LIVE Trading on Lam Research (LRCX)LIVE Trading on Lam Research (LRCX)

Price is currently positioned at the lower boundary of its valid channel, while at the same time two valid divergences are present on the MACD and RSI. In addition, all the specific conditions of one of my personal trading systems have been met.

Follow proper r

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.90 USD

5.36 B USD

18.44 B USD

1.24 B

About Lam Research Corporation

Sector

Industry

CEO

Timothy M. Archer

Website

Headquarters

Fremont

Founded

1980

IPO date

May 11, 1984

Identifiers

3

ISIN US5128073062

Lam Research Corp. engages in the design, manufacture, marketing, refurbishment, and provision of semiconductor processing equipment used in the fabrication of integrated circuits. It operates through the following geographical segments: United States, China, Europe, Japan, Korea, Southeast Asia and Taiwan. The company was founded by David K. Lam in 1980 and is headquartered in Fremont, CA.

Related stocks

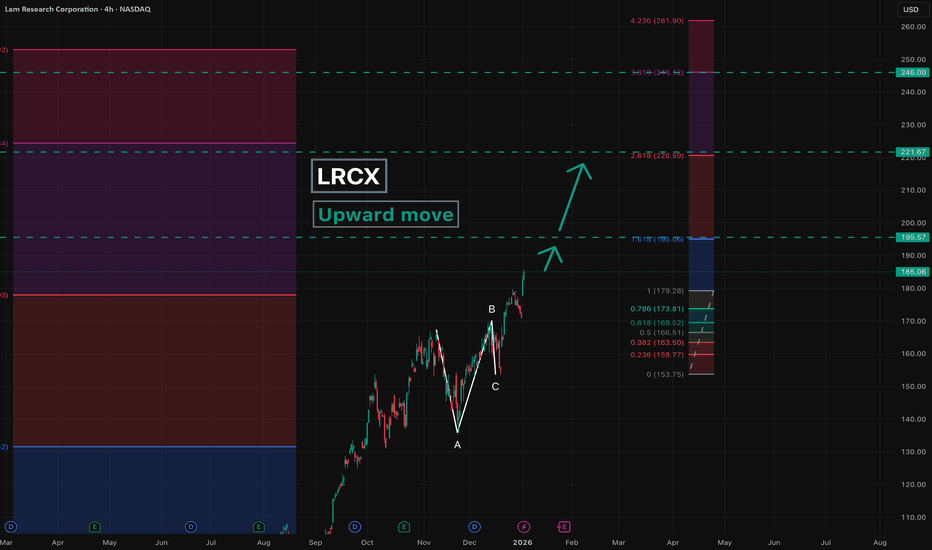

Lam Research - Upward MoveLam Research has completed corrective wave 4 and has started moving higher.

Sub-waves 1 and 2 are complete, and we are now continuing within sub-wave 3 .

Potential targets:

195 -> 221 -> 246

---

Please subscribe and leave a comment.

You’ll get new information faster than anyone else.

LRCX Sustained Uptrend Backed by Strong FundamentalsLam Research (LRCX) is experiencing renewed buying pressure as the stock maintains a well-defined uptrend, characterized by higher highs and higher lows while trading above its key moving averages—confirming strong bullish momentum.

Lam Research Corp. is a $299.51bn market-capitalization company sp

LRCX heads up at $162.99: Golden Genesis fib should give a DIP This is a followup to my previous long call below.

LRCX got a boost from the last Earnings report.

It has just hit a Golden Genesis fib at $162.99

Look for a Break-n-Retest or a Dip-to-Fib to buy.

.

Last Plot that gave a PERFECT LONG:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts

LRCX / USD 1D — Bullish Continuation With Structured Pullback Lam Research has transitioned into a renewed bullish phase, confirmed by a bullish short-term average crossover and multiple upside target interactions. Price is currently holding above the short-term mean, signaling trend acceptance following the recent expansion.

The broader structure reflects tr

Liquidity Grab. Puts are ValidMarket Context **

Price pushed aggressively into a well-known high where retail traders expect continuation. That level is crowded with buy stops and breakout entries.

**1 – Core Insight **

This move is not strength—it’s a liquidity grab designed to fuel smart money shorts.

**3 – Supporting

Check for support near 159.51-161.01

Hello, fellow traders!

Follow me to get the latest information quickly.

Have a great day.

-------------------------------------

(LRCX 1D Chart)

If LRCX finds support near the 159.51-161.01 level and rises, it is expected to rise to around the Fibonacci level of 2.618 (197.94).

Since the curren

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

LRCX4983309

Lam Research Corporation 3.125% 15-JUN-2060Yield to maturity

5.60%

Maturity date

Jun 15, 2060

LRCX4983308

Lam Research Corporation 2.875% 15-JUN-2050Yield to maturity

5.43%

Maturity date

Jun 15, 2050

LRCX4803606

Lam Research Corporation 4.875% 15-MAR-2049Yield to maturity

5.42%

Maturity date

Mar 15, 2049

LRCX4803602

Lam Research Corporation 3.75% 15-MAR-2026Yield to maturity

4.17%

Maturity date

Mar 15, 2026

LRCX4983304

Lam Research Corporation 1.9% 15-JUN-2030Yield to maturity

4.01%

Maturity date

Jun 15, 2030

US512807AU2

Lam Research Corporation 4.0% 15-MAR-2029Yield to maturity

3.95%

Maturity date

Mar 15, 2029

See all LRCX bonds

Frequently Asked Questions

The current price of LRCX is 235.53 USD — it has increased by 1.83% in the past 24 hours. Watch Lam Research Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Lam Research Corporation stocks are traded under the ticker LRCX.

LRCX stock has risen by 6.73% compared to the previous week, the month change is a 11.56% rise, over the last year Lam Research Corporation has showed a 188.73% increase.

We've gathered analysts' opinions on Lam Research Corporation future price: according to them, LRCX price has a max estimate of 325.00 USD and a min estimate of 221.00 USD. Watch LRCX chart and read a more detailed Lam Research Corporation stock forecast: see what analysts think of Lam Research Corporation and suggest that you do with its stocks.

LRCX reached its all-time high on Jan 30, 2026 with the price of 251.87 USD, and its all-time low was 0.07 USD and was reached on Aug 23, 1990. View more price dynamics on LRCX chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LRCX stock is 4.92% volatile and has beta coefficient of 2.05. Track Lam Research Corporation stock price on the chart and check out the list of the most volatile stocks — is Lam Research Corporation there?

Today Lam Research Corporation has the market capitalization of 294.12 B, it has decreased by −0.36% over the last week.

Yes, you can track Lam Research Corporation financials in yearly and quarterly reports right on TradingView.

Lam Research Corporation is going to release the next earnings report on Apr 29, 2026. Keep track of upcoming events with our Earnings Calendar.

LRCX earnings for the last quarter are 1.27 USD per share, whereas the estimation was 1.17 USD resulting in a 8.48% surprise. The estimated earnings for the next quarter are 1.35 USD per share. See more details about Lam Research Corporation earnings.

Lam Research Corporation revenue for the last quarter amounts to 5.34 B USD, despite the estimated figure of 5.23 B USD. In the next quarter, revenue is expected to reach 5.70 B USD.

LRCX net income for the last quarter is 1.59 B USD, while the quarter before that showed 1.57 B USD of net income which accounts for 1.62% change. Track more Lam Research Corporation financial stats to get the full picture.

Yes, LRCX dividends are paid quarterly. The last dividend per share was 0.26 USD. As of today, Dividend Yield (TTM)% is 0.42%. Tracking Lam Research Corporation dividends might help you take more informed decisions.

Lam Research Corporation dividend yield was 0.95% in 2025, and payout ratio reached 22.15%. The year before the numbers were 0.75% and 27.59% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 19 K employees. See our rating of the largest employees — is Lam Research Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Lam Research Corporation EBITDA is 7.34 B USD, and current EBITDA margin is 34.10%. See more stats in Lam Research Corporation financial statements.

Like other stocks, LRCX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Lam Research Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Lam Research Corporation technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Lam Research Corporation stock shows the strong buy signal. See more of Lam Research Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.