SBUX Option Sellers at 93.30, cost basis at 92.70, if cb is broken first target 90.73 but if it goes up punches to 96.27 CB. Assuming momentum continues first price target at 100.03 then 104.73

light green = call price targets

purple = equal support if cb and buyers floor is broken. Buyers floor at 92.15

Key facts today

A federal judge dismissed Missouri's lawsuit against Starbucks, ruling no evidence of discrimination related to the company's diversity policies affecting local job seekers.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.20 USD

1.86 B USD

37.16 B USD

1.14 B

About Starbucks Corporation

Sector

Industry

CEO

Brian R. Niccol

Website

Headquarters

Seattle

Founded

1985

IPO date

Jun 26, 1992

Identifiers

3

ISIN US8552441094

Starbucks Corp engages in the production, marketing, and retailing of specialty coffee. It operates through the following segments: North America; International; and Channel Development. The North America and International segments sells coffee and other beverages, complementary food, packaged coffees, single-serve coffee products, and a focused selection of merchandise through company-oriented stores, and licensed stores. The Channel Development segment include sales of packaged coffee, tea, and ready-to-drink beverages to customers outside of its company-operated and licensed stores. The firm's brands include Seattle’s Best Coffee, Evolution Fresh, Ethos, Starbucks Reserve and Princi. The company was founded by Jerry Baldwin and Howard D. Schultz on November 4, 1985 and is headquartered in Seattle, WA.

Related stocks

Starbucks Wave Analysis – 22 January 2026- Starbucks reversed from resistance zone

- Likely to fall to support level 92.50

Starbucks recently reversed down from the resistance zone between the strong resistance level 96.60 (former strong resistance from July and also support from March of 2025).

The resistance level 96.60 was strengthene

The 13 EMA System + Swing TradingThere is alot to say about the

share price of Starbucks NASDAQ:SBUX

because its down -6% this year alone.

Even though this is the case the sales

of Starbucks have gone up.

Sadly some under-performing businesses

in New York and California have

been shut down about 400 stores

This is according

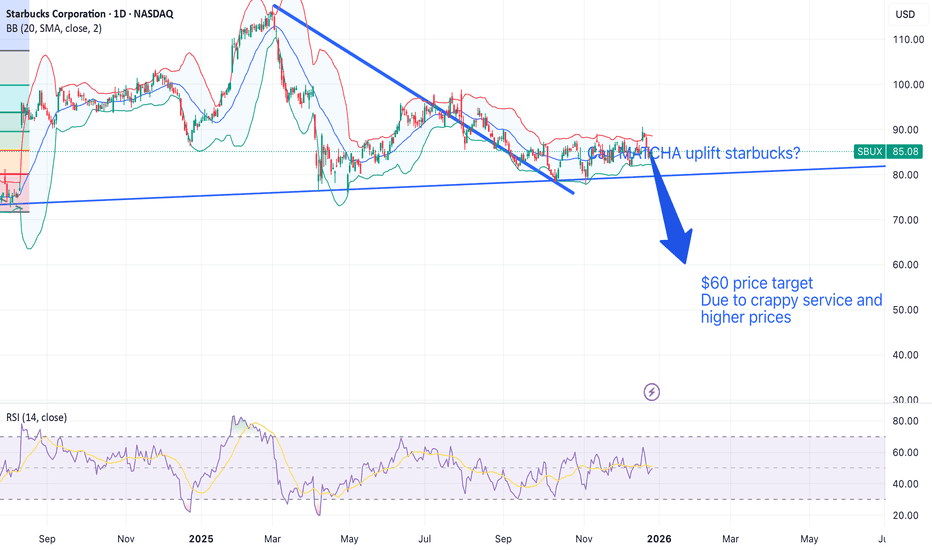

SBUX 1D Chart DeclineStarbucks (SBUX) stock, as shown in the 1-day chart, has declined sharply due to a combination of operational challenges, weak earnings, and broader market pressures, making it a poor choice for swing trading. Q4 2025 results revealed a $230 million revenue miss and operating margins contracting to

Longterm Elloit wave SBUX 12/18/2025In my view, Starbucks has completed its first major wave, which began in 1992. We can observe that wave (b) retraced more than 80% of wave (a), indicating a high probability that wave (c) could form an expanded flat correction.

Moreover, SBUX has tested its long-term trendline multiple times withou

Starbucks at Support - Time to Brew a Bullish Move?📈SBUX has been moving inside a clean rising channel for years, respecting both the upper and lower bounds with precision.

⚔️Right now, Starbucks is retesting the lower bound of this long-term channel, a zone that has historically acted as a strong support (blue arrows).

As long as this area ho

SBUX - Starbucks 100 Soon?Hello Everyone, Followers,

This week i will share not too much as in my scans i couldn't find many potential stocks.

First one is Starbucks. I have a some positions on Starbucks and it is performing well during the last quarter and my expectations on it actually high.

So 29th of October they will

Starbucks (SBUX) — Fibonacci Targets Ahead $340 → $1600☕ Starbucks (SBUX) — Riding the Wave 3 Expansion to New Highs 🚀

Starbucks (SBUX) — Wave 3 Expansion in Progress ☕ | Fibonacci Targets $340+ Before Wave 4 Correction 🚀

“Smart Money Brewing — Wave 3 Still in Play!” ☕📈

⚙️ Elliott Wave | 🧠 Smart Money Concept | 📊 Fundamentals | ⏳ Long-Term Cyc

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US855244BE8

Starbucks Corporation 4.75% 15-FEB-2026Yield to maturity

8.12%

Maturity date

Feb 15, 2026

US855244BA6

Starbucks Corporation 3.5% 15-NOV-2050Yield to maturity

5.75%

Maturity date

Nov 15, 2050

US855244AU3

Starbucks Corporation 4.45% 15-AUG-2049Yield to maturity

5.74%

Maturity date

Aug 15, 2049

US855244AM1

Starbucks Corporation 3.75% 01-DEC-2047Yield to maturity

5.72%

Maturity date

Dec 1, 2047

SBUX4964889

Starbucks Corporation 3.35% 12-MAR-2050Yield to maturity

5.72%

Maturity date

Mar 12, 2050

SRBC

Starbucks Corporation 4.3% 15-JUN-2045Yield to maturity

5.72%

Maturity date

Jun 15, 2045

SBUX4665314

Starbucks Corporation 4.5% 15-NOV-2048Yield to maturity

5.70%

Maturity date

Nov 15, 2048

SBUX6071258

Starbucks Corporation 5.4% 15-MAY-2035Yield to maturity

4.82%

Maturity date

May 15, 2035

SBUX5748270

Starbucks Corporation 5.0% 15-FEB-2034Yield to maturity

4.55%

Maturity date

Feb 15, 2034

SBUX5538332

Starbucks Corporation 4.8% 15-FEB-2033Yield to maturity

4.55%

Maturity date

Feb 15, 2033

SBUX5359418

Starbucks Corporation 3.0% 14-FEB-2032Yield to maturity

4.43%

Maturity date

Feb 14, 2032

See all SBUX bonds

Frequently Asked Questions

The current price of SBUX is 99.45 USD — it has increased by 3.52% in the past 24 hours. Watch Starbucks Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Starbucks Corporation stocks are traded under the ticker SBUX.

SBUX stock has risen by 7.26% compared to the previous week, the month change is a 11.72% rise, over the last year Starbucks Corporation has showed a −11.24% decrease.

We've gathered analysts' opinions on Starbucks Corporation future price: according to them, SBUX price has a max estimate of 120.00 USD and a min estimate of 74.00 USD. Watch SBUX chart and read a more detailed Starbucks Corporation stock forecast: see what analysts think of Starbucks Corporation and suggest that you do with its stocks.

SBUX reached its all-time high on Jul 23, 2021 with the price of 126.32 USD, and its all-time low was 0.32 USD and was reached on Jun 26, 1992. View more price dynamics on SBUX chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SBUX stock is 3.73% volatile and has beta coefficient of 1.23. Track Starbucks Corporation stock price on the chart and check out the list of the most volatile stocks — is Starbucks Corporation there?

Today Starbucks Corporation has the market capitalization of 109.45 B, it has decreased by −3.83% over the last week.

Yes, you can track Starbucks Corporation financials in yearly and quarterly reports right on TradingView.

Starbucks Corporation is going to release the next earnings report on May 5, 2026. Keep track of upcoming events with our Earnings Calendar.

SBUX earnings for the last quarter are 0.56 USD per share, whereas the estimation was 0.59 USD resulting in a −4.38% surprise. The estimated earnings for the next quarter are 0.41 USD per share. See more details about Starbucks Corporation earnings.

Starbucks Corporation revenue for the last quarter amounts to 9.92 B USD, despite the estimated figure of 9.65 B USD. In the next quarter, revenue is expected to reach 9.08 B USD.

SBUX net income for the last quarter is 293.30 M USD, while the quarter before that showed 133.10 M USD of net income which accounts for 120.36% change. Track more Starbucks Corporation financial stats to get the full picture.

Yes, SBUX dividends are paid quarterly. The last dividend per share was 0.62 USD. As of today, Dividend Yield (TTM)% is 2.55%. Tracking Starbucks Corporation dividends might help you take more informed decisions.

Starbucks Corporation dividend yield was 2.93% in 2025, and payout ratio reached 149.81%. The year before the numbers were 2.34% and 68.95% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 7, 2026, the company has 381 K employees. See our rating of the largest employees — is Starbucks Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Starbucks Corporation EBITDA is 5.11 B USD, and current EBITDA margin is 14.08%. See more stats in Starbucks Corporation financial statements.

Like other stocks, SBUX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Starbucks Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Starbucks Corporation technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Starbucks Corporation stock shows the strong buy signal. See more of Starbucks Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.