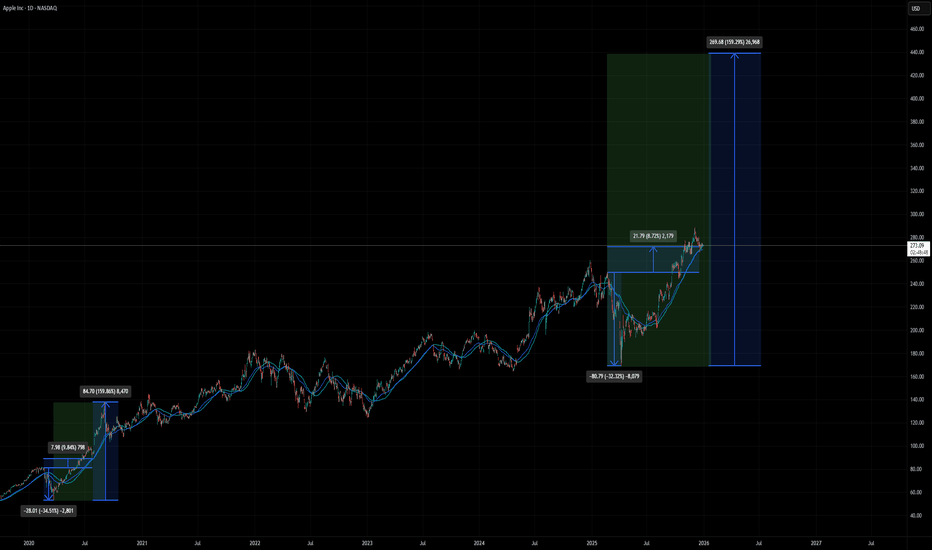

AAPL holding higher lows after strong momentumApple has been trending higher with a clear series of higher highs and higher lows.

Price is now consolidating near recent highs after a strong momentum leg, which often signals

digestion rather than immediate weakness.

Key observations:

• Trend structure remains intact

• Pullbacks are shallow

Key facts today

Hon Hai Precision Industry Co. saw a 22% rise in quarterly sales due to high demand for Apple's iPhone 17, launched in September, boosting Apple's market share against Samsung.

Apple is projected to contribute significantly to the S&P 500's anticipated earnings growth in 2026, although its share of this growth is expected to decrease compared to 2025.

Apple's forward P/E ratio is about 34, indicating that its ecosystem and services strengths are reflected in the stock price, potentially capping short-term gains.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.49 USD

112.01 B USD

416.16 B USD

14.76 B

About Apple Inc

Sector

Industry

CEO

Timothy Donald Cook

Website

Headquarters

Cupertino

Founded

1976

Identifiers

3

ISIN US0378331005

Apple, Inc engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other variety of related services. It operates through the following geographical segments: Americas, Europe, Greater China, Japan, and Rest of Asia Pacific. The Americas segment includes North and South America. The Europe segment consists of European countries, as well as India, the Middle East, and Africa. The Greater China segment comprises of China, Hong Kong, and Taiwan. The Rest of Asia Pacific segment includes Australia and Asian countries. Its products and services include iPhone, Mac, iPad, AirPods, Apple TV, Apple Watch, Beats products, Apple Care, iCloud, digital content stores, streaming, and licensing services. The company was founded by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak in 1976 and is headquartered in Cupertino, CA.

Related stocks

AAPL – Jan 2 Market Preview (15m structure + GEX context)Starting with the 15-minute chart, AAPL is pretty clear structurally.

We already saw a CHoCH to the downside, followed by a BOS, which tells me short-term control shifted away from buyers. Since that breakdown, price has been sliding lower and then compressing around 272–272.5, with very weak follow

Apple - Going DeeperIt looks like a full five-wave structure has formed.

Waves 1 and 5 are almost equal in size.

We may still see a short push higher, back toward 288 , and then the move down begins.

Alternatively, the decline could start from the current level.

Potential targets:

260 -> 243 -> 229

---

Ple

AAPL Long 1D Investment Conservative TradeConservative Trade

+ long impulse

+ 1/2 correction

+ SOS level

+ support level

+ volumed 2Sp+

? technical volume

Calculated affordable stop market

1 to 2 R/R take profit within 1D range

Monthly Trend

"+ long impulse

+ neutral zone 2

+ long volume distribution"

Yearly Trend

+ long impulse

+ neutra

Market Structure and OB + Demand ReactionNASDAQ:AAPL On the Daily timeframe, AAPL’s market structure remains clear and well-defined. Price has formed two Breaks of Structure (BOS), confirming overall bullish trend continuation. After that, a bearish Change of Character (CHoCH) appeared, which led to a corrective move to the downside. Duri

APPL (APPLE) BUY IDEAAPPL (APPLE) BUY IDEA

📊 Market Sentiment

Market sentiment is bullish, driven by expectations of the FED’s potential rate cut in December. In addition, Trump’s likely nominee for the new FED Chair is Kevin Hassett a strong supporter of aggressive rate cuts.

This possibility has pushed markets hig

AAPL CRACK!AAPL just flashed its first CRACK! of this structure.

AAPL has moved from the upper trendline to the bottom more through time than price.

In my BKC (Bare Knuckle Charting) read, the real tell isn’t the crack… It’s the miss. The previous high couldn’t even tag the upper trendline. That’s subtle, bu

Capital Flows & Global Asset Allocation StrategiesUnderstanding Capital Flows

Capital flows refer to the movement of money for investment, trade, or business production between countries. These flows can be broadly classified into foreign direct investment (FDI), portfolio investment, and other flows such as bank lending and trade credit.

FDI inv

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US37833EL0

Apple Inc. 2.85% 05-AUG-2061Yield to maturity

5.51%

Maturity date

Aug 5, 2061

US37833ER7

Apple Inc. 4.1% 08-AUG-2062Yield to maturity

5.51%

Maturity date

Aug 8, 2062

US37833EG1

Apple Inc. 2.8% 08-FEB-2061Yield to maturity

5.48%

Maturity date

Feb 8, 2061

US37833EK2

Apple Inc. 2.7% 05-AUG-2051Yield to maturity

5.48%

Maturity date

Aug 5, 2051

US37833DW7

Apple Inc. 2.65% 11-MAY-2050Yield to maturity

5.48%

Maturity date

May 11, 2050

US37833DQ0

Apple Inc. 2.95% 11-SEP-2049Yield to maturity

5.48%

Maturity date

Sep 11, 2049

US37833EF3

Apple Inc. 2.65% 08-FEB-2051Yield to maturity

5.47%

Maturity date

Feb 8, 2051

US37833EQ9

Apple Inc. 3.95% 08-AUG-2052Yield to maturity

5.46%

Maturity date

Aug 8, 2052

US37833DD9

Apple Inc. 3.75% 12-SEP-2047Yield to maturity

5.44%

Maturity date

Sep 12, 2047

APC3

Apple Inc. 3.75% 13-NOV-2047Yield to maturity

5.43%

Maturity date

Nov 13, 2047

US37833EA4

Apple Inc. 2.55% 20-AUG-2060Yield to maturity

5.43%

Maturity date

Aug 20, 2060

See all AAPL bonds

Curated watchlists where AAPL is featured.

Frequently Asked Questions

The current price of AAPL is 267.26 USD — it has decreased by −0.87% in the past 24 hours. Watch Apple Inc stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Apple Inc stocks are traded under the ticker AAPL.

AAPL stock has fallen by −1.48% compared to the previous week, the month change is a −4.23% fall, over the last year Apple Inc has showed a 9.82% increase.

We've gathered analysts' opinions on Apple Inc future price: according to them, AAPL price has a max estimate of 350.00 USD and a min estimate of 215.00 USD. Watch AAPL chart and read a more detailed Apple Inc stock forecast: see what analysts think of Apple Inc and suggest that you do with its stocks.

AAPL reached its all-time high on Dec 3, 2025 with the price of 288.62 USD, and its all-time low was 0.05 USD and was reached on Jul 8, 1982. View more price dynamics on AAPL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AAPL stock is 2.02% volatile and has beta coefficient of 1.24. Track Apple Inc stock price on the chart and check out the list of the most volatile stocks — is Apple Inc there?

Today Apple Inc has the market capitalization of 4.00 T, it has decreased by −2.19% over the last week.

Yes, you can track Apple Inc financials in yearly and quarterly reports right on TradingView.

Apple Inc is going to release the next earnings report on Jan 29, 2026. Keep track of upcoming events with our Earnings Calendar.

AAPL earnings for the last quarter are 1.85 USD per share, whereas the estimation was 1.78 USD resulting in a 4.10% surprise. The estimated earnings for the next quarter are 2.66 USD per share. See more details about Apple Inc earnings.

Apple Inc revenue for the last quarter amounts to 102.47 B USD, despite the estimated figure of 102.23 B USD. In the next quarter, revenue is expected to reach 137.32 B USD.

AAPL net income for the last quarter is 27.47 B USD, while the quarter before that showed 23.43 B USD of net income which accounts for 17.21% change. Track more Apple Inc financial stats to get the full picture.

Yes, AAPL dividends are paid quarterly. The last dividend per share was 0.26 USD. As of today, Dividend Yield (TTM)% is 0.38%. Tracking Apple Inc dividends might help you take more informed decisions.

Apple Inc dividend yield was 0.40% in 2025, and payout ratio reached 13.66%. The year before the numbers were 0.43% and 16.11% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jan 6, 2026, the company has 166 K employees. See our rating of the largest employees — is Apple Inc on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Apple Inc EBITDA is 144.75 B USD, and current EBITDA margin is 34.78%. See more stats in Apple Inc financial statements.

Like other stocks, AAPL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Apple Inc stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Apple Inc technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Apple Inc stock shows the buy signal. See more of Apple Inc technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.