Elise | BTCUSD · 30M – Liquidity Reaction StructureBITSTAMP:BTCUSD

After taking external liquidity above 71,000 earlier, BTC shifted bearish and compressed into HTF demand. The recent sweep below 66,000 triggered a strong reaction, suggesting short-term upside toward internal resistance. Upside remains corrective unless structure breaks above 69,0

Crypto market

ETHUSD 2H ANALYSIS ( MUST READ IT )Hello traders

Here's my first idea about ETHEREUM ETHUSD and what do think about it ? Kindly share your idea about ETHEREUM ETHUSD with me in comment section

Key Points 😊

Resistance zone : 2.030/2.040

First Target 1,855

Second Target 1,780

Don't forget to share this with your friends and famil

Bitcoin 10X Long with 689% profits potentialIt's been several days since Bitcoin hit bottom, six days now.

The drop that started 14-January 2026 was composed of strong bearish momentum; it was lower, followed by lower and then more lower. The longest stop was one or two days, never more than that. There was nothing weak about the drop.

Bitc

ETH/USD Decision Points for Next MoveEthereum is currently exhibiting a textbook bullish reversal structure as it stabilizes within a high-confluence demand zone between $1,800 and $1,900. After a period of bearish dominance, the price action is shifting from a sequence of lower lows to a potential Market Structure Shift (MSS), evidenc

DOGE – At Weekly Support… But Not Bullish YetDOGE is currently approaching a major weekly support zone $0.08 – $0.05 .

This area has previously acted as a strong demand zone, so it’s definitely a level to watch. However, structure still matters.

Price remains bearish, trading inside the falling red channel with clear lower highs and lower lo

Bitcoin Rejects Resistance, Eyes Support Test Around $65KHello traders! Here’s my technical outlook on BTCUSDT (1H) based on the current chart structure. Bitcoin previously traded within a well-defined descending channel, where price respected both the resistance and support boundaries, confirming controlled bearish pressure rather than impulsive selling.

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

After the recent sharp decline, Bitcoin has entered a clear consolidation range. The upper and lower boundaries of this range are marked on the chart.

As long as price remains inside this range, we should not expect a strong directional move. In

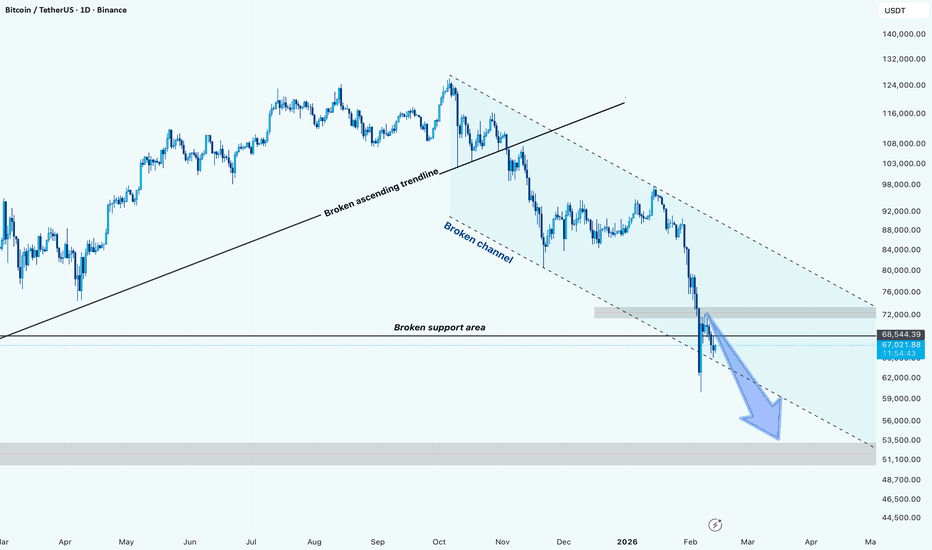

BTCUSDT: Structure Break & Bearish Channel ContinuationHi!

Bitcoin has shifted into a clear bearish market structure after breaking the long-term ascending trendline and losing the key horizontal support zone. Price is now trading inside a descending channel, confirming downside momentum.

The recent breakdown below the 68K support area turned previous

Bitcoin: Is the WXYXZ Correction Setting Up Wave C?Bitcoin: Is the WXYXZ Correction Setting Up Wave C?

During the last 5 days BTC declined by nearly 5% from 72250 to 65170

Looks like the B wave has more a corrective movement and is expanding as WXYXZ pattern. If the price manages to move above the previous X near 68300 it will add the chances t

BTCUSDT Short: Bearish Structure Holds - Focus on 65,000 DemandHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. BTCUSDT has been trading within a well-defined descending channel, reflecting sustained bearish pressure and consistent seller control. Throughout this phase, price respected the channel boundarie

See all popular ideas

Community trends

Coin ranking

SymbolPrice & chgMarket cap

SymbolMarket cap / Price

SymbolPrice & chgTVL

SymbolTVL / Price

Crypto collections

Market cap charts

Frequently Asked Questions

Cryptocurrency is a type of digital currency that relies on cryptography for security, making it hard to duplicate or manipulate. It operates on blockchain technology — a shared ledger managed by a network of computers. Unlike traditional currencies, cryptocurrencies aren't controlled by central entities like governments or banks, allowing them to function independently which helped cryptocurrencies find a huge popularity among users worldwide.

Crypto mining is the process of verifying transactions on a blockchain and adding them to a decentralized ledger. It prevents double-spending and keeps the network secure.

Miners use specialized hardware and software to solve complex cryptographic problems. When successful, they earn newly created coins as a reward.

While mining is often linked to coin creation, it also plays a vital role in maintaining the security and functionality of the entire blockchain system.

Miners use specialized hardware and software to solve complex cryptographic problems. When successful, they earn newly created coins as a reward.

While mining is often linked to coin creation, it also plays a vital role in maintaining the security and functionality of the entire blockchain system.

Markets can be highly volatile — and crypto leads the pack. Prices can swing dramatically, often triggered by seemingly minor events, making it tricky to decide which coin to buy. That's why a well-rounded analysis is key.

Here's how to make smarter crypto decisions:

- Chart the price with Supercharts: apply indicators and drawing tools, leave notes and highlight trends

- Spot opportunities with tools like the Crypto Coins Screener and Heatmap

- Explore crypto trading ideas for strategies and insights

Here's how to make smarter crypto decisions:

- Chart the price with Supercharts: apply indicators and drawing tools, leave notes and highlight trends

- Spot opportunities with tools like the Crypto Coins Screener and Heatmap

- Explore crypto trading ideas for strategies and insights

Staking in crypto is when a coin holder locks up their assets for a set period to help support the blockchain's operations, such as validating transactions. In return, they earn rewards — making staking a popular way to generate passive income from crypto holdings.

The safest choice when buying cryptocurrency is to go to a well-known crypto exchange. Some of the popular names are Binance, Coinbase, Kraken. But you'll have to find a reliable broker and create an account first. You can trade crypto right from TradingView charts — just choose a broker and connect to your account.

Before you trade, it's essential to do your research:

- Analyze the chart using technical indicators

- Stay updated with the latest market news

- Evaluate risks and test your strategy

- Be prepared for all outcomes — smart preparation leads to smarter trading

Before you trade, it's essential to do your research:

- Analyze the chart using technical indicators

- Stay updated with the latest market news

- Evaluate risks and test your strategy

- Be prepared for all outcomes — smart preparation leads to smarter trading

The largest cryptocurrencies by market capitalization are Bitcoin (1.38 T USD), Ethereum (247.96 B USD), and Tether USDt (183.73 B USD).

A coin's market capitalization is its price multiplied by the total number of coins in circulation. Watch detailed market cap charts to stay ahead of market trends.

TVL (Total Value Locked) measures the total amount of cryptocurrency held within a token's protocol. A higher TVL often signals stronger security, deeper liquidity, and greater trust from the community.

Explore the full list of coins ranked by TVL to make smarter trading decisions.

Explore the full list of coins ranked by TVL to make smarter trading decisions.

Today, coins with the biggest price growth are Humanity Protocol (31.93%), pippin (23.66%), and Compound (23.49%). Check out the full list of crypto market gainers to spot market trends.

Today, coins with the biggest price loss are River (25.25%), MYX Finance (13.48%), and LayerZero (6.56%). Check out the full list of crypto market losers to spot market trends.

In crypto, dominance refers to a coin's market cap relative to the total market cap of the broader crypto market. It shows how much influence a coin has compared to the rest.

On TradingView, crypto dominance is calculated by dividing a coin's market cap by the combined market cap of the top 125 coins, then multiplying by 100. It's a useful metric to gauge a coin's relative strength and market position.

On TradingView, crypto dominance is calculated by dividing a coin's market cap by the combined market cap of the top 125 coins, then multiplying by 100. It's a useful metric to gauge a coin's relative strength and market position.

Before jumping into live crypto markets, it's smart to test your trading skills. With Paper Trading on TradingView, you can practice strategies in real time without risking real money — just click the Paper Trading icon in the trading panel.

Want to sharpen your edge even more? Try Bar Replay to simulate past price action and fine-tune your approach.

Want to sharpen your edge even more? Try Bar Replay to simulate past price action and fine-tune your approach.

Crypto prices are shaped by many of the same factors as stocks — but with a unique twist. Market sentiment is especially powerful: news about regulations, mainstream adoption, or tech upgrades can send prices soaring or crashing. For example, tweets from figures like Elon Musk have caused spikes in Bitcoin and Dogecoin, while events like China's crypto crackdown triggered sharp sell-offs.

Other key drivers include:

- Demand for a specific coin

- Technological upgrades (e.g., network forks or improvements)

- Market liquidity

- Broader economic trends like inflation or shifting interest rates

To stay ahead, use these tools to track crypto markets and spot changes early:

- Crypto Coin Screener and Heatmap

- DEX and CEX Screeners

- Latest crypto market news

Other key drivers include:

- Demand for a specific coin

- Technological upgrades (e.g., network forks or improvements)

- Market liquidity

- Broader economic trends like inflation or shifting interest rates

To stay ahead, use these tools to track crypto markets and spot changes early:

- Crypto Coin Screener and Heatmap

- DEX and CEX Screeners

- Latest crypto market news