STRATEGY The collapse continues..Strategy (MSTR) completely lost its 1W MA200 (orange trend-line) last week, making its losses at more than -80% from its November 2024 All Time High (ATH), continuing to outperform even Bitcoin in losses. Given that the Bear Cycle on stocks hasn't started yet, this can only get (much) worse, somethi

Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−13.88 USD

−3.85 B USD

477.23 M USD

267.16 M

About Strategy Inc

Sector

Industry

CEO

Phong Q. Le

Website

Headquarters

Vienna

Founded

1989

Identifiers

3

ISIN US5949728530

Strategy, Inc. engages in the provision of enterprise analytics and mobility software. The firm designs, develops, markets, and sells software platforms through licensing arrangements and cloud-based subscriptions and related services. Its product packages include Hyper. The company was founded by Michael J. Saylor and Sanjeev K. Bansal on November 17, 1989, and is headquartered in Vienna, VA.

Related stocks

MicroStrategy (MSTR) Shares Rebound After a Dramatic Sell-OffMicroStrategy (MSTR) Shares Rebound After a Dramatic Sell-Off

Shares of Strategy Incorporated (MSTR) suffered a severe collapse, falling by more than 75% from their July 2025 highs to last Thursday’s low. The main trigger was concern over the cryptocurrency market, as the company holds more than 7

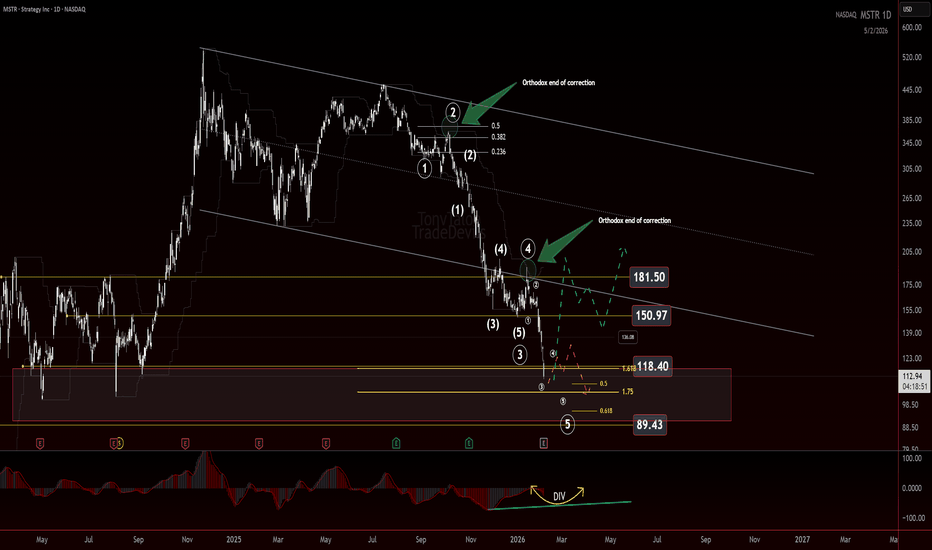

MSTR: What's the strategy? If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

Questions Waiting for Answers

MSTR at the larger degree of the Elliott Wave structure is still being resolved. What stands out is the most recent move down, which

Full Reset before Full SendWhy March 2025 Could See New Highs

What's Happening Right Now?

Everyone is freaking out right now, but this is actually creating one of the best buying opportunities we've seen. Bitcoin is trading around $95,600 after dropping about 24% from its peak of $126,000 in October.

The Fear & Greed Ind

MSFT - High-Risk Reaction Trade at HTF SupportNASDAQ:MSFT is now down nearly 80% from its all-time high, approaching a major higher time frame (HTF) support zone. This is not a trend reversal play — it's a reaction trade at a critical level where a bounce is possible if sentiment stabilizes. The risk is high, but so is the short-term reward po

RECAP - MSTR bounce from support perfectlyNo Reasonable Scenario' Forces Strategy To Sell Bitcoin As $440 Target Stands: TD Cowen

Strategy Inc (NASDAQ:MSTR) shares surged 22% Friday as TD Cowen maintained its $440 price target, arguing there is “no reasonable scenario” forcing the company to sell Bitcoin (CRYPTO: BTC) despite trading underw

MSTR Monthly OutlookFollow me here on TW for my regular critical updates on crypto (BTC, ETH, SOL, MSTR) and metals (GLD, SL, PL) based on Martin Armstrong's Socrates.

Look in my TW Ideas for posts of each market individually.

All 4 crypto markets BTC ETH SOL MSTR are currently crossing MONTHLY REVERSAL levels, cons

MSTR Dislocation Trade — Quant Models Signal Recovery WindowMSTR QuantSignals V4 Swing 2026-02-05

MSTR is trading at extreme oversold conditions (RSI ~17) near a critical support zone, signaling potential seller exhaustion.

Quant models and institutional flow suggest accumulation, creating a favorable environment for a mean-reversion bounce over the next

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US594972AT8

Strategy Inc 0.0% 01-MAR-2030Yield to maturity

—

Maturity date

Mar 1, 2030

MSTR6034213

Strategy Inc 0.875% 15-MAR-2031Yield to maturity

—

Maturity date

Mar 15, 2031

MSTR6242992

Strategy Inc 0.0% 01-DEC-2029Yield to maturity

—

Maturity date

Dec 1, 2029

US594972AN1

Strategy Inc 2.25% 15-JUN-2032Yield to maturity

—

Maturity date

Jun 15, 2032

MSTR6032672

Strategy Inc 0.625% 15-MAR-2030Yield to maturity

—

Maturity date

Mar 15, 2030

US594972AQ4

Strategy Inc 0.625% 15-SEP-2028Yield to maturity

—

Maturity date

Sep 15, 2028

See all STRC bonds

XPF

iShares S&P/TSX North American Preferred Stock Index ETF (CAD-Hedged) Trust UnitsWeight

1.09%

Market value

1.93 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of STRC is 100.00 USD — it has increased by 0.27% in the past 24 hours. Watch Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock stocks are traded under the ticker STRC.

STRC stock has risen by 1.34% compared to the previous week, the month change is a −0.07% fall, over the last year Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock has showed a 12.99% increase.

STRC reached its all-time high on Jan 13, 2026 with the price of 100.42 USD, and its all-time low was 88.00 USD and was reached on Jul 25, 2025. View more price dynamics on STRC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

STRC stock is 0.64% volatile and has beta coefficient of 0.87. Track Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock stock price on the chart and check out the list of the most volatile stocks — is Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock there?

Today Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock has the market capitalization of 38.22 B, it has decreased by −12.21% over the last week.

Yes, you can track Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock financials in yearly and quarterly reports right on TradingView.

Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock is going to release the next earnings report on May 4, 2026. Keep track of upcoming events with our Earnings Calendar.

STRC earnings for the last quarter are −42.93 USD per share, whereas the estimation was −0.08 USD resulting in a −53.56 K% surprise. The estimated earnings for the next quarter are −14.96 USD per share. See more details about Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock earnings.

Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock revenue for the last quarter amounts to 122.99 M USD, despite the estimated figure of 119.12 M USD. In the next quarter, revenue is expected to reach 117.91 M USD.

STRC net income for the last quarter is −12.44 B USD, while the quarter before that showed 2.79 B USD of net income which accounts for −546.55% change. Track more Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock financial stats to get the full picture.

Like other stocks, STRC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Strategy Inc - Variable Rate Series A Perpetual Stretch Preferred Stock stock right from TradingView charts — choose your broker and connect to your account.