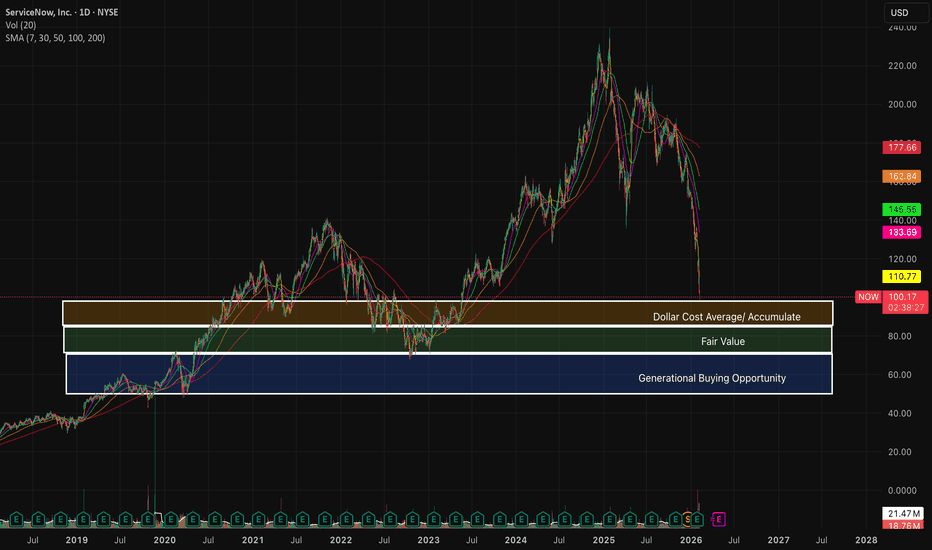

Is NOW the time to DCA?Enterprise software is getting smoked. We are experiencing an epic multiple compression in the entire sector. Now is the time to start looking at the best in breed companies, let me draw your attention to the best in the business - Service Now.

With an 84.5% subscription gross margin and 98% renewa

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.69 USD

1.75 B USD

13.28 B USD

1.04 B

About ServiceNow, Inc.

Sector

Industry

CEO

William R. McDermott

Website

Headquarters

Santa Clara

Founded

2004

IPO date

Jun 28, 2012

Identifiers

3

ISIN US81762P1021

ServiceNow, Inc. engages in the provision of an end-to-end workflow automation platform for digital businesses. Its Now Platform is a cloud-based solution embedded with artificial intelligence (AI) and machine learning (ML). The company was founded by Frederic B. Luddy in June 2004 and is headquartered in Santa Clara, CA.

Related stocks

1/21/26 - $now - Okay, catching my eye1/21/26 :: VROCKSTAR :: NYSE:NOW

Okay, catching my eye

- didn't like it at 2x this price (rare 'call the top' wtf post in 1/29/25 nearly a year ago), but at today's levels... i think you'll be fine

- rule of 40 king

- major lock in checks box of "installed base" in a world where some 14 year old

NOW ServiceNow Options Ahead of EarningsIf you haven`t bought NOW before the rally:

Now analyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 155usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $3.20.

If thes

Long $NOWThis name seems very oversold to me. RSI is at 12 right now. Entering long at $135.50.

We have a good RR here, a little over 3:1. First target is the bottom of the gap at $159.50, and second target is the full gap close at $171/$172. Target 2 also coincides with the VWAP 2025 ATHs. I would love to

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of NOW is 100.74 USD — it has decreased by −1.84% in the past 24 hours. Watch ServiceNow, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange ServiceNow, Inc. stocks are traded under the ticker NOW.

NOW stock has fallen by −14.29% compared to the previous week, the month change is a −31.93% fall, over the last year ServiceNow, Inc. has showed a −50.76% decrease.

We've gathered analysts' opinions on ServiceNow, Inc. future price: according to them, NOW price has a max estimate of 260.00 USD and a min estimate of 115.00 USD. Watch NOW chart and read a more detailed ServiceNow, Inc. stock forecast: see what analysts think of ServiceNow, Inc. and suggest that you do with its stocks.

NOW stock is 5.11% volatile and has beta coefficient of 1.49. Track ServiceNow, Inc. stock price on the chart and check out the list of the most volatile stocks — is ServiceNow, Inc. there?

Today ServiceNow, Inc. has the market capitalization of 105.37 B, it has decreased by −12.31% over the last week.

Yes, you can track ServiceNow, Inc. financials in yearly and quarterly reports right on TradingView.

ServiceNow, Inc. is going to release the next earnings report on Apr 29, 2026. Keep track of upcoming events with our Earnings Calendar.

NOW earnings for the last quarter are 0.92 USD per share, whereas the estimation was 0.88 USD resulting in a 3.98% surprise. The estimated earnings for the next quarter are 0.97 USD per share. See more details about ServiceNow, Inc. earnings.

ServiceNow, Inc. revenue for the last quarter amounts to 3.57 B USD, despite the estimated figure of 3.53 B USD. In the next quarter, revenue is expected to reach 3.74 B USD.

NOW net income for the last quarter is 401.00 M USD, while the quarter before that showed 502.00 M USD of net income which accounts for −20.12% change. Track more ServiceNow, Inc. financial stats to get the full picture.

No, NOW doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 8, 2026, the company has 29.19 K employees. See our rating of the largest employees — is ServiceNow, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ServiceNow, Inc. EBITDA is 2.60 B USD, and current EBITDA margin is 20.35%. See more stats in ServiceNow, Inc. financial statements.

Like other stocks, NOW shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ServiceNow, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ServiceNow, Inc. technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ServiceNow, Inc. stock shows the strong sell signal. See more of ServiceNow, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.