Next report date

Report period

H1 2024

EPS estimate

0.16USD

Revenue estimate

240.26 MUSD

0.31USD

253.52 MUSD

463.77 MUSD

780.88 M

About RIGHTMOVE ORD GBP0.001

Sector

Industry

CEO

Dag Erik Johan Svanstrom

Website

Headquarters

Milton Keynes

Founded

2007

ISIN

GB00BGDT3G23

FIGI

BBG000Q0XY72

Rightmove Plc is engaged in the operation of property search platform. It operates through the following segments: Agency, New Homes, and Others. The Agency segment consists of resale and lettings property advertising services. The New Homes segment is focused on providing the property advertising services to new home developers and housing associations. The Others segment is involved in the overseas and commercial property advertising services and non-property advertising services. The company was founded by Reginald Stephen Shipperley on May 16, 2000 and is headquartered in London, the United Kingdom.

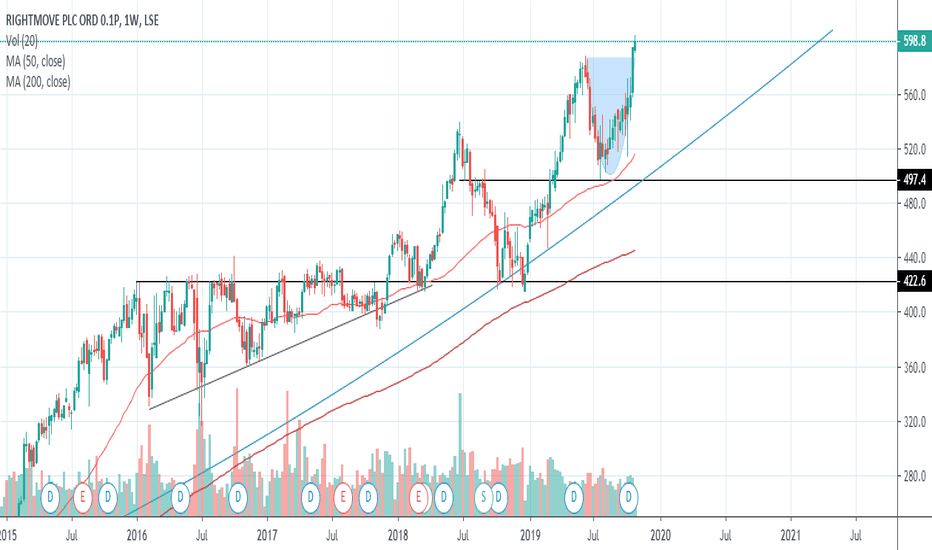

Rightmove Stock Analysis - London Market PlaceBased on the below fundamental analysis and technical analysis (breakout of resistance) the idea is to go long

Good news for property owners from the Halifax Index meant investor confidence grew in the market.

Shares in property portal Rightmove (RMV.L) surged on Friday as investors looked past a

Rightmove PLC 6 RRR shortTrading Methodology:

1. An asymmetric bullish/bearish pennant is drawn using ascending and descending curved trend lines with a minimum of three price action touche points per line. The direction is determined by the previous trend.

2. The angle tool is applied from the earliest two trend touch po

Rightmove Making The Right MovesLast post: June 14th. See chart .

Review: Price had started trending strong after breaking through resistance.

Update: Price continues to trend to the upside and still looks strong.

Conclusion: We will be looking for long opportunities following the next breakout.

Any comments or questions, d

Rightmove Still TrendingLast post: May 27th. See chart .

Review: Price had broken the resistance level and was approaching the £50.00 round number.

Update: Price eventually broke through £50.00 and has gained momentum.

Conclusion: We can look for entry opportunities after a breakout of a previous high on the daily tim

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of RTMVF is 6.99 USD — it has increased by 1.01% in the past 24 hours. Watch Rightmove Plc stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Rightmove Plc stocks are traded under the ticker RTMVF.

Rightmove Plc is going to release the next earnings report on Jul 26, 2024. Keep track of upcoming events with our Earnings Calendar.

RTMVF stock is 1.00% volatile and has beta coefficient of 1.25. Track Rightmove Plc stock price on the chart and check out the list of the most volatile stocks — is Rightmove Plc there?

RTMVF earnings for the last quarter are 0.16 USD per share, whereas the estimation was 0.15 USD resulting in a 2.46% surprise. The estimated earnings for the next quarter are 0.16 USD per share. See more details about Rightmove Plc earnings.

Rightmove Plc revenue for the last quarter amounts to 227.78 M USD despite the estimated figure of 227.20 M USD. In the next quarter revenue is expected to reach 236.31 M USD.

Yes, you can track Rightmove Plc financials in yearly and quarterly reports right on TradingView.

RTMVF net income for the last quarter is 126.93 M USD, while the quarter before that showed 126.22 M USD of net income which accounts for 0.56% change. Track more Rightmove Plc financial stats to get the full picture.

Today Rightmove Plc has the market capitalization of 5.40 B, it has decreased by 3.72% over the last week.

Rightmove Plc dividend yield was 1.62% in 2023, and payout ratio reached 37.97%. The year before the numbers were 1.66% and 36.28% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, RTMVF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Rightmove Plc stock right from TradingView charts — choose your broker and connect to your account.

RTMVF reached its all-time high on Jun 22, 2018 with the price of 70.85 USD, and its all-time low was 2.53 USD and was reached on Dec 4, 2008. View more price dynamics on RTMVF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Rightmove Plc technincal analysis shows the neutral today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Rightmove Plc stock shows the sell signal. See more of Rightmove Plc technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on Rightmove Plc future price: according to them, RTMVF price has a max estimate of 9.51 USD and a min estimate of 5.60 USD. Watch RTMVF chart and read a more detailed Rightmove Plc stock forecast: see what analysts think of Rightmove Plc and suggest that you do with its stocks.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Rightmove Plc EBITDA is 334.82 M USD, and current EBITDA margin is 72.19%. See more stats in Rightmove Plc financial statements.