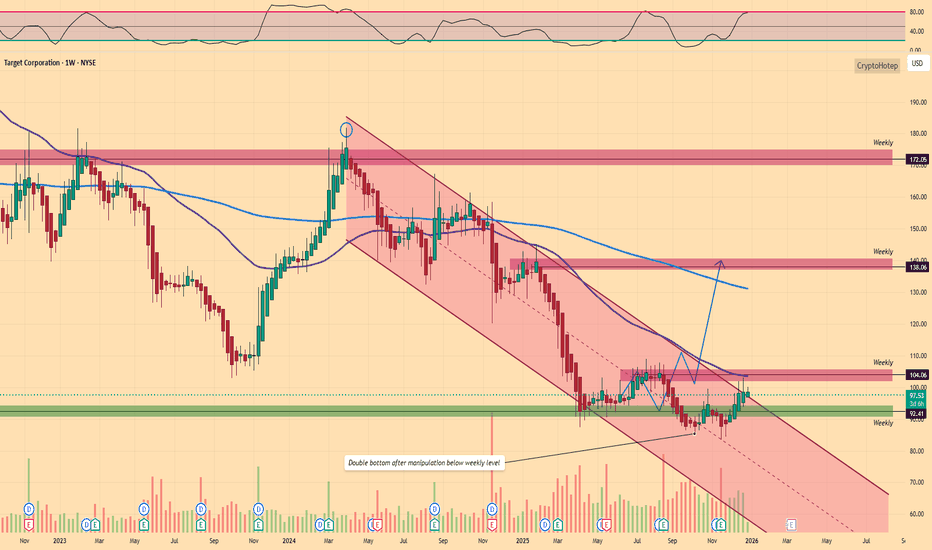

Target (TGT) Could be attempting to Reverse Bear TrendThis is an analysis of the 1 Week or Macro timeframe. We zoom out to get a feel for the big picture moves.

Where Target's current price action has reached, it warrants attention and to me is a critical area to watch.

Why critical? Well, we have reached the Upper bounds of Targets Bearish Channel s

Target Corporation

No trades

Key facts today

Target has promoted Lisa Roath and Cara Sylvester under CEO Michael Fiddelke. Analysts suggest external leadership may improve the company's stagnant performance.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.17 EUR

3.95 B EUR

102.89 B EUR

451.62 M

About Target Corporation

Sector

Industry

CEO

Michael J. Fiddelke

Website

Headquarters

Minneapolis

Founded

1902

IPO date

Sep 8, 1969

Identifiers

3

ISIN US87612E1064

Target Corp. engages in the operation and ownership of general merchandise stores. It offers food and general merchandise, clothing and household goods, electronics, and toys. Its brands include A New Day, All in Motion, Art Class, Auden, AVA & VIV, Boots and Barkley, Brightroom, Bullseye's Playground, Casaluna, Cat & Jack, Cloud Island, Colsie, dealworthy, Embark, Everspring, Favorite Day, Figmint, Future Collective, Gigglescape, Good & Gather, Goodfellow & Co, Hearth & Hand with Magnolia, Heyday, Hyde & EEK! Boutique, JoyLab, Kindfull, Kona Sol, Made By Design, Market Pantry, Mondo Llama, More Than Magic, Opalhouse, Open Story, Original Use, Pillowfort, Project 62, Room Essentials, Shade & Shore, Smartly, Smith & Hawken, Sonia Kashuk, Spritz, Sun Squad, Threshold, Universal Thread, up&up, Wild Fable, Wondershop, Xhilaration, California Roots, Casa Cantina, The Collection, Headliner, Jingle & Mingle, Rosé Bae, Photograph, SunPop, and Wine Cube. The company was founded by George Draper Dayton in 1902 and is headquartered in Minneapolis, MN.

Related stocks

Target Corporation breakout momentum points to another leg highCurrent Price: 115.55

Direction: LONG

Confidence level: 58%(Several professional traders show strong bullish momentum signals and price is above all major moving averages, but limited X sentiment volume keeps confidence moderate.)

Targets

Target 1: 118.50

Target 2: 122.50

Stop Levels

Stop 1: 11

TGT: All levels of interestTGT (Target), consumer defensive play crashing on bad earnings and inflation concerns....

Weekly chart.

Now oversold. Can we go lower?

Here are the levels I'm watching to enter:

- 139.30: I'll be buying if we reach that level. If it holds it will be a long term investment for me. If it just boun

$TGT / Target Comeback Year?Watch out for Target next year......may be their comeback year in 2026.

Their technicals look good as price looks to be double bottomed near the $95 area (along with manipulation) and the only thing standing in it's way is to clear $105 weekly level and this downward trend.

If those two items ar

Target aims for $130Sellers exhausted?

Bulls reasserting control?

A sustained move above $103 could target previous resistance of around $130

Which where a W pattern formation points towards as well.

Consenus by analysts is a "hold"

But if consumer spending picks up under favourable economic conditions earnings cou

TGT - targeting more upsideNYSE:TGT - Strong bullish rebound was seen and bear trap is in place after prices fails to close significantly below the support of US$84.76. Furthermore, ichimoku is showing a three bullish golden cross in an early stage, which confirm the bullish reversal. V-shaped bottom is eyeing a potential re

$TGT is testing a key weekly resistance level NYSE:TGT is testing a key weekly resistance level, the same zone it’s failed to clear since August.

This week closed strong: highest weekly close since August and on increasing volume.

Price did reject intraday, but it’s knocking at the door. A retest of $95.84 is healthy and a solid spot to asses

$TGT - Target - Pre-Covid Price LevelsTarget is down 67% from its all time highs.

Not sure how much more of a beating this stock price can take before value catches up.

Intrinsic Value calculations put this stock 40-60% undervalued. Some analysts suggest caution as sales declined around 2.7% in Quarter 3 and showed a higher operating

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US87612EBF25

Target Corporation 3.625% 15-APR-2046Yield to maturity

5.54%

Maturity date

Apr 15, 2046

DYHB

Target Corporation 3.9% 15-NOV-2047Yield to maturity

5.54%

Maturity date

Nov 15, 2047

TGT5344011

Target Corporation 2.95% 15-JAN-2052Yield to maturity

5.52%

Maturity date

Jan 15, 2052

TGT5527761

Target Corporation 4.8% 15-JAN-2053Yield to maturity

5.51%

Maturity date

Jan 15, 2053

TGT3869508

Target Corporation 4.0% 01-JUL-2042Yield to maturity

5.35%

Maturity date

Jul 1, 2042

TGT.IJ

Target Corporation 7.0% 15-JAN-2038Yield to maturity

5.03%

Maturity date

Jan 15, 2038

TGT.ID

Target Corporation 6.5% 15-OCT-2037Yield to maturity

4.99%

Maturity date

Oct 15, 2037

TGT6094660

Target Corporation 5.25% 15-FEB-2036Yield to maturity

4.88%

Maturity date

Feb 15, 2036

TGT6035418

Target Corporation 5.0% 15-APR-2035Yield to maturity

4.78%

Maturity date

Apr 15, 2035

TGT5885569

Target Corporation 4.5% 15-SEP-2034Yield to maturity

4.60%

Maturity date

Sep 15, 2034

US87612EBE5

Target Corporation 2.5% 15-APR-2026Yield to maturity

4.44%

Maturity date

Apr 15, 2026

See all DYH bonds

Frequently Asked Questions

The current price of DYH is 96.54 EUR — it has decreased by −1.82% in the past 24 hours. Watch Target Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Target Corporation stocks are traded under the ticker DYH.

DYH stock has risen by 2.70% compared to the previous week, the month change is a 4.39% rise, over the last year Target Corporation has showed a −23.90% decrease.

We've gathered analysts' opinions on Target Corporation future price: according to them, DYH price has a max estimate of 117.51 EUR and a min estimate of 52.88 EUR. Watch DYH chart and read a more detailed Target Corporation stock forecast: see what analysts think of Target Corporation and suggest that you do with its stocks.

DYH stock is 2.83% volatile and has beta coefficient of 0.85. Track Target Corporation stock price on the chart and check out the list of the most volatile stocks — is Target Corporation there?

Today Target Corporation has the market capitalization of 43.11 B, it has decreased by −5.99% over the last week.

Yes, you can track Target Corporation financials in yearly and quarterly reports right on TradingView.

Target Corporation is going to release the next earnings report on Mar 10, 2026. Keep track of upcoming events with our Earnings Calendar.

DYH earnings for the last quarter are 1.54 EUR per share, whereas the estimation was 1.48 EUR resulting in a 4.18% surprise. The estimated earnings for the next quarter are 1.81 EUR per share. See more details about Target Corporation earnings.

Target Corporation revenue for the last quarter amounts to 21.90 B EUR, despite the estimated figure of 21.95 B EUR. In the next quarter, revenue is expected to reach 25.71 B EUR.

DYH net income for the last quarter is 597.20 M EUR, while the quarter before that showed 819.02 M EUR of net income which accounts for −27.08% change. Track more Target Corporation financial stats to get the full picture.

Yes, DYH dividends are paid quarterly. The last dividend per share was 0.96 EUR. As of today, Dividend Yield (TTM)% is 3.99%. Tracking Target Corporation dividends might help you take more informed decisions.

Target Corporation dividend yield was 3.23% in 2024, and payout ratio reached 50.35%. The year before the numbers were 3.01% and 48.99% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 12, 2026, the company has 440 K employees. See our rating of the largest employees — is Target Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Target Corporation EBITDA is 6.77 B EUR, and current EBITDA margin is 8.08%. See more stats in Target Corporation financial statements.

Like other stocks, DYH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Target Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Target Corporation technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Target Corporation stock shows the neutral signal. See more of Target Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.