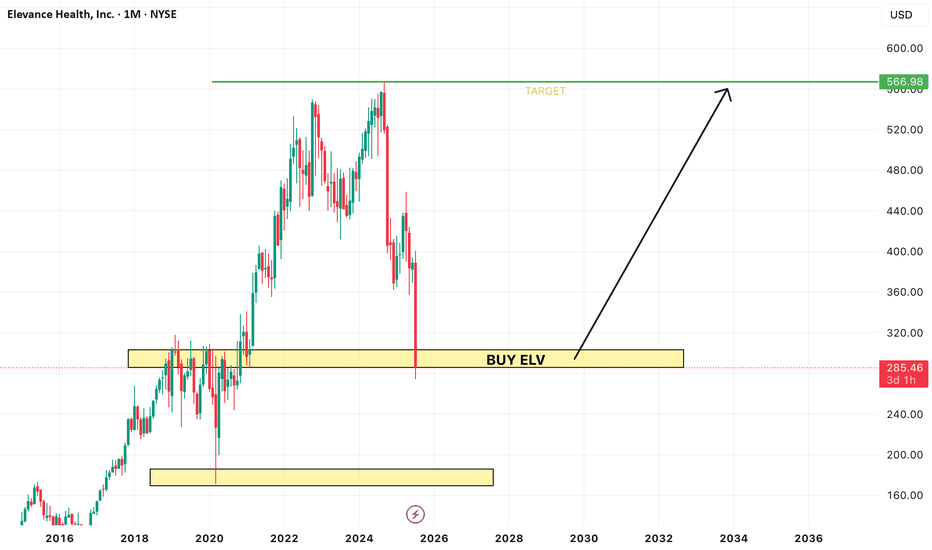

ELV (Elevance Health) – Catching the Knife or Catching Value?Elevance (ELV) just took a 12% hit after Q2 earnings missed estimates and full-year guidance was cut significantly. But here's the thing—the selloff may be overdone. The stock now trades at a forward P/E of ~10, well below industry peers, and is approaching multi-year support levels.

📥 Entry Plan

Key facts today

Elevance Health, Inc. released its annual Form 10-K report, detailing financial and operational performance, revenue segments, geographical performance, strategic initiatives, and sector challenges.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.66 B USD

199.13 B USD

221.59 M

About Elevance Health, Inc.

Sector

Industry

CEO

Gail Koziara Boudreaux

Website

Headquarters

Indianapolis

Founded

1944

IPO date

Oct 30, 2001

Identifiers

3

ISIN US0367521038

Elevance Health, Inc. operates as a health company, which engages in improving lives and communities, and making healthcare simpler. It operates through the following segments: Health Benefits, CarelonRx, Carelon Services, and Corporate and Other. The Health Benefits segment offers a comprehensive suite of health plans and services to different customers. The CarelonRx segment markets and offers pharmacy services to affiliated health plan customers, as well as to external customers. The Carelon Services segment integrates physical, behavioral, pharmacy, and social services with the aim of delivering whole health affordably by offering a broad array of healthcare related services. The Corporate & Other segment includes businesses that do not individually meet the quantitative threshold for an operating segment. The company was founded in 1944 and is headquartered in Indianapolis, IN.

Related stocks

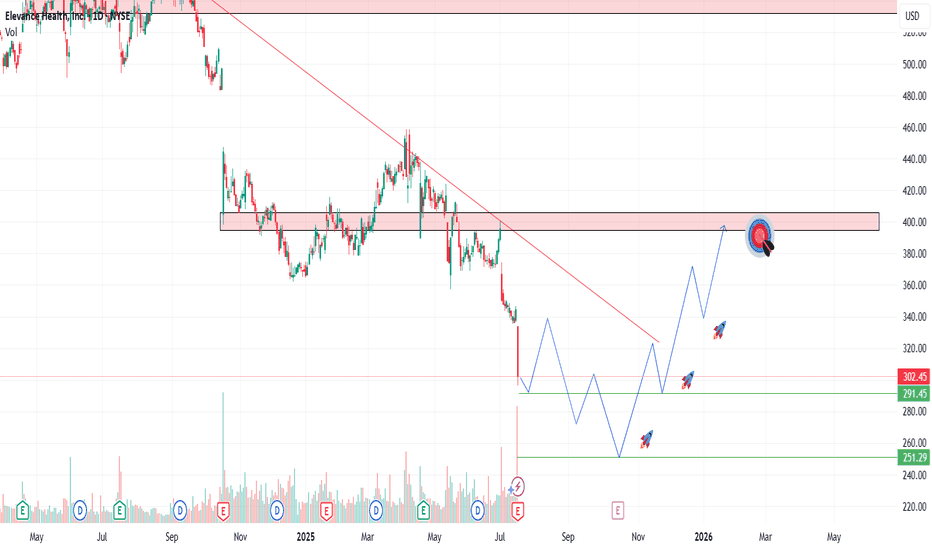

$ELV: Breakout Setting UPWhat I’m seeing

This is Elevance Health (ELV) transitioning from a corrective phase into early re-accumulation. The prior downtrend is well-defined: lower highs capped by the descending trendline and repeated BOS to the downside. That trend resolved with a sell-side liquidity sweep into discount, fo

$ELV tightening inside a contracting wedge🚨 NYSE:ELV tightening inside a contracting wedge while defending the discount zone. Liquidity has been swept, CHoCH confirmed, and price is pushing back into Equilibrium → Premium. If momentum holds, a drive toward the $348–$352 zone becomes a valid upside path.

📌 Key Observations

Higher-timefra

$ELV – Smart Money Structure & VolanX ViewNYSE:ELV – Smart Money Structure & VolanX View

Market Structure: Price is recovering from a deep discount zone with multiple internal CHoCH events confirming short-term bullish intent. Current structure shows stabilization above the 0.382–0.50 Fib zone, suggesting accumulation before expansion (Sc

Elevance Health (ELV) – Trendline Reversal and Breakout SetupElevance Health ( NYSE:ELV ) is pushing higher along a rising trendline and is now testing a critical resistance zone around $340.67. A breakout above this level would signal a bullish reversal, with upside potential toward $402 (~18% move).

Entry trigger: Breakout above $340.67 with confirmation.

Elevance is losing the long term trendlineLosing such a large trendline is always a bad signal for a company.

The price can easily fall from 15 to 25% in the upcoming weeks or months, take care with this stock unless you are shorting.

This is especially significant while we are seeing Indexs, BTC and more doing new all time highs.

A SL

Potential 33% gain in ELVELV has a potential for a reversal for potentially 33% gain.

Using the Data Distribution with Extreme Clusters custom indicator, we can see that the stock is overextended on both the 5D chart (longer term) and 1D (shorter term) chart.

The last weekly bar ended up on a very high volume. Looking a

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US36752AR4

Elevance Health, Inc. 1.5% 15-MAR-2026Yield to maturity

7.62%

Maturity date

Mar 15, 2026

ANTM4153492

Elevance Health, Inc. 4.85% 15-AUG-2054Yield to maturity

5.98%

Maturity date

Aug 15, 2054

ANTM5923067

Elevance Health, Inc. 5.85% 01-NOV-2064Yield to maturity

5.95%

Maturity date

Nov 1, 2064

ANTM5405192

Elevance Health, Inc. 4.55% 15-MAY-2052Yield to maturity

5.87%

Maturity date

May 15, 2052

ANTM5815444

Elevance Health, Inc. 5.65% 15-JUN-2054Yield to maturity

5.87%

Maturity date

Jun 15, 2054

US036752AX13

Elevance Health, Inc. 6.1% 15-OCT-2052Yield to maturity

5.86%

Maturity date

Oct 15, 2052

US36752AS2

Elevance Health, Inc. 3.6% 15-MAR-2051Yield to maturity

5.83%

Maturity date

Mar 15, 2051

ANTM6169846

Elevance Health, Inc. 5.7% 15-SEP-2055Yield to maturity

5.83%

Maturity date

Sep 15, 2055

ELVH5534305

Elevance Health, Inc. 5.125% 15-FEB-2053Yield to maturity

5.82%

Maturity date

Feb 15, 2053

AE1J

Elevance Health, Inc. 4.375% 01-DEC-2047Yield to maturity

5.77%

Maturity date

Dec 1, 2047

ANTM4983288

Elevance Health, Inc. 3.125% 15-MAY-2050Yield to maturity

5.76%

Maturity date

May 15, 2050

See all ELV bonds

Frequently Asked Questions

The current price of ELV is 338.98 USD — it has increased by 2.03% in the past 24 hours. Watch Elevance Health, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Elevance Health, Inc. stocks are traded under the ticker ELV.

ELV stock has fallen by −2.56% compared to the previous week, the month change is a −9.15% fall, over the last year Elevance Health, Inc. has showed a −15.32% decrease.

We've gathered analysts' opinions on Elevance Health, Inc. future price: according to them, ELV price has a max estimate of 425.00 USD and a min estimate of 332.00 USD. Watch ELV chart and read a more detailed Elevance Health, Inc. stock forecast: see what analysts think of Elevance Health, Inc. and suggest that you do with its stocks.

ELV stock is 3.46% volatile and has beta coefficient of 0.25. Track Elevance Health, Inc. stock price on the chart and check out the list of the most volatile stocks — is Elevance Health, Inc. there?

Today Elevance Health, Inc. has the market capitalization of 75.33 B, it has decreased by −6.49% over the last week.

Yes, you can track Elevance Health, Inc. financials in yearly and quarterly reports right on TradingView.

Elevance Health, Inc. is going to release the next earnings report on Apr 22, 2026. Keep track of upcoming events with our Earnings Calendar.

ELV earnings for the last quarter are 3.33 USD per share, whereas the estimation was 3.10 USD resulting in a 7.54% surprise. The estimated earnings for the next quarter are 10.57 USD per share. See more details about Elevance Health, Inc. earnings.

Elevance Health, Inc. revenue for the last quarter amounts to 49.31 B USD, despite the estimated figure of 49.84 B USD. In the next quarter, revenue is expected to reach 48.77 B USD.

ELV net income for the last quarter is 547.00 M USD, while the quarter before that showed 1.19 B USD of net income which accounts for −53.99% change. Track more Elevance Health, Inc. financial stats to get the full picture.

Yes, ELV dividends are paid quarterly. The last dividend per share was 1.71 USD. As of today, Dividend Yield (TTM)% is 2.02%. Tracking Elevance Health, Inc. dividends might help you take more informed decisions.

Elevance Health, Inc. dividend yield was 1.95% in 2025, and payout ratio reached 27.13%. The year before the numbers were 1.77% and 25.39% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, ELV shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Elevance Health, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Elevance Health, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Elevance Health, Inc. stock shows the sell signal. See more of Elevance Health, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.