Amd - This stock is just crashing!🎯Amd ( NASDAQ:AMD ) is clearly heading lower:

🔎Analysis summary:

After we witnessed a major bullish break and retest in April of 2025, Amd rallied about +150%. But with the recent rejection at the major resistance trendline, Amd is now reversing. Following this bearish market structure, Amd c

Advanced Micro Devices, Inc.

No trades

Key facts today

AMD has partnered with OpenAI to create next-gen MI400 chips, aiming to deploy them this year. This deal could bring in billions in revenue for AMD.

AMD shares rose 0.4% to $221.91 in premarket trading after unveiling new processors at CES, following a 1.1% drop to $221.08 on Monday. Chip makers showed positive activity.

At CES, AMD CEO Lisa Su introduced the MI440X, part of the MI400 AI hardware series, featuring 8 GPUs for enterprise AI. The MI455 processors are also being sold to firms like OpenAI.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.74 EUR

1.59 B EUR

24.91 B EUR

1.62 B

About Advanced Micro Devices Inc

Sector

Industry

CEO

Lisa T. Su

Website

Headquarters

Santa Clara

Founded

1969

Identifiers

3

ISIN US0079031078

Advanced Micro Devices, Inc. engages in the provision of semiconductor businesses. It operates through the following segments: Data Center, Client, Gaming, and Embedded. The Data Center segment includes server-class CPUs, GPUs, AI accelerators, DPUs, FPGAs, SmartNICs, and Adaptive SoC products. The Client segment refers to the computing platforms, which are a collection of technologies that are designed to work together to provide a more complete computing solution. The Gaming segment is a fundamental component across many products and can be found in APU, GPU, SoC or a combination of a discrete GPU with another product working in tandem. The Embedded segment focuses on the embedded CPUs, GPUs, APUs, FPGAs, and Adaptive SoC products. The company was founded by W. J. Sanders III on May 1, 1969 and is headquartered in Santa Clara, CA.

Related stocks

Amd - This correction is not over yet!🤬Amd ( NASDAQ:AMD ) can still drop another -30%:

🔎Analysis summary:

2025 has been an incredible - yet expected - year for Amd. And now, Amd is literally just perfectly rejecting the overall resistance trendline. Looking at higher timeframe structure, Amd is still not done with the drop and ca

Bullish Break Above FractalFriday's gap up and break above the fractal should propel the stock higher, with the Fibonacci Extension applied the next TP is $231 at the 1.00 ext level. If it breaks that, the next fib ext level at the 1.618 is $245. The Feb monthly expected move from the option chain is $30.30 according to Tast

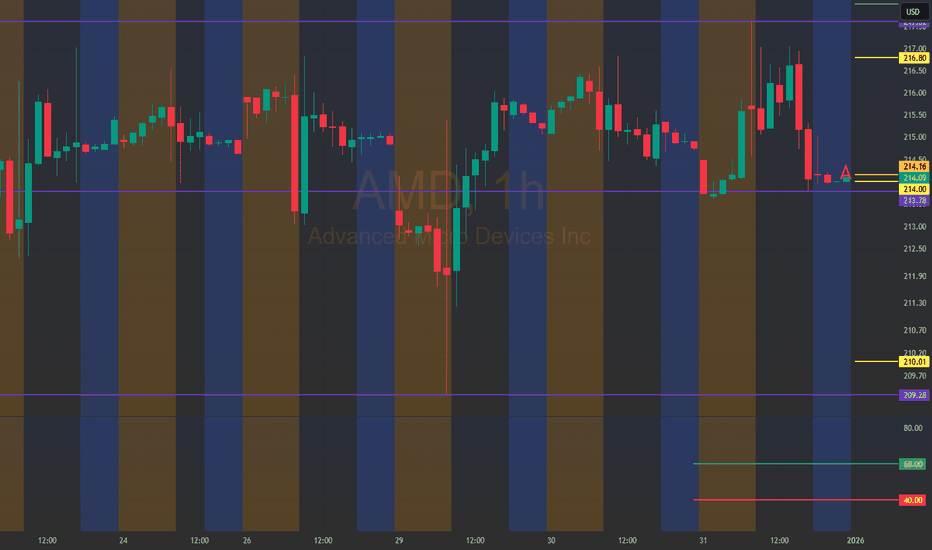

Hello trader, for tomorrow, New Year's Day, AMD: 214.16, www.tradingview.com

maintaining an upward trend.

In case of an opening in the closing price zone, we could take a quick bullish trade, possibly up to 216.00, a resistance zone.

In case of a breakout, the next upward continuation price would be 218.00.

Otherwise, our bearish entry would be below 2

ello trader, this is part #2 and the result for AMD: 212.56www.tradingview.com

In the first part #1, we said that in case of an opening in the closing price zone, we could take a quick bullish trade, possibly up to 216.00, a resistance zone.

In case of a breakout, the next upward continuation price would be 218.00. One thing I forgot to mention was the p

Hello trader, this was the result with AMD: 215.34www.tradingview.com

Remember the first part #1 where I outlined the entry points, explaining that the 214.00 zone is a technical price level that the stock could use as a support level for a bounce.

Unlike the bearish entry below 214.00, the entry was planned below 212.00, but currently, the pric

Hello trader, for tomorrow, 12/24/25, AMD: 214.90www.tradingview.com

The market has been very choppy and volatile these past few days. It's time to trade with caution, taking quick profits.

Remember that the market opening revolves around the closing price and its technical price of 214.00. Our bullish entry is above 214.00, with a possible exi

Hello trader, AMD: 214.95www.tradingview.com

Below are the marked prices or lines; this is just to give you a better understanding of the price levels.

The stock's opening price is around the closing price and its technical price (214.00)

A quick bullish entry would be at 214.00, targeting 220.00, but if it breaks 220.00

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMD5426832

Advanced Micro Devices, Inc. 4.393% 01-JUN-2052Yield to maturity

5.48%

Maturity date

Jun 1, 2052

AMD5426831

Advanced Micro Devices, Inc. 3.924% 01-JUN-2032Yield to maturity

4.23%

Maturity date

Jun 1, 2032

AMD6026360

Advanced Micro Devices, Inc. 4.319% 24-MAR-2028Yield to maturity

3.75%

Maturity date

Mar 24, 2028

AMD6026359

Advanced Micro Devices, Inc. 4.212% 24-SEP-2026Yield to maturity

3.74%

Maturity date

Sep 24, 2026

See all AMD bonds

Curated watchlists where AMD is featured.

Frequently Asked Questions

The current price of AMD is 189.76 EUR — it has decreased by −1.09% in the past 24 hours. Watch Advanced Micro Devices, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange Advanced Micro Devices, Inc. stocks are traded under the ticker AMD.

AMD stock has risen by 3.53% compared to the previous week, the month change is a 1.52% rise, over the last year Advanced Micro Devices, Inc. has showed a 53.13% increase.

We've gathered analysts' opinions on Advanced Micro Devices, Inc. future price: according to them, AMD price has a max estimate of 324.23 EUR and a min estimate of 170.65 EUR. Watch AMD chart and read a more detailed Advanced Micro Devices, Inc. stock forecast: see what analysts think of Advanced Micro Devices, Inc. and suggest that you do with its stocks.

AMD stock is 1.25% volatile and has beta coefficient of 1.64. Track Advanced Micro Devices, Inc. stock price on the chart and check out the list of the most volatile stocks — is Advanced Micro Devices, Inc. there?

Today Advanced Micro Devices, Inc. has the market capitalization of 310.43 B, it has decreased by −4.48% over the last week.

Yes, you can track Advanced Micro Devices, Inc. financials in yearly and quarterly reports right on TradingView.

Advanced Micro Devices, Inc. is going to release the next earnings report on Feb 3, 2026. Keep track of upcoming events with our Earnings Calendar.

AMD earnings for the last quarter are 1.02 EUR per share, whereas the estimation was 1.00 EUR resulting in a 2.40% surprise. The estimated earnings for the next quarter are 1.12 EUR per share. See more details about Advanced Micro Devices, Inc. earnings.

Advanced Micro Devices, Inc. revenue for the last quarter amounts to 7.88 B EUR, despite the estimated figure of 7.46 B EUR. In the next quarter, revenue is expected to reach 8.20 B EUR.

AMD net income for the last quarter is 1.06 B EUR, while the quarter before that showed 740.24 M EUR of net income which accounts for 43.10% change. Track more Advanced Micro Devices, Inc. financial stats to get the full picture.

No, AMD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jan 6, 2026, the company has 28 K employees. See our rating of the largest employees — is Advanced Micro Devices, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Advanced Micro Devices, Inc. EBITDA is 5.18 B EUR, and current EBITDA margin is 20.11%. See more stats in Advanced Micro Devices, Inc. financial statements.

Like other stocks, AMD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Advanced Micro Devices, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Advanced Micro Devices, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Advanced Micro Devices, Inc. stock shows the strong buy signal. See more of Advanced Micro Devices, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.