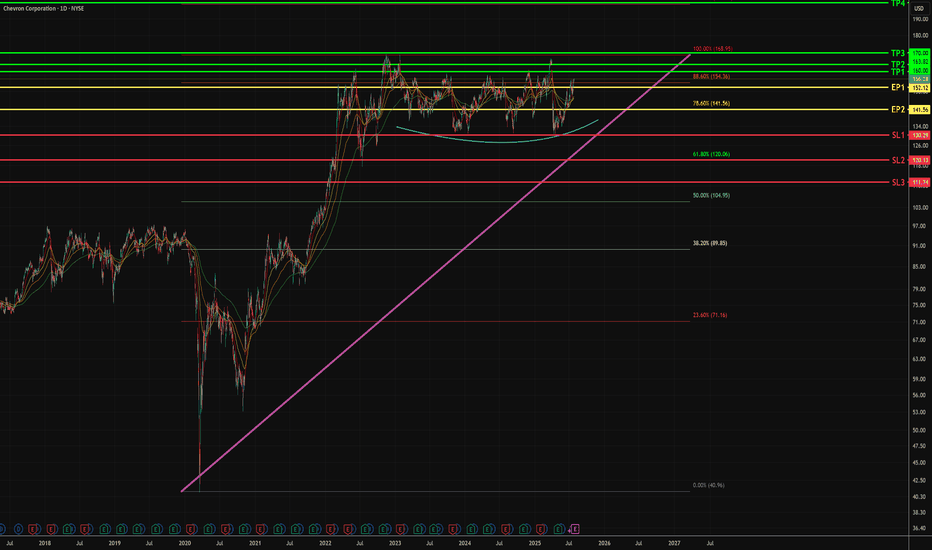

CVX - Potential Swing Upside - Mid TermTimeline - now to 3 months

1. Bullish flag pattern sustained, form during Oct 2021.

2. Rounding bottom above 1D resistance at $130

- Last close is above Fib 88.6% - $154.36

- In the 2 days, weak selling pressure is noticed.

3. More attempts to break 88.6% Fib level opposed to $130 support line

Key facts today

On November 21, 2025, Chevron Corp (CVX) Vice President Jeff B. Gustavson filed a Form 144 to sell 9,325 shares of restricted stock.

Dambisa F. Moyo, a Director at Chevron (CVX), reported gifting 662 shares on November 21, 2025, raising her total holdings to 14,172 shares.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.06 EUR

17.06 B EUR

186.89 B EUR

2.00 B

About Chevron Corporation

Sector

Industry

CEO

Michael K. Wirth

Website

Headquarters

Houston

Founded

1879

ISIN

US1667641005

FIGI

BBG000F5P129

Chevron Corp. engages in the provision of administrative, financial management, and technology support for energy and chemical operations. It operates through the Upstream and Downstream segments. The Upstream segment consists of the exploration, development, and production of crude oil and natural gas, the liquefaction, transportation, and regasification associated with liquefied natural gas, the transporting of crude oil by major international oil export pipelines, the processing, transporting, storage, and marketing of natural gas, and a gas-to-liquids plant. The Downstream segment consists of the refining of crude oil into petroleum products, the marketing of crude oil and refined products, the transporting of crude oil and refined products by pipeline, marine vessel, motor equipment, and rail car, and the manufacturing and marketing of commodity petrochemicals and plastics for industrial uses and fuel & lubricant additives. The company was founded on September 10, 1879 and is headquartered in Houston, TX.

Related stocks

Update for CVX: Looking for an up move/wave.

As discussed before in our previous post, NYSE:CVX looks like it will go up, it did go up so if you are in manage your trades. We can see pushing higher and lets see how far will it go.

For reference, this is our previews chart:

Always remember WTW 4 Golder Rules:

1) Do not jump in

2) Do not

Remember that 4hour chart because it's your Entry Have you ever thought one day it will happen?

You look straight into your blind spot.And you say one day I will see.

You look straight into your life,

Knowing tomorrow won't change and say "it will change"

This is where you find comedy.

Its not trying to be funny it's funny when you see yourself

$CVX: The calm before the storm. We're watching a beautiful consolidation on the daily chart. Price is coiled between $152.00 and $154.50.

This is not a time for guesswork. This is an IMMINENT BREAKOUT. This is how I’m viewing the setup for today.

• BULLISH Trigger: A 2-Up candle break above the recent high of $154.50. Target the

return to proven buyers provides cheap entry 1->4 :

* number 3 closes above number 1, this

establishes number 2 as a set of proven market

participants, at number 4 we return to these

proven players, price moves up then returns giving a

chance for an entry near the buyers proven ground

next?

* anchored vwap at number 1 shows price returni

Chevron Stock Chart Fibonacci Analysis 082125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 153/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where CHV is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of CHV is 130.50 EUR — it has decreased by −0.58% in the past 24 hours. Watch Chevron Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on XETR exchange Chevron Corporation stocks are traded under the ticker CHV.

CHV stock has fallen by −2.97% compared to the previous week, the month change is a −1.88% fall, over the last year Chevron Corporation has showed a −14.91% decrease.

We've gathered analysts' opinions on Chevron Corporation future price: according to them, CHV price has a max estimate of 175.38 EUR and a min estimate of 106.61 EUR. Watch CHV chart and read a more detailed Chevron Corporation stock forecast: see what analysts think of Chevron Corporation and suggest that you do with its stocks.

CHV stock is 1.36% volatile and has beta coefficient of 0.60. Track Chevron Corporation stock price on the chart and check out the list of the most volatile stocks — is Chevron Corporation there?

Today Chevron Corporation has the market capitalization of 261.99 B, it has decreased by −0.21% over the last week.

Yes, you can track Chevron Corporation financials in yearly and quarterly reports right on TradingView.

Chevron Corporation is going to release the next earnings report on Jan 30, 2026. Keep track of upcoming events with our Earnings Calendar.

CHV earnings for the last quarter are 1.58 EUR per share, whereas the estimation was 1.44 EUR resulting in a 9.54% surprise. The estimated earnings for the next quarter are 1.35 EUR per share. See more details about Chevron Corporation earnings.

Chevron Corporation revenue for the last quarter amounts to 42.38 B EUR, despite the estimated figure of 41.71 B EUR. In the next quarter, revenue is expected to reach 41.28 B EUR.

CHV net income for the last quarter is 3.02 B EUR, while the quarter before that showed 2.11 B EUR of net income which accounts for 42.68% change. Track more Chevron Corporation financial stats to get the full picture.

Yes, CHV dividends are paid quarterly. The last dividend per share was 1.48 EUR. As of today, Dividend Yield (TTM)% is 4.51%. Tracking Chevron Corporation dividends might help you take more informed decisions.

Chevron Corporation dividend yield was 4.50% in 2024, and payout ratio reached 67.08%. The year before the numbers were 4.05% and 53.14% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 22, 2025, the company has 45.3 K employees. See our rating of the largest employees — is Chevron Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Chevron Corporation EBITDA is 29.53 B EUR, and current EBITDA margin is 18.85%. See more stats in Chevron Corporation financial statements.

Like other stocks, CHV shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Chevron Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Chevron Corporation technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Chevron Corporation stock shows the sell signal. See more of Chevron Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.