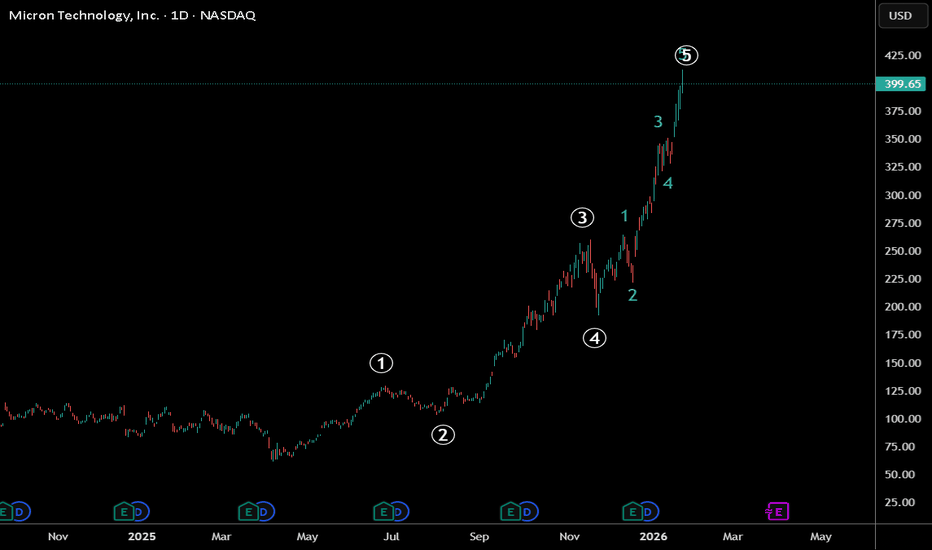

Micron Technology - Here comes the ultimate reversal!🥊Micron Technology ( NASDAQ:MU ) is soon collpasing:

🔎Analysis summary:

Micron Technology is clearly retesting a major resistance trendline. We can also see that Micron Technology is somewhat overextended and ready for a healthy correction. All it needs now is bearish confirmation and we coul

Key facts today

Micron Technology's shares fell about 2% after Samsung announced early mass production of HBM4 chips for Nvidia's AI accelerator, potentially affecting Micron's market position.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.62 USD

8.54 B USD

37.38 B USD

1.12 B

About Micron Technology, Inc.

Sector

Industry

CEO

Sanjay Mehrotra

Website

Headquarters

Boise

Founded

1978

IPO date

Jun 1, 1984

Identifiers

3

ISIN US5951121038

Micron Technology, Inc. engages in the provision of innovative memory and storage solutions. It operates through the following segments: Compute and Networking Business Unit (CNBU), Mobile Business Unit (MBU), Embedded Business Unit (EBU), and Storage Business Unit (SBU). The CNBU segment includes memory products and solutions sold into client, cloud server, enterprise, graphics, and networking markets. The MBU segment is involved in memory and storage products sold into smartphone and other mobile-device markets. The EBU segment focuses on memory and storage products sold into automotive, industrial, and consumer Markets. The SBU segment consists of SSDs and component-level solutions sold into enterprise and cloud, client, and consumer storage markets. The company was founded by Ward D. Parkinson, Joseph Leon Parkinson, Dennis Wilson, and Doug Pitman on October 5, 1978 and is headquartered in Boise, ID.

Related stocks

Live Trade on Micron Technology (MU)The price is currently at the bottom of its channel and meets all the conditions of one of our trading systems for a buy setup.

Follow proper risk and money management.

This is just my personal view, so please trade based on your own strategy and trading system.

Follow me on TradingView for mor

MU — Time for a CorrectionFollowing our previous idea:

We have been rising for a long time, and it appears that it is time for a correction.

Let’s define the initial targets for the first corrective move.

Key targets:

376 — local correction

346

327

The potential move from the current level is 16–20%.

Micron Technology (MU) – Pullback Within a Primary UptrendMU is currently finding near-term demand around its 20-day moving average following a pullback within a well-established uptrend. While the broader trend remains constructive, additional buying interest would help confirm continuation. Some caution is warranted, however, as the S&P 500 recently clos

Smart Money Is Accumulating — MU Breakout Loading⚡ MU Swing Trade — AI Momentum Building

Signal: BULLISH

Conviction: Moderate

Alpha Score: 72

Horizon: 1–4 Weeks

🎯 Trade Setup

Instrument: $380 CALL (Mar 7, 2026)

Entry: $8.50 – $10.50

Target 1: $15.00 (+50%)

Target 2: $22.00 (+125%)

Stop Loss: $5.50 (-40%)

R:R: 1:3.2

🧠 Thesis

AI memory dem

MICRON (MU) — EXTENDED CLIMAX, POTENTIAL RETRACEMENT📌 MICRON (MU) — EXTENDED CLIMAX, POTENTIAL CORRECTION MAP, AND FUTURE BUY ZONES

Timeframe: 1D

Current Price Context: MU is trading in a highly extended region after an aggressive multi-month rally, pushing into a major premium zone while showing signs of exhaustion.

🔺 1. Price is Extremely Overbou

MU GEX - Potential Call Gamma Squeeze🔶 MU — Call Resistance at 400 Becomes the Decision Point 🔶

MU continued higher last week and tagged the 400 level , which now stands out as the largest call resistance on the board.

That level matters.

🔶 Structural Context 🔶

Price has reached a key call wall at 400 🟢

Momentum rema

MU Institutional Divergence: Weekly Put OpportunityMU QuantSignals V4 Weekly 2026-02-09

⚡ QS V4 ELITE: MU Weekly Put Setup

System Status: TREND CONFIRMED

Signal: PUTS

Conviction: MODERATE

Alpha Score: 62 (Quant Synthesis)

Horizon: Weekly (Exp: Feb 13, 2026)

Core Thesis:

MU is showing a clear bearish divergence despite bullish semiconductor h

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MU5283110

Micron Technology, Inc. 3.477% 01-NOV-2051Yield to maturity

5.57%

Maturity date

Nov 1, 2051

MU5283109

Micron Technology, Inc. 3.366% 01-NOV-2041Yield to maturity

5.50%

Maturity date

Nov 1, 2041

MU6062157

Micron Technology, Inc. 6.05% 01-NOV-2035Yield to maturity

5.10%

Maturity date

Nov 1, 2035

MU5980483

Micron Technology, Inc. 5.8% 15-JAN-2035Yield to maturity

4.97%

Maturity date

Jan 15, 2035

MU5568332

Micron Technology, Inc. 5.875% 15-SEP-2033Yield to maturity

4.88%

Maturity date

Sep 15, 2033

MU5537465

Micron Technology, Inc. 5.875% 09-FEB-2033Yield to maturity

4.79%

Maturity date

Feb 9, 2033

MU6062156

Micron Technology, Inc. 5.65% 01-NOV-2032Yield to maturity

4.72%

Maturity date

Nov 1, 2032

MU5283108

Micron Technology, Inc. 2.703% 15-APR-2032Yield to maturity

4.52%

Maturity date

Apr 15, 2032

MU5732741

Micron Technology, Inc. 5.3% 15-JAN-2031Yield to maturity

4.46%

Maturity date

Jan 15, 2031

MU4858016

Micron Technology, Inc. 4.663% 15-FEB-2030Yield to maturity

4.38%

Maturity date

Feb 15, 2030

MU4795145

Micron Technology, Inc. 5.327% 06-FEB-2029Yield to maturity

4.23%

Maturity date

Feb 6, 2029

See all MU bonds

Frequently Asked Questions

The current price of MU is 375.82 USD — it has decreased by −2.84% in the past 24 hours. Watch Micron Technology, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Micron Technology, Inc. stocks are traded under the ticker MU.

MU stock has fallen by −6.96% compared to the previous week, the month change is a 15.25% rise, over the last year Micron Technology, Inc. has showed a 303.31% increase.

We've gathered analysts' opinions on Micron Technology, Inc. future price: according to them, MU price has a max estimate of 530.00 USD and a min estimate of 100.00 USD. Watch MU chart and read a more detailed Micron Technology, Inc. stock forecast: see what analysts think of Micron Technology, Inc. and suggest that you do with its stocks.

MU stock is 4.76% volatile and has beta coefficient of 2.33. Track Micron Technology, Inc. stock price on the chart and check out the list of the most volatile stocks — is Micron Technology, Inc. there?

Today Micron Technology, Inc. has the market capitalization of 431.63 B, it has increased by 9.04% over the last week.

Yes, you can track Micron Technology, Inc. financials in yearly and quarterly reports right on TradingView.

Micron Technology, Inc. is going to release the next earnings report on Apr 1, 2026. Keep track of upcoming events with our Earnings Calendar.

MU earnings for the last quarter are 4.78 USD per share, whereas the estimation was 3.96 USD resulting in a 20.67% surprise. The estimated earnings for the next quarter are 8.45 USD per share. See more details about Micron Technology, Inc. earnings.

Micron Technology, Inc. revenue for the last quarter amounts to 13.64 B USD, despite the estimated figure of 12.91 B USD. In the next quarter, revenue is expected to reach 18.65 B USD.

MU net income for the last quarter is 5.24 B USD, while the quarter before that showed 3.20 B USD of net income which accounts for 63.70% change. Track more Micron Technology, Inc. financial stats to get the full picture.

Yes, MU dividends are paid quarterly. The last dividend per share was 0.12 USD. As of today, Dividend Yield (TTM)% is 0.12%. Tracking Micron Technology, Inc. dividends might help you take more informed decisions.

Micron Technology, Inc. dividend yield was 0.38% in 2025, and payout ratio reached 6.06%. The year before the numbers were 0.48% and 66.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 10, 2026, the company has 53 K employees. See our rating of the largest employees — is Micron Technology, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Micron Technology, Inc. EBITDA is 22.46 B USD, and current EBITDA margin is 49.13%. See more stats in Micron Technology, Inc. financial statements.

Like other stocks, MU shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Micron Technology, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Micron Technology, Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Micron Technology, Inc. stock shows the buy signal. See more of Micron Technology, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.