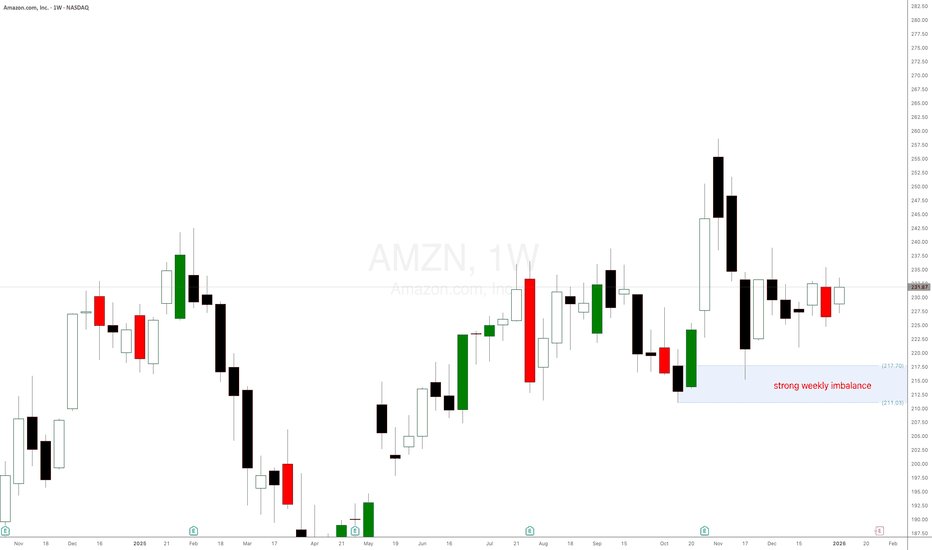

Amazon - A quite boring new all time high!🎈Amazon ( NASDAQ:AMZN ) is simply heading for new highs:

🔎Analysis summary:

For the past couple of months, Amazon has overall just been consolidating. But in the meantime, we witnessed a major bullish break and retest and an expected rally of +50%. Following this quite slow behavior, Amazon w

Key facts today

Amazon launched the Creators Foundry to support UAE content creators, offering dedicated storefronts and global selling opportunities to connect with millions of customers on Amazon.ae.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.20 USD

59.25 B USD

637.96 B USD

9.69 B

About Amazon.com, Inc.

Sector

Industry

CEO

Andrew R. Jassy

Website

Headquarters

Seattle

Founded

1994

IPO date

May 15, 1997

IPO offer price

18.00 USD

Identifiers

3

ISIN US0231351067

Amazon.com, Inc. engages in the provision of online retail shopping services. It operates through the following business segments: North America, International, and Amazon Web Services (AWS). The North America segment includes retail sales of consumer products and subscriptions through North America-focused websites such as amazon.com and amazon.ca. The International segment offers retail sales of consumer products and subscriptions through internationally-focused websites. The Amazon Web Services segment involves in the global sales of compute, storage, database, and AWS service offerings for start-ups, enterprises, government agencies, and academic institutions. The company was founded by Jeffrey P. Bezos in July 1994 and is headquartered in Seattle, WA.

Related stocks

AMZN TA – Dec 9: Uptrend Intact, But Stall Into Dealer ResistanAMZN pushed higher in a controlled manner after reclaiming trend support, but price is now stalling right below a major dealer resistance zone. This is not weakness — it’s absorption.

The tape tells us buyers are present, but dealers are capping upside for now.

Structure & Price Action (15-min)

* C

AMAZON - EMA 200: Where Institutions Step InAMZN - CURRENT PRICE : 237.70

📈 AMZN — Institutional Support Holds, Momentum Breakout

AMZN continues to trade in a primary uptrend, with EMA 200 acting as a strong institutional accumulation zone. Multiple pullbacks toward the EMA 200 (highlighted in green) were met with immediate buying interest

AMZN in Post-Breakdown Stabilization. Key Decision On Dec. 5AMZN heads into Dec 5 after a sharp sell-side impulse, followed by price stabilization near demand. On the 15-minute chart, the most important event already happened: a clean BOS to the downside after failing to hold above 232–235, which confirms a short-term bearish structure shift.

Since the break

AMZN: Rebuilding Structure After Sharp RotationOn the 4H chart, AMZN shows a sharp impulsive move followed by a volatile pullback and stabilisation. Price is now rebuilding structure after the rotation, suggesting the market is recalibrating before the next directional phase develops.

Disclosure: We are part of Trade Nation's Influencer program

Amazon: Persistent Upward PressureAmazon initially continued its upward trajectory, extending the rise until January 2. There was a brief pullback of about 4% afterward, but it was quickly recovered. Consequently, price again reached the levels observed before the holiday season. In line with our primary scenario, we expect price to

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMZN6237342

Amazon.com, Inc. 5.55% 20-NOV-2065Yield to maturity

5.69%

Maturity date

Nov 20, 2065

AMZN5396185

Amazon.com, Inc. 4.1% 13-APR-2062Yield to maturity

5.59%

Maturity date

Apr 13, 2062

AMZN5182960

Amazon.com, Inc. 3.25% 12-MAY-2061Yield to maturity

5.58%

Maturity date

May 12, 2061

AMZN6237344

Amazon.com, Inc. 5.45% 20-NOV-2055Yield to maturity

5.57%

Maturity date

Nov 20, 2055

AMZN4531868

Amazon.com, Inc. 4.25% 22-AUG-2057Yield to maturity

5.54%

Maturity date

Aug 22, 2057

AMZN5396184

Amazon.com, Inc. 3.95% 13-APR-2052Yield to maturity

5.50%

Maturity date

Apr 13, 2052

AMZN5182959

Amazon.com, Inc. 3.1% 12-MAY-2051Yield to maturity

5.48%

Maturity date

May 12, 2051

AMZN4996700

Amazon.com, Inc. 2.5% 03-JUN-2050Yield to maturity

5.47%

Maturity date

Jun 3, 2050

AMZN4531866

Amazon.com, Inc. 4.05% 22-AUG-2047Yield to maturity

5.43%

Maturity date

Aug 22, 2047

AMZN4996701

Amazon.com, Inc. 2.7% 03-JUN-2060Yield to maturity

5.38%

Maturity date

Jun 3, 2060

US23135AQ9

Amazon.com, Inc. 4.95% 05-DEC-2044Yield to maturity

5.28%

Maturity date

Dec 5, 2044

See all AMZN bonds

Curated watchlists where AMZN is featured.

Frequently Asked Questions

The current price of AMZN is 247.38 USD — it has increased by 0.44% in the past 24 hours. Watch Amazon.com, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Amazon.com, Inc. stocks are traded under the ticker AMZN.

AMZN stock has risen by 6.93% compared to the previous week, the month change is a 8.12% rise, over the last year Amazon.com, Inc. has showed a 10.84% increase.

We've gathered analysts' opinions on Amazon.com, Inc. future price: according to them, AMZN price has a max estimate of 360.00 USD and a min estimate of 250.00 USD. Watch AMZN chart and read a more detailed Amazon.com, Inc. stock forecast: see what analysts think of Amazon.com, Inc. and suggest that you do with its stocks.

AMZN reached its all-time high on Nov 3, 2025 with the price of 258.60 USD, and its all-time low was 0.07 USD and was reached on May 22, 1997. View more price dynamics on AMZN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AMZN stock is 2.32% volatile and has beta coefficient of 0.30. Track Amazon.com, Inc. stock price on the chart and check out the list of the most volatile stocks — is Amazon.com, Inc. there?

Today Amazon.com, Inc. has the market capitalization of 2.64 T, it has increased by 0.25% over the last week.

Yes, you can track Amazon.com, Inc. financials in yearly and quarterly reports right on TradingView.

Amazon.com, Inc. is going to release the next earnings report on Jan 29, 2026. Keep track of upcoming events with our Earnings Calendar.

AMZN earnings for the last quarter are 1.95 USD per share, whereas the estimation was 1.57 USD resulting in a 24.34% surprise. The estimated earnings for the next quarter are 1.95 USD per share. See more details about Amazon.com, Inc. earnings.

Amazon.com, Inc. revenue for the last quarter amounts to 180.17 B USD, despite the estimated figure of 177.91 B USD. In the next quarter, revenue is expected to reach 211.26 B USD.

AMZN net income for the last quarter is 21.19 B USD, while the quarter before that showed 18.16 B USD of net income which accounts for 16.64% change. Track more Amazon.com, Inc. financial stats to get the full picture.

No, AMZN doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jan 12, 2026, the company has 1.56 M employees. See our rating of the largest employees — is Amazon.com, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Amazon.com, Inc. EBITDA is 141.68 B USD, and current EBITDA margin is 19.15%. See more stats in Amazon.com, Inc. financial statements.

Like other stocks, AMZN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Amazon.com, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Amazon.com, Inc. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Amazon.com, Inc. stock shows the strong buy signal. See more of Amazon.com, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.