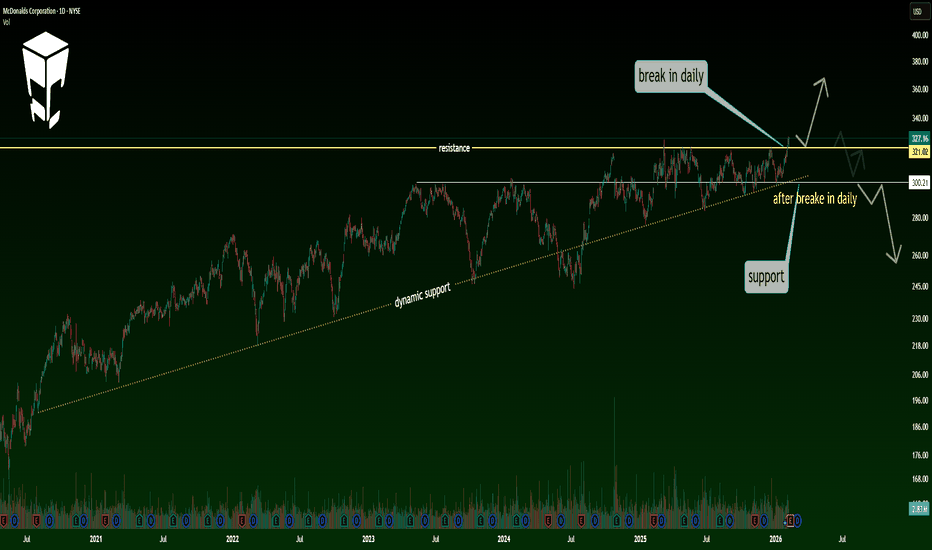

MCD Daily Breakout | Real Move or Fake?👋 Hello and well done!

Greetings to all TradingView followers and the respected TradingView team.

This analysis is presented by Forex City Pro Team 🚀

🍔 Brief Overview of McDonald’s (MCD)

McDonald’s Corporation (MCD) is one of the world’s largest and most established brands in the fast-food industry

McDonald's Corporation

No trades

Key facts today

McDonald's is set to announce its quarterly earnings on February 11, alongside Cisco Systems and T-Mobile US.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.05 EUR

7.94 B EUR

25.04 B EUR

711.92 M

About McDonald's Corporation

Sector

Industry

CEO

Christopher J. Kempczinski

Website

Headquarters

Chicago

Founded

1955

IPO date

Apr 21, 1965

Identifiers

3

ISIN US5801351017

McDonald's Corp. engages in the operation and franchising of restaurants. It operates through the following segments: U.S., International Operated Markets, and International Developmental Licensed Markets and Corporate. The U.S. segment focuses its operations on the United States. The International Operated Markets segment consists of operations and the franchising of restaurants in Australia, Canada, France, Germany, Italy, the Netherlands, Russia, Spain, and the U.K. The International Developmental Licensed Markets and Corporate segment consists of developmental licensee and affiliate markets in the McDonald’s system. The firm's products include Big Mac, Quarter Pounder with Cheese, Filet-O-Fish, several chicken sandwiches, Chicken McNuggets, wraps, McDonald's Fries, salads, oatmeal, shakes, McFlurry desserts, sundaes, soft serve cones, pies, soft drinks, coffee, McCafe beverages, and other beverages. The company was founded by Raymond Albert Kroc on April 15, 1955, and is headquartered in Oak Brook, IL.

Related stocks

MCD Wave Analysis – 5 February 2026

- MCD reversed from major resistance level 325.00

- Likely to fall to support level 316.00

MCD recently reversed from the resistance zone between the multi-month resistance level 325.00 (former yearly high from the start of 2025) and the upper daily Bollinger Band.

The downward reversal from thi

McDonald’s: Upcoming PeakMcDonald's has broken out upward from its previously established sideways phase, continuing the turquoise wave B. We expect its peak slightly higher, but clearly below the resistance at $326.32. Once the top is logged, we anticipate the transition into the green corrective wave . This wave should l

MCD in BUY ZONEMy trading plan is very simple.

I buy or sell when at either of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow volume spikes beyond it's Bollinger Bands

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom of channe

Is $MCD Setting Up for a Swing Trade Expansion?MCD Bullish Pullback Heist 🍔📈 | 320 Break = Green Lights?

🍔 NYSE:MCD — McDonald’s Corporation (NYSE)

Stock Market Profit Playbook | Swing Trade Setup

This is my original technical idea, built on price structure, trend behavior, and momentum context — presented in a clean, TradingView-friendly sty

McDonald’s: In the Trend ChannelMcDonald’s is entering another phase of consolidation, with no clear trend emerging for now. We’ve introduced a pink trend channel that closely tracks the development of the ongoing blue five-wave sequence. At this stage, price appears to be moving through wave (v) of this pattern, which should also

Te 2 Biggest Problems When Buying Stock Options My body is in pain.

Because I have been exercising.

Also I did yard work.

Determining the whether is not easy.

Just when you think it's raining.

It doesn't rain.

When you think it won't rain.

Then it rains.

Look at this chart.

The stochastic has crossed.

The %k above the %d

Below the 50 level.

$MCD VCP (Volatility Contraction Pattern) AnalysisOverview of the VCP Pattern in MCD

The Volatility Contraction Pattern (VCP), originally named by Mark Minervini, is characterized by a series of price contractions accompanied by declining volume. While Minervini typically focuses on shorter timeframes with more pronounced contractions and volume r

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MDOB

McDonald's Corporation 4.125% 11-JUN-2054Yield to maturity

6.26%

Maturity date

Jun 11, 2054

US58013MFK5

McDonald's Corporation 3.625% 01-SEP-2049Yield to maturity

5.68%

Maturity date

Sep 1, 2049

XS248628502

McDonald's Corporation 3.75% 31-MAY-2038Yield to maturity

5.67%

Maturity date

May 31, 2038

MCD4971144

McDonald's Corporation 4.2% 01-APR-2050Yield to maturity

5.66%

Maturity date

Apr 1, 2050

US58013MEV2

McDonald's Corporation 4.6% 26-MAY-2045Yield to maturity

5.65%

Maturity date

May 26, 2045

MCD5472110

McDonald's Corporation 5.15% 09-SEP-2052Yield to maturity

5.65%

Maturity date

Sep 9, 2052

US58013MFC38

McDonald's Corporation 4.45% 01-MAR-2047Yield to maturity

5.64%

Maturity date

Mar 1, 2047

MCD5632699

McDonald's Corporation 5.45% 14-AUG-2053Yield to maturity

5.64%

Maturity date

Aug 14, 2053

US58013MFA71

McDonald's Corporation 4.875% 09-DEC-2045Yield to maturity

5.63%

Maturity date

Dec 9, 2045

MCD4666684

McDonald's Corporation 4.45% 01-SEP-2048Yield to maturity

5.62%

Maturity date

Sep 1, 2048

US58013MER16

McDonald's Corporation 3.625% 01-MAY-2043Yield to maturity

5.57%

Maturity date

May 1, 2043

See all MDO bonds

Frequently Asked Questions

The current price of MDO is 273.45 EUR — it has increased by 0.75% in the past 24 hours. Watch McDonald's Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange McDonald's Corporation stocks are traded under the ticker MDO.

MDO stock has risen by 5.13% compared to the previous week, the month change is a 6.36% rise, over the last year McDonald's Corporation has showed a −3.49% decrease.

We've gathered analysts' opinions on McDonald's Corporation future price: according to them, MDO price has a max estimate of 315.84 EUR and a min estimate of 212.26 EUR. Watch MDO chart and read a more detailed McDonald's Corporation stock forecast: see what analysts think of McDonald's Corporation and suggest that you do with its stocks.

MDO stock is 1.86% volatile and has beta coefficient of 0.23. Track McDonald's Corporation stock price on the chart and check out the list of the most volatile stocks — is McDonald's Corporation there?

Today McDonald's Corporation has the market capitalization of 197.23 B, it has increased by 2.80% over the last week.

Yes, you can track McDonald's Corporation financials in yearly and quarterly reports right on TradingView.

McDonald's Corporation is going to release the next earnings report on Feb 11, 2026. Keep track of upcoming events with our Earnings Calendar.

MDO earnings for the last quarter are 2.74 EUR per share, whereas the estimation was 2.84 EUR resulting in a −3.21% surprise. The estimated earnings for the next quarter are 2.59 EUR per share. See more details about McDonald's Corporation earnings.

McDonald's Corporation revenue for the last quarter amounts to 6.03 B EUR, despite the estimated figure of 6.04 B EUR. In the next quarter, revenue is expected to reach 5.82 B EUR.

MDO net income for the last quarter is 1.94 B EUR, while the quarter before that showed 1.91 B EUR of net income which accounts for 1.50% change. Track more McDonald's Corporation financial stats to get the full picture.

Yes, MDO dividends are paid quarterly. The last dividend per share was 1.60 EUR. As of today, Dividend Yield (TTM)% is 2.19%. Tracking McDonald's Corporation dividends might help you take more informed decisions.

McDonald's Corporation dividend yield was 2.34% in 2024, and payout ratio reached 59.52%. The year before the numbers were 2.10% and 53.87% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 9, 2026, the company has 150 K employees. See our rating of the largest employees — is McDonald's Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. McDonald's Corporation EBITDA is 12.18 B EUR, and current EBITDA margin is 53.85%. See more stats in McDonald's Corporation financial statements.

Like other stocks, MDO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade McDonald's Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So McDonald's Corporation technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating McDonald's Corporation stock shows the strong buy signal. See more of McDonald's Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.