Predictions and analysis

Is this a massive Head and Shoulders pattern for Sugar? The head and left shoulder are complete but will the right shoulder form and head to the mid 7s? Time will tell and we'll know by early 2025. This all started in June 2014.

📊 COTTON ⏱ TIME: 1W 📝It is reaching very important areas for spot purchases, and you can make purchases in a gradual and managed manner. It has also been checked for fundamental analysis and is a sustainable and strong project for the future. ⭕️risk: LOW 📍buy market:89 $ 📌TP1: 104 $ 📌TP2: 116 $ 📌TP3: 124 $ 📌TP4: 150 $ ⛔️SL: 74.5$

Looks like Sugar is breaking out after forming a bottom in the past 3 years.

The soft commodities sector of the commodity market can be highly volatile. Historically, sugar, coffee, cotton, cocoa, and frozen concentrated orange juice futures that trade on the Intercontinental Exchange have doubled, tripled, and halved in value over short periods. While clothing and other consumer goods depend on the cotton market, the other sector members...

Corn seems expensive compared to Soybean for 1 year ahead delivery. Maybe the too tight corn SxD due to Ukr war and post USDA Planting Intentions pressuring the spot prices is pricing too much for 2023 crop. While soybean seems behind the curve on a comparative basis. RSI for the ratio spread at 30s

Coffee reached our target at 120. However, there is still no signal the decline is done and we want to follow the trend. The support is broken and it makes me believe there is a big chance we can see a retest of important support/resistance near 104. So, if you still hold your shorts, consider adding trailing stops and let the good time roll.

The COT report is bearish, the seasonal tendency is to the downside. We have a divergence in the 4h chart. So, where do we sell? I think breaking below Thursday's low or formation of lower high would be good entries. 120 has been an important level for Coffee. It has to be tested again and it is our swing target.

US Coffee futures ( KC1!) has completed ABC zigzag up side where C wave was extended impulse. It dropped in wave A in 15 min time frame, so get in to sell trade in B wave near 124.25, with stops above invalidation level above 127.50 for target of C wave down up to 116.50, which is the 4th wave zone of internal wave of C previous wave of Up cycle.

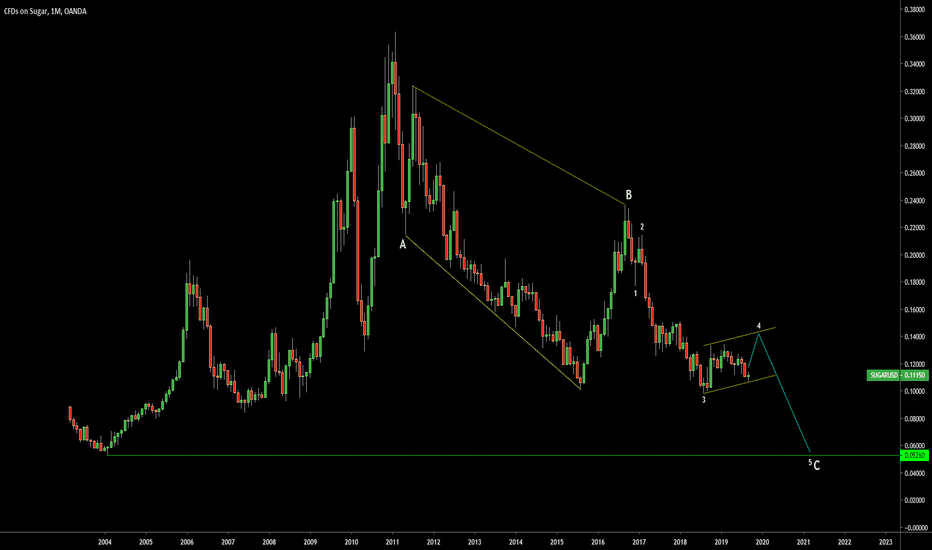

US Sugar futures ( SB1!) has completed ABC zigzag as the part of Y wave, as mentioned in previous updates. The total sequence is WXY as double zigzag, which is well known in Elliott wave theory and mostly seen in commodities and currencies. In last updates, we already posted the bull set up for buy a C wave, Now its over. stay short in B wave up at around...

COCOA is sideways for the last 10 years and seems like it will stay like that. Hello traders! Today we will talk about Cocoa and its price action from Elliott Wave perspective. Well, looking at the longer-term weekly chart, we can see Cocoa moving sideways for the last 10 years in the 3700 – 1700 range, ideally within a bigger bearish triangle pattern in wave...

Beautiful structure as sugar price gonna complete the large correction to tag the multi-decade low of 0.0526 Wave C is 5 waves and it is in the second leg of wave 4 up before the last drop.

Taking support at daily kijunsen which coincide with 50% retracement of current rally, you would never like to miss a buy. In a bull run RSI at 50 needs to give support and it almost kissed that level. Re buying here can provide quick profits towards 100 and recent high. Fundamentally, Brazilian Real rallied big after we spotted bottom against USD at 4.10 . Coffee...

Coffee is trading near multi year horizontal support of 95 cents. While excessive supply and falling Brazilian real crushed the prices, there is ray of hope ahead. With price almost reaching 95 level which seems safe accumulation level, there can be gains in coming months. Farmers in Brazil are reducing coffee cultivation area will lead reduction in inventories in...

Oversold OrangeJuice market makes me thinking LONG.

A bull spread OJK19-OJN19 is quite low and it offers interesting RRR. COT analysis confirms an oversold state of a market. Entry -1,5 SL -2,0 ($75/contract) PT 0,0 ($225/contract)

Orange Juice price is a bit oversold and a bullish correction could come very soon.

Orange Juice price is a bit oversold and a bullish correction could come very soon. I built a bull spread OJF19-OJH19 and I wait for an entry about -1,50 with SL -2,50 ($150/contract) and PT 2,00 ($525/contract).