Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.52 USD

−73.62 M USD

0.00 USD

123.62 M

About Oklo Inc.

Sector

Industry

CEO

Jacob DeWitte

Website

Headquarters

Santa Clara

Founded

2013

IPO date

Jul 12, 2021

Identifiers

3

ISIN US02156V1098

Oklo, Inc. engages in the development of fission reactors. It provides clean energy through the design and deployment of fast fission power plants. The company was founded by Jacob DeWitte and Caroline Cochran on July 3, 2013 and is headquartered in Santa Clara, CA.

Related stocks

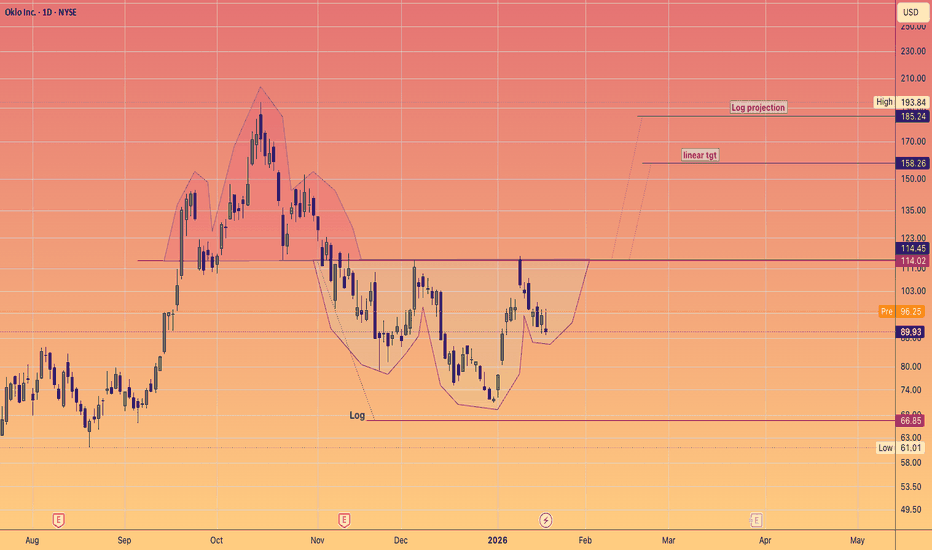

Is OKLO about to go nuclear again ? OKLO remains in a strong primary uptrend, with price holding above the rising 200-day moving average , a key institutional trend filter.

The 200-day MA is now acting as dynamic support, and the recent pullback respected this level, signaling buyers defending structure rather than distributing.

Pric

Long $OKLOI am looking for a bounce of the VWAP from the April lows. This also coincides with an area of support and resistance (yellow rectangle). The trade sets up with multiple confluences so I am looking to enter if we close the gap around 78.20. If we break down below the prior low at 70.86 we will stop

OKLO 1D: Transition phase after declineOn the daily chart OKLO has shifted from a prolonged downtrend into a basing phase. After a sequence of lower highs and lower lows, price broke out of a falling wedge and pulled back into a demand zone. Selling pressure failed to resume and recent lows remain intact.

From a structural perspective, p

US–Iran Peace Talks Crushing Oklo Hype? Why “Good” News Is SendiOklo Inc. ( NYSE:OKLO ) is a U.S.-based startup specializing in the development of small modular nuclear reactors (SMRs). Founded in 2013, the company aims to build compact, safe, and efficient nuclear energy systems for data centers, industrial applications, and remote locations. Oklo went public i

$OKLO: SMR? More like SM-ARE You Seeing This Breakout?!After surging over 1,000% in 2025 and then cooling off, Oklo has spent early 2026 stabilizing and looking for its next leg up.

📊 The Technical Setup

The Bottom is In: The stock hit a floor in late 2025 and is now showing signs of a sharp rebound, recently climbing back toward the $90–$100 range.

$

Okalo breakout setup as momentum builds above $95:Current Price: 94.95 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 63%(Based on mixed but improving trader conviction, bullish technical language in snippets, and real-time social momentum leaning higher)

Targets

Target 1: 100.00

Target 2: 108.00

Stop Levels

Stop 1

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NUKL

VanEck Uranium and Nuclear Technologies UCITS ETF Accum A USDWeight

6.46%

Market value

143.57 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of OKLO is 77.53 USD — it has decreased by −7.37% in the past 24 hours. Watch Oklo Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Oklo Inc. stocks are traded under the ticker OKLO.

OKLO stock has fallen by −14.42% compared to the previous week, the month change is a −0.32% fall, over the last year Oklo Inc. has showed a 100.39% increase.

We've gathered analysts' opinions on Oklo Inc. future price: according to them, OKLO price has a max estimate of 175.00 USD and a min estimate of 87.00 USD. Watch OKLO chart and read a more detailed Oklo Inc. stock forecast: see what analysts think of Oklo Inc. and suggest that you do with its stocks.

OKLO reached its all-time high on Oct 15, 2025 with the price of 193.84 USD, and its all-time low was 5.35 USD and was reached on Sep 9, 2024. View more price dynamics on OKLO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

OKLO stock is 7.45% volatile and has beta coefficient of 2.32. Track Oklo Inc. stock price on the chart and check out the list of the most volatile stocks — is Oklo Inc. there?

Today Oklo Inc. has the market capitalization of 11.50 B, it has decreased by −1.81% over the last week.

Yes, you can track Oklo Inc. financials in yearly and quarterly reports right on TradingView.

Oklo Inc. is going to release the next earnings report on Mar 30, 2026. Keep track of upcoming events with our Earnings Calendar.

OKLO earnings for the last quarter are −0.20 USD per share, whereas the estimation was −0.13 USD resulting in a −48.15% surprise. The estimated earnings for the next quarter are −0.17 USD per share. See more details about Oklo Inc. earnings.

Oklo Inc. revenue for the last quarter amounts to 0.00 USD, matching the estimated figure, and no changes in revenue are expected for the next quarter.

OKLO net income for the last quarter is −29.72 M USD, while the quarter before that showed −24.68 M USD of net income which accounts for −20.41% change. Track more Oklo Inc. financial stats to get the full picture.

No, OKLO doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 3, 2026, the company has 113 employees. See our rating of the largest employees — is Oklo Inc. on this list?

Like other stocks, OKLO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Oklo Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Oklo Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Oklo Inc. stock shows the buy signal. See more of Oklo Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.