Opening (IRA): SPY February 27th 590/600/725/735 Iron Condor... for a 1.29 credit.

Comments: More of an engagement/boredom trade than anything else. Selling the 10 delta short options and buying the wings out from there to generate a 75% POP (Probability of Profit) setup that pays in the neighborhood of 10% of the width of the wings.

Metrics:

Max Profit: 1.29 ($129)

Buying Power Effect: 8.71 ($871)

ROC at Max: 14.81%

50% Max: .65 ($65)

ROC at 50% Max: 7.41%

Will look to adjust on side test or on side approaching worthless.

Ironcondor

Opening (IRA): SPY January 30th 605/615/730/740 Iron Condor... for a 1.25 credit.

Comments: Structuring the setup such that the credit received is about 1/10th the width of the wings which results in the short option legs being at about their respective 10 delta strikes.

Metrics:

Max Profit: 1.25 ($125)

Max Loss/Buying Power Effect: 8.75 ($875)

ROC at Max: 14.28%

ROC at 50% Max: 7.14%

Will generally look to adjust on side test or on side approaching worthless. Am looking to take profit at .25, resulting in a 1.00 ($100) realized gain.

Options Blueprint Series [Intermediate]: ES Condor in the Clouds1 — The Market in a Cloud Layer

The S&P 500 (E-mini and Micro E-mini) futures have recently been caught in a curious atmospheric pattern — not of weather, but of price action. After a strong sell-off shook the market a few days ago, both Fibonacci extensions and retracement zones now cluster densely above and below the current price. When these are joined by multiple Floor Trader Pivot Points and Unfilled Order (UFO) zones sitting in similar regions, a clear message emerges: this market is potentially trapped in a range.

Resistance has been repeatedly observed near 6,873, while the lower boundary around 6,437 continues to attract buyers. The index seems to be trapped between Fibs — a typical post-volatility consolidation phase.

For traders who understand that sideways markets can be just as valuable as trending ones, this environment presents an opportunity. Instead of chasing direction, the goal becomes to capture time decay while staying within defined risk limits.

2 — The Strategy: Short Iron Condor Fundamentals

A Short Iron Condor combines two credit spreads:

A short call spread above current price

A short put spread below current price

Together, they create a “no-fly zone” for the underlying — a region where the trader earns maximum profit if price remains between the inner strikes.

This position benefits from:

Stable or neutral price movement

Time decay (theta)

Declining implied volatility

The Iron Condor offers defined risk and defined reward, making it a powerful candidate for range-bound markets like the current ES setup. While the maximum gain is limited to the net premium collected, the maximum loss is also capped, making this a risk-defined non-directional strategy.

Because this structure has both call and put spreads, it offers low Vega exposure — meaning it’s not overly sensitive to volatility shocks. For intermediate traders, this makes it a comfortable way to step beyond simple single-leg strategies and into the world of multi-leg, theta-driven structures.

3 — The Setup: Building the ES Condor

For this idea, we’re looking at the ES (E-mini S&P 500 Futures) options expiring on November 13.

The structure is built as follows:

Sell 6880 Call @ 34.43

Buy 6890 Call @ 31.69

Buy 6430 Put @ 55.32

Sell 6440 Put @ 57.07

This results in a net credit, generating the potential for a maximum profit of 4.49 points (per spread), while the maximum risk stands at -5.51 points. The reward-to-risk ratio comes to approximately 0.8:1, with a statistical win rate of 52.6% based on the current volatility surface, and the Breakeven points: 6,436 and 6,884.

As long as the ES price remains between these levels by expiration, the structure will achieve profitability. The Iron Condor works best when volatility remains stable or contracts — a condition currently supported by the post-drop equilibrium visible in implied volatility readings across near-term expirations.

4 — Chart Context: Technical Landscape Supporting the Range

The chart of the E-mini S&P 500 Futures (ES) reveals a tight compression zone forming between Fibonacci extensions and retracement levels above @ 0.618 (≈6,868) and below @ 0.618 (≈6,437). This overlap with Floor Trader Pivots — specifically R1 at 6,873 and S1 at 6,488 — paints a classic range structure. This setup can be the natural habitat for an Iron Condor.

While directional traders may feel frustrated by sideways movement, option sellers can see this as a period of controlled opportunity — where theta decay compensates for the market’s hesitation.

In other words, as long as ES continues to “hover in the clouds,” the Condor quietly collects premium.

5 — CME Product Specifications and Margins

Understanding the underlying contracts is essential when selecting between E-mini S&P 500 Futures (ES) and Micro E-mini S&P 500 Futures (MES) for this options setup.

E-mini S&P 500 (ES) Futures

Tick Size: 0.25 = $12.50 per tick

Trading Hours: Nearly 24 hours (Sunday–Friday, CME Globex)

Margin (approx.): $21,000 per contract

Micro E-mini S&P 500 (MES) Futures

Contract Size: 1/10 of ES

Tick Size: 0.25 = $1.25 per tick

Margin (approx.): $2,100 per contract

(Margins may vary slightly depending on volatility and broker policies.)

For smaller accounts or for traders looking to practice scaling and hedging, the MES provides a highly capital-efficient alternative to ES.

When executing the Short Iron Condor, traders may also consider margin offsets if the structure is risk-defined — a benefit when using portfolio margin accounts. However, margin usage will vary by broker and account type.

6 — Risk Management: Keeping the Condor in the Clouds

Every Iron Condor begins with a disciplined approach to risk.

Here’s how it can be managed:

Position Sizing: Determine exposure based on the maximum loss, not the credit received. For instance, risking 1–2% of account equity per structure keeps risk contained even during volatility spikes.

Exit Before Expiration: Avoid gamma risk in the final days. Closing the trade when 50–60% of the maximum profit is achieved can reduce time risk while locking in gains.

Adjustments: If price nears a breakeven zone (6,436 or 6,884), traders can consider rolling the threatened side further away or closing half of the position to reduce delta exposure.

Volatility Awareness: A volatility spike can temporarily pressure the mark-to-market value.

Because the Iron Condor is short Vega, it benefits from a calm or contracting volatility regime.

When markets are calm, this strategy works beautifully; when storms approach, it’s time to bring the Condor to the ground.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

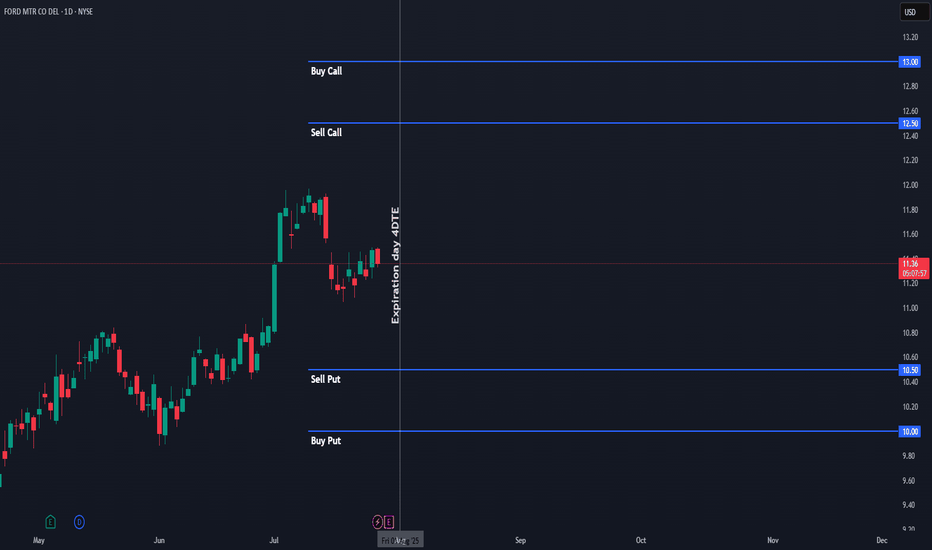

$F Iron Condor – Aug 1st Expiration | $7 Credit | I’m opening an Iron Condor on Ford ($F) with expiration on Friday, August 1st, 2025. The trade is based on the daily chart, using visible support/resistance levels to define the range. I selected strikes with approximately 0.15 delta on each side, giving the setup a high probability of success.

🔹 Total premium collected: $7 per contract

🔹 Stop loss: Defined at 50% of the premium collected (~$3.50)

🔹 Trade logic: We want $F to stay within the range throughout the week to let theta do its job.

🔹 Exit plan: If the price approaches either short strike, I will consider exiting at break-even or take a controlled loss.

This is a non-directional options strategy designed to benefit from time decay and low volatility. The setup is ideal for sideways price action, with no major catalysts expected during the week.

🎯 Target: Full profit if price stays within range until expiration.

❌ Stop: Exit if the price threatens any wing – max loss capped at 50% of the premium received.

This trade combines high probability with well-defined risk and is perfect for consistent weekly income when the market shows indecision or chop.

DG Trading Setup: Capitalizing on RangeDollar General has experienced a stabilization phase following its Q1 2025 results, with same-store sales increasing 2.4% and revenue growing 5.3% to $10.4 billion. The company has regained traction in the discount retail space, mitigating previous challenges related to shrink and operational inefficiencies.

Institutional Flow & Market Positioning

Recent institutional flow highlights large orders in DG’s 115 call and 110 put, signaling either:

- A range-bound setup, where smart money expects the stock to stay between $110-$115 in the near term.

- Potential volatility, with institutions hedging both directions ahead of an unexpected move.

Considering the ATR (18) and standard deviation (7.353), this aligns with a low-breakout probability, making range-based strategies the optimal play. The absence of earnings between now and July further supports sideways movement expectations.

Options Trade Setup: Iron Condor

To capitalize on premium decay and IV contraction, I’m structuring an iron condor:

- Sell 115 Call / Buy 120 Call

- Sell 110 Put / Buy 105 Put

This strategy ensures limited risk while collecting premium in a high-probability range trade.

DLTR: Range + Flow SetupDLTR – Trading Within Range Amid Strategic Evolution & Flow Anomalies

Dollar Tree (DLTR) continues to show strength post–Q1 FY2025 earnings, breaking higher as it pushes through its multi-price format transition and nears the Family Dollar divestiture. The stock is outperforming key peers (DG, TJX, COST) and trading above both the 50- and 200-day MAs — a signal of growing institutional confidence.

On the fundamentals: Net sales (ex-Family Dollar) jumped 11.3% to $4.64B, comps grew 5.4%, and gross margin expanded to 35.6% despite transitional headwinds. Full-year EPS was guided up to $5.15–$5.65, reflecting management’s conviction in sustained growth. Analysts responded by revising EPS to $6.12 (+13.5% YoY), validating the turnaround thesis.

Valuation-wise, DLTR remains notably underpriced. It’s trading at 16.66x forward earnings — well below the retail average and far cheaper than peers like COST (51.1x), TJX (26.9x), and DG (19.0x). The gap is especially compelling given DLTR’s momentum and shift toward higher-margin discretionary sales via the “3.0” format.

Unusual Activity Insight:

What caught my attention was a cluster of unusual options activity suggesting a short-term strangle strategy centered around the July 18 expiration — likely positioning for the stock to stay range-bound while capturing premium from elevated IV post-earnings. The structure and OI shifts imply smart money is playing both ends of the current price band.

Trading Range and Setup:

DLTR has been respecting a range between $92 and $102, consolidating after its post-earnings move. That behavior, combined with the flow signals, sets the stage perfectly for a defined-risk premium play.

My Approach: Iron Condor (July 18 Expiration)

- Sell 100 Call / Buy 105 Call

- Sell 95 Put / Buy 90 Put

This iron condor aligns with the projected range, offering attractive premium while keeping defined exposure. With theta working in our favor and volatility elevated, it’s a setup that thrives in quiet bullish chop — exactly what we’ve seen since the Q1 breakout

Navigating MSTR’s Price Swings: A Smart Options ApproachOverview

MicroStrategy (MSTR) has continued to capture market attention due to its aggressive Bitcoin strategy and significant stock price volatility. In 2025, MSTR surged 41% in one quarter but also reported a massive $4.22 billion net loss in Q1, raising concerns about long-term financial stability. Analysts remain divided, setting price targets ranging from $200 to $650, largely dependent on Bitcoin’s performance and broader market conditions.

Key Developments Impacting MSTR

✔ Bitcoin Exposure: MSTR maintains a large Bitcoin position, making its stock highly correlated to BTC’s price movements.

✔ AI Integration: The company is investing in AI-driven products, which could provide diversification outside of Bitcoin.

✔ Institutional View: Analysts remain split on MicroStrategy’s valuation due to its uncertain revenue model.

✔ Macro Volatility: Market-wide sentiment, interest rates, and crypto regulations will influence MSTR’s trajectory.

Options Strategy for the Week

🚀 Iron Condor Setup for June 6 Expiration

To capitalize on MSTR’s volatility while managing risk, an Iron Condor strategy is structured within a controlled range:

- Inner Range: Sell Calls at 395 and Puts at 335

- Coverage: Buy Calls at 415 and Puts at 315

✅ Objective: Profiting from sideways price movement while minimizing exposure to extreme volatility.

✅ Risk Management: If MSTR breaks above 415 or below 315, the long positions hedge against excessive losses.

Opening (IRA): SPX May 16th 5000/5030/5785/5815 Iron Condor... for a 10.45 credit.

Comments: High IVR. After having taken small profit on the setup I put on before "Liberation Day," back in with a more symmetric setup in a higher IV environment.

Metrics:

Buying Power Effect: 19.55

Max Profit: 10.45

ROC at Max: 53.45%

50% Max: 5.23

ROC at 50% Max: 26.73%

Will generally look to take profit at 50% max, roll in untested side on side test, manage at 21 DTE.

Opening (IRA): LULU April 17th 300/310/390/400 Iron Condor... for a 3.39 credit.

Comments: Delta neutral earnings announcement IV contraction play.

Metrics:

Buying Power Effect: 6.61

Max Profit: 3.39

ROC at Max: 51.3%

50% Max: 1.70

ROC at 50% Max: 25.6%

Will generally look to take profit at 50% max ... .

Opening (IRA): IWM May 16th 190/195/220/225 Iron Condor... for a 1.70 credit.

Comments: I think I have more than enough long delta on at the moment, so opting to go nondirectional/delta neutral here. Selling the 25's and buying the wings out from there, collecting one-third the width of the wings in credit.

Metrics:

Buying Power Effect: 3.30

Max Profit: 1.70

ROC at Max: 51.5%

50% Max: .85

ROC at 50% Max: 25.8%

Will generally look to take profit at 50% max, roll in oppositional side on side test.

Opening (IRA): IBIT May 16th 41/44/57/60 Iron Condor... for a 1.02 credit.

Comments: Going neutral assumption here, selling the 25 delta's and buying wings 3 strikes out, collecting one-third the width of the wings.

Metrics:

Buying Power Effect: 1.98

Max Profit: 1.02

ROC at Max: 51.5%

50% Max: .51

ROC at 50% Max: 25.8%

Will generally look to take profit at 50% max, roll wings in on side test.

Opening (IRA): SPX May 16th 5130/5160/5850/5880 Iron Condor... for a 10.20 credit.

Comments: High IVR/IV >21. Hesitant to add more long delta here, so going delta neutral in SPX and structuring the trade such that I receive one-third the width of the wings (30) in credit.

Metrics:

Buying Power Effect: 19.80

Max Profit: 10.20

ROC at Max: 51.52%

50% Max: 5.10

ROC at 50% Max: 25.8%

Will generally look to take profit at 50% max, rolling down oppositional side on side test, but won't hesitate to take profit quickly if IV crushes in dramatically post "Liberation Day."

Opening (IRA): TSLA March 21st 330/335/465/470 IC*... for a 1.70 credit.

Comments: Post-earnings, IV remains fairly decent here at 57.3. Selling the -20 delta short option legs and buying the wings out from there. Basically, just doing small stuff while I wait for other stuff to play out.

Metrics:

Max Profit: 1.70

Buying Power Effect: 3.30

ROC at Max: 51.2%

50% Max: .85

ROC at 50% Max: 25.8%

Delta/Theta: .95/2.24

Will generally look to take profit at 50% max, consider doing a delta adjustment when the delta/theta ratio skews out to >2.0.

* -- Iron Condor.

Opening (IRA): SMH February 21st 195/220/270/295 Iron Condor... for a 3.91 credit.

Comments: Back into the semiconductor ETF, where I don't have a position on currently. Going comparatively low delta, with the short options camped out at the 17 delta on both sides and the wings about 1/10th the price of the underlying in width.

Metrics:

Max Profit: 3.91

Buying Power Effect: 21.09

ROC at Max: 18.54%

50% Max: 1.96

ROC at 50% Max: 9.27%

Will generally look to take profit at 50% max, roll untested side in toward current price on side test.

Opening (IRA): PLTR Feb 28th 70/75/100/105 Iron Condor... for a 2.11 credit.

Comments: High IVR/IV at 89.1/81.3. Adding to my PLTR position as an earnings announcement volatility contraction play.

Metrics:

Max Profit: 2.11

Buying Power Effect: 2.89

ROC at Max: 73.01%

50% Max: 1.06

ROC at 50% Max: 36.51%

Will generally look to take profit at 50% max, immediately roll out to March if a side is tested.

Opening (IRA): INTC Feb 21st 15/19/20/24 Skinny IC... for a 2.04 credit.

Comments: High IVR/IV (91.4/69.7) earnings announcement volatility contraction play. Going "skinny"/"almost iron fly" here. For purposes of take profit, treating it as an iron fly, where I generally look to take profit at 25% max.

Metrics:

Max Profit: 2.04

Buying Power Effect/Max Loss: 1.96

25% Max: .51

ROC at 25% Max: 25.0%