On 1H ETH/USD there is a possibility for Alternate Bat harmonic pattern. The price might reach the $1750-1780 levels.

After forming the Gartley pattern on the 8th of March, gold seems to be going up again. The Gartley formation can be supported by the 38,2% Fibonacci retracement level: If the current move gets negated, we also have a possible Butterfly pattern forming at $1560: Scripts used in this analysis: Harmonic Scanner Pro Harmonic Predictor

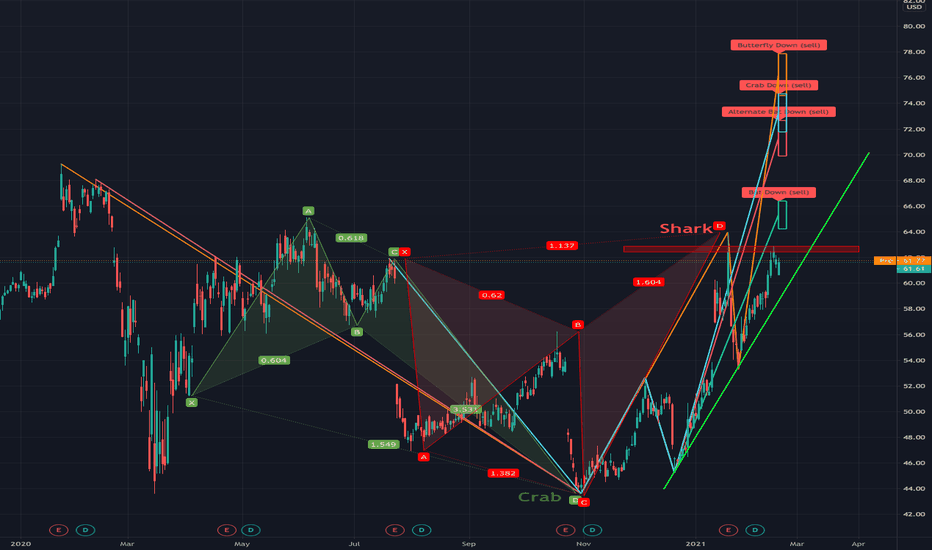

Intel has formed a bullish Crab at the end of October, followed by a bearish Shark in January. After returning to the upward trend, it has recently bounced off from the resistance level at around $62.50 (red rectangle). However, if it breaks that resistance line, we have multiple possible harmonic formations that can form above: Bat at $64-$66 Alternate Bat...

Bitcoin is in a place where two harmonic formations could be forming. Bat formation with point D around $13000 and an Alternate Bat with point D at $4500. But that would mean a huge crash. Would I bet my money on this scenario? Not really, but I would be careful with buying at least until we negate those formations (that would happen after the price reaches the $41000).

Bearish Gartley pattern has formed on the Toronto Dominion Bank price. We have 3 different take profit levels (depending on your risk/reward appetite). Stop loss can be placed at $58. This pattern was detected with my "Harmonic Scanner."

Bearish Gartley pattern has formed on Apple price. One take profit level is at point B ($125), but there is not much profit to gain since the price is almost there. Another take profit level is at the $107 price level. A good place for stop loss is around $131. The price has bounced from point D, which is a good sign. This pattern was detected with my "Harmonic Scanner."

Price of Starbucks has reached an interesting point and there is a chance for a bearish butterfly pattern. If the price starts falling, it might go down all the way to $50 (with some other take profit points on the way). However, if the price goes over $110 in the next few days, butterfly formation is negated and you should not short sell it. The Butterfly...

Bearish Gartley pattern, price is still bouncing from the last high point. With a tight stop-loss, it might be a good short occasion (I use a 5% error margin from the "ideal formation"). If the price crosses the stop-loss line, the formation is negated.