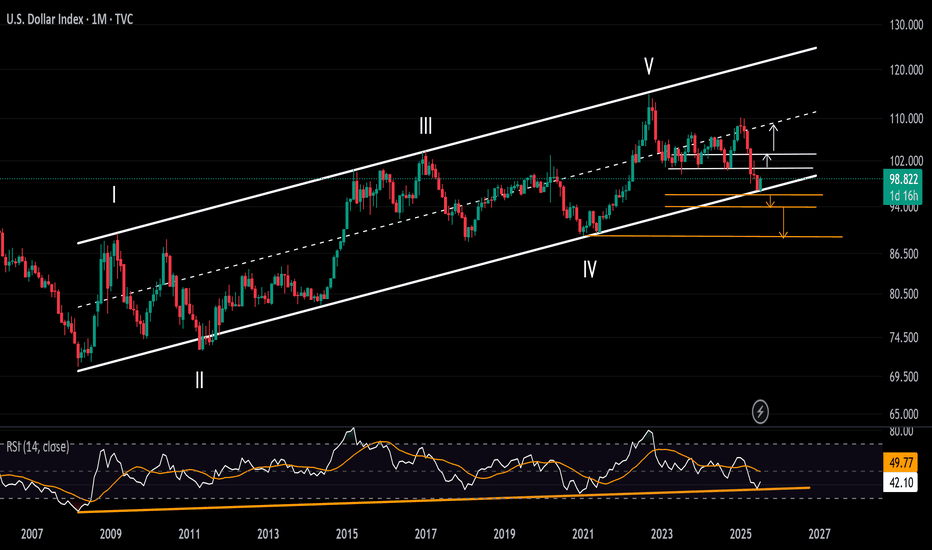

DXY Surge Pressures Currency Market in Volatile Market WeekThe US Dollar Index (DXY) has held its rebound off historical support zones on both the price chart and the RSI indicator throughout July. The monthly RSI is bouncing off a support line extending between the troughs of 2008 and 2020. Meanwhile, price action is rebounding from a support trendline that connects the lows of 2008, 2014, and 2021, within the 96–94 zone.

Bearish Scenario: A solid close below this support zone may confirm a long-term bearish signal, potentially pushing the index toward the 94 and 90 levels.

Bullish Scenario: A confident move above 100 and 103 could signal a reversal in the currency market, potentially leading the DXY back toward the mid-range of the long-standing channel between 105 and 107, originating from the 2008 lows.

Written by Razan Hilal, CMT

FOMC

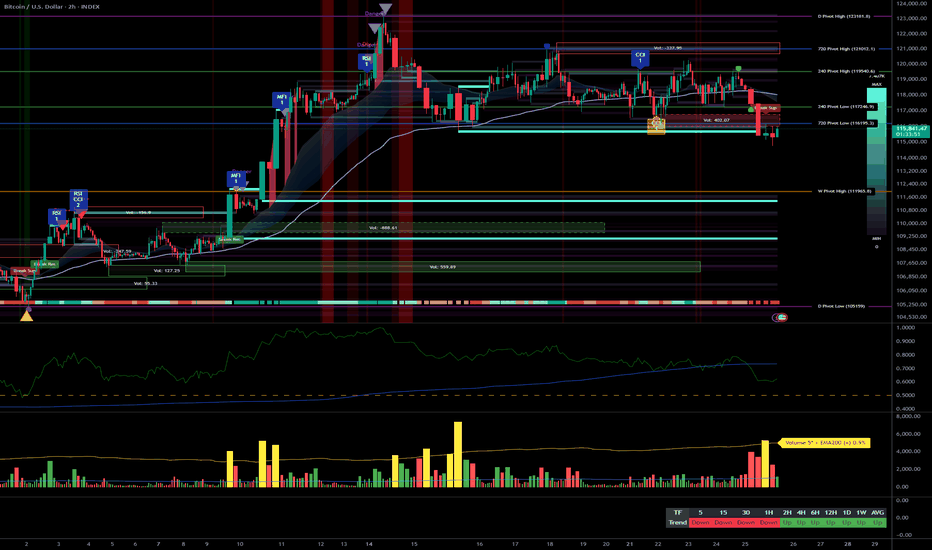

XAU/USD Intraday Plan | Support & Resistance to WatchGold remains in a bearish structure, consolidating in a narrow range after the sharp drop earlier this week. Price is trading around 3,330, testing the 3,334 resistance zone while still below the 200MA (3,362), which may act as dynamic resistance.

As long as price stays below 3,348–3,362, the bias remains to the downside, with a break below 3,309 likely exposing the 3,289–3,267 support zone.

A clean reclaim above 3,334- 3,348 would neutralize the immediate downside pressure and open the path back toward 3,373–3,387.

📌 Key Levels to Watch

Resistance:

‣ 3,334

‣ 3,348

‣ 3,362

‣ 3,373

‣ 3,387

Support:

‣ 3,309

‣ 3,289

‣ 3,267

‣ 3,241

🔎Fundamental Focus – FOMC

The FOMC rate decision and Powell’s press conference later today will be the key driver for gold. Expect sharp volatility and potential whipsaws around the release.

⚠️ Manage risk carefully, avoid chasing initial spikes, and wait for clear direction once the event dust settles.

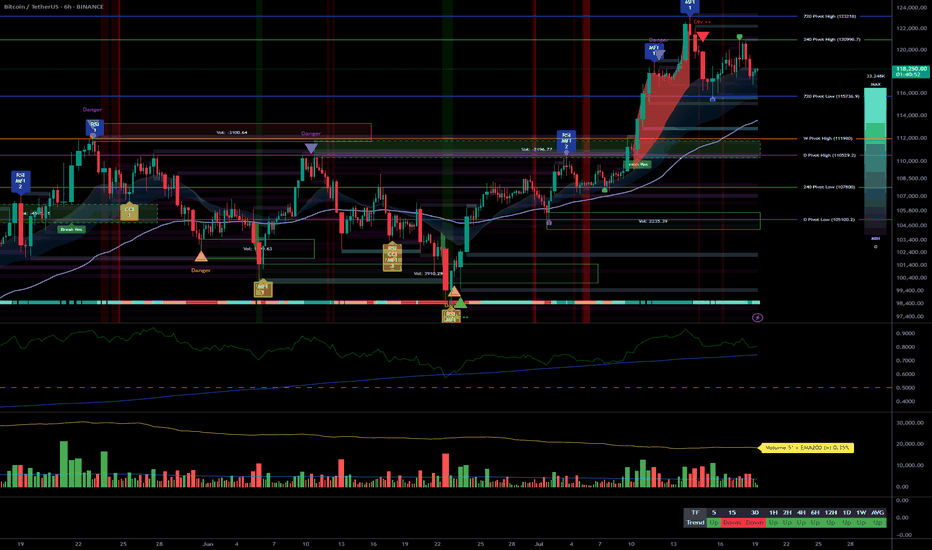

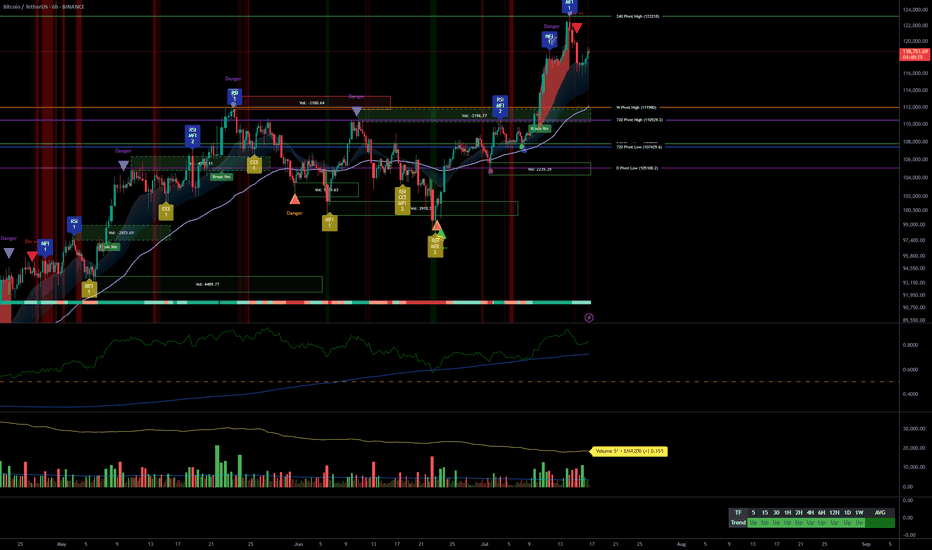

$BTC Daily OutlookDaily Chart

Today’s close printed a small bearish doji; visually bearish but still another inside-day that keeps BTC boxed between the High-Volume Node / v-Level cluster at $116 860-$123 300.

Holding $116 860 remains critical; lose it on a daily close and price can easily slide to the weekly breakout shelf near $111 960. We are now 16 days inside this balance. Per Auction-Market-Theory rule #5, the longer price churns at the edge, the more resting liquidity is absorbed, eventually a decisive push will follow. If buyers defend $116 860 again, the path opens toward range high $123 300 and the prior ATH; if they fail, expect a fast flush to the weekly V-Level.

Footprint Read

Value Area High and Low span the full candle, with the POC parked mid-range, classic two-sided trade. Delta finished negative and the heaviest prints sit at session lows: sellers hit the bid hard, yet could not follow through. That absorption leaves shorts vulnerable to a squeeze if new selling momentum doesn’t appear quickly.

Fundamental Pulse – Week Ahead

ETF Flows: Spot-Bitcoin ETFs booked three consecutive inflow days to close last week (+$180 M net). Sustained demand under the range supports the bullish case.

Macro Data: U.S. FOMC & Federal Fund Rates prints for this week; expect more volatility starting from tomorrow.

Game Plan

Primary bias stays long while daily candles close above $116 860; upside trigger is a clean for now or shorts squeeze toward $123 300.

If $116 860 breaks with volume, prepare for a quick liquidity hunt into the weekly shelf at $111 960, where we reassess for swing longs.

Intraday: I’ll monitor the Intraday Chart on tomorrow's High impact events and look for best opportunities across the board. Alt window: a fresh downtick in BTC Dominance could spark rotation; watch high-Open Interest majors if BTC ranges.

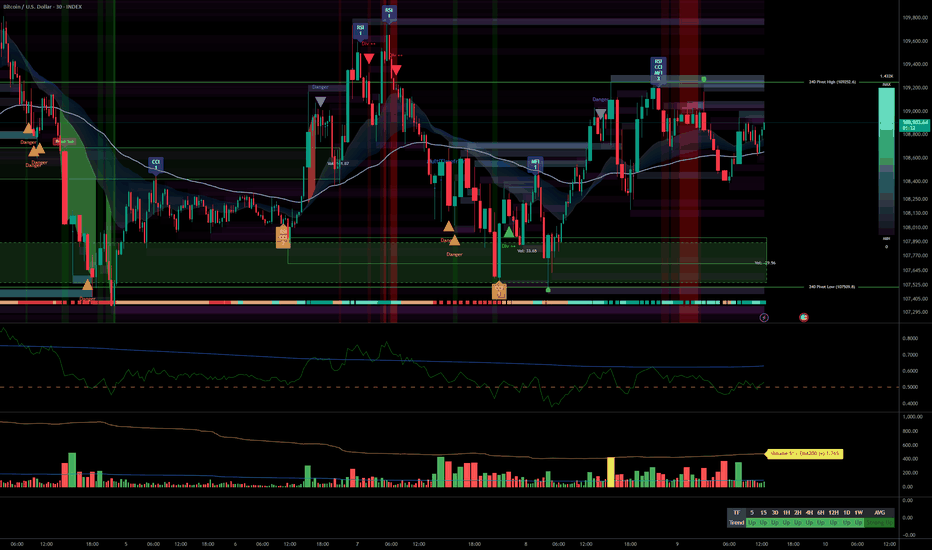

Multi-timeframe analysis, strong momentum, FOMC risk/reward plan__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Strong momentum and bullish consensus confirmed across all timeframes.

Key support/resistance : 114k–116k (critical support), 123k (major pivot).

Healthy organic volume , no extreme peaks except isolated moments (30min/15min).

Risk On / Risk Off Indicator : Dominant bullish signal, neutral only on 15min.

Multi-timeframe structure : Perfect alignment daily/4H/2H/1H, caution on 15/30min (slight inflection but no abnormal divergence).

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias : Structural bull market, intact dynamic.

Opportunities : Tactical buys on pullbacks (114–116k), swing on breakout 123k.

Risk areas : Below 114k = risk of invalidation, targets 111k–105k.

Macro catalysts : FOMC imminent (high volatility expected), watch geopolitical tensions.

Action plan : Favor swing/cautious trading ahead of FOMC, dynamic stops, act on first post-Powell trigger.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D : Active range 114k–123k; strong supports, momentum maintained; Risk On / Risk Off Indicator strongly bullish.

12H/6H/4H : Clean bullish structure, no excesses or divergence; price sits within major horizontal clusters.

2H/1H : Healthy impulse/correction phases; key intermediate supports 114.6k, 117.5k to watch.

30min/15min : Slightly weaker momentum but constructive microstructure, no immediate sell threat; localized volume spikes on support reactions.

ISPD DIV : No behavioral stress observed throughout.

Cross-timeframe summary : Bullish confluence dominant; caution on short-term reversals tied to FOMC and on-chain volatility spikes.

__________________________________________________________________________________

Multi-timeframe Cross Analysis & Decisional Rationale

__________________________________________________________________________________

As long as BTC > 114k = bullish bias, buying pullbacks, swing target 123k.

Active management post-FOMC strongly advised (enter/reduce after first H4 close).

Increased volatility risk in case of Fed/geopolitical shock; mandatory stops.

Sector momentum (Risk On / Risk Off Indicator) and volume underpin the bullish case unless exogenous alert.

Invalidation below 114k = prudent, neutral, or tactical shorts towards 111k–105k.

__________________________________________________________________________________

Macro, On-chain & Economic Calendar

__________________________________________________________________________________

FOMC July 29th : pivotal event, any surprise = strong intraday move (BTC sensitive to Powell speech).

US Macro: strong fundamentals but caution on trade war, inflation "contained."

On-chain : realized cap BTC >$1T, high open interest in derivatives = leveraged risk, beware speculative altcoin excess.

Global risk : market remains buyer until bearish Fed/geopolitical shock; swing trading favored, tight stops recommended.

__________________________________________________________________________________

Action plan

__________________________________________________________________________________

Favor buying/reloading on pullbacks to 114.6k–116k (stop <114k).

Break above 123k = bull confirmation, further extension likely to 126–128k depending on FOMC outcome.

Prioritize strict risk management; monitor liquidity/supports on macro/on-chain volatility peaks.

__________________________________________________________________________________

Countdown to Powell’s rate decision: What to watch WednesdayFederal Reserve Chair Jerome Powell is under mounting pressure from President Donald Trump to begin cutting interest rates.

Markets and analysts overwhelmingly expect the Fed to hold rates steady this Wednesday.

But what if the political heat is becoming too much to bear, and Powell and the Fed board advocate for a cut this week? Some Fed governors, Chris Waller and Michelle Bowman , have already signaled support for an early cut.

FX pairs to watch

USD/JPY:

This pair remains highly sensitive to yield differentials and broader risk sentiment. However, any hawkish resistance or emphasis on data dependency may keep the pair supported, especially if risk appetite holds.

EUR/USD:

The euro has shown relative strength in recent sessions, but the pair has been hit by the announcement of the trade deal struck between the EU and US. If the Fed clearly signals it's not ready to ease, the USD could regain even ground.

Very important Economic Calendar 28.07–01.08: FOMC, BTC, tariffsThis Week (July 28 – August 1) — the final week of the month is packed with key events.

Save this post and forward it to 3 friends 😉

📋 High volatility ahead — as the Fed’s key "threelemma" (inflation, labor market, tariffs) comes into focus.

Several important macro releases are scheduled — each one matters on its own, but combined, they can move markets sharply.

🗓 Monday (July 28)

▪️ 12:30 UTC – QRA (Part 1): upcoming US Treasury borrowing needs

▪️ 16:00 UTC – 2Y & 5Y bond auctions – key indicator of market expectations ahead of FOMC

🔗 Strong demand = stronger rate cut expectations

🗓 Tuesday (July 29)

▪️ 12:30 UTC – US GDP (Q2 estimate)

▪️ 16:00 UTC – 7Y bond auction

🗓 Wednesday (July 30)

▪️ 12:15 UTC – ADP employment report – early signal ahead of NFP

▪️ 12:30 UTC – QRA (Part 2): breakdown of Treasury borrowing

▪️ 18:00 UTC – FOMC rate decision (no change expected – 4.5%) + Powell’s press conference

🗓 Thursday (July 31)

▪️ 12:30 UTC – PCE inflation (June) – Fed’s favorite inflation gauge

🗓 Friday (August 1)

▪️ 12:30 UTC – Nonfarm Payrolls (employment)

▪️ 13:00 UTC – ISM Manufacturing Index (July)

▪️ 13:00 UTC – Univ. of Michigan Consumer Sentiment Index

▪️ All day – July auto sales data

🚨 LIBERATION DAY 2.0

Potentially the most impactful event of the week: the Trump administration will begin sending “tariff letters” to ~200 countries.

This marks the end of the temporary tariff relief (April 8 – August 1).

Markets expect a new wave of global trade tension — timing is still uncertain.

💡 Summary:

Every day brings a new potential driver.

Markets are nervous and highly reactive — sharp moves are likely...

CRYPTOCAP:BTC is currently being held above $117K, but Wednesday and Friday bring high risk of "news bombs".

Strategic Multi-Swing Analysis – Pivots and Post-FOMC Outlook__________________________________________________________________________________

Technical Overview – Summary Points

➤ Sustained bullish momentum on BTCUSDT across all swing timeframes.

➤ Key supports: 116400–117400 (likely rebound), major supports: 105047–114674.

➤ Main resistances: 119000–120000 (short term), major ceiling at 123240 (1D/12H).

➤ Risk On / Risk Off Indicator: "Strong Buy" signal – tech sector leadership confirmed.

➤ Volumes normal to moderately elevated, no excess or behavioral anomaly (ISPD "Neutral").

➤ No euphoria or capitulation flags; general wait-and-see attitude, FOMC event ahead.

__________________________________________________________________________________

Strategic Summary

➤ Strategic bullish bias remains as long as 116400/117400 supports hold.

➤ Opportunity window: buy pullbacks towards 117400–116400 with tight stops; clear invalidation below 115900.

➤ Risks: FOMC-induced volatility, increased leverage on alts, potential capitulation if key support breaks.

➤ Catalysts: FOMC communication, geopolitical context (no immediate threat), background risk-off climate not yet triggered.

➤ Action plan: Prioritize post-event reaction over anticipation; maintain strict technical protection.

__________________________________________________________________________________

Multi-Timeframe Analysis

1D: Uptrend confirmed. Price above all major supports. Strong resistance at 123240, key support at 105047, normal volumes, Risk On / Risk Off Indicator "Strong Buy", ISPD "Neutral".

12H: Bullish bias. Resistance cluster 120002–123240. Intermediate supports 114674/111949. Momentum/volume supported, no excesses.

6H: Bullish near range top, supports at 114674/111949, ceiling at 120002–123240. Solid Risk On / Risk Off Indicator.

4H–2H: Up momentum, resistance 119003–120002–123240, supports 116474/117800. Moderate/normal volumes.

1H: Strong uptrend, thick resistance at 119000–120000, immediate supports 117800/116474. Slight volume uptick ahead of FOMC.

30min–15min: Resistance 119003–120000 (~H4 pivot). Intraday support 117400–117800/118200. Both Risk On / Risk Off Indicator and ISPD neutral, normal volumes, bullish as long as 116474 holds.

SYNTHESIS: Broad bullish confluence on MTFTI from 1H to 1D/W.

Supports at 116474/117400 are key pivots for maintaining bullish swing view.

No behavioral alerts or extreme volumes.

Consolidation/waiting likely before FOMC release – monitor reactions at pivot zones.

__________________________________________________________________________________

Strategic decision & macro

Opportunities: Swing bullish scenario favored as long as key supports hold, buy strategic pullbacks, reverse on clear break.

Main risk: FOMC volatility, altcoin excesses, possible post-announcement fake moves. Active monitoring essential.

Macro/on-chain: No excess, BTC realized cap > $1T; aggressive rotation into alts, high open interest. No capitulation. Major on-chain & technical support aligned at 114500–118000.

Action plan: Favor reactivity (post-FOMC), tight stops, progressive take profits at 119500–123240 resistance. No aggressive pre-positioning.

__________________________________________________________________________________

Macro catalysts overview

FOMC expected: status quo, market sensitive to any Powell tone shift.

Global macro: latent risk-off, geopolitical drivers closely watched.

BTC stable, no technical disruptor in the immediate term.

__________________________________________________________________________________

Final Decision Summary

Robust technical setup with a clear bullish bias. Optimal entries on 117400-116400 pullbacks, stops below support, active management needed during FOMC. No on-chain excess; constructive background unless exogenous shock or resistance failure (119000–123240). Stay alert for breakout/reject pivot.

__________________________________________________________________________________

GBPUSD: Sellers Are Taking ControlWelcome back to the Weekly Forex Forecast for the week of July 28 - Aug 1st

In this video, we will analyze the following FX market:

GBPUSD

GBP is weak vs USD. GU is heading lower with a bit of steam.

The Monthly and the Weekly are still bullish, but the Daily and 4H indicate weakness. I would not entertain longs until I see a bullish BOS.

Look for the CISD on the 4H in the beginning of the week, confirming sells are the way to go.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XAUUSD (GOLD): Wait For The BOS! FOMC and NFP Looms!In this Weekly Market Forecast, we will analyze the Gold (XAUUSD) for the week of July 28 - June 1st.

Gold is in the middle of a consolidation. Bas time to look for new entries!

FOMC on Wednesday and NFP on Friday. Potential news drivers to move price in a decisive direction!

Wait for a break of structure (BOS) either direction before entering a new trade.

Be mindful that the Monthly is bullish, and the Weekly is neutral.

The Daily is bearish, with 3 days of data indicating so. I am leaning towards this bias, as the draws on liquidity are near and obvious.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Bitcoin: Strategic Entry Plan on Pullback – 116k Buy Opportunity__________________________________________________________________________________

Technical Overview – Summary Points

➤ Bullish momentum across all higher timeframes (1H to 1W) supported by Risk On / Risk Off Indicator (Strong Buy).

➤ Major supports: 116,128 and 111,980 (multi-timeframe pivots). Key resistance at 123,218.

➤ Very high intraday volumes, pointing towards probable capitulation zones.

➤ Multi-timeframe behaviors: Technical rebound anticipated on the 116,128–115,600 zone, caution if 111,980 breaks.

__________________________________________________________________________________

Strategic Summary

➤ Global Bias: Bullish confirmed mid/long-term.

➤ Accumulation opportunities on key pullbacks near 116,128 and 111,980.

➤ Risk zone: sustained closes below 111,980 = invalidation of bullish outlook (target 105,100).

➤ Macro catalysts: FOMC meeting (July 29-30), heightened event-risk period.

➤ Action plan: favor entries after FOMC volatility resolution, stop-loss adjusted below 111,980.

__________________________________________________________________________________

Multi-Timeframe Analysis

Daily (1D) : Compression under 123,218 resistance, primary bullish trend, no extreme signals.

12H : Healthy consolidation under resistance, no euphoria or panic, normal volumes.

6H : Price squeezed between major supports (116,128–111,980), uptrend confirmed.

4H : Institutional volumes on supports, favors technical rebound.

2H : Speculative rebound underway, confirmation needed for short-term bottom.

1H : Strong capitulation signal, record volumes, immediate retest of 116,128 support.

30min : Local oversold status, extreme sentiment, high technical reversal probability.

15min : Phase of panic likely ending, short-term rebound anticipated.

Key Indicators:

Risk On / Risk Off Indicator: Strong buy on 1D–4H, neutral on 30min and 15min.

ISPD DIV: Neutral to Buy (capitulation signaled on 1H+30min).

Volumes: Very high at lows = capitulation + potential bottom.

MTFTI: Up momentum above 1H, down on lower timeframes (30–5min).

__________________________________________________________________________________

Cross Timeframe Synthesis

High timeframe alignment confirms bullish bias, supported by buyer volumes.

Key zone 116,128–111,980 = multi-timeframe support, tactical focus.

Main risk: break of 111,980.

__________________________________________________________________________________

Operational synthesis & macro context

Bullish bias validated unless breakdown below 111,980.

Tactical accumulation window on pullbacks, 1H confirmation needed.

Volatility risk increases ahead/during FOMC, dynamic stop management essential.

Altcoins fragile: extra caution if BTC triggers Risk Off.

Calendar to watch: FOMC (July 29–30), Durable Goods (July 25).

__________________________________________________________________________________

On-Chain (Glassnode) :

BTC consolidates, no extreme signs; ETH outperforming but caution on alts (elevated leverage).

__________________________________________________________________________________

⏳ *Decision Recap for July 25, 2025, 10:56 CEST:*

— BUY ZONE tactical at 116,128–115,600 (BTC), 1H confirmation required.

— Stop-loss below 111,980 / Swing target >120,000–123,218.

— Risks : Fed announcements, flushes on supports, altcoins at risk.

__________________________________________________________________________________

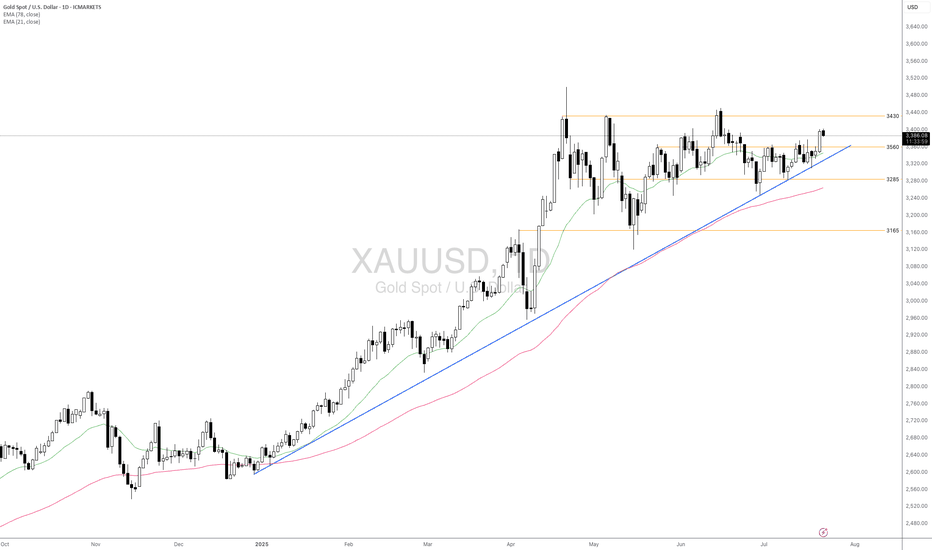

Will The Emerging Uncertainties Support Gold Ahead?Macro approach:

- XAUUSD advanced this week, supported by broad-based US dollar weakness and reviving safe-haven demand amid rising global trade tensions. The yellow metal briefly reached a five-week high as investors sought safety following headlines of escalating US tariffs and uncertainty over the Fed’s policy direction.

- Gold may remain well-supported if risk aversion persists, with upcoming global PMIs and further US trade developments set to guide market direction. Additional Fed commentary and central bank actions could trigger new volatility for XAUUSD throughout the week.

Technical approach:

- XAUUSD remains above both the EMA21 and EMA78, reflecting ongoing bullish momentum. The recent price action shows consolidation below the resistance at 3430 after rejecting the swing high. In contrast, higher lows have formed above the ascending trendline and the support at 3285.

- If XAUUSD stays above the support at 3560, it may extend towards the previous swing high at around 3430 and open for another record high.

- On the contrary, if the price drops below the support at 3560 and the ascending trendline, it may retreat toward the following support at 3165.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

Bitcoin at 120,000: Decisive Breakout or Renewed Consolidation?__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strongly bullish on H1 and above; healthy consolidation below ATH.

Supports/Resistances: 120,000 USDT (pivot resistance), 116,400–117,000 (major support), 104,000–110,000 (long-term support).

Volumes: Normal, no anomaly nor climax detected.

Risk On / Risk Off Indicator: Strong buy signal on all timeframes except very short term. Sectoral health confirmed.

Multi-timeframe: Short-term bearish divergence on 15/30min, but robust technical structure above H1-D1.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias: Confirmed bullish across all timeframes; no major break detected.

Opportunities: Strategic buys between 116,400–117,000 (pullback); confirmed breakout above 120,000 (target 130,000).

Risk zones: Below 116,000 (potential correction to 112,000–104,000), false breakout at the top.

Macro catalysts: Monitor Fed (next FOMC July 29-30), volatility on risk assets, geopolitical tensions.

Action plan: Prioritize stop management, stay reactive ahead of macro events. Main scenario: buy confirmed pullback or validated breakout.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D / 12H: Bullish structure intact but facing historical resistance (120k), strong supports in place (104–107k).

6H / 4H / 2H: Consolidation below resistance, no signs of exhaustion, tactical supports at 116,000–117,000.

1H / 30min / 15min: Weakness on shorter timeframes (sellers at top), confirmation of range polarization. No emotional excesses (ISPD DIV neutral), standard volumes.

Risk On / Risk Off Indicator: Strong buy except for very short-term fatigue.

Summary:

Multi-horizon bullish bias, technical and sectoral confluence for upside extension if clear breakout >120,000. Key support to hold at 116,400–117,000. Buy dips, ride breakout up to 130,000. Focus on risk management, flexibility advised as macro (Fed) nears.

__________________________________________________________________________________

Key macro events to watch

__________________________________________________________________________________

2025-07-18: Fed rate/volatility debate (Equity, Bonds, BTC).

2025-07-29: FOMC (potential pivot for risk assets).

__________________________________________________________________________________

Strategic decision & final summary

__________________________________________________________________________________

Main bias: Bullish, to be validated at key levels, favor buying dips/breakouts.

Risk management: Stop below 116,000, scale out progressively after 125k, reinforced protection ahead of FOMC.

Opportunities: Pullback 116,400–117,000 (RR >3); H4/D breakout >120,000 targeting 130,000 (RR >2).

Monitoring: Macro (Fed, geopolitics), dynamic management according to market response to news.

Conclusion:

A validated move above 120,000 projects target to 130,000 (next statistical/on-chain extension). Deep dips can be bought above 104,000. Do not loosen risk management as Fed date approaches.

Bitcoin Full analysis: Buy the dip confirmed, 123240 key__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Very bullish across all timeframes; healthy compression above previous range.

Key Supports: 115731–110481 USDT (structural, 1D to 1H).

Major Resistances: 123240 USDT (multi-frame pivot).

Volume: Normal, no climax or distribution — flows support the dominant bias.

Risk On / Risk Off Indicator: Strong bullish HLTF signal; short-term neutral intraday.

ISPD DIV: Neutral on all timeframes.

Multi-TF Behavior: Bull rally, no excess, no euphoria or capitulation; market holds above key levels.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global Bias: Strong bullish – MT/LT “buy on dips” confirmed.

Opportunities: Progressive buying (117800, 115731 USDT), continuation on breakout >123240.

Risk Zones: Possible pullback if clear rejection below 123240, swing invalidation if close <115731-111949.

Macro Catalysts: Awaiting FOMC late July, short-term volatility limited. Watch geopolitics, extreme compression.

Action Plan: Swing entry: 118300–119000. Stop: 115500. Target: 123200 then 126000+. R/R ≥2.5. Adjust risk management before FOMC.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Bullish momentum, supports at 105054/107939–110483. Risk On / Risk Off Indicator strong buy, healthy volume, ISPD neutral.

12H: Consolidation below 123240, aligned supports 110481/115731, healthy structure.

6H: Confirmed momentum, continuous compression, no major sell signals.

4H: Rally structure robust, corrections limited and on support.

2H: Key support band 115731–110481, volume supports rebound, possible rotation below 123240.

1H: Rally confirmed, no panic selling detected.

30min/15min: Intraday consolidation, micro-range below resistance, stable volume, Risk On / Risk Off Indicator short-term neutral.

Cross-TF summary: CLEAR momentum across all frames, no significant divergence, high-quality HTF supports. Next >123240 breakout likely fast and dynamic.

__________________________________________________________________________________

Technical & Fundamental Synthesis

__________________________________________________________________________________

Technical Synthesis: Broad bullish confirmation; buy-the-dip valid on 117800/115731, no aggressive downside signal. Swing positions above 118200 to be favored, expect acceleration after clear break of 123240.

Stops & Invalidation: Swing stops below 115731/111949. Closing below = increased risk, “off” bias.

Fundamentals: Optimal pre-FOMC swing window, US market in wait-and-see mode short term. Neutral/volatile geopolitics, no immediate shocks.

On-chain: Heavy accumulation, historic compression, ETF flows strong (but on short pause). Imminent volatility squeeze possible either way.

Recommendation: Actively monitor 123240 (breakout above), 115731 (below = increased caution). Adjust stops and sizing, remain highly responsive, especially as FOMC approaches.

__________________________________________________________________________________

SPX 6300 Highs to 6200 Lows - Watch Key LevelsThis week earnings season kicks off

-Notables include JPM, GS, BAC, WFC, NFLX, KMI, PEP and others

US Inflation (CPI and PPI) this week

-forecasts are showing HIGHER inflation

-consumers care, but markets may not

6300-6350 key resistance area for SPX

6200 key support area for SPX

If we break the 6200 floor, there's room to fall to 6000-5700 to find stronger support

I discuss the 50 day moving averarages on the S&P and Nasdaq as levels to watch

For the remainder of the month...

7/18 July Monthly Expiration

7/30 US FOMC (with Press Conference)

8/1 US Non-Farm

8/1 US Tariff Deadline (per Trump)

Markets will have to really love a slew of good earnings and good news to see more highs and melt-ups through this typically bumpy season (Aug-Sep)

Thanks for watching!!!

Bitcooin Major invalidation: breaks below 107793 then 105054k$__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strong bullish bias across all timeframes, confirmed by the Risk On / Risk Off Indicator.

Key Support/Resistance: HTF daily pivot zone 105054–102019. Major resistances: 109179 then 110483–111949. Key supports: 107793–105054.

Volume: Normal and healthy on all TFs, no euphoria; uptick on 30min, watch for breakout confirmation.

Multi-TF Behavior: Bullish consolidation, no behavioral excesses detected. ISPD DIV strictly neutral, no panic or euphoria visible.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global Bias: Dominant bullish structure. Trend remains steady as long as the HTF daily support 105054–102019 holds.

Opportunities: Buy on dips, target the confirmed breakout of 109179 to extend towards 110483–111949. “Buy-the-dip” remains relevant on 107793–105054.

Risk zones: Volatility expected around the FOMC minutes (07/09) & risks linked to the end of the US tariffs suspension. Neutral/bearish scenario below 105054.

Macro catalysts: FOMC, US tariff decision, bullish institutional news; exercise caution ahead of major 07/09 events.

Action Plan: Active management on macro catalysts; stops below 107793 (ST) or 105054 (swing). Act post-news for signal confirmation.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D : Bullish structure, consolidating below key resistance at 110483/111949. Buyers control above 105054–102019.

12H/6H/4H : Upper-range under control, no signs of distribution or exhaustion. 109179 is immediate resistance to watch for breakout.

2H/1H : Active micro-range between 107793–109179. “Buy the dip” on support, execute on confirmed breakout.

30min/15min : No extreme signals, moderate volatility, volumes contained; breakout needs to be confirmed above 109179.

Risk On / Risk Off Indicator : Strong BUY signal from daily to 30min, still positive on 15min.

Summary : Homogeneous context, robust bullish trend. Major resistances ahead, no case for counter-trend shorting while key supports hold.

__________________________________________________________________________________

Cross-Analysis & Fundamentals

__________________________________________________________________________________

On-chain trend: Massive HODLing, no selling pressure, stable liquidity, institutions buying.

Macro & calendar: High uncertainty for 07/09. Watch FOMC minutes, end of US tariffs, US auctions, oil inventories. Extreme volatility possible—caution.

Risk Management Synthesis: Buy on support/lower range, active management pre-catalysts, technical stop below 107793/105054, targets at resistance 110483–111949.

Bitcoin bullish Bias Consolidated: Robust Supports, Eyeing 11194__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum : Strong bullish consensus across all timeframes, confirmed by the Risk On / Risk Off Indicator (STRONG BUY).

Key Supports : 107761 (240min Pivot), 105054.7 (D Pivot Low, swing invalidation zone), 102019.9 (240min Pivot), 74485 (W Pivot Low, macro invalidation).

Key Resistances : 109676.5 – 110630.1 (240min & 1D cluster), 111949 (W Pivot High).

Volume : Normal to very high, no selling climax detected.

Multi-TF Behaviours : No behavioral excess indicated by ISPD DIV, healthy market structure.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall Bias : Confirmed bullish. Any pullback towards 107761/105054.7 = buy-the-dip opportunity.

Risk Zones : Below 105054.7 = multi-TF invalidation, risk of bearish acceleration to 102019.9.

Macro Catalysts : Focus on FOMC (29–30/07). Until then, controlled volatility, bullish bias sustained.

Action Plan : Buy on support, partial profit near 110630–111949 cluster. Reduce exposure/partial exit before FOMC.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

Daily (1D) : Steady bullish momentum, resistances at 110630–111949 being watched.

12H – 6H – 4H – 2H : Bias remains strong, intermediate supports defended (107761). No behavioral or breakout alerts.

1H – 30min : Continued bullish dominance, increased volatility and volume but no distribution signs.

15min : Local technical correction, no key pivot broken. Overall trend still absorbed by buyers.

Risk On / Risk Off Indicator : Strong Buy signal (slight neutral on 15min).

Summary : Bullish confirmation across all timeframes. Only a break below 107761 would weaken the setup.

__________________________________________________________________________________

Strategic Synthesis – Recommended Actions

__________________________________________________________________________________

• Remain net long while 105054.7 holds.

• Buy zone: retest at 107761/105054.7.

• Take profits gradually below 110630/111949; manage risk if key support breaks.

• Only major macro shocks or break of 105054.7 invalidate current plan.

• Solid on-chain positioning, no major capitulation risk detected.

__________________________________________________________________________________

Macro Calendar Watchlist

• 08/07/2025: RBA & RBNZ rate decisions (limited BTC impact)

• 29–30/07: FOMC (US Fed, key BTC/risk catalyst)

• Anticipate rising volatility ahead of FOMC. Monitor volume, possible institutional profit-taking.

__________________________________________________________________________________

On-Chain & Institutional Flow Analysis

Majority of investors in profit, holding dominates, new ATH for long-term holders.

Robust ETF/institutional flows.

No liquidity stress or stablecoin squeeze seen.

__________________________________________________________________________________

Conclusion

Market structure remains bullish and sound. Setup: buy on pullback, take profit under resistance, monitor macro events (esp. FOMC). Plan only invalidated by break below 105054.7 or negative macro catalyst.

__________________________________________________________________________________

AUD/USD Short: Riding the Perfect Storm to 0.6400Hello, traders! 🚀

A rare and powerful setup is forming on AUD/USD, and all signs are pointing decisively lower. 👇 This isn't just a simple technical pattern; it's a perfect storm of fundamental, technical, and event-driven factors aligning to create a high-conviction short opportunity.

If you're looking for a clean setup with a clear catalyst, this is it. Let's break it down! 🧐

The Core Thesis: Why We're Bearish 🌪️

This trade is built on three powerful pillars that are converging at the same time:

Massive Policy Divergence: 🇺🇸 vs 🇦🇺 This is the engine of the trade.

The Fed (USD): Remains HAWKISH 🦅. They are laser-focused on fighting stubborn inflation and have signaled they are in no rush to cut rates.

The RBA (AUD): Is actively DOVISH 🐨. They've already cut rates and are widely expected to cut again this week to support a weakening economy.

Result: This widening gap in interest rate policy creates a fundamental tailwind that heavily favors a stronger USD and a weaker AUD. 💸

The Dual-Catalyst Event (July 9th): 🗓️ This is the trigger.

FOMC Minutes Release: The minutes from the Fed's last meeting are expected to confirm their hawkish stance, reinforcing USD strength.

Tariff Deadline: A 90-day suspension of Trump-era tariffs expires on the same day . The base case is that tariffs will be reimposed, sparking a risk-off move in the markets.

Result: Risk-off sentiment is toxic for the risk-sensitive Aussie dollar (AUD) and a magnet for the safe-haven US dollar (USD). This is a potential double-whammy for AUD/USD. 💥

The Technical Picture is Screaming "Down" 📉

The chart tells a crystal-clear story of rejection and weakness. As you can see on the 4H chart, the price action is incredibly bearish after failing to break out higher.

The Great Wall of Resistance: Bulls threw everything they had at the 0.6590 - 0.6600 resistance zone and were decisively rejected. 🧱 This wasn't just any level; it was an 8-month high and a major long-term resistance area. A failure this strong is a huge red flag for buyers. 🛑

Momentum has Flipped: We saw classic bearish divergence on the higher timeframes, and as you can see on this 4H chart, we have now decisively broken below the recent rising channel. The path of least resistance has flipped from up to down. 👇

The Trade Plan 🎯

Here are the precise levels for executing this trade idea.

Asset: AUD/USD

Direction: Short (Sell) 📉

Entry Zone: ➡️ Look for a patient entry on a pullback to the 0.6535 - 0.6550 area. This was previous support and is now expected to act as strong resistance. We want to sell into strength.

Stop Loss: 🛑 A daily close above 0.6610 . This level is safely above the recent highs. A break here would invalidate our bearish thesis.

Target 1 (TP1): ✅ 0.6475 . This is the first logical support level. A good area to take partial profits and move your stop loss to break-even.

Target 2 (TP2): 🏆 0.6400 . This is our primary target, representing the bottom of the multi-week trading range and offering an excellent risk-to-reward ratio.

Conclusion: 💡

It's rare for fundamentals, technicals, and a major event catalyst to align so perfectly. The rejection at major resistance, combined with the powerful fundamental driver of policy divergence and the upcoming dual-catalyst on July 9th, makes this a high-conviction setup.

This is my analysis and not financial advice. Always do your own research and manage your risk carefully.

What do you think? Are you bearish on the Aussie too? Let me know your thoughts in the comments below! 👇

And if you found this analysis helpful, please give it a BOOST 🚀 and FOLLOW for more trade ideas! 👍

What to Expect From FOMC and the Market’s Reaction to It? With tariffs and Middle East escalation in focus, central banks have somewhat fallen to the backstage recently. But today’s FOMC meeting might change that. The federal funds rate upper band is most likely to stay at 4.50% with a unanimous vote. However, today’s focus will not be on the interest rate itself but rather on the dot plot and updated economic forecasts.

Inflation continues to move closer to the 2% target, but that trend may have shifted with the latest CPI report. Although recent inflation data came in better than expected, inflation appears to be flattening above 2% and could start rising again in the near future. Last week’s CPI and Core CPI reports showed early signs of this, and the upcoming PCE and Core PCE data could confirm those signals. Why is inflation still low despite tariffs? The main reason is frontloading.

U.S. consumers and firms frontloaded many goods, especially durable good, ahead of the tariff hikes. Now, with tariffs in effect, consumption has slowed, and many firms are holding elevated inventory levels. In this environment, firms are reluctant to raise prices due to lower demand and high stockpiles. This suppressive effect is expected to gradually fade, allowing prices to rise. For that reason, the Fed is unlikely to begin rate cuts prematurely. Inflation could make a peak in the last quarter of 2025 or the first quarter of 2026 in our view. But the possible oil price spike due to Iran – Israel war could change this projection.

At the March FOMC meeting when the economic projections were last updated, some of the tariff impacts were already incorporated. Inflation and unemployment were revised higher, while GDP was revised lower. Despite this, the Fed maintained its forecast of two rate cuts for both 2025 and 2026. However, since March, newly announced tariffs have been more extensive than expected. Some board members including Jerome Powell stated that. As a result, a similar adjustment to the forecasts may occur today: higher inflation and unemployment, lower GDP. Accordingly, the dot plot could show only one rate cut for 2025 and three for 2026. Why would the Fed cut more in 2026? Because the tariff impact is expected to be a one-time shock, not a structural shift. Once the effects wear off, the Fed could ease more. But there are some risks to that. According to some new research and New York FED President Williams, not only long term inflation expectations needs to be anchored, rather the “whole curve” So during a possible inflation peak came with tariff effects, FED could not cut repeatedly and should closely watch the effects on short-term inflation expectations.

The main focus of today’s FOMC will be on the economic forecasts and the dot plot. If the new projections reflect only one cut for 2025, this would be bullish for the dollar. If the 2026 projection also shows only two cuts, that would be even more bullish. On the other hand, if the current forecast of two cuts in both 2025 and 2026 remains unchanged, the reaction could be slightly dovish for the dollar.

During the post-meeting press conference, Chair Powell is likely to focus on uncertainties related to tariffs and energy prices, especially given the rising geopolitical tensions in the Middle East. Powell may downplay the hawkish tone of the dot plot during the conference, potentially reducing the overall market impact.

With all this in mind, the dollar index could either break out of the descending wedge formation on the hourly chart or continue drifting toward the lower boundary. Holding above the 99 level could be key for short-term price action.

GBP/JPY in Trouble? Smart Money Rotates Into Yen📊 1. COT Analysis

JPY (Japanese Yen):

Non-Commercial Net Long: +54,615 – showing strong long accumulation since March.

Recent Changes:

Long: -5,319

Short: +1,235

➡️ Mixed signals short-term, but overall net long positioning remains strong. Speculative funds are still heavily favoring the Yen, suggesting potential continued strength.

GBP (British Pound):

Non-Commercial Net Long: +51,634 (111,076 long – 59,442 short)

Recent Changes:

Long: +7,404

Short: -9,015

➡️ Specs are still net long on GBP, but exposure has slightly decreased. The divergence with the Yen is narrowing.

🔎 COT Summary:

Both currencies are being bought by speculators, but the JPY has shown more consistent long-term positioning. Net momentum appears to shift in favor of Yen strength, pointing to potential downside for GBP/JPY.

📅 2. Seasonality – June

Historically, June is a weak month for GBP/JPY, especially over 20y, 15y, 5y, and 2y windows.

Monthly average return is negative across all major historical timeframes (e.g. -1.2415 over 10 years).

➡️ Seasonality reinforces a bearish bias for June.

🧠 3. Retail Sentiment

Short: 52%

Long: 48%

➡️ Retail positioning is balanced, slightly skewed short. Not a strong contrarian signal, but also doesn’t support a bullish breakout scenario.

📉 4. Technical Analysis

Current Structure: Ascending channel from mid-May → currently testing lower boundary.

Key Zone: 195.600–196.520 is a major supply zone with multiple rejections.

Recent Candle Action: Bearish pin bar + engulfing candle → strong rejection from resistance.

Downside Targets:

First: 193.076

Second: 191.439

Break of the channel would further confirm a trend reversal.

➡️ Price action supports a short scenario with high reward-to-risk toward lower zones.

THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

A you can see traders the pre-event price action started yesterday with the hourly now playing between the MA’s and waiting for FOMC for a potential breakout. As usual, we have highlighted the key levels and added the red boxes for all of you to help navigate the movement should this not be priced in.

Also remember, there is a press conference after the release, this is usually the time the market will react to anything Powell says about future plans for the economy.

Now, looking at the 4H, we have support at the 3370-65 level and below that 3355. If these are attacked and give a RIP, opportunity for the long trade may be available into the 3395 red box which price will need to break to go higher. If we can break above this red box, we can then look to attempt higher price with the levels 3430, 3445 and above that 3455-60 on the horizon. It’s that red box sitting higher up around the 3470-75 region which needs to be watched if we do get up there as an opportunity to attempt the reverse trade may present itself from there depending on the volume.

So in summary, we have 3 key levels in play, ideally a move upside and rejection from the 3400-6 level giving a further dip would suit buyers to get better pricing.

KOG’s RED BOX TARGETS:

BREAK ABOVE 3395 for 3404, 3406, 3410, 3420, 3430, 3435 and 3459 in extension of the move

BREAK BELOW 3380 FOR 3375, 3364, 3351, 3342, 3333 AND 3327 IN EXTENSION OF THE MOVE

LEARN AND GENERATE YOUR OWN SIGNALS. You don't need any of us to guide you.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

TAO 4H - Downtrend bottom? Altcoins have certainly taken a backseat to BTC this cycle with Bitcoin dominance holding around 65%. Despite this, there are still some good setups in altcoins presenting themselves each day, one of which is TAO on the 4H.

To me it looks to be in a clear downtrend respecting the upper and lower limits while reacting off of support levels on the way down. As it stands price has reached a key S/R level that has proven to be support in the past and is in conjunction with the lower end of the trend channel.

With FOMC only hours away and TAO being at such a critical level this would be an interesting place to do business. A good reaction off the level would kickstart a move towards the trends upper limits. A loss of this level and it's very possible what has been support can turn into resistance.

To me the R:R here is good for a long position, the threat to the trade is bearish reaction to FOMC, escalation geo-politically which effects risk-on assets and therefor overalls TA.