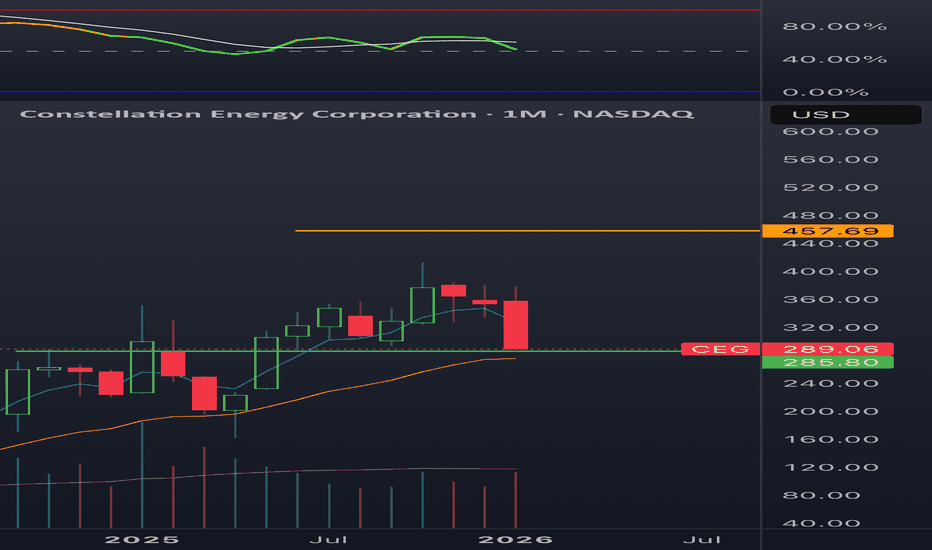

CEG BEFORE EARNINGSCEG is in a corrective leg after a clear rejection from the 330–345 supply zone, with prior distribution also visible around 360–370 (failed holds and heavy selling response on retests). The breakdown through the rising structure shifts control to sellers unless price can reclaim 330+.

Demand/absor

Constellation Energy Corporation

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

8.73 USD

3.75 B USD

23.59 B USD

289.34 M

About Constellation Energy Corporation

Sector

Industry

CEO

Joseph Dominguez

Website

Headquarters

Baltimore

Founded

1960

IPO date

Jan 19, 2022

Identifiers

3

ISIN US21037T1097

Constellation Energy Corp. engages in the generation, supply, and marketing of clean electricity, and renewable energy products and solutions. The firm also offers wholesale energy, retail products and services. It operates under the following geographical segments: Mid-Atlantic, Midwest, New York, Electric Reliability Council of Texas (ERCOT), and Other Power Regions Segment. The company was founded in 1960 and is headquartered in Baltimore, MD.

Related stocks

CEG pivot long CEG has had a strong correction as natural gas prices remain low and the market overreacts to earnings per usual. Now that they own calpine they are the largest private energy producer in America. I’ve had an alarm set for 285$ for months and am heavily eyeing this one. Cash secured puts are 1700$ o

CEG- blue box SHORTi was bullish on this name past few years, until something fundamental changed

trump administration cap on electricity costs.. this is a big one that prompted a price discovery downwards.

weekly squeeze down

daily squeeze down fired with an impulse sell candle

price gapped < 20/50 structure

also

NVDA Earnings, FOMC Minutes, US Non-Farm OH MY!!!All eyes on NVDA and earnings - they matter (a lot)

More important than a beat or miss is the price action around NVDA earnings

-bulls have a long ways to go to reclaim all-time highs

-bears have pressured NVDA enough that it seems like major support could break

FOMC Minutes today

-CME Fed Watch

NASDAQ: CEG — Strong Rebound from Support, Uptrend Still Intact?On the daily chart, CEG found solid support and began to rebound.

The September price action shows a clear higher high, higher low structure — confirming a healthy uptrend. The upward trendline (green) continues to act as reliable dynamic support.

In October, the stock broke above the previou

Constellation Energy CEG Clean Energy Utility Leader BUYConstellation Energy is the largest producer of carbon-free energy in the U.S., leading in nuclear, wind, solar, and hydro power generation. With utilities shifting to renewable solutions, CEG offers investors a stable yet growth-oriented play on the clean energy transition.

Constellation Energy Chart Fibonacci Analysis 092425Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 332/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of CEG is 287.45 USD — it has decreased by −0.19% in the past 24 hours. Watch Constellation Energy Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Constellation Energy Corporation stocks are traded under the ticker CEG.

CEG stock has fallen by −4.35% compared to the previous week, the month change is a −19.72% fall, over the last year Constellation Energy Corporation has showed a 3.02% increase.

We've gathered analysts' opinions on Constellation Energy Corporation future price: according to them, CEG price has a max estimate of 481.00 USD and a min estimate of 342.23 USD. Watch CEG chart and read a more detailed Constellation Energy Corporation stock forecast: see what analysts think of Constellation Energy Corporation and suggest that you do with its stocks.

CEG stock is 3.38% volatile and has beta coefficient of 1.89. Track Constellation Energy Corporation stock price on the chart and check out the list of the most volatile stocks — is Constellation Energy Corporation there?

Today Constellation Energy Corporation has the market capitalization of 89.92 B, it has decreased by −1.91% over the last week.

Yes, you can track Constellation Energy Corporation financials in yearly and quarterly reports right on TradingView.

Constellation Energy Corporation is going to release the next earnings report on Feb 19, 2026. Keep track of upcoming events with our Earnings Calendar.

CEG earnings for the last quarter are 3.04 USD per share, whereas the estimation was 3.11 USD resulting in a −2.32% surprise. The estimated earnings for the next quarter are 2.27 USD per share. See more details about Constellation Energy Corporation earnings.

Constellation Energy Corporation revenue for the last quarter amounts to 6.57 B USD, despite the estimated figure of 6.20 B USD. In the next quarter, revenue is expected to reach 5.17 B USD.

CEG net income for the last quarter is 930.00 M USD, while the quarter before that showed 839.00 M USD of net income which accounts for 10.85% change. Track more Constellation Energy Corporation financial stats to get the full picture.

Yes, CEG dividends are paid quarterly. The last dividend per share was 0.39 USD. As of today, Dividend Yield (TTM)% is 0.54%. Tracking Constellation Energy Corporation dividends might help you take more informed decisions.

Constellation Energy Corporation dividend yield was 0.63% in 2024, and payout ratio reached 11.85%. The year before the numbers were 0.97% and 22.52% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jan 30, 2026, the company has 14.26 K employees. See our rating of the largest employees — is Constellation Energy Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Constellation Energy Corporation EBITDA is 7.16 B USD, and current EBITDA margin is 28.25%. See more stats in Constellation Energy Corporation financial statements.

Like other stocks, CEG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Constellation Energy Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Constellation Energy Corporation technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Constellation Energy Corporation stock shows the neutral signal. See more of Constellation Energy Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.