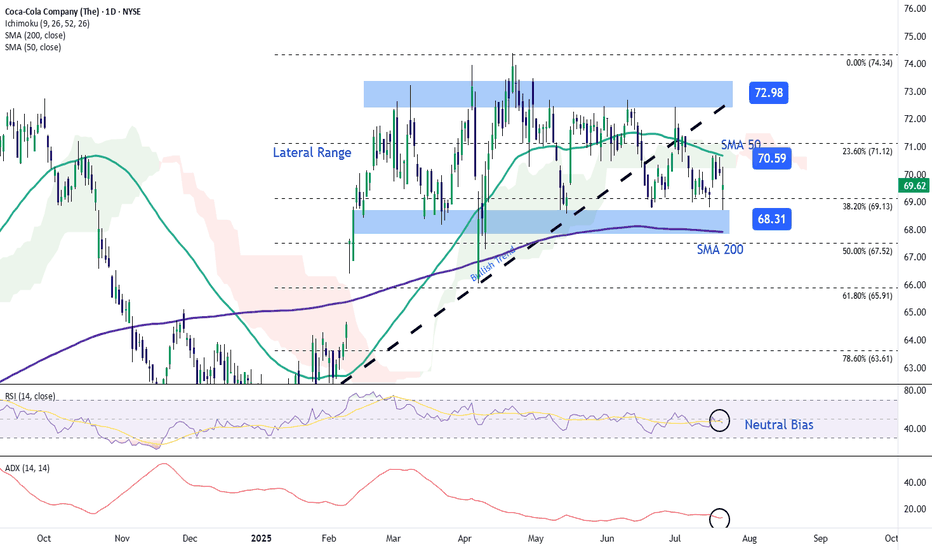

Coca Cola Are We Making New Highs or Dropping to $52 Good evening Trading Family

So here is the analysis if we can hold above 67.20 then we can see new highs being created all the way up to 80 dollars or higher.

However if we break below 67.20 we can see the market deeply correct back down to possibly as low as 52 levels.

Stay Sharp and follow t

Key facts today

Coca-Cola is experiencing declining sales among U.S. Hispanic consumers due to immigration enforcement and reduced remittances from Mexico, which may further impact demand.

Coca-Cola (KO) closed at $66.21, with a net change of -$0.22 and a trading volume of 12,762,484 shares.

Coca-Cola spun off its bottling network nearly a decade ago, a strategy now suggested by Elliott Investment Management for PepsiCo to boost margins and concentrate on core brands.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.83 USD

10.63 B USD

46.77 B USD

4.27 B

About Coca-Cola Company (The)

Sector

Industry

CEO

James Quincey

Website

Headquarters

Atlanta

Founded

1886

ISIN

US1912161007

FIGI

BBG000BMX289

The Coca-Cola Co is the nonalcoholic beverage company, which engages in the manufacture, market, and sale of non-alcoholic beverages which include sparkling soft drinks, water, enhanced water and sports drinks, juice, dairy and plant-based beverages, tea and coffee and energy drinks. Its brands include Coca-Cola, Diet Coke, Coca-Cola Zero, Fanta, Sprite, Minute Maid, Georgia, Powerade, Del Valle, Schweppes, Aquarius, Minute Maid Pulpy, Dasani, Simply, Glaceau Vitaminwater, Bonaqua, Gold Peak, Fuze Tea, Glaceau Smartwater, and Ice Dew. It operates through the following segments: Europe, Middle East and Africa, Latin America, North America, Asia Pacific, Bottling Investments and Global Ventures. The company was founded by Asa Griggs Candler in 1886 and is headquartered in Atlanta, GA.

Related stocks

Coca-Cola Might Have Lost its PopCoca-Cola has gone nowhere for a year, and some traders may see downside risk.

The first pattern on today’s chart is the series of lower highs since April -- despite an uptrend in the broader market at the same time. Does that relative weakness indicate a lack of buying interest?

Second, the soft-

KO(Coca Cola) Long trading opportunity(swing-trading) 1I expect a swing of about $4-$5 all the way up to $72+- within 1-3 months.

I am risking money in the form of a short put option to expire the 12'th of September (will be followed by a covered call opened on the 12'th September if assignment is imminent)

My entry price is $67.50-$68

I personally t

Coca-Cola Wave Analysis – 3 September 2025

- Coca-Cola reversed from the support area

- Likely to rise to resistance level 70.00

Coca-Cola recently reversed from the support area between the strong support level 67.45 (which has been reversing the price from April), lower daily Bollinger Band and the 50% Fibonacci correction of the upward

Coca-Cola: Uphill Battle Toward Key ResistanceThe climb toward our resistance level at $74.38—and ultimately into our beige Target Zone between $76.58 and $81.51—remains challenging for now. Coca-Cola shares have made little headway over the past two weeks. With the stock swinging both up and down, there’s still no clear direction. We’re mainta

When inflation runs hot, it's time for something coolSorry if the title sucked you in, but this trade really isn't about inflation. At least not primarily. Though KO and other consumer staples would likely do better in an inflationary environment than a lot of stocks would, that's not my rationale here. I do like KO's relative lack of volatility, t

The Coca-Cola Company (KO)Capital appreciation potential has reached its limit. We believe that at these levels a drop in prices is plausible, which could reach the three indicated targets. Below the $60 area could become very interesting, considering the dividend paid, could become a proxy of Treasury.

Coca-Cola: A Strategic Long Play Amid Market VolatilityCurrent Price: $70.34

Direction: LONG

Targets:

- T1 = $72.45

- T2 = $74.00

Stop Levels:

- S1 = $68.75

- S2 = $67.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify

Coca-Cola Stock Falls Despite Strong EarningsDuring the latest trading session, Coca-Cola stock maintained a clear neutral bias after a nearly 1% decline, falling below the $70 per share level. This movement came despite the company reporting better-than-expected results, with earnings per share (EPS) of $0.87, above the $0.83 expected, and to

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

C

KO3669979

Coca-Cola Enterprises, Inc. /Old/ 7.0% 15-MAY-2098Yield to maturity

5.53%

Maturity date

May 15, 2098

See all KO bonds

Curated watchlists where KO is featured.

Frequently Asked Questions

The current price of KO is 66.21 USD — it has decreased by −0.33% in the past 24 hours. Watch Coca-Cola Company (The) stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Coca-Cola Company (The) stocks are traded under the ticker KO.

KO stock has fallen by −0.70% compared to the previous week, the month change is a −6.69% fall, over the last year Coca-Cola Company (The) has showed a −5.97% decrease.

We've gathered analysts' opinions on Coca-Cola Company (The) future price: according to them, KO price has a max estimate of 85.00 USD and a min estimate of 70.00 USD. Watch KO chart and read a more detailed Coca-Cola Company (The) stock forecast: see what analysts think of Coca-Cola Company (The) and suggest that you do with its stocks.

KO stock is 0.77% volatile and has beta coefficient of 0.20. Track Coca-Cola Company (The) stock price on the chart and check out the list of the most volatile stocks — is Coca-Cola Company (The) there?

Today Coca-Cola Company (The) has the market capitalization of 284.95 B, it has decreased by −0.86% over the last week.

Yes, you can track Coca-Cola Company (The) financials in yearly and quarterly reports right on TradingView.

Coca-Cola Company (The) is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

KO earnings for the last quarter are 0.87 USD per share, whereas the estimation was 0.83 USD resulting in a 4.37% surprise. The estimated earnings for the next quarter are 0.78 USD per share. See more details about Coca-Cola Company (The) earnings.

Coca-Cola Company (The) revenue for the last quarter amounts to 12.62 B USD, despite the estimated figure of 12.57 B USD. In the next quarter, revenue is expected to reach 12.46 B USD.

KO net income for the last quarter is 3.81 B USD, while the quarter before that showed 3.33 B USD of net income which accounts for 14.41% change. Track more Coca-Cola Company (The) financial stats to get the full picture.

Yes, KO dividends are paid quarterly. The last dividend per share was 0.51 USD. As of today, Dividend Yield (TTM)% is 3.01%. Tracking Coca-Cola Company (The) dividends might help you take more informed decisions.

Coca-Cola Company (The) dividend yield was 3.12% in 2024, and payout ratio reached 78.83%. The year before the numbers were 3.12% and 74.52% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 23, 2025, the company has 69.7 K employees. See our rating of the largest employees — is Coca-Cola Company (The) on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Coca-Cola Company (The) EBITDA is 14.38 B USD, and current EBITDA margin is 23.34%. See more stats in Coca-Cola Company (The) financial statements.

Like other stocks, KO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Coca-Cola Company (The) stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Coca-Cola Company (The) technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Coca-Cola Company (The) stock shows the neutral signal. See more of Coca-Cola Company (The) technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.