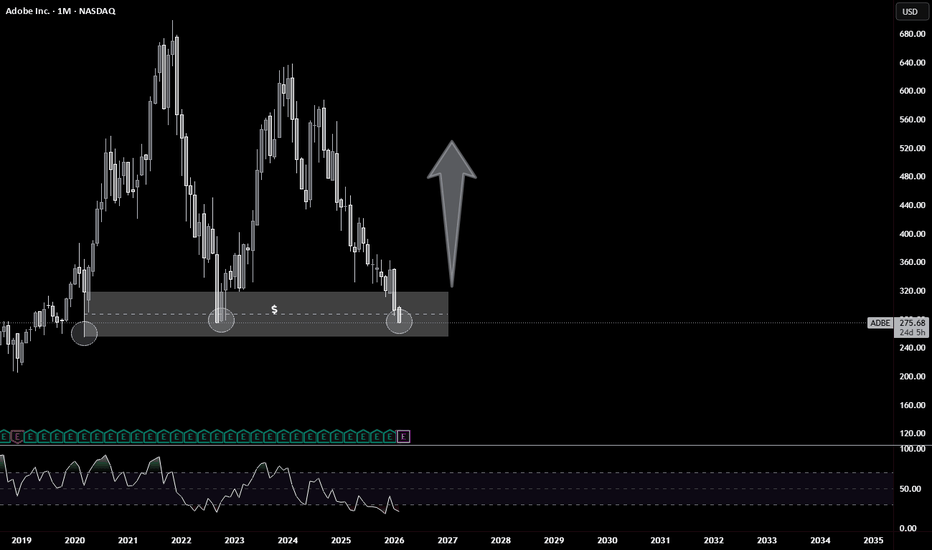

ADBE - Good Buy Opportunity?ADBE chart has been struggling recently but there is a chance we see some relief.

This current price zone has a nice probability of giving a bounce. Morningstar has ADBE fair value to be estimated at around $560 (90% upside from current price). Looks like a great opportunity!

Valuation:

P/E ->

Key facts today

Adobe's shares declined by 3.1% amid concerns regarding the competitive threat posed by new AI models from Anthropic and OpenAI to traditional software applications and licensing models.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

16.74 USD

7.13 B USD

23.77 B USD

408.89 M

About Adobe Inc.

Sector

Industry

CEO

Shantanu Narayen

Website

Headquarters

San Jose

Founded

1982

IPO date

Aug 20, 1986

Identifiers

3

ISIN US00724F1012

Adobe, Inc. is a global technology company, which engages in the provision of digital marketing and media solutions. It operates through the following segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Media segment offers products and services that enable individuals, teams, businesses, and enterprises to create, publish, and promote content anywhere and accelerate productivity by transforming view, share, engage with and collaborate on documents and creative content. The Digital Experience segment focuses on integrated platform and set of products, services, and solutions that enable businesses to create, manage, execute, measure, monetize, and optimize customer experiences that span from analytics to commerce. The Publishing and Advertising segment includes legacy products and services that address diverse market opportunities, including eLearning solutions, technical document publishing, web conferencing, document and forms platform, web app development, high-end printing, and Adobe Advertising offerings. The company was founded by Charles M. Geschke and John E. Warnock in December 1982 and is headquartered in San Jose, CA.

Related stocks

Adobe Daily Re-Rating: Buying the AI Subscription GiantAdobe has sold off hard into a multi‑year support zone, leaving the stock trading more than 30% below last year’s levels even as it continues to post double‑digit revenue growth and strong profitability from its subscription model.

Management is guiding for solid EPS in 2026 and expects AI‑driven p

Adobe Inc. (ADBE) – Accumulation in the Buy ZoneThis analysis presents a long-term outlook for Adobe (ADBE) from a weekly timeframe perspective. The current chart structure suggests we are approaching a major structural pivot point.

1. Technical Analysis: Key Buy Zone

On the weekly chart, the price has returned to a historically significant sup

Live trading on AdobeLive trade on Adobe

The primary analysis can be found in the linked post

Follow proper risk and money management.

This is just my personal view, so please trade based on your own strategy and trading system.

Follow me on TradingView for more analyses and live stock trades.

NASDAQ:ADBE

Gradual basing followed by recovery • Continued consolidation bGradual basing followed by recovery

• Continued consolidation between $320–360

• Volatility decreases, downside momentum weakens

• First upside objective: $375

• Secondary target: $410–430 (major resistance / 50% retracement zone)

This scenario fits a typical transition from Wave 4 into early W

Has Adobe hit bottom?Adobe has been in a long-term downtrend. With the recent price drops, it's P/E ratio has reached 18. Examining the candles from the past weeks, we can assess that it is attempting to form a bottom structure called "Broadening Wedge bottom" or "Megaphone Bottom" or "Expanding Triangle Reversal". If i

Adobe breakdown risk grows as sellers control the trend:Current Price: 296.12 (Analysis was generated on Monday Morning)

Direction: SHORT

Confidence level: 58%(The professional trader snippets lean bearish with repeated “fallen knife” language, while real-time social sentiment shows selling pressure. Signals are mixed in strength, but downside risk dom

1/20/25 - $adbe - Actually a large position here1/20/25 :: VROCKSTAR :: NASDAQ:ADBE

Actually a large position here

- nobody is going to rip out adbe for their design and marketing production teams because someone has a cool vibe coded tool or did a weekend hackathon.

- in a lot of ways, these new tools will feed the adbe monster

- no SBC issue

ADBE Long: Buying Opportunity at 52-Week Lows - Target $360-400BULLISH SETUP ON ADOBE (ADBE)

CONTEXT:

Adobe is trading at 52-week lows ($296) in a strong demand zone. The stock has experienced excessive selling due to AI fears, but fundamentals remain solid.

TECHNICAL ANALYSIS:

- Price in demand zone (support $290-300)

- QQE indicator showing BUY signals

- RS

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ADBE5981558

Adobe Inc. 5.3% 17-JAN-2035Yield to maturity

4.71%

Maturity date

Jan 17, 2035

ADBE5784629

Adobe Inc. 4.95% 04-APR-2034Yield to maturity

4.61%

Maturity date

Apr 4, 2034

US724PAD1

Adobe Inc. 2.3% 01-FEB-2030Yield to maturity

4.12%

Maturity date

Feb 1, 2030

ADBE5981252

Adobe Inc. 4.95% 17-JAN-2030Yield to maturity

4.04%

Maturity date

Jan 17, 2030

ADBE5784440

Adobe Inc. 4.8% 04-APR-2029Yield to maturity

3.91%

Maturity date

Apr 4, 2029

US724PAC3

Adobe Inc. 2.15% 01-FEB-2027Yield to maturity

3.87%

Maturity date

Feb 1, 2027

ADBE5784439

Adobe Inc. 4.85% 04-APR-2027Yield to maturity

3.80%

Maturity date

Apr 4, 2027

ADBE5981557

Adobe Inc. 4.75% 17-JAN-2028Yield to maturity

3.76%

Maturity date

Jan 17, 2028

See all ADBE bonds

Frequently Asked Questions

The current price of ADBE is 269.39 USD — it has decreased by −3.69% in the past 24 hours. Watch Adobe Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Adobe Inc. stocks are traded under the ticker ADBE.

ADBE stock has fallen by −7.64% compared to the previous week, the month change is a −18.37% fall, over the last year Adobe Inc. has showed a −38.88% decrease.

We've gathered analysts' opinions on Adobe Inc. future price: according to them, ADBE price has a max estimate of 605.00 USD and a min estimate of 270.00 USD. Watch ADBE chart and read a more detailed Adobe Inc. stock forecast: see what analysts think of Adobe Inc. and suggest that you do with its stocks.

ADBE reached its all-time high on Nov 22, 2021 with the price of 699.54 USD, and its all-time low was 0.21 USD and was reached on Aug 28, 1986. View more price dynamics on ADBE chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ADBE stock is 5.04% volatile and has beta coefficient of 1.02. Track Adobe Inc. stock price on the chart and check out the list of the most volatile stocks — is Adobe Inc. there?

Today Adobe Inc. has the market capitalization of 110.58 B, it has decreased by −3.13% over the last week.

Yes, you can track Adobe Inc. financials in yearly and quarterly reports right on TradingView.

Adobe Inc. is going to release the next earnings report on Mar 12, 2026. Keep track of upcoming events with our Earnings Calendar.

ADBE earnings for the last quarter are 5.50 USD per share, whereas the estimation was 5.40 USD resulting in a 1.88% surprise. The estimated earnings for the next quarter are 5.86 USD per share. See more details about Adobe Inc. earnings.

Adobe Inc. revenue for the last quarter amounts to 6.19 B USD, despite the estimated figure of 6.11 B USD. In the next quarter, revenue is expected to reach 6.28 B USD.

ADBE net income for the last quarter is 1.86 B USD, while the quarter before that showed 1.77 B USD of net income which accounts for 4.74% change. Track more Adobe Inc. financial stats to get the full picture.

No, ADBE doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 6, 2026, the company has 31.36 K employees. See our rating of the largest employees — is Adobe Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Adobe Inc. EBITDA is 9.52 B USD, and current EBITDA margin is 40.10%. See more stats in Adobe Inc. financial statements.

Like other stocks, ADBE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Adobe Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Adobe Inc. technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Adobe Inc. stock shows the strong sell signal. See more of Adobe Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.