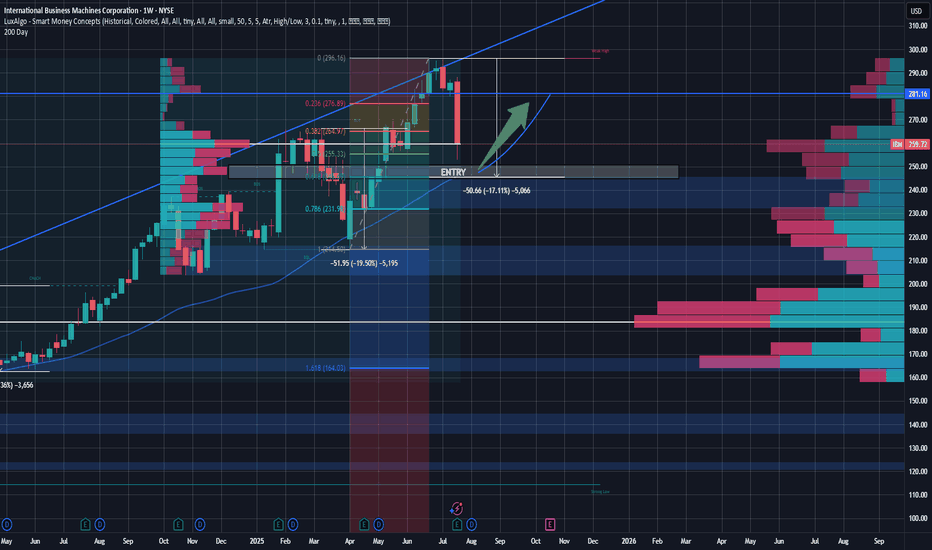

IBM - Closed the GAP, What is next?Hello Everyone, Followers,

In September 7th I shared below analysis and talked about possible GAP closure for IBM. Here is the link:

Approx %15 in 20 days , not bad :))

Now what is next for IBM:

Related to the Quantum Computing news support this move, as IBM is also working on the Quantum area a

Key facts today

At GITEX GLOBAL 2025, IBM presented its watsonx platform, showcasing AI applications like a Ferrari F1 simulator and Sevilla FC's Scout Advisor, emphasizing significant productivity gains from AI.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5,880 CLP

6.01 T CLP

62.63 T CLP

930.60 M

About International Business Machines Corporation

Sector

Industry

CEO

Arvind Krishna

Website

Headquarters

Armonk

Founded

1911

ISIN

US4592001014

FIGI

BBG00YFST283

International Business Machines Corp. is an information technology company, which engages in the provision of integrated solutions that leverage information technology and knowledge of business processes. It operates through the following segments: Software, Consulting, Infrastructure, Financing, and Other. The Software segment combines hybrid cloud platform and software solutions to help clients become more data-driven, and to automate, secure, and modernize their environments. The Consulting segment focuses on integrating skills on strategy, experience, technology and operations by domain and industry. The Infrastructure segment offers solutions for hybrid cloud and is the foundation of the hybrid cloud stack. Infrastructure is optimized for infusing AI into mission-critical transactions and tightly integrated with IBM Software including Red Hat for accelerated hybrid cloud benefits. The Financing segment refers to the client and commercial financing, facilitating IBM clients’ acquisition of IT systems, software, and services. The company was founded by Charles Ranlett Flint and Thomas J. Watson Sr. on June 16, 1911 and is headquartered in Armonk, NY.

Related stocks

IBM Wave Analysis – 25 September 2025- IBM broke resistance area

- Likely to rise to resistance level 286.75

IBM recently broke the resistance area between the resistance level 276.00 and the 61.8% Fibonacci correction of the ABC correction (4) from June.

The breakout of this resistance area accelerated the active short-term impulse

IBM Rebound Trade - Buying the Pullback at Key ConfluenceSetup:

IBM is setting up for a potential high-conviction long entry around the $245 level, a price zone marked by multiple layers of technical confluence and volume-based support. Over the last 18 months, IBM has seen two notable pullbacks—both in the 17–20% range, often around earnings events. The

IBM Wave Analysis – 19 September 2025

- IBM broke resistance level 264.80

- Likely to rise to resistance level 276.30

IBM recently broke the resistance zone between the resistance level 264.80 (which stopped the previous wave (ii) in July) and the 50% Fibonacci correction of the ABC correction (4) from June.

The breakout of this resi

Bullish Alert: confirmed Head & Shoulders Breakout Price action has been building tension for weeks. After forming a classic head & shoulders pattern , the market seemed uncertain — bulls testing, bears pushing back. But price has broken the neckline decisively, signaling that buyers have taken control. This breakout is the confirmation that the pr

IBM | The Trend Is Your Friend | LONGInternational Business Machines Corp. is an information technology company, which engages in the provision of integrated solutions that leverage information technology and knowledge of business processes. It operates through the following segments: Software, Consulting, Infrastructure, Financing, an

IBM Wave Analysis – 9 September 2025- IBM broke resistance area

- Likely to rise to resistance level 265.00

IBM recently broke resistance area between the resistance level 253.60 (which has been reversing the price from the start of August) and the 38.2% Fibonacci correction of the downward impulse C from July.

The breakout of this

IBM watch $256-258: Key Resistance zone Break should RUN STRONG IBM has been clawing its way back from a downtrend.

Now testing a key Resistance zone at $256.19-258.21

Look for a Break-n-Retest or a Dip-to-Fib leg for entry.

.

See "Related Publications" for previous charts --------------->>>>>>>>>>>>>

Such as this EXACT BOTTOM call:

Hit BOOST and FOLLOW for

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS258374304

International Business Machines Corporation 4.875% 06-FEB-2038Yield to maturity

5.88%

Maturity date

Feb 6, 2038

IBM.GY

International Business Machines Corporation 7.125% 01-DEC-2096Yield to maturity

5.83%

Maturity date

Dec 1, 2096

US459200KC4

International Business Machines Corporation 4.25% 15-MAY-2049Yield to maturity

5.61%

Maturity date

May 15, 2049

I

IBM5744047

IBM International Capital Pte. Ltd. 5.3% 05-FEB-2054Yield to maturity

5.60%

Maturity date

Feb 5, 2054

IBM5999346

International Business Machines Corporation 5.7% 10-FEB-2055Yield to maturity

5.60%

Maturity date

Feb 10, 2055

IBM5354862

International Business Machines Corporation 3.43% 09-FEB-2052Yield to maturity

5.59%

Maturity date

Feb 9, 2052

IBM5534365

International Business Machines Corporation 5.1% 06-FEB-2053Yield to maturity

5.57%

Maturity date

Feb 6, 2053

IBM5449458

International Business Machines Corporation 4.9% 27-JUL-2052Yield to maturity

5.54%

Maturity date

Jul 27, 2052

US459200JH5

International Business Machines Corporation 4.7% 19-FEB-2046Yield to maturity

5.53%

Maturity date

Feb 19, 2046

IBM4983326

International Business Machines Corporation 2.95% 15-MAY-2050Yield to maturity

5.52%

Maturity date

May 15, 2050

IBM.GX

International Business Machines Corporation 7.0% 30-OCT-2045Yield to maturity

5.43%

Maturity date

Oct 30, 2045

See all IBMCL bonds

Curated watchlists where IBMCL is featured.

Frequently Asked Questions

The current price of IBMCL is 274,120 CLP — it hasn't changed in the past 24 hours. Watch International Business Machines Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange International Business Machines Corporation stocks are traded under the ticker IBMCL.

IBMCL stock has risen by 8.78% compared to the previous week, the month change is a 8.78% rise, over the last year International Business Machines Corporation has showed a 47.94% increase.

We've gathered analysts' opinions on International Business Machines Corporation future price: according to them, IBMCL price has a max estimate of 333,969.47 CLP and a min estimate of 188,931.30 CLP. Watch IBMCL chart and read a more detailed International Business Machines Corporation stock forecast: see what analysts think of International Business Machines Corporation and suggest that you do with its stocks.

IBMCL reached its all-time high on Aug 5, 2025 with the price of 274,120 CLP, and its all-time low was 83,650 CLP and was reached on Jan 4, 2021. View more price dynamics on IBMCL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

IBMCL stock is 1.44% volatile and has beta coefficient of 0.68. Track International Business Machines Corporation stock price on the chart and check out the list of the most volatile stocks — is International Business Machines Corporation there?

Today International Business Machines Corporation has the market capitalization of 256.19 T, it has increased by 2.57% over the last week.

Yes, you can track International Business Machines Corporation financials in yearly and quarterly reports right on TradingView.

International Business Machines Corporation is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

IBMCL earnings for the last quarter are 2.62 K CLP per share, whereas the estimation was 2.48 K CLP resulting in a 5.70% surprise. The estimated earnings for the next quarter are 2.36 K CLP per share. See more details about International Business Machines Corporation earnings.

International Business Machines Corporation revenue for the last quarter amounts to 15.88 T CLP, despite the estimated figure of 15.52 T CLP. In the next quarter, revenue is expected to reach 15.53 T CLP.

IBMCL net income for the last quarter is 2.05 T CLP, while the quarter before that showed 1.01 T CLP of net income which accounts for 104.07% change. Track more International Business Machines Corporation financial stats to get the full picture.

Yes, IBMCL dividends are paid quarterly. The last dividend per share was 1.63 K CLP. As of today, Dividend Yield (TTM)% is 2.32%. Tracking International Business Machines Corporation dividends might help you take more informed decisions.

International Business Machines Corporation dividend yield was 3.03% in 2024, and payout ratio reached 103.78%. The year before the numbers were 4.05% and 81.49% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 10, 2025, the company has 293.4 K employees. See our rating of the largest employees — is International Business Machines Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. International Business Machines Corporation EBITDA is 15.61 T CLP, and current EBITDA margin is 24.48%. See more stats in International Business Machines Corporation financial statements.

Like other stocks, IBMCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade International Business Machines Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So International Business Machines Corporation technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating International Business Machines Corporation stock shows the buy signal. See more of International Business Machines Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.