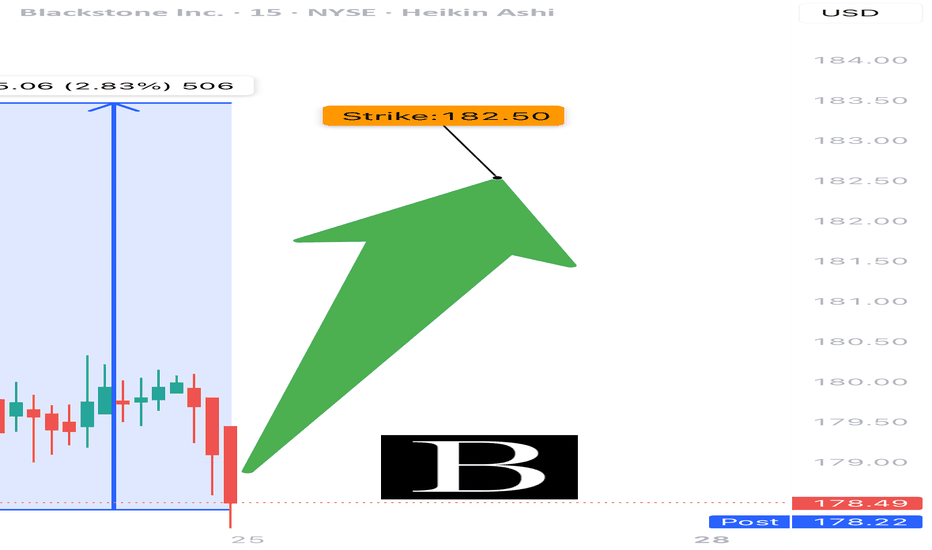

BX Blackstone Options Ahead of EarningsIf you haven`t bought BX before the rally:

Now analyzing the options chain and the chart patterns of BX Blackstone prior to the earnings report this week,

I would consider purchasing the 145usd strike price Calls with

an expiration date of 2026-2-20,

for a premium of approximately $3.90.

If these

Key facts today

Blackstone's share prices fell this week due to market fears about the software industry's outlook and concerns over the valuations of loans tied to software firms.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.87 USD

3.02 B USD

14.62 B USD

730.98 M

About Blackstone Inc.

Sector

Industry

CEO

Stephen Allen Schwarzman

Website

Headquarters

New York

Founded

1985

IPO date

Jun 22, 2007

Identifiers

3

ISIN US09260D1072

Blackstone, Inc. engages in the provision of investment and fund management services. It operates through the following segments: Real Estate, Private Equity, Credit and Insurance, and Hedge Fund Solutions. The Real Estate segment includes management of opportunistic real estate funds, Core+ real estate funds, high-yield real estate debt funds, and liquid real estate debt funds. The Private Equity segment consists of management of flagship corporate private equity funds, sector and geographically focused corporate private equity funds, core private equity funds, an opportunistic investment platform, a secondary fund of funds business, infrastructure-focused funds, a life sciences investment platform, a growth equity investment platform, a multi-asset investment program for eligible high net worth investors and a capital markets services business. The Credit and Insurance segment refers to Blackstone Credit, which is organized into two overarching strategies: private credit which includes mezzanine direct lending funds, private placement strategies, stressed and distressed strategies and energy strategies, and liquid credit which consists of CLOs, closed-ended funds, open ended funds and separately managed accounts. In addition, the segment includes an insurer-focused platform, an asset-based finance platform, and publicly traded master limited partnership investment platform. The Hedge Fund Solutions segment focuses on Blackstone Alternative Asset Management, which manages a broad range of commingled and customized hedge fund of fund solutions. It also includes a GP Stakes business and investment platforms that invest directly, as well as investment platforms that seed new hedge fund businesses and create alternative solutions through daily liquidity products. The company was founded by Stephen Allen Schwarzman in 1985 and is headquartered in New York, NY.

Related stocks

Blackstone to Invest $1.2B in Power Facility-Key Levels to WatchBlackstone Inc. (NYSE: BX) has announced a $1.2 billion investment in a new power generation facility in West Virginia, a move that reinforces its commitment to addressing the rising global electricity demand driven by artificial intelligence and industrial expansion. The 600-megawatt Wolf Summit En

Sellers Exhausted - Bulls Spring Loaded at Value📊 **To view my confluences and linework:**

Step 1️⃣: Grab the chart

Step 2️⃣: Unhide Group 1 in the object tree

Step 3️⃣: Hide and unhide specific confluences one by one

💡 **Pro tip:** Double-click the screen to reveal RSI, MFI, CVD, and OBV indicators alongside divergence markings! 🎯

Title: 🎯 BX

BX |Bullish Momentum Incoming | LONGBlackstone, Inc. engages in the provision of investment and fund management services. It operates through the following segments: Real Estate, Private Equity, Credit and Insurance, and Hedge Fund Solutions. The Real Estate segment includes management of opportunistic real estate funds, Core+ real es

BX : First Attempt at Silent StockBlackstone has now decided to invest in Europe.

The stock is technically above the 50 and 200 period moving averages.

After leveling the trend line, an increase in volume was also observed.

In that case, holding a short-medium term or opening a long position with a reasonable risk/reward ratio in a

BX EARNINGS TRADE (07/24)

🚨 BX EARNINGS TRADE (07/24) 🚨

💼 Blackstone drops earnings after close — setup looks 🔥 bullish

🧠 Key Insights:

• 📉 TTM Revenue: -8.2%, but Q2 bounce back = $764M profit

• 💰 Margins: Strong → 45.3% operating, 20.6% net

• 📈 RSI: 73.88 = HOT momentum

• 🧠 AUM: $1.2 Trillion = 🐘 heavyweight

• 🔥 Options

BX Long Trade Setup!📊

⏱️ Timeframe:

30-minute chart

📍 Technical Highlights:

Bullish pennant breakout forming after a strong uptrend (continuation pattern ✅)

Breakout area: Around $163 (red resistance)

Support held near $162 zone (white/yellow lines)

🎯 Targets:

TP1: $164.15

TP2: $165.05

(Both resistance levels mar

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BX5337775

Blackstone Private Credit Fund 4.0% 15-JAN-2029Yield to maturity

6.72%

Maturity date

Jan 15, 2029

BX5302996

Blackstone Private Credit Fund 3.25% 15-MAR-2027Yield to maturity

6.46%

Maturity date

Mar 15, 2027

BX5257560

Blackstone Private Credit Fund 2.625% 15-DEC-2026Yield to maturity

6.42%

Maturity date

Dec 15, 2026

BX6081039

Blackstone Private Credit Fund 6.0% 22-NOV-2034Yield to maturity

6.22%

Maturity date

Nov 22, 2034

BX5945588

Blackstone Private Credit Fund 5.6% 22-NOV-2029Yield to maturity

6.11%

Maturity date

Nov 22, 2029

BX5986898

Blackstone Private Credit Fund 6.0% 29-JAN-2032Yield to maturity

6.10%

Maturity date

Jan 29, 2032

BX6275550

Blackstone Private Credit Fund 5.35% 12-MAR-2031Yield to maturity

6.01%

Maturity date

Mar 12, 2031

BX5945590

Blackstone Private Credit Fund 6.0% 22-NOV-2034Yield to maturity

6.00%

Maturity date

Nov 22, 2034

BX5736916

Blackstone Private Credit Fund 6.25% 25-JAN-2031Yield to maturity

5.96%

Maturity date

Jan 25, 2031

BX5705233

Blackstone Private Credit Fund 7.3% 27-NOV-2028Yield to maturity

5.84%

Maturity date

Nov 27, 2028

BX6166864

Blackstone Private Credit Fund 5.05% 10-SEP-2030Yield to maturity

5.79%

Maturity date

Sep 10, 2030

See all BX bonds

Frequently Asked Questions

The current price of BX is 134.54 USD — it has decreased by −5.24% in the past 24 hours. Watch Blackstone Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Blackstone Inc. stocks are traded under the ticker BX.

BX stock has fallen by −11.32% compared to the previous week, the month change is a −13.70% fall, over the last year Blackstone Inc. has showed a −22.58% decrease.

We've gathered analysts' opinions on Blackstone Inc. future price: according to them, BX price has a max estimate of 215.00 USD and a min estimate of 141.00 USD. Watch BX chart and read a more detailed Blackstone Inc. stock forecast: see what analysts think of Blackstone Inc. and suggest that you do with its stocks.

BX stock is 6.39% volatile and has beta coefficient of 1.13. Track Blackstone Inc. stock price on the chart and check out the list of the most volatile stocks — is Blackstone Inc. there?

Today Blackstone Inc. has the market capitalization of 163.14 B, it has decreased by −5.01% over the last week.

Yes, you can track Blackstone Inc. financials in yearly and quarterly reports right on TradingView.

Blackstone Inc. is going to release the next earnings report on Apr 16, 2026. Keep track of upcoming events with our Earnings Calendar.

BX earnings for the last quarter are 1.75 USD per share, whereas the estimation was 1.54 USD resulting in a 13.93% surprise. The estimated earnings for the next quarter are 1.38 USD per share. See more details about Blackstone Inc. earnings.

Blackstone Inc. revenue for the last quarter amounts to 3.94 B USD, despite the estimated figure of 3.68 B USD. In the next quarter, revenue is expected to reach 3.51 B USD.

BX net income for the last quarter is 1.02 B USD, while the quarter before that showed 624.92 M USD of net income which accounts for 62.45% change. Track more Blackstone Inc. financial stats to get the full picture.

Yes, BX dividends are paid quarterly. The last dividend per share was 1.29 USD. As of today, Dividend Yield (TTM)% is 3.50%. Tracking Blackstone Inc. dividends might help you take more informed decisions.

Blackstone Inc. dividend yield was 3.04% in 2025, and payout ratio reached 121.20%. The year before the numbers were 2.00% and 95.26% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Blackstone Inc. EBITDA is 7.67 B USD, and current EBITDA margin is 53.16%. See more stats in Blackstone Inc. financial statements.

Like other stocks, BX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Blackstone Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Blackstone Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Blackstone Inc. stock shows the neutral signal. See more of Blackstone Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.