After a long correction in wave 2 flat, Bitcoin has moved into wave 3

Solana ends the move in wave 3 and goes into correction in wave 4

After a major corrective zigzag ABC - Ripple is back to the downtrend again

After a strong impulse of 30% / $7000. Bitcoin gradually declines in a zigzag-like correction Targets $28k - FWB:27K

5 Wave ~4800-5000 Possibly Ending SPX Hypercycle A long search for the DIP awaits us $-)

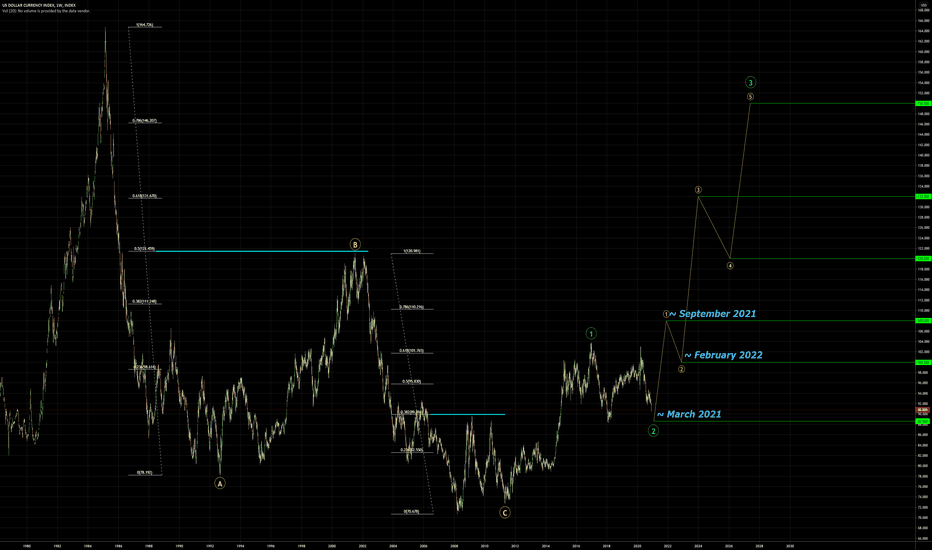

Reversal Soon and Ressurection Dollar Who is Daddy here ?... )))

Next Move Wave C and Long Grow

V Wave 135-years Supercycle ~6500-7000 and Crush

Correction ~38% Fibo Support Level ~90 Rebound from dynamic resistance

Wave B or maybe 2 Complete Reversal and Soon Dump Target ~$20k

The euro continues to fall, the EU economy is increasingly depressed A little more and we can see 1.5 Euros for a dollar It will be great for USA

After the covid monetary policy, and helicopter money handouts, the cycle of tightening and rate hikes to fight inflation began. At this point, there is already talk that it is time to lower the rate, although let's be honest - inflation has not gone anywhere, and continues to grow. In this case, we will get a secondary inflation already structural, which again...

Boeing is slowly recovering after an 80% plum. The correction is taking place in the form of double zigzag WXY. Correction target = $300-$320 range

After dropping 80% where all the bubbles deflate! Alibaba on the not so good news from China is moving in a correction upwards in the form of an ABZ zigzag. First available target is 140. Whether there will be a continuation of the move - we will consider after reaching the target