🔥 INTC “Intel Corporation” – The Thief’s Profit Playbook 🕶️💰 (Swing/Day Trade Setup)

⚔️ Plan Overview – Bullish Setup with Thief Precision

The Thief Strategy is in play here — a smart layering entry method designed to steal optimal positions from impatient traders. 🕵️♂️

Our mission: Load, Layer, Loot, and Leave with Profits.

🎯 Entry Plan (Layering Method)

We’re layering multiple buy limits (thief-style) to catch value dips:

Buy Limit Layers: 35.00 💵 → 36.00 💵 → 37.00 💵

(⚙️ You can expand your layers based on your risk tolerance and style — thieves adapt fast.)

💡 Why Layer? Because a pro thief never rushes a vault — we break in step-by-step. This builds position strength while keeping entry efficiency.

🛡️ Stop Loss (Thief’s Escape Hatch)

📉 Stop Loss @34.00

💬 “Dear Ladies & Gentlemen (Thief OG’s) — I’m not recommending you set my SL. You’re the boss of your vault. Manage your own risk, grab the bag, and disappear in profits like a shadow.” 🌑💼

🚀 Target Zone (Profit Extraction Level)

🎯 Main Target: @43.00

📛 Police Barricade @44.00 — strong resistance zone + overbought region + potential bull trap.

🧠 Play it smart — escape clean with gains at 43.00 before the blue lights flash. 🚨

💬 “Dear Ladies & Gentlemen (Thief OG’s) — not recommending you follow my TP blindly. Make your own move, take your profit, and vanish like a ghost.” 👻💸

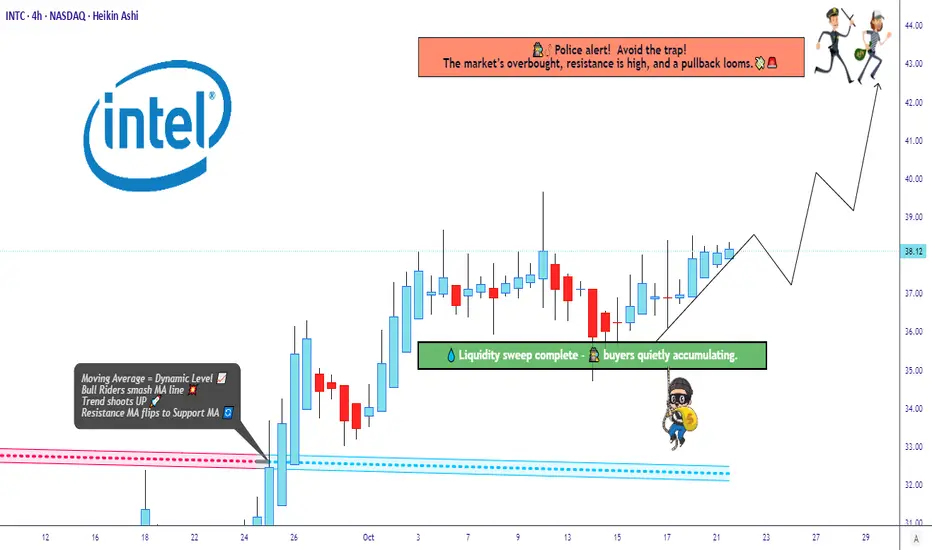

🧩 Technical Breakdown

Intel (INTC) forming a strong base accumulation near the $35–37 range.

Volume Profile shows liquidity pockets aligning with the layering zones.

RSI hovering mid-levels → room for upside before overbought conditions hit near $43–44.

EMA Confluence: Price reclaiming short-term EMA — early trend reversal signals in motion.

Fundamental Boost: Intel’s AI chip roadmap and cost-optimization headlines add bullish narrative momentum. ⚙️📈

🌍 Related Pairs to Watch (Correlation & Market Sync)

💠 NVDA – Leader in AI semis; momentum correlation ~0.78 with INTC.

NVDA – Leader in AI semis; momentum correlation ~0.78 with INTC.

💠 AMD – Similar sector swing potential; can mirror INTC lag-moves.

AMD – Similar sector swing potential; can mirror INTC lag-moves.

💠 SMH (VanEck Semiconductor ETF) – Sector strength indicator. A breakout above resistance supports INTC’s upside.

SMH (VanEck Semiconductor ETF) – Sector strength indicator. A breakout above resistance supports INTC’s upside.

💠 QQQ /

QQQ /  NDX – Tech-heavy indices; bullish bias strengthens chip sector sentiment.

NDX – Tech-heavy indices; bullish bias strengthens chip sector sentiment.

🧭 Correlation Tip: If NVDA or QQQ rallies strongly while INTC consolidates — that’s your thief’s golden signal to layer your entries quietly before the breakout sparks. ⚡

⚙️ Risk Management Wisdom

Never go all-in; layer your risk like a pro.

Keep your SL tight but mind flexible.

Respect zones — police don’t like thieves hanging around too long. 😎

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📜 Disclaimer: This is a Thief-Style Trading Strategy shared for educational & fun purposes only. Not financial advice. Trade wisely — stay stealthy. 🕶️

#INTC #Intel #StockMarket #SwingTrade #DayTrading #ThiefStrategy #LayeredEntries #TechnicalAnalysis #NASDAQ #StocksToWatch #AIStocks #TradingViewCommunity #TradingViewEditorsPick #Semiconductors #NVDA #AMD #QQQ #ProfitPlaybook

⚔️ Plan Overview – Bullish Setup with Thief Precision

The Thief Strategy is in play here — a smart layering entry method designed to steal optimal positions from impatient traders. 🕵️♂️

Our mission: Load, Layer, Loot, and Leave with Profits.

🎯 Entry Plan (Layering Method)

We’re layering multiple buy limits (thief-style) to catch value dips:

Buy Limit Layers: 35.00 💵 → 36.00 💵 → 37.00 💵

(⚙️ You can expand your layers based on your risk tolerance and style — thieves adapt fast.)

💡 Why Layer? Because a pro thief never rushes a vault — we break in step-by-step. This builds position strength while keeping entry efficiency.

🛡️ Stop Loss (Thief’s Escape Hatch)

📉 Stop Loss @34.00

💬 “Dear Ladies & Gentlemen (Thief OG’s) — I’m not recommending you set my SL. You’re the boss of your vault. Manage your own risk, grab the bag, and disappear in profits like a shadow.” 🌑💼

🚀 Target Zone (Profit Extraction Level)

🎯 Main Target: @43.00

📛 Police Barricade @44.00 — strong resistance zone + overbought region + potential bull trap.

🧠 Play it smart — escape clean with gains at 43.00 before the blue lights flash. 🚨

💬 “Dear Ladies & Gentlemen (Thief OG’s) — not recommending you follow my TP blindly. Make your own move, take your profit, and vanish like a ghost.” 👻💸

🧩 Technical Breakdown

Intel (INTC) forming a strong base accumulation near the $35–37 range.

Volume Profile shows liquidity pockets aligning with the layering zones.

RSI hovering mid-levels → room for upside before overbought conditions hit near $43–44.

EMA Confluence: Price reclaiming short-term EMA — early trend reversal signals in motion.

Fundamental Boost: Intel’s AI chip roadmap and cost-optimization headlines add bullish narrative momentum. ⚙️📈

🌍 Related Pairs to Watch (Correlation & Market Sync)

💠

💠

💠

💠

🧭 Correlation Tip: If NVDA or QQQ rallies strongly while INTC consolidates — that’s your thief’s golden signal to layer your entries quietly before the breakout sparks. ⚡

⚙️ Risk Management Wisdom

Never go all-in; layer your risk like a pro.

Keep your SL tight but mind flexible.

Respect zones — police don’t like thieves hanging around too long. 😎

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📜 Disclaimer: This is a Thief-Style Trading Strategy shared for educational & fun purposes only. Not financial advice. Trade wisely — stay stealthy. 🕶️

#INTC #Intel #StockMarket #SwingTrade #DayTrading #ThiefStrategy #LayeredEntries #TechnicalAnalysis #NASDAQ #StocksToWatch #AIStocks #TradingViewCommunity #TradingViewEditorsPick #Semiconductors #NVDA #AMD #QQQ #ProfitPlaybook

Trade active

Trade closed: target reached

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.