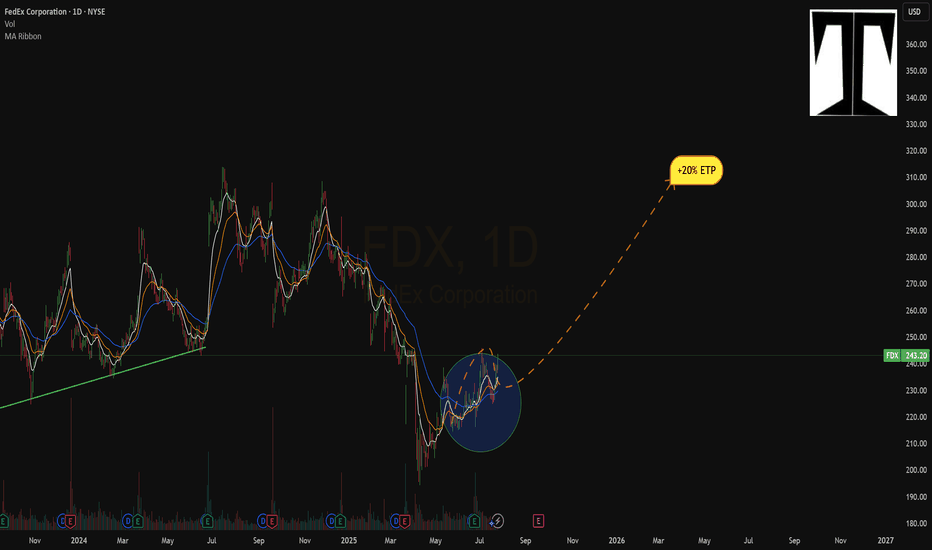

Fedex Fake OutSo Fedex just had earnings @ market close.

And as you can see, earnings were good...?

But if you zoom out and look in history. you will see that...

Every time Fedex had earnings, it would pump into resistance

and reject just as sharply.

Is this a coincidence? I cant say... but this is somethin

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

18.21 USD

4.09 B USD

87.93 B USD

215.12 M

About FedEx Corporation

Sector

Industry

CEO

Rajesh Subramaniam

Website

Headquarters

Memphis

Founded

1971

Identifiers

3

ISINUS31428X1063

FedEx Corp. is a holding company, which engages in the provision of transportation, e-commerce, business services, and business solutions. It operates through the following segments: FedEx Express, FedEx Freight, Corporate, Other, and Eliminations. The FedEx Express segment offers transportation and delivery services. The FedEx Freight segment refers to freight transportation services to business and residences. The FedEx Services segment includes sales, marketing, information technology, communications, customer service, technical support, billing and collection services, and certain back-office functions that support the company's operating segments. The Corporate, Other, and Eliminations segment is involved in the corporate headquarters costs for executive officers and certain legal and finance functions, as well as certain other costs and credits not attributed to the firm's core business. The company was founded by Frederick Wallace Smith on June 18, 1971, and is headquartered in Memphis, TN.

Related stocks

Fedex Chart Fibonacci Analysis 092425Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 232/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

Fedex Chart Fibonacci Analysis 092025Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 233/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

FedEX analysis FDX has found resistance 🚧 at the trendline

From here, price may look to tap into the fair value gap highlighted in purple as the next logical target area.

🎯 Conclusion: Bias is cautiously bullish — I expect FedEx could push into the fair value gap on its next leg higher. This view is based on te

$FDX Bullish CaseFedEx is sitting right on long-term channel support around $220 with RSI neutral, giving a favorable risk/reward setup. On the fundamental side, global trade volumes are recovering, e-commerce tailwinds remain intact, and management’s DRIVE program is cutting billions in costs through automation + A

9/9/25 - $fdx - my canary, but watching only9/9/25 :: VROCKSTAR :: NYSE:FDX

my canary, but watching only

- updated my thinking on NYSE:UPS following such an anti-stellar YTD performance

- the google trends reflect the reality that mgmt (of all these co's) has been saying

- in a lot of ways NYSE:FDX 's mgn profile and non-amzn affected b

FedexThe monthly is looking like it may go failed 2, and the weekly is setting up for a 3-2-2 reversal back to the top. This has a high probability since the 2-down retraced 50% of the last three bars. In a perfect scenario, 229 calls expiring this Friday would work, but to give the move more time to dev

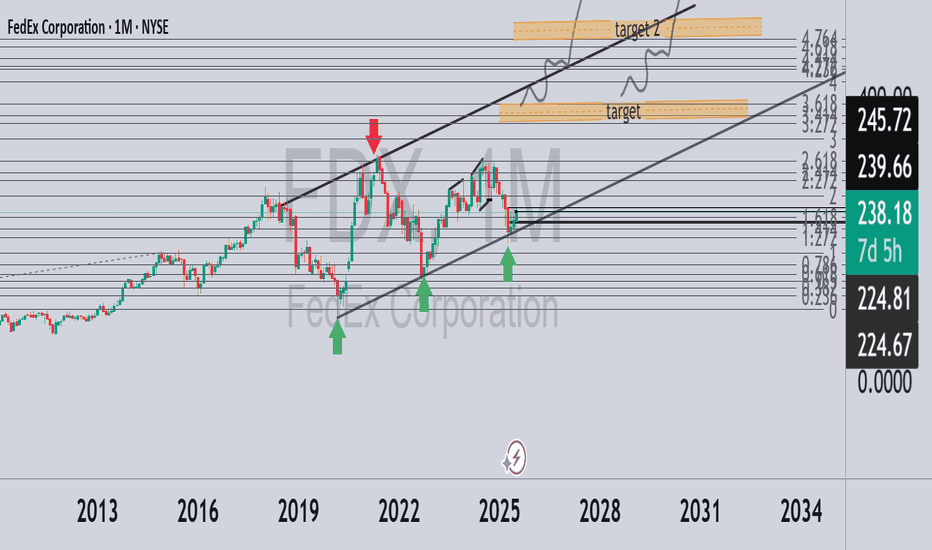

FedEx - Is the recovery process here yet? FDX The monthly chart of FedEx (symbol: FDX) shows a classic ascending channel pattern, with the price touching the bottom of the channel several times and finding support (green arrows), and on the other hand stopping several times at the upper resistance line (red arrow).

In July, we received a stron

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US31428XBD7

FedEx Corporation 4.5% 01-FEB-2065Yield to maturity

7.29%

Maturity date

Feb 1, 2065

US31428XBN5

FedEx Corporation 4.4% 15-JAN-2047Yield to maturity

6.33%

Maturity date

Jan 15, 2047

FDX.GD

Federal Express Corporation 7.6% 01-JUL-2097Yield to maturity

6.33%

Maturity date

Jul 1, 2097

FDX6083334

FedEx Corporation 4.05% 15-FEB-2048Yield to maturity

6.32%

Maturity date

Feb 15, 2048

US31428XBG0

FedEx Corporation 4.55% 01-APR-2046Yield to maturity

6.31%

Maturity date

Apr 1, 2046

FDXD

FedEx Corporation 4.1% 01-FEB-2045Yield to maturity

6.23%

Maturity date

Feb 1, 2045

FDX6237489

FedEx Corporation 4.5% 01-FEB-2065Yield to maturity

6.22%

Maturity date

Feb 1, 2065

FDX4739441

FedEx Corporation 4.95% 17-OCT-2048Yield to maturity

6.18%

Maturity date

Oct 17, 2048

US31428XBQ8

FedEx Corporation 4.05% 15-FEB-2048Yield to maturity

6.16%

Maturity date

Feb 15, 2048

US31428XBE5

FedEx Corporation 4.75% 15-NOV-2045Yield to maturity

6.14%

Maturity date

Nov 15, 2045

FDX3992903

FedEx Corporation 4.1% 15-APR-2043Yield to maturity

6.11%

Maturity date

Apr 15, 2043

See all FDX bonds

Curated watchlists where FDX is featured.

Frequently Asked Questions

The current price of FDX is 293.13 USD — it has increased by 1.48% in the past 24 hours. Watch FedEx Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange FedEx Corporation stocks are traded under the ticker FDX.

FDX stock has fallen by −0.74% compared to the previous week, the month change is a 8.21% rise, over the last year FedEx Corporation has showed a 4.12% increase.

We've gathered analysts' opinions on FedEx Corporation future price: according to them, FDX price has a max estimate of 360.00 USD and a min estimate of 210.00 USD. Watch FDX chart and read a more detailed FedEx Corporation stock forecast: see what analysts think of FedEx Corporation and suggest that you do with its stocks.

FDX stock is 1.96% volatile and has beta coefficient of 1.07. Track FedEx Corporation stock price on the chart and check out the list of the most volatile stocks — is FedEx Corporation there?

Today FedEx Corporation has the market capitalization of 68.92 B, it has decreased by −0.90% over the last week.

Yes, you can track FedEx Corporation financials in yearly and quarterly reports right on TradingView.

FedEx Corporation is going to release the next earnings report on Mar 19, 2026. Keep track of upcoming events with our Earnings Calendar.

FDX earnings for the last quarter are 4.82 USD per share, whereas the estimation was 4.12 USD resulting in a 17.09% surprise. The estimated earnings for the next quarter are 4.02 USD per share. See more details about FedEx Corporation earnings.

FedEx Corporation revenue for the last quarter amounts to 23.50 B USD, despite the estimated figure of 22.78 B USD. In the next quarter, revenue is expected to reach 23.35 B USD.

FDX net income for the last quarter is 955.00 M USD, while the quarter before that showed 823.00 M USD of net income which accounts for 16.04% change. Track more FedEx Corporation financial stats to get the full picture.

Yes, FDX dividends are paid quarterly. The last dividend per share was 1.45 USD. As of today, Dividend Yield (TTM)% is 1.95%. Tracking FedEx Corporation dividends might help you take more informed decisions.

FedEx Corporation dividend yield was 2.53% in 2024, and payout ratio reached 32.82%. The year before the numbers were 1.98% and 29.25% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jan 4, 2026, the company has 300 K employees. See our rating of the largest employees — is FedEx Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. FedEx Corporation EBITDA is 10.66 B USD, and current EBITDA margin is 11.77%. See more stats in FedEx Corporation financial statements.

Like other stocks, FDX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FedEx Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FedEx Corporation technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FedEx Corporation stock shows the strong buy signal. See more of FedEx Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.