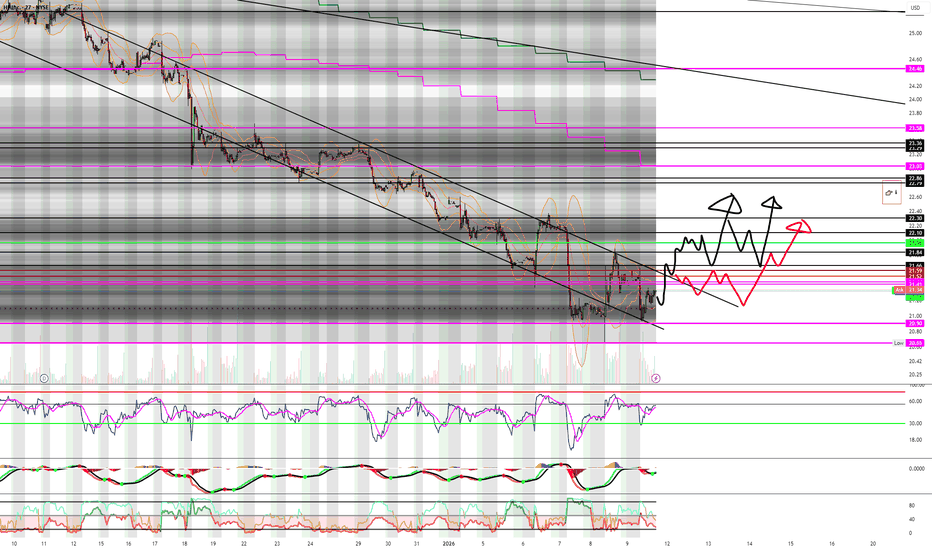

Bottoming. HP is next up ngl...My biggest edge on this one that backs my short term outlook is the fact that the POC on the volume profile inficator and also largest area of volume (Thats what a POC is) is located at this bottom that we hit within the last few trading days.

Targets next week are $21.5 and $22.

Other indicator i

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.68 USD

2.53 B USD

55.33 B USD

915.24 M

About HP Inc.

Sector

Industry

CEO

Bruce Dale Broussard

Website

Headquarters

Palo Alto

Founded

1939

IPO date

Mar 17, 1961

Identifiers

3

ISIN US40434L1052

HP Inc. is an information technology company, which engages in the provision of personal computing and other access devices, imaging and printing products, and related technologies, solutions, and services. It operates through the following segments: Personal Systems, Printing, and Corporate Investments. The Personal Systems segment offers commercial and consumer desktop and notebook personal computers, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories, software, support, and services for the commercial and consumer markets. The Printing segment provides consumer and commercial printer hardware, supplies, solutions and services, and scanning devices. The Corporate Investments segment includes HP Labs and certain business incubation projects. The company was founded by William R. Hewlett and David Packard in 1939 and is headquartered in Palo Alto, CA.

Related stocks

HPQ could make a big move from here! OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

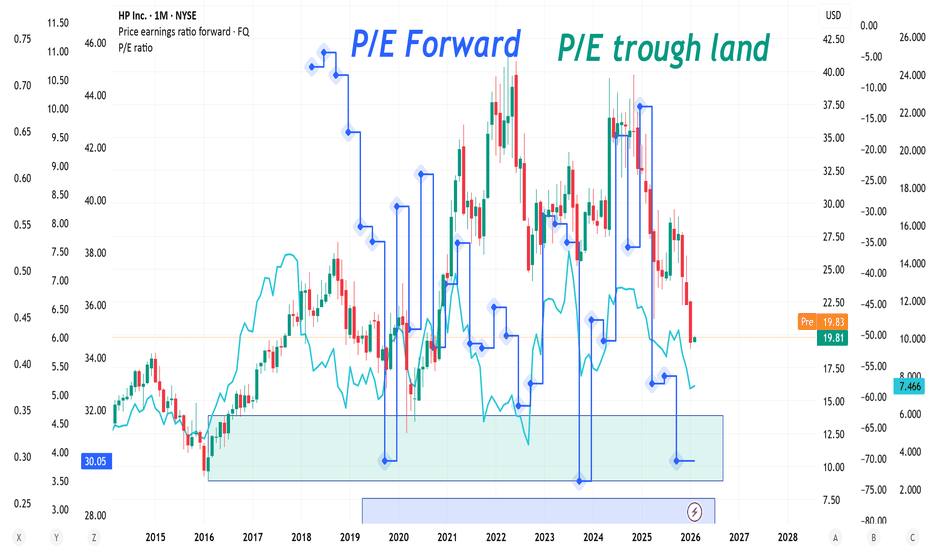

HP Heading for trough lands! Tech Vs Fund ! Which it's gunna B!Thread for HP...

The Price-to-Earnings (P/E) ratio is a key valuation metric, calculated as \(\text{Stock\ Price}\div \text{Earnings\ Per\ Share\ (EPS)}\), that measures how much investors pay for a company's earnings. It helps determine if a stock is overvalued (high P/E) or undervalued (low P/E)

HPQ: Strategy Shift — Selling Time, Not Direction (2/5/2026)Today’s price action in HPQ reinforces an important distinction I’m making in this market:

This is a premium-harvesting environment, not a conviction LEAPS environment — yet.

Rather than forcing a directional trade, I’m separating short-term income from long-term positioning and letting price earn

HPQ | Wrong Memories, Right Support & P/E IS DANG LOWNYSE:HPQ

Remember the good ol' days?

Cornucopias on your tightie whities label...

Beren stein Bears...

A shiny new HP desktop delivered in a cow-patterned box...

WRONGGGGGGGGGGGGGGG

There never was a cornucopia on your fruit of the loom undies.

It is and always was the Beren STAIN Bears.

It

HP (HPQ) recent selloff shows potential longHello. This is a Macro analysis on HP Inc. (HPQ). I will discuss Technical developments indicating oversold conditions from its recent DECLINE in price. Aim of this is educational in purpose.

I will use price action, candlestick patterns, indicators and more to bring up the idea that there is poten

HPQ HP Options Ahead of EarningsIf you haven`t sold HPQ before the previous earnings:

Now analyzing the options chain and the chart patterns of HPQ HP prior to the earnings report this week,

I would consider purchasing the 23usd strike price Puts with

an expiration date of 2025-12-19,

for a premium of approximately $0.74.

If the

HPQ – Earnings Setup for 25 Nov Hello Everyone and Followers,

This is the last one from my side for this week and i will try to update my posting next week.

HPQ will release their report on Tuesday as well.

HPQ has been under heavy selling pressure ahead of earnings, dropping into the 23.96 area after breaking several major tre

HPQ Wave Analysis – 18 November 2025

- HPQ broke support level 23.50

- Likely to fall to support level 21.20

HPQ recently broke the support level 23.50 (former monthly low from June, which stopped wave (B) of the previous long-term ABC correction 2 from April).

The breakout of the support level 23.50 accelerated the active impulse

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

HPQ5198772

HP Inc. 1.45% 17-JUN-2026Yield to maturity

7.45%

Maturity date

Jun 17, 2026

HPQ5198795

HP Inc. 2.65% 17-JUN-2031Yield to maturity

6.61%

Maturity date

Jun 17, 2031

US428236BR31

HP Inc. 6.0% 15-SEP-2041Yield to maturity

6.00%

Maturity date

Sep 15, 2041

HPQ6054240

HP Inc. 6.1% 25-APR-2035Yield to maturity

5.21%

Maturity date

Apr 25, 2035

US40434LAN5

HP Inc. 5.5% 15-JAN-2033Yield to maturity

5.03%

Maturity date

Jan 15, 2033

HPQ5343666

HP Inc. 2.65% 17-JUN-2031Yield to maturity

4.65%

Maturity date

Jun 17, 2031

HPQ5389716

HP Inc. 4.2% 15-APR-2032Yield to maturity

4.43%

Maturity date

Apr 15, 2032

HPQ6054241

HP Inc. 5.4% 25-APR-2030Yield to maturity

4.40%

Maturity date

Apr 25, 2030

US40434LAC9

HP Inc. 3.4% 17-JUN-2030Yield to maturity

4.36%

Maturity date

Jun 17, 2030

HPQ5343667

HP Inc. 1.45% 17-JUN-2026Yield to maturity

4.19%

Maturity date

Jun 17, 2026

HPQ5389285

HP Inc. 4.0% 15-APR-2029Yield to maturity

4.17%

Maturity date

Apr 15, 2029

See all HPQ bonds

Frequently Asked Questions

The current price of HPQ is 19.26 USD — it has increased by 2.07% in the past 24 hours. Watch HP Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange HP Inc. stocks are traded under the ticker HPQ.

HPQ stock has risen by 0.63% compared to the previous week, the month change is a −8.33% fall, over the last year HP Inc. has showed a −41.81% decrease.

We've gathered analysts' opinions on HP Inc. future price: according to them, HPQ price has a max estimate of 30.00 USD and a min estimate of 18.00 USD. Watch HPQ chart and read a more detailed HP Inc. stock forecast: see what analysts think of HP Inc. and suggest that you do with its stocks.

HPQ stock is 4.56% volatile and has beta coefficient of 1.50. Track HP Inc. stock price on the chart and check out the list of the most volatile stocks — is HP Inc. there?

Today HP Inc. has the market capitalization of 17.68 B, it has increased by 2.26% over the last week.

Yes, you can track HP Inc. financials in yearly and quarterly reports right on TradingView.

HP Inc. is going to release the next earnings report on Feb 24, 2026. Keep track of upcoming events with our Earnings Calendar.

HPQ earnings for the last quarter are 0.93 USD per share, whereas the estimation was 0.92 USD resulting in a 0.98% surprise. The estimated earnings for the next quarter are 0.76 USD per share. See more details about HP Inc. earnings.

HP Inc. revenue for the last quarter amounts to 14.64 B USD, despite the estimated figure of 14.50 B USD. In the next quarter, revenue is expected to reach 13.87 B USD.

HPQ net income for the last quarter is 795.00 M USD, while the quarter before that showed 763.00 M USD of net income which accounts for 4.19% change. Track more HP Inc. financial stats to get the full picture.

Yes, HPQ dividends are paid quarterly. The last dividend per share was 0.30 USD. As of today, Dividend Yield (TTM)% is 6.07%. Tracking HP Inc. dividends might help you take more informed decisions.

HP Inc. dividend yield was 4.18% in 2025, and payout ratio reached 43.62%. The year before the numbers were 3.10% and 39.29% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 16, 2026, the company has 55 K employees. See our rating of the largest employees — is HP Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HP Inc. EBITDA is 4.75 B USD, and current EBITDA margin is 8.41%. See more stats in HP Inc. financial statements.

Like other stocks, HPQ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HP Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HP Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HP Inc. stock shows the sell signal. See more of HP Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.