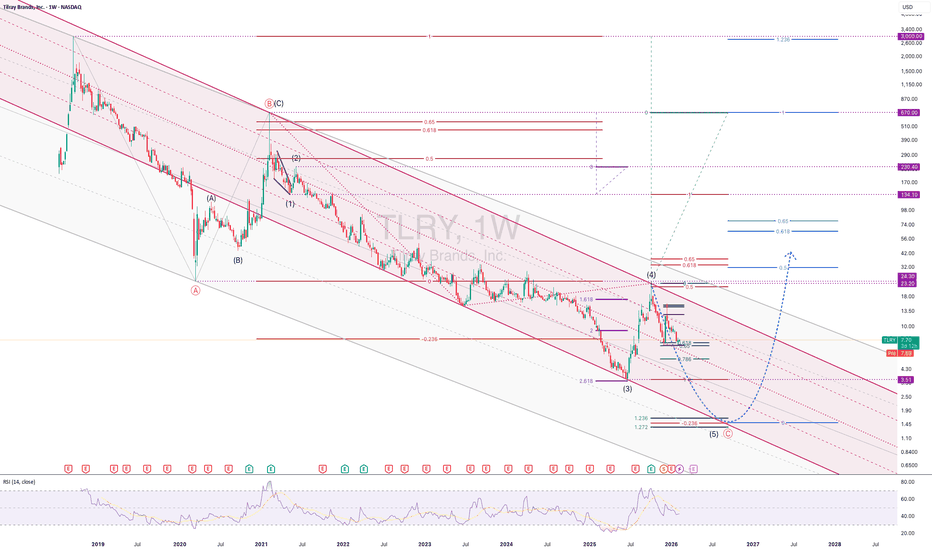

TLRY [TILRAY] EWP FIB TC ANALYSIS WEEKLY TFTLRY – Macro Elliott Wave Structure

The 2018 IPO spike to the split-adjusted $3000 represents a speculative blow-off and is not counted as part of a standard Elliott impulse. This type of parabolic launch is treated as an exogenous event, followed by a full corrective cycle.

The true Elliott stru

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−22.12 USD

−2.19 B USD

821.31 M USD

115.60 M

About Tilray Brands, Inc.

Sector

Industry

CEO

Irwin David Simon

Website

Headquarters

Leamington

Founded

2018

IPO date

Jul 19, 2018

Identifiers

3

ISIN US88688T2096

Tilray Brands, Inc. engages as a consumer packaged goods company, which focuses on medical cannabis research and the cultivation, processing, and distribution of cannabis products worldwide. It operates through the followings segments: Cannabis, Distribution, Beverage, and Wellness. The Cannabis segment focuses on cultivation, production, distribution, and sale of both medical and adult-use cannabis products. The Distribution segment is involved in purchase, resale, and distribution of pharmaceutical and wellness products. The Beverage segment refers to the production, marketing, and sale of beverages. The Wellness segment represents the production, marketing, and distribution of hemp-based food and other wellness products. The company was founded on January 24, 2018 and is headquartered in Leamington, Canada.

Related stocks

Green Rush ReloadedTilray is currently testing the bottom of a key daily gap near the $8.00 level, an area that has acted as strong technical support. A decisive breakout above the $16.00 level would confirm renewed bullish momentum and open the door for a push toward the $23.14 resistance, which aligns with prior maj

Tilray Brands' (NASDAQ: TLRY) record-breaking fiscal Q2 2026Based on a comprehensive analysis of Tilray Brands' (NASDAQ: TLRY) record-breaking fiscal Q2 2026 earnings report and its broader financial trajectory, several key technical price levels have emerged as critical support and risk zones. These levels provide a structured framework for assessing the st

$TLRY after-hours after earnings tradeNASDAQ:TLRY — Bought some in the after-hours after earnings. Tilray did just beat on revenue and the chart looks constructive. Sitting near the lower end of the range with a double bottom, which makes this a good trade even without strong earnings.

Stop: $9 should hold. Target don't know yet need

Buy above $9If price drops back below $9, I'm going to be having a word with the charting gods. The technical setup here is very textbook.

White boxes on the chart may be fractals.

(Essentially, waves of momentum that ripple through like little mirror signatures after the initial wave.)

Tilray has a crazy awe

TLRY - A Last Gasp of a Dying Industry, Or?.....Cannabis stocks have been nothing short of annihilated lately.

The last administration failed to deliver on their hot air promises and now the current one has done nothing to help the industry. Yet.

We're headed either toward mass bankruptcy or the beginning of a new cycle.

TLRY around 25 on t

Buy the DipI am buying this dip. We've re-entered a good support area, but we need to watch the gap from Friday 12Dec2025. Gaps can be magnetic in that the market wants price discovery in those areas.

Entering the gap is fine, but if price starts to drag down to $9 then we are in caution mode. This December i

Tilray: 80% gains!TLRY shares have made significant strides, boasting a gain of over 80%. Currently, the price continues to develop within orange wave iii, aiming to surpass the resistance at $23.20 in the next phase. A drop below the support at $3.51, however, would trigger our alternative scenario. In this case, it

Go TimeThis is the bounce we've been waiting for.

We have entered buy the dip mode on Tilray.

As long as we hold above $8.80, I'm bullish.

Biggest risk is that Trump 180's, but my longstanding theory has been and still is that the government is saving cannabis legalization for the next big downturn. Next

Tilray Soars on Trump Policy Shift: Buy or Sell?Tilray (TLRY) shares jumped 30% following major political news. President Donald Trump announced plans to reclassify cannabis as a Schedule III drug. Additionally, a new pilot program may allow seniors to buy cannabis through Medicare. The stock has now doubled since its December lows. This analysis

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CUSS

iShares VII PLC - iShares MSCI USA Small Cap CTB Enhanced ESG UCITS ETF Accum.Ptg.Shs USDWeight

0.01%

Market value

396.48 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of TLRY is 7.51 USD — it has increased by 0.27% in the past 24 hours. Watch Tilray Brands, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Tilray Brands, Inc. stocks are traded under the ticker TLRY.

TLRY stock has risen by 4.31% compared to the previous week, the month change is a −19.76% fall, over the last year Tilray Brands, Inc. has showed a −21.36% decrease.

We've gathered analysts' opinions on Tilray Brands, Inc. future price: according to them, TLRY price has a max estimate of 22.00 USD and a min estimate of 9.25 USD. Watch TLRY chart and read a more detailed Tilray Brands, Inc. stock forecast: see what analysts think of Tilray Brands, Inc. and suggest that you do with its stocks.

TLRY reached its all-time high on Sep 19, 2018 with the price of 3,000.00 USD, and its all-time low was 3.51 USD and was reached on Jun 23, 2025. View more price dynamics on TLRY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TLRY stock is 4.17% volatile and has beta coefficient of 1.20. Track Tilray Brands, Inc. stock price on the chart and check out the list of the most volatile stocks — is Tilray Brands, Inc. there?

Today Tilray Brands, Inc. has the market capitalization of 874.97 M, it has decreased by −1.03% over the last week.

Yes, you can track Tilray Brands, Inc. financials in yearly and quarterly reports right on TradingView.

Tilray Brands, Inc. is going to release the next earnings report on Apr 14, 2026. Keep track of upcoming events with our Earnings Calendar.

TLRY earnings for the last quarter are −0.41 USD per share, whereas the estimation was −0.21 USD resulting in a −91.89% surprise. The estimated earnings for the next quarter are −0.14 USD per share. See more details about Tilray Brands, Inc. earnings.

Tilray Brands, Inc. revenue for the last quarter amounts to 217.51 M USD, despite the estimated figure of 210.94 M USD. In the next quarter, revenue is expected to reach 201.35 M USD.

TLRY net income for the last quarter is −44.93 M USD, while the quarter before that showed −322.00 K USD of net income which accounts for −13.85 K% change. Track more Tilray Brands, Inc. financial stats to get the full picture.

No, TLRY doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 15, 2026, the company has 2.84 K employees. See our rating of the largest employees — is Tilray Brands, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Tilray Brands, Inc. EBITDA is 24.20 M USD, and current EBITDA margin is 3.13%. See more stats in Tilray Brands, Inc. financial statements.

Like other stocks, TLRY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Tilray Brands, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Tilray Brands, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tilray Brands, Inc. stock shows the sell signal. See more of Tilray Brands, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.