USDCHF - HTF Bullish | Range Behavior | Conditional ContinuationBias: Bullish (Higher Timeframe)

Model: Accumulation → Expansion → Distribution → Correction → Delivery

State: Speculation / Tracking

Execution: Conditional

⸻

Higher Timeframe Context

USDCHF remains bullish from previous weeks, with the higher timeframe structure holding firm.

Price continues to trade within a defined range, respecting the broader bullish framework.

⸻

Mid-Term Structure & Reaction

Price previously accumulated and mitigated into a mid-term order block (orange zone, left of chart), where buyers showed up with a clean bullish reaction.

From that zone:

• Accumulation formed

• A strong bullish push followed

• Leading into a clear expansion phase

⸻

Distribution & Current Behavior

Following expansion, price transitioned into a distribution phase.

Selling pressure pushed price lower, but it quickly bounced back into the accumulation area, forming what now appears to be a correction zone, not a reversal.

This behavior suggests rebalancing, not structural failure.

⸻

Execution Scenarios

From here, I’m watching two potential paths:

Scenario 1 — Deeper Correction

• Price sweeps sell-side liquidity on lower timeframes

• Trades into the green accumulation / pivot order block

• Buyers step in, leaving clear bullish footprints

• Buy opportunities considered from that zone

Scenario 2 — Strength Continuation

• Price shows strong momentum

• Fully breaks the mid-term lower high

• Confirms bullish realignment without deeper discount

In both cases, liquidity must be taken before execution is considered.

⸻

Mindset

This is still speculation territory.

Patience is the key.

Tracking is the edge.

Structure leads execution.

Until confirmation prints, we wait.

Let smart money show the hand. Let’s go. 📈🔥

Pivot Points

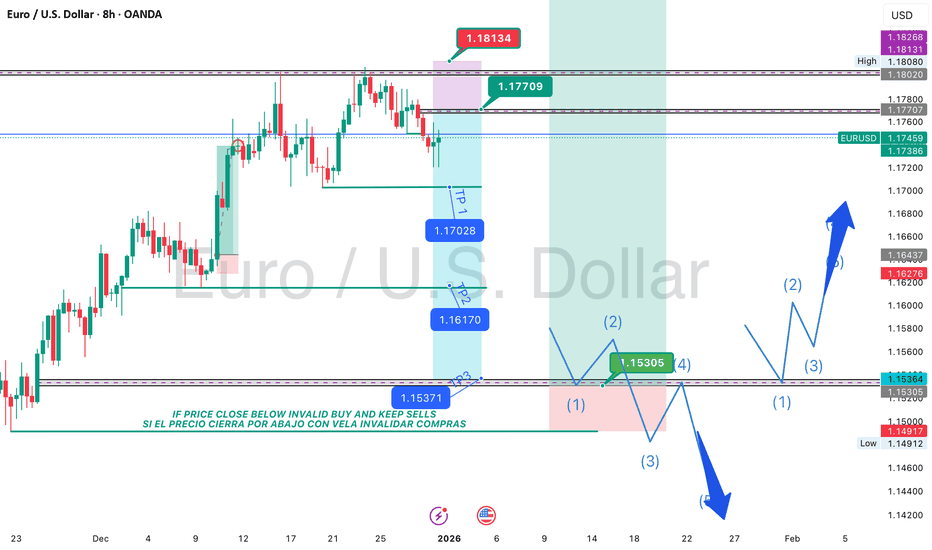

EURUSD - HTF Bullish|Patience Over Prediction|Tracking The CycleBias: Bullish (Higher Timeframe)

Model: Accumulation → Expansion → Distribution → Mitigation → Delivery

State: Tracking / Speculation

Execution: Conditional

⸻

Higher Timeframe Context

EURUSD remains bullish on the higher timeframe, and this has not changed.

This is why I consistently stress one thing across every post:

Tracking is the edge. Patience is the key.

A lot of traders got burned here — not because structure failed, but because they rushed the phase.

⸻

Market Cycle Read

Price has clearly fallen out of the distribution phase, something that was visible early for those tracking structure instead of chasing moves.

We saw:

• A clean expansion out of the accumulation area

• Confirmation that buyers were still active

• Proof that the higher-timeframe bullish narrative remained intact

Fast hands paid the price. Patient hands followed the footprints.

⸻

Mid-Term Structure Alignment

Mid-term structure rotated exactly where it was meant to:

• Into the HTF internal framework structure order block

• A lower high was broken, confirming bullish realignment

• A new high was printed, followed by a minor reaction

This reaction is information, not weakness.

⸻

Current Focus

From the recent accumulation → expansion → distribution, price is now disputing away, suggesting the market is preparing for its next corrective phase.

What I want to see next:

• Full mitigation back into the accumulation zone

• Additional timeframe confirmation

• Alignment before targeting higher highs

No chasing. No guessing.

⸻

Mindset

Beginners react late.

Professionals follow clues and footprints.

Patience is the key.

Tracking is the edge.

Structure never lies.

Until price gives confirmation, we wait.

Let smart money lead. Let’s go. 📈🔥

EURGBP - HTF Bullish Structure | Mitigation into Accumulation |EURGBP — HTF Bullish Structure | Mitigation into Accumulation | Speculation Phase

Bias: Bullish (Higher Timeframe)

Model: Accumulation → Expansion → Distribution → Mitigation → Delivery

State: Speculation / Tracking

Execution: Conditional

⸻

Higher Timeframe Context

EURGBP remains bullish on the higher timeframe, with overall mappings unchanged from previous weeks.

Structure continues to hold bullish, keeping the directional bias intact.

⸻

Mid-Term Behavior

On the mid-term, price has shown distribution behavior, clearly marked in red, which has disrespected the prior internal cycle and cleared the path for rebalancing.

This move is viewed as a corrective phase, not a reversal.

⸻

Market Theory & Point of Interest

From a bullish auction theory perspective, price is rotating back into a higher-timeframe internal framework structure order block — the same accumulation area that previously fueled expansion.

This zone remains the key point of interest.

⸻

Execution Plan

Once price achieves full mitigation into this test area, I’ll be looking for:

• Stabilization within the POI

• A corrective reaction to the upside

• Conditions aligning for continuation delivery higher, in line with the HTF bullish bias

Lower timeframes must show bullish realignment before execution.

⸻

Mindset

For now, this remains speculation only.

Patience is needed.

Tracking is the edge.

Let structure lead.

Until then, we wait for confirmation — not prediction.

Let’s go. 📈🔥

HTF Bullish | AMD in Play | Speculation PhaseBias: Bullish (Higher Timeframe)

Model: Accumulation → Manipulation → Distribution → Mitigation → Delivery

State: Speculation / Tracking

Execution: Conditional

⸻

Higher Timeframe Context

As price is visualized on the higher timeframes, the market remains in a bullish phase, with structure continuously breaking to the upside.

Price has expanded aggressively and is currently holding near the highs, reinforcing bullish control.

⸻

Market Cycle Read

Although price appears to be in a distribution zone following expansion, the structure aligns cleanly with an AMD model:

• Accumulation formed at the base

• Manipulation cleared liquidity

• Distribution delivering price lower

This suggests the current pause is part of a healthy cycle, not exhaustion.

⸻

Framework & Point of Interest

If price distributes back into the internal framework structure / order block area, that zone becomes the focus.

From there, I’ll be watching for:

• Stabilization and mitigation

• A corrective phase

• Conditions aligning for continuation of delivery within the broader bullish cycle

⸻

Execution Conditions (LTF)

Lower timeframes must show bullish realignment before participation:

• Bullish reaction from the POI

• Bearish structure invalidation (lower high break)

• Pullback forming a new accumulation buy zone

⸻

Mindset

For now, this is speculation only.

Patience is the key.

Tracking is the edge.

Let smart money lead.

Until then, we wait for confirmation — not prediction.

Let’s go. 📈🔥

GBPJPY - HTF Bullish | High-Range Consolidation | Distribution Bias: Bullish (Higher Timeframe)

Model: Consolidation → Distribution → Mitigation → Realignment → Delivery

State: Speculation / Tracking

Execution: Conditional

⸻

Higher Timeframe Context

GBPJPY remains bullish on the higher timeframe, showing strong continuation characteristics.

Structurally, this setup closely mirrors AUDJPY, with price currently holding near the highs.

⸻

Current Phase

Price is consolidating at premium levels, which increases the probability of a distribution phase.

From here, I’m anticipating a potential move lower to fill inefficiencies resting beneath price.

This would be a healthy corrective move, not a bearish shift.

⸻

HTF / Mid-Term Point of Interest

Below current price:

• Liquidity rests above and around key levels

• Order blocks sit underneath that liquidity

• Clear inducement present

If price drops into this zone and mitigates cleanly, that area becomes the focus for continuation.

⸻

Lower Timeframe Plan (Realignment)

Within the accumulation area, I’ll be watching lower timeframes for bullish realignment:

Required confirmations:

• A bullish reaction from the POI

• A lower high being broken (bearish structure invalidation)

• A pullback on the bullish leg, forming a new accumulation buy zone

➡️ This would open the door for the next delivery leg higher.

⸻

Invalidation

If price:

• Fails to show bullish reaction

• Continues to respect bearish structure

• Does not break the lower high

➡️ No longs taken. Price likely seeks deeper discount.

⸻

Mindset

Currently in speculation mode.

Patience is the key.

Tracking is the edge.

Structure leads execution.

Until then — we wait and let price confirm. Let’s go. 📈🔥

AUDJPY - HTF Bullish | Distribution * Mitigation Watch Bias: Bullish (Higher Timeframe)

Model: Expansion → Distribution → Mitigation → Delivery

Execution: Conditional

State: Patience / Tracking

⸻

Higher Timeframe Context

AUDJPY remains bullish on the higher timeframe, with structure consistently printing higher highs.

Directional bias remains intact — no HTF structural damage at this stage.

⸻

Current Phase

After expanding into the highs, price has entered a distribution zone, showing signs of manipulative behavior.

This suggests price may dispute lower to rebalance inefficiencies before the next move.

⸻

Mid-Term Point of Interest

I’m watching for a potential move into a mid-term order block / point of interest.

From this zone, I want to see:

• Stabilization and holding behavior

• A clean correction phase

• Conditions forming for the next delivery leg higher

⸻

Lower Timeframe Conditions

If on the lower timeframes:

• Structure fails to hold

• A lower high is broken

• Bullish confluences do not print

➡️ Then this becomes a no-trade environment.

In that case, price is likely seeking deeper liquidity and more discounted territory before continuation.

⸻

Mindset

Currently in speculation mode.

Patience is the key.

Tracking is the edge.

Structure leads.

That’s the money lead.

Until then — we let price show its hand. 📈🔥

USDJPY - Bullish Continuation | HTF Control | Patience PhaseBias: Bullish

Structure: Higher Timeframe Continuation

Timeframes: HTF / Mid-Term / LTF

⸻

Higher Timeframe Context

USDJPY remains bullish, with higher-timeframe mappings unchanged from previous weeks.

Price continues to respect and trade within HTF structure, confirming directional control remains intact.

⸻

Mid-Term Perspective

On the mid-term, price completed a clean mitigation, which has been held since last week, followed by continued expansion.

This reinforces that buyers remain in control and that the broader bullish narrative is still valid.

⸻

Current State

Price continues to press toward highs, maintaining bullish momentum.

No structural damage has occurred — this is continuation, not reversal.

⸻

Lower Timeframe Plan

At the moment, I am waiting for a second-entry opportunity.

Execution plan:

• Allow price to distribute

• Look for a return into a prior accumulation area

• Once mitigation is complete, buy points will be considered

This will be the operating mood for the upcoming week.

⸻

Mindset

Currently in speculation mode.

No chasing. No forcing.

Patience is the key. Tracking is the edge.

Let price come to us. 📈🔥

GBPUSD - Bullish Structure | HTF POI Alignment | Patience PhaseBias: Bullish

Model: Accumulation → Delivery → Mitigation → Expansion

Timeframes: Daily / 4H / 30M / 5M

⸻

HTF Context (Daily)

GBPUSD remains in bullish market structure, with a major Daily high broken, confirming higher-timeframe continuation.

The red order flow provides directional confluence, and price has already shown a clean bullish reaction from this HTF point of interest.

Following that reaction, we observed accumulation forming, which successfully delivered price higher — validating bullish intent.

⸻

Mid-Term Structure (4H / 30M)

From an internal perspective (blue micro structure), price respected internal structure, accumulated, and then broke out, confirming participation from buyers.

Buyers accumulated from a key pivot, delivered expansion, and distributed, before price mitigated back into the origin of orders — a classic revisit of a higher-timeframe POI.

Zooming out to the mid-term perspective, a lower high was taken, followed by a manipulative push, leading to redistribution into the orange POI.

This orange zone aligns with:

• Daily HTF POI

• Mid-term reaction zone

• Internal accumulation (blue)

➡️ Triple confluence zone = stronger probability accumulation area.

⸻

Current State (Execution Phase)

From this aligned accumulation zone, price has already shown a strong expansion, confirming buyers are active.

At the moment:

• Price is in a pause / corrective phase

• I am waiting for minor sell-side liquidity to be taken

• Looking for full mitigation into a minor accumulation area

This is not entry time yet — this is tracking time.

⸻

LTF Plan (5M Execution)

Once price completes mitigation:

• I’ll look for 5M structure confirmation

• Entry will be based on accumulation → expansion logic

• Targeting continuation toward higher highs

Until then:

Patience is the edge. Tracking is the work.

⸻

Final Notes

I’m currently in speculation mode, allowing price to show its hand before committing.

No rushing. No forcing. Letting structure do the talking.

4H → 30M → 5M execution model in play.

Let it come to us. 💪📈

TWT Analysis (4H)The price has made deep drops, and it appears that market makers have collected sufficient liquidity to change the trend.

After the drops, the price ranged at the bottom for a period, which seems to have been sufficient as an accumulation phase for an upward move on the hourly timeframe. Market makers also appear to have filled their orders.

The mid-term bearish trendline has been broken. The bearish C wave appears to be a diametric and has already ended. A proper pullback to the broken trendline has not yet occurred. A pullback is expected soon, after which the price is expected to enter the C wave.

We have marked two entry points on the chart where positions should be entered using a DCA approach. Targets have been specified on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

Trading is not hard or complicated if you have a professional coach.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

Rivn round two longRIVN has pulled back to the golden pocket and looks ready to resume towards 25$ soon. I missed the first leg since I’m not a major fan of the company, but I would trade this. I’ve learned to really just wait for my levels and set alarms. I will enter this if we get a consolidation candle.

BEAT Analysis (4H)BEAT has experienced a significant drop, during which it swept a large liquidity pool on the downside. This type of move often indicates a liquidity grab rather than pure bearish continuation. However, the price has not yet shown a strong or convincing recovery, which suggests that the market is still searching for a proper support level.

Based on current price action and structure, we expect the price to move further downward toward the marked zone, where a reaction and potential support formation are anticipated. This zone aligns with previous demand and liquidity areas, making it a key level to watch closely.

It is important to note that BEAT is a highly volatile and high-risk asset. Due to its volatility and market behavior, it is more suitable for spot trading rather than leveraged positions. Proper risk management is essential when trading this asset.

All targets are clearly marked on the chart, and traders are advised to follow the plan accordingly.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

For entry, using a DCA (Dollar-Cost Averaging) strategy within the specified zone is recommended, rather than entering with a single position. This approach helps manage risk and reduce the impact of volatility.

If a daily candle closes below the invalidation level, this analysis will be considered invalid, and the scenario should be reassessed.

As always, this setup requires patience and confirmation from price action. Manage your risk wisely and trade responsibly.

Levels the Month 01/2026 ∷BitCoin∷supply 🐻&🦄🎠🐴🐎&🐂 demand🔳30Day🔲

__________________________

U-Support-Resistance🔀

107983 114504 123921 127109 134561 141330 148683 163597 173105 176190 179905 187741 191035 202908 206248

Mids∷🏛∷

103825 105583 107359 109141 111126 113231 115062 130860 139696 141499 143278 145114 146995 149760 151663 153554 158365 162842

L-Support-Resistance🔀

86042 87563 90889 92490 99052 100680 105455 108910 112206 113850 115530 117142 121915

EURUSD: Support & Resistance Analysis for Next Week 🇪🇺🇺🇸

Here is my latest structure analysis and important

supports and resistances for EURUSD for the next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

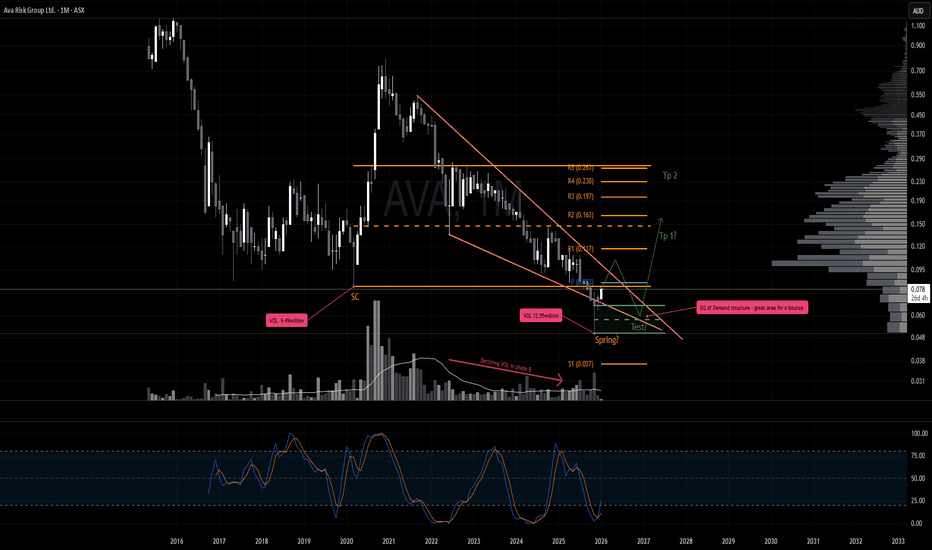

Reversal Incoming AVA is shaping up as one to watch.

The November low may have formed a high‑volume spring with a brief throw‑under of the wedge structure. It’s a constructive signal, but confirmation is still lacking. Price has yet to break back into the range and close convincingly.

For the bullish scenario, the key level is the new yearly pivot at $0.083.

Importance of this zone: it’s the first approach into the yearly pivot, it aligns with range‑low resistance, and it intersects the downward resistance trendline. A clean, impulsive break on increased volume and close above this cluster would signal real strength.

If that breakout occurs, the next expectation is a pullback to retest the spring, especially given the spring printed higher volume than the selling climax, making it a logical demand check.

Scenario 2

Since price is in high-risk zone a strong rejection here could result in a much deeper pullback. First zone of interest would be the yearly 1 pivot

S Buy/Long Signal (4H)The price of SUSDT (Sonic) is currently trading at a key level. We have a bullish CH on the chart. Also, there is no strong resistance or supply zone ahead of the price.

The price can reach higher zones soon.

We have two entry points and should enter using a DCA strategy.

Targets have been marked on the chart.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

EURUSD is in a Downside DirectionHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

ETC Secondary Trend 4.9 Year Triangle (like XRP) 10/2025Logarithm. Time frame: 1 week. Declines from the high in the secondary trend, as before -92%. Formation of the #accumulation zone. Price is being squeezed into a corner.

🔵 Main trend — ascending, rising channel, since the inception of cryptocurrency.

🟡 Secondary trend — downward, transition to a sideways trend - #accumulation, and formation of a 4.9-year symmetrical triangle.

🟣 Local trend — downward, squeezed into the corner of a large triangle and "tension" consolidation before an exit.

Main Trend

Control your risks and stick to your trading plan. Don't get caught up in market and news noise, which shapes dominant opinions and the illogical actions of the majority, which are doomed to lose in the future.

Everything will be as it usually is with assets (stocks, cryptocurrencies, less often, are just a few examples of how these are not real assets, but imitations of usefulness, that is, a complete scam market), which have been around for a long time. For a while (from the very beginning), the upward primary trend is maintained, and huge, multi-year patterns are formed near dynamic support. That is, an upward breakout , perhaps initially throwing passengers under the market , or some fictitious cryptocurrency events before a price rise (on a large time frame). Don't be alarmed, but ignore them, or use this opportunity to reduce the average price of the overall position. Or rather, before a dominant trend change, the "point of no return."

A striking example of this is XRP with its huge triangle and its exit (the first wave +600%, which is a capitulation on profits, or, in slang, a "hamster pump"). Then 2-3 waves of price pumps, where at each consolidation in the trend they will "bury" and cry "all is lost." In the last wave, possibly with spikes as before, a full-fledged #distribution zone will form.

XRP/USD Main trend 07 2022

ETC Main Trend. Ascending Channel (all time) 10 2025Time frame: 1 week. Logarithm.

🔵Main trend: ascending, rising channel, since the inception of cryptocurrency.

🟡Secondary trend: descending, transitioning to a sideways trend (#accumulation), and forming a 4.9-year symmetrical triangle.

🟣Local trend: descending, trapped in the corner of a large triangle and “tension” consolidation before exiting.

Manage your risks and stick to your trading plan, don't get caught up in market and news noise, which creates dominant opinions and illogical actions by the majority, who are doomed to lose in the future.

Everything will be as it usually is with assets (stocks, less so cryptocurrencies. These are just a few examples of how these aren't real assets, but imitations of usefulness, i.e., a complete scam market). These assets have maintained an upward primary trend for a long time (from the very beginning), and huge, multi-year patterns form near dynamic support. That is, an upward breakout may initially throw passengers under the market , or some fictitious cryptocurrency events before a price rise (on a large time frame) don't be alarmed; ignore them, or use this opportunity to reduce the average price of the overall position. Or rather, before a dominant trend change, the "point of no return."

A striking example of this is XRP with its huge triangle and its exit (the first wave +600%, which is a capitulation on profits, or, in slang, a "hamster pump"). Then there will be 2-3 waves of price growth pumps, with each consolidation in the trend being "buried" and the cry "all is lost." In the final wave, possibly with spikes as before, a full-fledged #distribution zone will form.

XRP/USD Main Trend 07 2022

The market is simple at its core, but complex due to the interactions between people and their capital. The combination of simplicity and complexity creates many variations that you can exploit to profit from it. Your success and understanding of this determines your profit or loss in speculative markets.

You can complicate things without understanding their simplicity, which looks ridiculous from the outside. Playing smart. Or, conversely, simplifying complex, often false, concepts so that everything becomes clear and understandable. Simplicity is the essence of complexity.

In any activity, you should not pursue complexity to achieve the desired result, but rather simplification and optimization, so that you can achieve the same or better results with less effort and risk.

The entire secondary trend and this triangle with a local denouement zone in it.

Your trading plan and risk management eliminate all worries, indecision, emotional outbursts, predictions, and other people's right and wrong opinions.