Key facts today

UPS has increased peak season surcharges due to mixed demand signals, showcasing its pricing strength. This change may affect large shippers as the shipping season nears.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.73 USD

5.78 B USD

90.89 B USD

735.90 M

About United Parcel Service, Inc.

Sector

Industry

CEO

Carol B. Tomé

Website

Headquarters

Atlanta

Founded

1907

ISIN

US9113121068

FIGI

BBG000L9CV04

United Parcel Service, Inc. (UPS) is a package delivery company. The Company is a provider of global supply chain management solutions. The Company operates through three segments: U.S. Domestic Package operations, International Package operations, and Supply Chain & Freight operations. As of December 31, 2016, the Company delivered packages in over 220 countries and territories. The Company offers a spectrum of the United States domestic guaranteed ground and air package transportation services. The International Package segment includes the small package operations in Europe, Asia-Pacific, Canada and Latin America, the Indian sub-continent, the Middle East and Africa. The Supply Chain & Freight segment includes its forwarding and logistics services, truckload freight brokerage, UPS Freight and its financial offerings through UPS Capital. The Company serves the global market for logistics services, which include transportation, distribution, contract logistics and ground freight.

Related stocks

UPS Here’s the latest on **United Parcel Service (UPS)** stock:

## Stock market information for United Parcel Service, Inc. (UPS)

* United Parcel Service, Inc. is a equity in the USA market.

* The price is 88.82 USD currently with a change of 2.66 USD (0.03%) from the previous close.

* The latest open

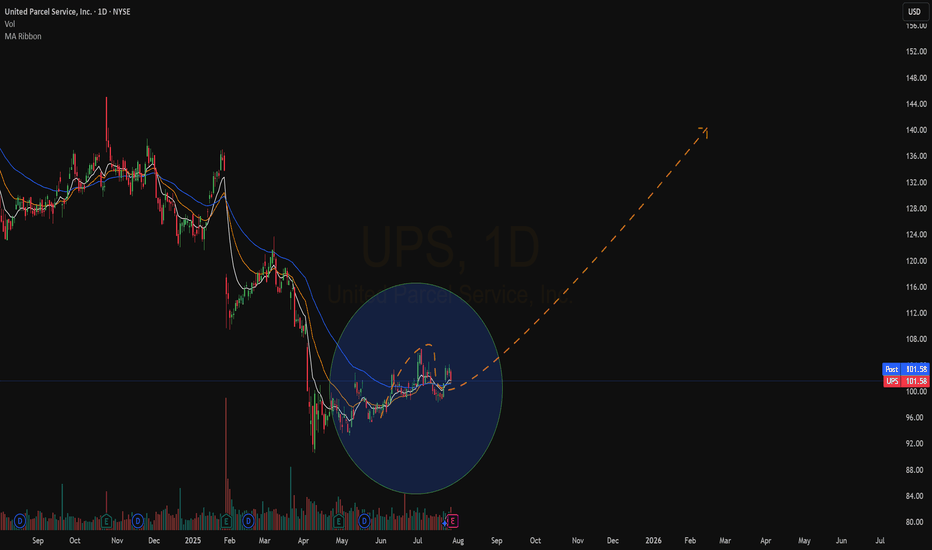

UPS Momentum Trade: Buy $88C → Target 100%+ Return by Friday

# 🚚 UPS Weekly Options Setup (8/18 – 8/22)

🔥 **Institutional Flow Signals a Bullish Week** 🔥

All major AI reports (xAI, DeepSeek, Google, Anthropic) are calling **MODERATE BULLISH**, backed by:

* 📊 **Call/Put Ratio = 3.47** → Strong institutional bias

* 📉 **VIX < 22** → Premiums favorable for lon

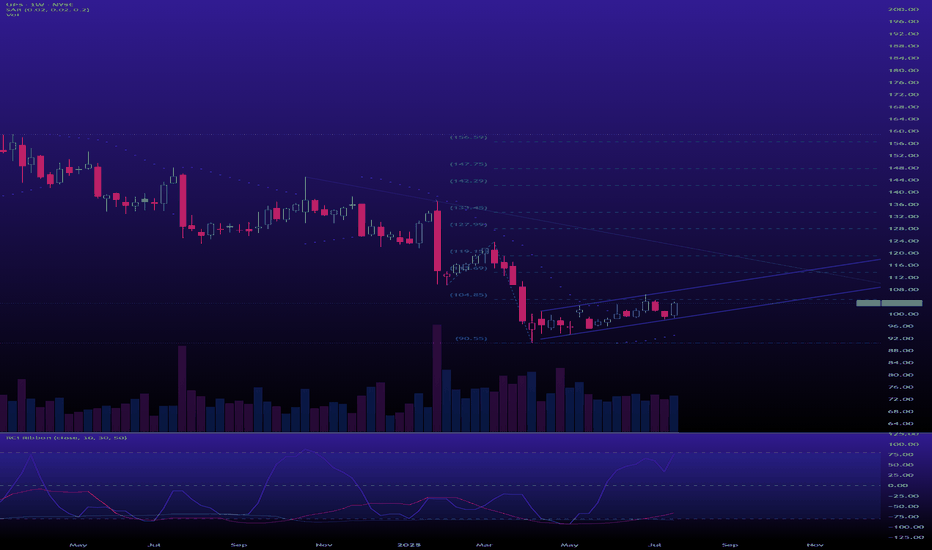

Warren Buffet and UPSHello I am the Cafe Trader.

There have been some wild days, and it's not over. Amidst all the stormy seas, and the major successes, I wanted to bring to your attention a stock that I think is becoming of great value.

UPS has been getting beat down for over three years, why?

Beatdown

- Trump Ta

Positioning UPS Long Amid Global Logistics Tailwinds Current Price: $103.56

Direction: LONG

Targets:

- T1 = $106.00

- T2 = $108.00

Stop Levels:

- S1 = $101.00

- S2 = $99.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligen

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UPS.GB

United Parcel Service of America, Inc. 7.62% 01-APR-2030Yield to maturity

—

Maturity date

Apr 1, 2030

UPS.GC

United Parcel Service of America, Inc. FRN 26-OCT-2049Yield to maturity

—

Maturity date

Oct 26, 2049

UPS4969031

United Parcel Service, Inc. 5.2% 01-APR-2040Yield to maturity

—

Maturity date

Apr 1, 2040

UPS6075096

United Parcel Service, Inc. 5.25% 14-MAY-2035Yield to maturity

—

Maturity date

May 14, 2035

UPS4969032

United Parcel Service, Inc. 5.3% 01-APR-2050Yield to maturity

—

Maturity date

Apr 1, 2050

UPS5547103

United Parcel Service, Inc. 4.875% 03-MAR-2033Yield to maturity

—

Maturity date

Mar 3, 2033

UPS.QD

United Parcel Service, Inc. 6.2% 15-JAN-2038Yield to maturity

—

Maturity date

Jan 15, 2038

UPS4871926

United Parcel Service, Inc. 3.4% 01-SEP-2049Yield to maturity

—

Maturity date

Sep 1, 2049

UPS6075098

United Parcel Service, Inc. 6.05% 14-MAY-2065Yield to maturity

—

Maturity date

May 14, 2065

UPS3908475

United Parcel Service, Inc. 3.625% 01-OCT-2042Yield to maturity

—

Maturity date

Oct 1, 2042

UPS4808741

United Parcel Service, Inc. 3.4% 15-MAR-2029Yield to maturity

—

Maturity date

Mar 15, 2029

See all UPS bonds

Curated watchlists where UPS is featured.

Female-led stocks: Who rules the world?

34 No. of Symbols

US truck stocks: State to state supply

24 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of UPS is 85.04 USD — it has decreased by −0.95% in the past 24 hours. Watch United Parcel Service, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange United Parcel Service, Inc. stocks are traded under the ticker UPS.

UPS stock has fallen by −4.22% compared to the previous week, the month change is a −0.64% fall, over the last year United Parcel Service, Inc. has showed a −34.23% decrease.

We've gathered analysts' opinions on United Parcel Service, Inc. future price: according to them, UPS price has a max estimate of 133.00 USD and a min estimate of 75.00 USD. Watch UPS chart and read a more detailed United Parcel Service, Inc. stock forecast: see what analysts think of United Parcel Service, Inc. and suggest that you do with its stocks.

UPS stock is 2.55% volatile and has beta coefficient of 0.84. Track United Parcel Service, Inc. stock price on the chart and check out the list of the most volatile stocks — is United Parcel Service, Inc. there?

Today United Parcel Service, Inc. has the market capitalization of 71.60 B, it has decreased by −0.34% over the last week.

Yes, you can track United Parcel Service, Inc. financials in yearly and quarterly reports right on TradingView.

United Parcel Service, Inc. is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

UPS earnings for the last quarter are 1.55 USD per share, whereas the estimation was 1.56 USD resulting in a −0.83% surprise. The estimated earnings for the next quarter are 1.34 USD per share. See more details about United Parcel Service, Inc. earnings.

United Parcel Service, Inc. revenue for the last quarter amounts to 21.20 B USD, despite the estimated figure of 20.85 B USD. In the next quarter, revenue is expected to reach 20.93 B USD.

UPS net income for the last quarter is 1.28 B USD, while the quarter before that showed 1.19 B USD of net income which accounts for 8.09% change. Track more United Parcel Service, Inc. financial stats to get the full picture.

Yes, UPS dividends are paid quarterly. The last dividend per share was 1.64 USD. As of today, Dividend Yield (TTM)% is 7.75%. Tracking United Parcel Service, Inc. dividends might help you take more informed decisions.

United Parcel Service, Inc. dividend yield was 5.17% in 2024, and payout ratio reached 96.41%. The year before the numbers were 4.12% and 83.08% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 6, 2025, the company has 490 K employees. See our rating of the largest employees — is United Parcel Service, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. United Parcel Service, Inc. EBITDA is 12.36 B USD, and current EBITDA margin is 13.53%. See more stats in United Parcel Service, Inc. financial statements.

Like other stocks, UPS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade United Parcel Service, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So United Parcel Service, Inc. technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating United Parcel Service, Inc. stock shows the sell signal. See more of United Parcel Service, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.