EURUSD Bullish Recovery After Healthy Correction, Target 1.1870Hello traders! Here’s my technical outlook on EURUSD (4H) based on the current chart structure. EURUSD previously traded within a mixed structure that transitioned from a broader corrective phase into a clear bullish recovery. After forming a base near the rising higher-timeframe trend line, price b

Forex market

GBPUSD Pullback into Resistance After Channel Breakdown...GBPUSD (1H), price has reacted from the demand zone and is now pulling back inside a broader bearish structure (below the descending channel + under the Ichimoku cloud). So the clean play here is a bullish pullback target into resistance:

🎯 Upside Targets (for the current bounce)

1st Target (TP1):

Don’t Rush to Buy EURUSD – The Bearish Trend Is Speaking UpEURUSD is currently leaning toward a short-term BEARISH trend, as recent news continues to favor the U.S. dollar over the euro . The ECB has kept interest rates unchanged with a rather cautious tone , while Eurozone data and momentum remain too weak to support a sustainable EUR recovery. In contra

AUDUSD Rally Into Sell Zone | Strong Dollar Theme Returns!Hey Traders,

In today’s trading session we are monitoring AUDUSD for a potential selling opportunity around the 0.70200 zone.

AUDUSD remains in a clear downtrend and is currently in a corrective pullback, approaching a confluence resistance area near 0.70200, where the descending trendline aligns

EUR/USD | Going to the bearish breaker (READ THE CAPTION)Good afternoon folks, Amirali here.

As you can see in the hourly chart of EURUSD, in the early hours of today, it reached the Bullish OB zone, then Swept the liquidity pool and then went up, hitting the IFVG and then gone above it, now being traded at 1.1796.

I'm eying the Bearish Breaker for a po

EURUSD: Triangle Resistance Holds - Bearish Bias Toward 1.1730Hello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD previously traded within a well-defined consolidation range, where price moved sideways for an extended period, reflecting temporary balance between buyers and sellers and gradual liquidity accumulation. This

TheGrove | EURUSD buy | Idea Trading AnalysisEURUSD broke through multiple Support level and is now holding above the trendline and key level zone. The current pullback toward the marked support cluster suggests a potential continuation of the bullish move, provided price holds this structure.

EUR/USD is trading within a rising channel, with

GBPUSD Double Bottom Signals Bullish MomentumGBPUSD Double Bottom Signals Bullish Momentum

GBPUSD has formed a small double bottom around the 1.3500 support, hinting at a possible bullish reversal.

The price is currently at 1.3585 and the GBPUSD has been rising since morning on low volume, but is only increasing.

I see short-term upside t

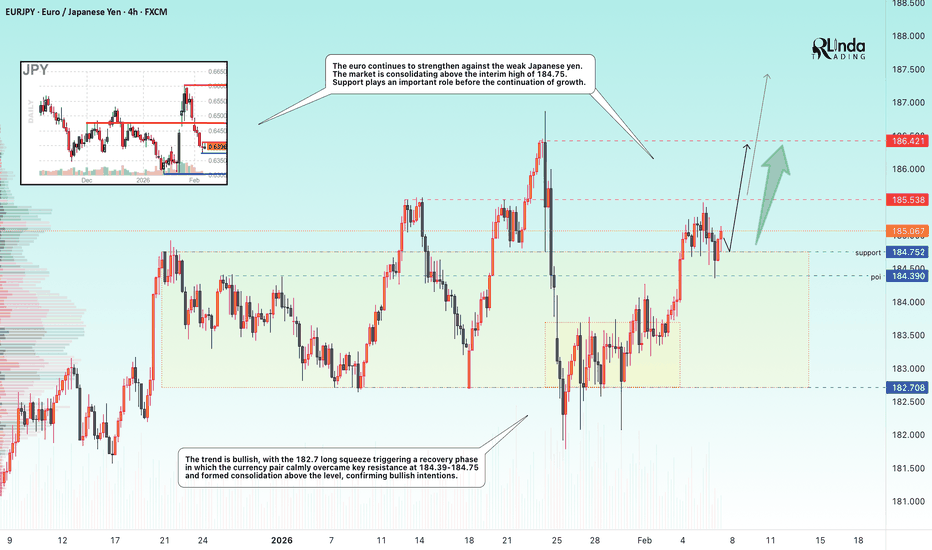

EURJPY - Breaking through resistance. Ready for growth FX:EURJPY is consolidating above the previously broken resistance level of 184.75 as part of a bullish trend. If the bulls maintain support, the price will be able to continue growing.

The euro continues to strengthen against the weak Japanese yen. The market is consolidating above the interi

See all popular ideas

Rates

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Frequently Asked Questions

Forex (foreign exchange) is a global market for trading currencies. Unlike stock markets, the forex market doesn't have any physical location, yet it's the most liquid market worldwide.

In forex, leverage is the use of "borrowed" money (usually from a broker) to invest in a currency. It helps traders open larger positions and gain greater exposure to the forex market. For example, with 100:1 leverage, a trader can control $100,000 in currency with just $1,000 of their own capital.

While leverage amplifies potential profits, it also increases potential risks, so it's crucial to understand and manage it properly, as it directly impacts the risk-reward ratio of trades.

While leverage amplifies potential profits, it also increases potential risks, so it's crucial to understand and manage it properly, as it directly impacts the risk-reward ratio of trades.

The forex market operates 24 hours a day during the trading week, with activity peaking across three major sessions:

- Tokyo session: 19:00 – 4:00 ET (often overlaps with the Sydney session: 17:00 – 2:00 ET)

- London session: 15:00 – 0:00 ET

- New York session: 8:00 – 17:00 ET

This round-the-clock schedule reflects the global nature of forex, enabling traders in all time zones to participate and helping maintain high market liquidity throughout the week.

- Tokyo session: 19:00 – 4:00 ET (often overlaps with the Sydney session: 17:00 – 2:00 ET)

- London session: 15:00 – 0:00 ET

- New York session: 8:00 – 17:00 ET

This round-the-clock schedule reflects the global nature of forex, enabling traders in all time zones to participate and helping maintain high market liquidity throughout the week.

A forex chart is a visual tool that shows how one currency moves in relation to another over a set period. The exchange rate is plotted on the vertical axis, while time runs along the horizontal axis.

Different chart types — like line, bar, and candlestick charts — can help you analyze a currency pair’s performance.

Explore our knowledge base to learn more about chart types and how to read them effectively.

Different chart types — like line, bar, and candlestick charts — can help you analyze a currency pair’s performance.

Explore our knowledge base to learn more about chart types and how to read them effectively.

In forex, spread is the difference between sell price (bid) and buy price (ask) of a currency. Basically, spread is a transaction fee traders pay to exchange the currency — brokers sell a currency for more money they bought it for, and buy it from traders for less money they're going to sell it for later, thus forming the spread.

Spreads can be wider or tighter with traders usually preferring the latter — tight spreads make a currency more affordable. Note that spreads can widen during periods of high volatility or low liquidity.

Spreads can be wider or tighter with traders usually preferring the latter — tight spreads make a currency more affordable. Note that spreads can widen during periods of high volatility or low liquidity.

Currencies are typically traded through forex brokers, so it’s important to choose one that fits your trading style and goals. With TradingView, you can trade directly from the chart — take a look at our list of integrated brokers to find the one that best fits your strategy.

Before you start, it's crucial to do you research: perform technical analysis on the chart or dive into fundamental analysis with the Economic calendar. Evaluate risks, and test you strategy.

Before you start, it's crucial to do you research: perform technical analysis on the chart or dive into fundamental analysis with the Economic calendar. Evaluate risks, and test you strategy.

Major are pairs in which currencies are paired with the US dollar. There are seven major pairs that that account for about three quarters of the whole forex market: EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, USDCHF, NZDUSD. See the full list of major pairs equipped with helpful data for a deeper analysis.

Minor currency pairs (also known as cross pairs) are currency pairs that don’t include the US dollar — for example, EURGBP or JPYAUD.

Explore the full list of minor pairs with key data to uncover new trading opportunities.

Explore the full list of minor pairs with key data to uncover new trading opportunities.

The Economic Calendar is a versatile tool that can help in the research of vaious assets, including currency pairs. As forex is a global market with millions of traders from around the world, macroeconomic events, as well as reports from certain countries, can easily influence the currency rates. For example, inflation reports, shifts in countries' balance of trade play a great role in the forex market's dynamic.

You can track all the important events in TradingView Economic Calendar. There you will learn about economic indicators and what they can affect; you can compare actual and historical data and see the divergence from the forecast to better understand trends. All this can help you design more event-driven strategies that will easily adapt to changes in the forex market.

You can track all the important events in TradingView Economic Calendar. There you will learn about economic indicators and what they can affect; you can compare actual and historical data and see the divergence from the forecast to better understand trends. All this can help you design more event-driven strategies that will easily adapt to changes in the forex market.

An exchange rate shows the value of one currency relative to another. For example, when we say that EURUSD rate is 1.18141 USD, it means that it wouild take 1.18141 USD to buy 1 euro.

Track USDJPY, GBPUSD, and other currency pairs on TradingView, and compare their live performance with our cross-rates tool.

Track USDJPY, GBPUSD, and other currency pairs on TradingView, and compare their live performance with our cross-rates tool.

Any market may be profitable if a reliable strategy and thorough analysis are at play. But there are a few advantages of the forex market that many traders see:

- Liquidity. Forex is the most liquid market, meaning you can quickly sell your assets with no complications

- Leverage. It allows traders to open larger positions on the market with potentially larger profits

- Volatility. Forex trading volumes can be extremely large, which leads to volatility, and more volatility means more opportunities. It also means more risks, so stay informed

- 24-hour trading. Forex market is open 24 hours a day during the week, which gives traders more space for maneuver

- Liquidity. Forex is the most liquid market, meaning you can quickly sell your assets with no complications

- Leverage. It allows traders to open larger positions on the market with potentially larger profits

- Volatility. Forex trading volumes can be extremely large, which leads to volatility, and more volatility means more opportunities. It also means more risks, so stay informed

- 24-hour trading. Forex market is open 24 hours a day during the week, which gives traders more space for maneuver

It’s always best to test your forex trading skills before entering live markets. With Paper Trading on TradingView, you can practice strategies in real time — just click the Paper Trading icon in the trading panel and start experimenting. You can also try the Bar Replay feature to simulate past price movements and refine your approach.

Forex exchange rates are largely driven by a country’s economic performance and political stability. Strong growth and low inflation typically boost a currency’s value, while political unrest or high inflation can cause it to weaken as investors look for safer or more profitable options.

Market sentiment also plays a key role, reacting to news and expectations around economic policy. On top of that, central banks may intervene directly to influence exchange rates, adding further complexity.

To stay ahead in any market conditions, use tools like the Economic Calendar, forex news, and technical analysis to guide your strategy.

Market sentiment also plays a key role, reacting to news and expectations around economic policy. On top of that, central banks may intervene directly to influence exchange rates, adding further complexity.

To stay ahead in any market conditions, use tools like the Economic Calendar, forex news, and technical analysis to guide your strategy.