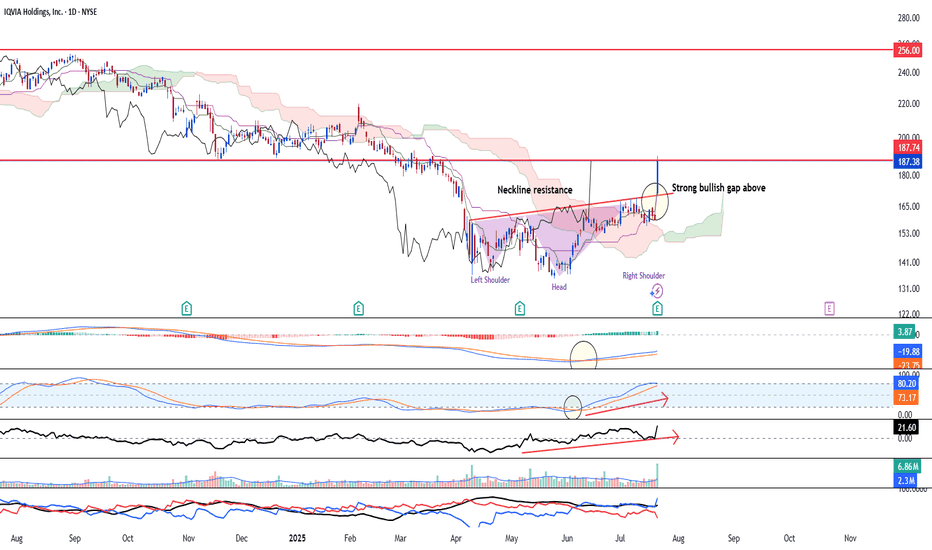

IQVIA (IQV) Pullback Finds Support Within a Strong UptrendIQVIA Holdings, Inc. is experiencing a healthy pullback and is attracting demand at a key support zone. The stock remains in a well-defined bullish uptrend, characterized by consistent higher highs and higher lows, while trading above aligned key moving averages—reinforcing bullish conviction.

IQVI

Key facts today

IQVIA Holdings' CEO Ari Bousbib highlighted growth from investments in clinical services and data solutions, noting improved demand despite earlier challenges in the biotech sector.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.93 USD

1.36 B USD

16.31 B USD

168.74 M

About IQVIA Holdings, Inc.

Sector

Industry

CEO

Ari Bousbib

Website

Headquarters

Durham

Founded

1950

IPO date

May 9, 2013

Identifiers

3

ISIN US46266C1053

IQVIA Holdings, Inc. engages in the provision of analytics, technology solutions, and clinical research services to the life sciences industry. It operates through the following segments: Technology and Analytics Solutions, Research and Development Solutions, and Contract Sales and Medical Solutions. The Technology and Analytics Solutions segment supplies mission critical information, technology solutions, and real-world solutions and services to the firm's life science clients. The Research and Development Solutions segment provides outsourced clinical research and clinical trial related services. The Contract Sales and Medical Solutions segment offers health care provider and patient engagement services to both biopharmaceutical customers and the healthcare market. The company was founded by Dennis B. Gillings and Gary Koch in 1982 and is headquartered in Durham, NC.

Related stocks

IQV - BUY ON DIPS IQV - CURRENT PRICE : 184.08

From May to July, IQVIA (IQV) staged a strong upward rally, supported by rising volume. Following this advance, the stock underwent a healthy retracement, consolidating recent gains without breaking its long-term uptrend. Take note that the up trendline is still inta

Trend Break Sparks Momentum.

IQVIA has recently broken its long-term downtrend, showing renewed momentum.

The company's solid growth prospects and attractive valuation multiples support further upside.

With this momentum shift, I expect a move toward the $225 level.

However, before entering a position, I want to see green H

Bottoming out confirmed after inverted HnS confirmedNYSE:IQV bottoming out bullish reversal is confirmed after all indicators see strong bullish momentum.

Ichimoku shows a three bullish golden cross and the strong bullish gap up above the neckline resistance of the inverted head and shoulder speaks of strong reversal.

MACD has come back as MACD/

IQV - BullishIQV is now trying to find its momentum and move up to the 249 area. You have to be mindful of the resistance above and if you are trading options, make sure to give yourself some time. Its a game of probabilities and the probabilities for this ticker are lining up for a bullish outlook.

Good luck.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

IQV5590191

IQVIA Inc. 6.5% 15-MAY-2030Yield to maturity

6.26%

Maturity date

May 15, 2030

IQV5590192

IQVIA Inc. 6.5% 15-MAY-2030Yield to maturity

5.57%

Maturity date

May 15, 2030

IQV6091480

IQVIA Inc. 6.25% 01-JUN-2032Yield to maturity

5.55%

Maturity date

Jun 1, 2032

QTRN4404230

IQVIA Inc. 5.0% 15-OCT-2026Yield to maturity

5.17%

Maturity date

Oct 15, 2026

IQV5590165

IQVIA Inc. 5.7% 15-MAY-2028Yield to maturity

5.12%

Maturity date

May 15, 2028

IQV4831576

IQVIA Inc. 5.0% 15-MAY-2027Yield to maturity

5.02%

Maturity date

May 15, 2027

XS230574243

IQVIA Inc. 1.75% 15-MAR-2026Yield to maturity

5.01%

Maturity date

Mar 15, 2026

IQV5763047

IQVIA Inc. 6.25% 01-FEB-2029Yield to maturity

4.44%

Maturity date

Feb 1, 2029

IQV5590167

IQVIA Inc. 5.7% 15-MAY-2028Yield to maturity

4.33%

Maturity date

May 15, 2028

5W8A

IQVIA Inc. 2.25% 15-MAR-2029Yield to maturity

3.40%

Maturity date

Mar 15, 2029

XS218994750

IQVIA Inc. 2.875% 15-JUN-2028Yield to maturity

3.32%

Maturity date

Jun 15, 2028

See all IQV bonds

Frequently Asked Questions

The current price of IQV is 177.18 USD — it has decreased by −1.24% in the past 24 hours. Watch IQVIA Holdings, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange IQVIA Holdings, Inc. stocks are traded under the ticker IQV.

IQV stock has fallen by −10.46% compared to the previous week, the month change is a −25.97% fall, over the last year IQVIA Holdings, Inc. has showed a −12.84% decrease.

We've gathered analysts' opinions on IQVIA Holdings, Inc. future price: according to them, IQV price has a max estimate of 287.00 USD and a min estimate of 200.00 USD. Watch IQV chart and read a more detailed IQVIA Holdings, Inc. stock forecast: see what analysts think of IQVIA Holdings, Inc. and suggest that you do with its stocks.

IQV stock is 5.82% volatile and has beta coefficient of 0.94. Track IQVIA Holdings, Inc. stock price on the chart and check out the list of the most volatile stocks — is IQVIA Holdings, Inc. there?

Today IQVIA Holdings, Inc. has the market capitalization of 30.17 B, it has decreased by −5.45% over the last week.

Yes, you can track IQVIA Holdings, Inc. financials in yearly and quarterly reports right on TradingView.

IQVIA Holdings, Inc. is going to release the next earnings report on Apr 23, 2026. Keep track of upcoming events with our Earnings Calendar.

IQV earnings for the last quarter are 3.42 USD per share, whereas the estimation was 3.40 USD resulting in a 0.64% surprise. The estimated earnings for the next quarter are 2.83 USD per share. See more details about IQVIA Holdings, Inc. earnings.

IQVIA Holdings, Inc. revenue for the last quarter amounts to 4.36 B USD, despite the estimated figure of 4.24 B USD. In the next quarter, revenue is expected to reach 4.09 B USD.

IQV net income for the last quarter is 514.00 M USD, while the quarter before that showed 331.00 M USD of net income which accounts for 55.29% change. Track more IQVIA Holdings, Inc. financial stats to get the full picture.

No, IQV doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. IQVIA Holdings, Inc. EBITDA is 3.43 B USD, and current EBITDA margin is 21.04%. See more stats in IQVIA Holdings, Inc. financial statements.

Like other stocks, IQV shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade IQVIA Holdings, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So IQVIA Holdings, Inc. technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating IQVIA Holdings, Inc. stock shows the sell signal. See more of IQVIA Holdings, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.