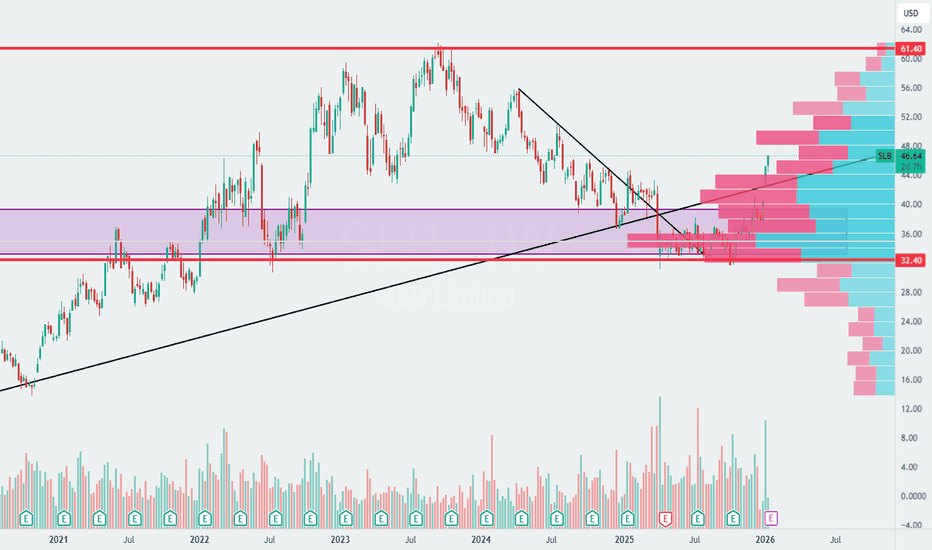

SLB Earnings Speculation: Buy Puts Before Close!SLB Earnings Signal | 2026-01-22

📊 TRADE DETAILS 📊

🎯 Instrument: SLB

🔀 Direction: PUT (SHORT)

🎯 Strike: 46.00

💵 Entry Price: 0.07

🎯 Profit Target: 0.12

🛑 Stop Loss: 0.03

📅 Expiry: 2026-01-23

📏 Size: N/A

📈 Confidence: 58%

⏰ Entry Timing: N/A

🚨 IMPORTANT NOTES

Katy AI's primary summary states "NEUT

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.39 USD

3.37 B USD

35.69 B USD

1.49 B

About SLB Limited

Sector

Industry

CEO

Olivier Le Peuch

Website

Headquarters

Houston

Founded

1926

IPO date

Feb 2, 1962

Identifiers

2

ISIN AN8068571086

SLB Ltd. engages in the provision of energy technology. It operates through the following business segments: Digital, Reservoir Performance, Well Construction, Production Systems, and All Other. The Digital segment involves the combination of digital solutions and data products with its Asset Performance Solutions. The Reservoir Performance segment consists of technologies and services for productivity and performance optimization. The Well Construction segment includes the full portfolio of products and services for well placement and performance, drilling, and wellbore assurance. The Production Systems segment focuses on the development of technologies and provides services to production and recovery from subsurface reservoirs to the surface, into pipelines, and refineries. The company was founded by Conrad Schlumberger and Marcel Schlumberger in 1926 and is headquartered in Houston, TX.

Related stocks

Schlumberger Limited holding trend support as buyers prepare neCurrent Price: 46.73 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 62%(Based on improving technical structure, constructive crowd wisdom from professional traders, supportive contract news, and a bullish tilt in real-time social chatter, tempered by light volume and

Very rare diamond patternThis very rare pattern usually indicates a change of trend. Is doing it in the weekly timeframe and setting up for a massive breakout of the descending channel. Also, oil is setting up an inverse HS and many of the big oil companies show bullish patterns. SL and TP are shown on the charts.

Good luc

SLB - What an Opportunityit looks like we are entering into a major third wave that will likely see prices rise to $100.

A challenging stock to hold/trade over the past few years, the cycle aspect seems right and even as the price of oil is treading water in the mid $50s, imagine the profits that these oil companies that a

$SLB LONG TERMNYSE:SLB

Chart:

Beautiful set up on the weekly chart

A) Breakout from previous downtrend on increasing volume

B) Increased volume on 1/5 weekly candle to get out of previous zone

C) Higher highs and higher lows on daily chart

Target= $60 Previous monthly/weekly resistance

News:

www.tra

Schlumberger Limited presses highs as energy momentum builds:Current Price: 45.20 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 58%(Signals are mixed in strength, but the balance of trader commentary, price action near highs, and supportive news flow keeps the upside case intact for this week)

Targets

Target 1: 46.20

Target 2

SLBThe Digital Engine Accelerates:

The digital business has been reported as a separate segment for the first time, highlighting its strategic priority. In Q3 2025, Digital revenue grew 11% quarter-over-quarter, with an operating margin exceeding 28%. Management forecasts this segment's EBITDA margin

SLB: Picks and Shovels for Trump’s New VenezuelaSLB (Schlumberger) is one of the few oilfield service giants with equipment and long operating history in Venezuela, making it a key “picks and shovels” play if US‑backed investment floods back into the country’s fields. Management has already discussed mobilizing rigs and specialized kit quickly as

SLB - Ground Floor Opportunity### Slb weekly trend analysis and one-year projection

You’ve got a strong weekly push: Stochastic is pinned high (99), RSI is constructive (61), MACD is positive, and SAR dots likely sit below price — classic continuation signals. The caveat is overbought momentum often demands either time or price

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SLB4080519

Cameron International Corporation 5.125% 15-DEC-2043Yield to maturity

5.99%

Maturity date

Dec 15, 2043

SLB3692252

Cameron International Corporation 5.95% 01-JUN-2041Yield to maturity

5.53%

Maturity date

Jun 1, 2041

SLB3673764

Cameron International Corporation 7.0% 15-JUL-2038Yield to maturity

5.10%

Maturity date

Jul 15, 2038

SLB5816417

Schlumberger Investment SA 5.0% 01-JUN-2034Yield to maturity

4.95%

Maturity date

Jun 1, 2034

SLB6039167

Schlumberger Holdings Corporation 5.0% 01-JUN-2034Yield to maturity

4.86%

Maturity date

Jun 1, 2034

SLB5584893

Schlumberger Investment SA 4.85% 15-MAY-2033Yield to maturity

4.83%

Maturity date

May 15, 2033

SLB6056526

Schlumberger Holdings Corporation 4.85% 15-MAY-2033Yield to maturity

4.69%

Maturity date

May 15, 2033

SLB6040253

Schlumberger Holdings Corporation 4.5% 15-MAY-2028Yield to maturity

4.34%

Maturity date

May 15, 2028

SLB6054402

Schlumberger Holdings Corporation 2.65% 26-JUN-2030Yield to maturity

4.29%

Maturity date

Jun 26, 2030

SLB5816413

Schlumberger Holdings Corporation 5.0% 15-NOV-2029Yield to maturity

4.18%

Maturity date

Nov 15, 2029

US806854AJ4

Schlumberger Investment SA 2.65% 26-JUN-2030Yield to maturity

4.08%

Maturity date

Jun 26, 2030

See all SLB bonds

Frequently Asked Questions

The current price of SLB is 50.70 USD — it has decreased by −3.58% in the past 24 hours. Watch SLB Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange SLB Limited stocks are traded under the ticker SLB.

SLB stock has fallen by −0.74% compared to the previous week, the month change is a 11.81% rise, over the last year SLB Limited has showed a 23.39% increase.

We've gathered analysts' opinions on SLB Limited future price: according to them, SLB price has a max estimate of 74.00 USD and a min estimate of 41.00 USD. Watch SLB chart and read a more detailed SLB Limited stock forecast: see what analysts think of SLB Limited and suggest that you do with its stocks.

SLB stock is 3.71% volatile and has beta coefficient of 0.75. Track SLB Limited stock price on the chart and check out the list of the most volatile stocks — is SLB Limited there?

Today SLB Limited has the market capitalization of 74.03 B, it has decreased by −1.42% over the last week.

Yes, you can track SLB Limited financials in yearly and quarterly reports right on TradingView.

SLB Limited is going to release the next earnings report on Apr 17, 2026. Keep track of upcoming events with our Earnings Calendar.

SLB earnings for the last quarter are 0.78 USD per share, whereas the estimation was 0.74 USD resulting in a 5.11% surprise. The estimated earnings for the next quarter are 0.60 USD per share. See more details about SLB Limited earnings.

SLB Limited revenue for the last quarter amounts to 9.74 B USD, despite the estimated figure of 9.55 B USD. In the next quarter, revenue is expected to reach 8.87 B USD.

SLB net income for the last quarter is 824.00 M USD, while the quarter before that showed 739.00 M USD of net income which accounts for 11.50% change. Track more SLB Limited financial stats to get the full picture.

Yes, SLB dividends are paid quarterly. The last dividend per share was 0.28 USD. As of today, Dividend Yield (TTM)% is 2.30%. Tracking SLB Limited dividends might help you take more informed decisions.

SLB Limited dividend yield was 2.97% in 2025, and payout ratio reached 48.55%. The year before the numbers were 2.87% and 35.41% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 7, 2026, the company has 109 K employees. See our rating of the largest employees — is SLB Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SLB Limited EBITDA is 7.24 B USD, and current EBITDA margin is 19.71%. See more stats in SLB Limited financial statements.

Like other stocks, SLB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SLB Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SLB Limited technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SLB Limited stock shows the buy signal. See more of SLB Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.