Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12.60 EUR

12.44 B EUR

27.20 B EUR

825.46 M

About Mastercard Incorporated

Sector

Industry

CEO

Michael E. Miebach

Website

Headquarters

Purchase

Founded

1966

ISIN

US57636Q1040

FIGI

BBG000GV4Z65

Mastercard, Inc. is a technology company, which engages in the provision of payment solutions for the development and implementation of credit, debit, prepaid, commercial, and payment programs through its brands including Mastercard, Maestro, and Cirrus. It also offers cyber and intelligence solutions. The company was founded in November 1966 and is headquartered in Purchase, NY.

Related stocks

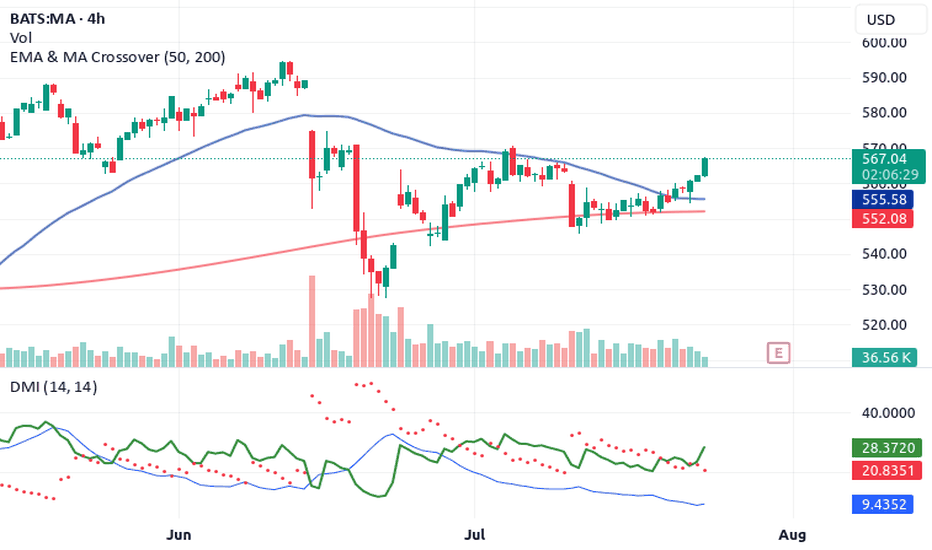

Mastercard Wave Analysis – 2 October 2025

- Mastercard rising inside impulse wave 3

- Likely to rise to resistance levels 585.00 and 600.00

Mastercard continues to rise inside the impulse wave 3, which started earlier from the support area between the support level 560,00 (which has been reversing the price from July) and the lower daily

Bulls Trapped at Critical Support - Reversal Spring Loads💡 To see my confluences and/or linework: Step 1: Grab chart 📊, Step 2: Unhide Group 1 in object tree 🎯, Step 3: Hide and unhide specific confluences one by one ✨. Double-click the screen to reveal RSI, MFI, CVD, and OBV indicators alongside divergence markings! 📈

The Market Participant Battle:

Be

Breaking: Mastercard Poised for Upside Momentum Amid Robust Current Price: $584.16

Direction: LONG

Targets:

- T1 = $610.00

- T2 = $640.00

Stop Levels:

- S1 = $570.00

- S2 = $550.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intel

Mastercard Wave Analysis – 17 September 2025

- Mastercard broke daily down channel

- Likely to rise to resistance level 600.00

Mastercard recently broke the resistance trendline of the daily down channel from the end of August (which enclosed the previous minor ABC correction ii).

The breakout of this down channel continues the active impu

Mastercard - Master your uptrend NYSE:MA is looking at a potential bullish upside after resuming back into its major uptrend line. With the resistance zone between 575.60-595.90 tested multiple times, the stock is looking at a weakening resistance zone, therefore increasing the probability of an upside break. MACD is looking at st

MASTERCARD Best Buy Entry Now, Target $577.50.

## 💳 MA Options Play: Weekly Bullish Setup with Caution!

**Mastercard (MA)** showing bullish momentum — but options flow says: “Proceed carefully.”

---

### 🟢 Bullish Signals (4/5 Models Agree):

* 📈 Weekly RSI uptrending

* 🔊 Strong weekly volume

* 🌀 Low volatility = cleaner setup

* 🧠 Multiple mo

Top 4 Buy Signals Lighting Up Mastercard (MA) 🚀 Top 4 Buy Signals Lighting Up Mastercard (MA) | Rocket Booster Strategy

Mastercard Inc. (MA) is showing explosive potential, and it’s not just one signal—it’s a whole confluence of confirmations. When

you align this much market momentum, you don’t ignore it. Let’s break down how Rocket Booster

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US57636QAL8

Mastercard Incorporated 3.65% 01-JUN-2049Yield to maturity

5.21%

Maturity date

Jun 1, 2049

MA5142291

Mastercard Incorporated 2.95% 15-MAR-2051Yield to maturity

5.17%

Maturity date

Mar 15, 2051

US57636QAH7

Mastercard Incorporated 3.8% 21-NOV-2046Yield to maturity

5.16%

Maturity date

Nov 21, 2046

MA4970638

Mastercard Incorporated 3.85% 26-MAR-2050Yield to maturity

5.14%

Maturity date

Mar 26, 2050

MA4602133

Mastercard Incorporated 3.95% 26-FEB-2048Yield to maturity

5.14%

Maturity date

Feb 26, 2048

MA5885400

Mastercard Incorporated 4.55% 15-JAN-2035Yield to maturity

4.39%

Maturity date

Jan 15, 2035

MA5808459

Mastercard Incorporated 4.875% 09-MAY-2034Yield to maturity

4.36%

Maturity date

May 9, 2034

MA5552138

Mastercard Incorporated 4.85% 09-MAR-2033Yield to maturity

4.25%

Maturity date

Mar 9, 2033

MA5885597

Mastercard Incorporated 4.35% 15-JAN-2032Yield to maturity

4.12%

Maturity date

Jan 15, 2032

MA6009561

Mastercard Incorporated 4.95% 15-MAR-2032Yield to maturity

4.07%

Maturity date

Mar 15, 2032

MA5302962

Mastercard Incorporated 2.0% 18-NOV-2031Yield to maturity

4.00%

Maturity date

Nov 18, 2031

See all M4I bonds

Curated watchlists where M4I is featured.

Frequently Asked Questions

The current price of M4I is 494.00 EUR — it has increased by 0.40% in the past 24 hours. Watch Mastercard Incorporated Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Mastercard Incorporated Class A stocks are traded under the ticker M4I.

M4I stock has risen by 6.31% compared to the previous week, the month change is a 2.46% rise, over the last year Mastercard Incorporated Class A has showed a 4.08% increase.

We've gathered analysts' opinions on Mastercard Incorporated Class A future price: according to them, M4I price has a max estimate of 661.44 EUR and a min estimate of 515.03 EUR. Watch M4I chart and read a more detailed Mastercard Incorporated Class A stock forecast: see what analysts think of Mastercard Incorporated Class A and suggest that you do with its stocks.

M4I stock is 0.47% volatile and has beta coefficient of 0.89. Track Mastercard Incorporated Class A stock price on the chart and check out the list of the most volatile stocks — is Mastercard Incorporated Class A there?

Today Mastercard Incorporated Class A has the market capitalization of 446.54 B, it has increased by 1.98% over the last week.

Yes, you can track Mastercard Incorporated Class A financials in yearly and quarterly reports right on TradingView.

Mastercard Incorporated Class A is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

M4I earnings for the last quarter are 3.52 EUR per share, whereas the estimation was 3.42 EUR resulting in a 2.99% surprise. The estimated earnings for the next quarter are 3.68 EUR per share. See more details about Mastercard Incorporated Class A earnings.

Mastercard Incorporated Class A revenue for the last quarter amounts to 6.90 B EUR, despite the estimated figure of 6.73 B EUR. In the next quarter, revenue is expected to reach 7.27 B EUR.

M4I net income for the last quarter is 3.14 B EUR, while the quarter before that showed 3.03 B EUR of net income which accounts for 3.63% change. Track more Mastercard Incorporated Class A financial stats to get the full picture.

Yes, M4I dividends are paid quarterly. The last dividend per share was 0.66 EUR. As of today, Dividend Yield (TTM)% is 0.51%. Tracking Mastercard Incorporated Class A dividends might help you take more informed decisions.

Mastercard Incorporated Class A dividend yield was 0.52% in 2024, and payout ratio reached 19.73%. The year before the numbers were 0.56% and 20.03% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 25, 2025, the company has 35.3 K employees. See our rating of the largest employees — is Mastercard Incorporated Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Mastercard Incorporated Class A EBITDA is 15.95 B EUR, and current EBITDA margin is 60.68%. See more stats in Mastercard Incorporated Class A financial statements.

Like other stocks, M4I shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Mastercard Incorporated Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Mastercard Incorporated Class A technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Mastercard Incorporated Class A stock shows the buy signal. See more of Mastercard Incorporated Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.