib (likely) or a Break-n-Retest next.

.

Previous Analysis that nailed a PERFECT BOTTOM:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=============

GE watch $260-261: Key support to maintain strong UptrendGE has been in a strong uptrend for a couple of years now.

Earnings report dropped it to support zone at $260.00-261.05

This zone is now clearly visible to everyon, so Do-or-Die here.

Long entry here with tight stop loss just below zone.

======================================================

.

Crazy claims #GEWe’re up about 6% since I recently shared this idea. I won’t go through the full methodology, just my price target. Short- to mid-term trade, and it looks like we’re breaking over 208 any day now. I’m in with a very small size, but after 208, I’m full size. Looking forward to next quarter to see if

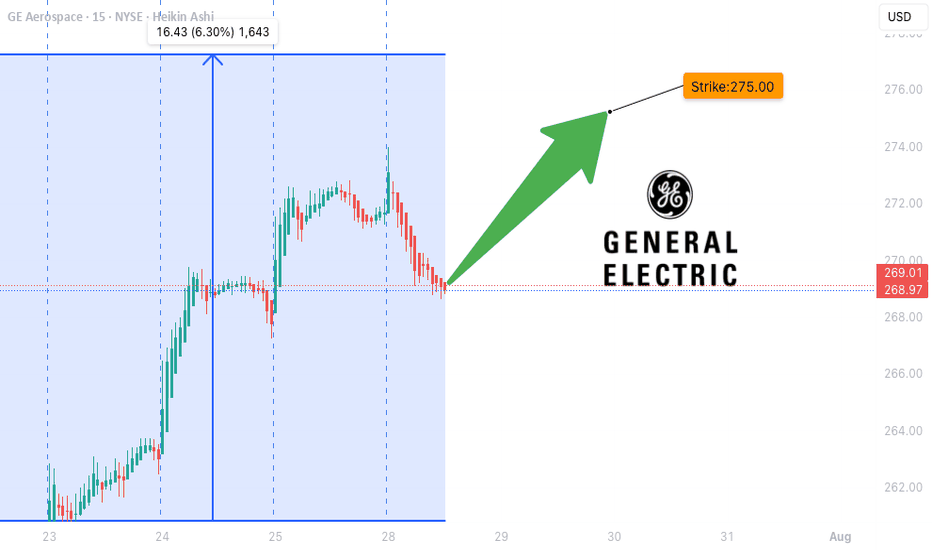

GE Targeting the Highs — Ready to Breakout?⚡ GE Weekly Options Alert (Aug 12, 2025)**

**Bias:** 🟡 **MODERATE BULLISH** — RSI strong but volume light

📊 **Key Stats:**

* **Call/Put Ratio:** 0.84 — neutral sentiment

* **Daily RSI:** 71.0 ↗ strong momentum

* **Weekly RSI:** 83.9 ↗ very bullish

* **Volume:** 0.8× last week — low institutional c

GE WEEKLY OPTIONS SETUP (2025-07-28)

### ⚙️ GE WEEKLY OPTIONS SETUP (2025-07-28)

**Mixed Signals, Bullish Flow – Can Calls Win This Tug-of-War?**

---

📊 **Momentum Breakdown:**

* **RSI:** Falling across models → ⚠️ *Momentum Weak*

* **Volume:** Weak 📉 = Low conviction from big players

* **Options Flow:** Call/Put ratio favors bull

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture an

GE Weekly Options Trade Setup – 07/14/2025 $290C | Exp. July 18

📈 GE Weekly Options Trade Setup – 07/14/2025

$290C | Exp. July 18 | Bullish Catalyst In Play

⸻

🔥 BULLISH MOMENTUM CONFIRMED

✅ All 5 major AI models (Grok, Claude, Gemini, Llama, DeepSeek) agree:

GE just broke out — strong momentum, price above MAs, MACD bullish.

📰 Catalyst: Citigroup Upgrade 💥

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

GE.HQH

General Electric Capital Corporation 4.5% 15-NOV-2025Yield to maturity

15.25%

Maturity date

Nov 15, 2025

G

GE4373214

GE Capital International Funding Co. ULC 3.373% 15-NOV-2025Yield to maturity

6.82%

Maturity date

Nov 15, 2025

G

75VG

GE Capital UK Funding Unlimited Co. 8.0% 14-JAN-2039Yield to maturity

6.05%

Maturity date

Jan 14, 2039

XS0182703743

General Electric Company 5.375% 18-DEC-2040Yield to maturity

6.03%

Maturity date

Dec 18, 2040

65LH

General Electric Capital Corporation 4.875% 18-SEP-2037Yield to maturity

5.73%

Maturity date

Sep 18, 2037

US369604BX0

General Electric Capital Corporation 4.25% 01-MAY-2040Yield to maturity

5.44%

Maturity date

May 1, 2040

GE.AC

General Electric Capital Corporation 5.0% 15-DEC-2025Yield to maturity

5.41%

Maturity date

Dec 15, 2025

GE4976362

General Electric Capital Corporation 4.35% 01-MAY-2050Yield to maturity

5.35%

Maturity date

May 1, 2050

US369604BF9

General Electric Capital Corporation 4.125% 09-OCT-2042Yield to maturity

5.30%

Maturity date

Oct 9, 2042

US369604BH58

General Electric Capital Corporation 4.5% 11-MAR-2044Yield to maturity

5.28%

Maturity date

Mar 11, 2044

US36962G3A0

General Electric Capital Corporation 6.15% 07-AUG-2037Yield to maturity

5.06%

Maturity date

Aug 7, 2037

See all GE bonds

Curated watchlists where GE is featured.

Frequently Asked Questions

The current price of GE is 305.00 USD — it has decreased by −0.17% in the past 24 hours. Watch GE Aerospace stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange GE Aerospace stocks are traded under the ticker GE.

GE stock has risen by 12.63% compared to the previous week, the month change is a 12.63% rise, over the last year GE Aerospace has showed a 90.83% increase.

We've gathered analysts' opinions on GE Aerospace future price: according to them, GE price has a max estimate of 374.00 USD and a min estimate of 255.00 USD. Watch GE chart and read a more detailed GE Aerospace stock forecast: see what analysts think of GE Aerospace and suggest that you do with its stocks.

GE stock is 0.17% volatile and has beta coefficient of 1.45. Track GE Aerospace stock price on the chart and check out the list of the most volatile stocks — is GE Aerospace there?

Today GE Aerospace has the market capitalization of 324.11 B, it has increased by 2.17% over the last week.

Yes, you can track GE Aerospace financials in yearly and quarterly reports right on TradingView.

GE Aerospace is going to release the next earnings report on Jan 27, 2026. Keep track of upcoming events with our Earnings Calendar.

GE earnings for the last quarter are 1.66 USD per share, whereas the estimation was 1.46 USD resulting in a 13.48% surprise. The estimated earnings for the next quarter are 1.44 USD per share. See more details about GE Aerospace earnings.

GE Aerospace revenue for the last quarter amounts to 11.30 B USD, despite the estimated figure of 10.39 B USD. In the next quarter, revenue is expected to reach 11.19 B USD.

GE net income for the last quarter is 2.16 B USD, while the quarter before that showed 2.03 B USD of net income which accounts for 6.36% change. Track more GE Aerospace financial stats to get the full picture.

Yes, GE dividends are paid quarterly. The last dividend per share was 0.36 USD. As of today, Dividend Yield (TTM)% is 0.44%. Tracking GE Aerospace dividends might help you take more informed decisions.

GE Aerospace dividend yield was 0.67% in 2024, and payout ratio reached 18.74%. The year before the numbers were 0.25% and 3.83% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 9, 2025, the company has 53 K employees. See our rating of the largest employees — is GE Aerospace on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GE Aerospace EBITDA is 9.53 B USD, and current EBITDA margin is 20.39%. See more stats in GE Aerospace financial statements.

Like other stocks, GE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GE Aerospace stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GE Aerospace technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GE Aerospace stock shows the strong buy signal. See more of GE Aerospace technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.