PYPL Weekly: Earnings Catalyst + Bullish AccumulationPYPL QuantSignals V4 Weekly 2026-01-28

Katy AI: +3.82% upside → $56.22 target

Institutional Flow: Upside strike accumulation

Technical State: Oversold → asymmetric bounce potential

Catalyst: Q4 earnings window → short-cover risk

Structure: Defined-risk, event-driven setup

🎯 Key Price Levels

C

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.04 USD

4.15 B USD

31.79 B USD

934.72 M

About PayPal Holdings, Inc.

Sector

CEO

James Alexander Chriss

Website

Headquarters

San Jose

Founded

1998

IPO date

Jul 20, 2015

Identifiers

3

ISIN US70450Y1038

PayPal Holdings, Inc. engages in the development of technology platforms that enable digital payments and simplifies commerce experiences on behalf of merchants and consumers worldwide. Its solutions include PayPal, PayPal Credit, Braintree, Venmo, Xoom, and Paydiant products. The firm also enables consumers to exchange funds with merchants using funding sources, which include bank account, PayPal account balance, PayPal Credit account, credit, and debit card or other stored value products. It operates through United States and Other Countries geographical segments. The company was founded in December 1998 and is headquartered in San Jose, CA.

Related stocks

PYPL Bearish BiasPayPal (PYPL) is trying to stabilize after a long, multi-timeframe downtrend, but the bigger picture remains heavy. News flow is mixed—AI partnerships and M&A efforts are constructive, yet analyst caution, insider selling, and legal headline risk keep a lid on sentiment. Technically, that aligns wit

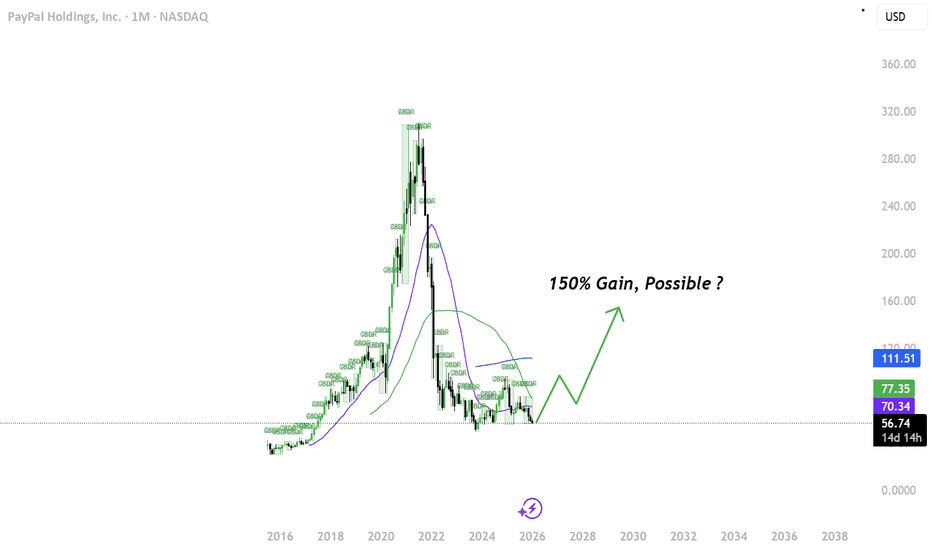

PYPL amazing entryI am looking at PYPL again after amazing run last time (see my previous trade idea here: ). This time I think we are set up for much bigger reversal on this stock with very strong double bottom on multiple timeframes (monthly and then locally daily with double bullish divergence). The fundamentals

PayPal Long Trading Fam,

Because I kept my stops fairly tight on my last entry into PYPL, I was stopped out. I was okay with that. However, since that time, I have received two more buy signals with my Pivot Zones indicator. I can't ignore these signals. I have re-entered at a price of $59.53 with a 1:4 rrr. S

PayPal Limbo: Too Weak to Fly, Too Dead to FallPayPal is sitting around $56 , which is basically the tariff low , the level where the market already dumped its fear and walked away. The price can absolutely slip below $56 , because stocks love humiliating anyone who thinks they found the bottom. But once it’s done embarrassing traders, it usu

Is Paypal a good buy ? - AnalysisWhy PayPal Stock Has Dropped ~80% From Its Highs

PayPal’s share price decline has been driven by several structural and market factors:

1. Growth Slowdown After Pandemic Surge

After booming during the pandemic, PayPal’s revenue growth slowed considerably, more moderate growth rather than rapid

PYPL Long trading/investing opportunity 1I expect a swing of about $15-$20 all the way up to $75+- around 1-3-6-12 months max.

I am risking money.

My entry price is $57.00

This is a buy and hold trade, long-term swing trade to short term investing.

PayPal is close to a long-term historic low again after going sideways from its massive

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PYPL5415329

PayPal Holdings, Inc. 5.25% 01-JUN-2062Yield to maturity

5.81%

Maturity date

Jun 1, 2062

US70450YAM5

PayPal Holdings, Inc. 5.05% 01-JUN-2052Yield to maturity

5.76%

Maturity date

Jun 1, 2052

PYPL5815519

PayPal Holdings, Inc. 5.5% 01-JUN-2054Yield to maturity

5.73%

Maturity date

Jun 1, 2054

US70450YAJ29

PayPal Holdings, Inc. 3.25% 01-JUN-2050Yield to maturity

5.72%

Maturity date

Jun 1, 2050

PYPL6020599

PayPal Holdings, Inc. 5.1% 01-APR-2035Yield to maturity

4.92%

Maturity date

Apr 1, 2035

PYPL5815518

PayPal Holdings, Inc. 5.15% 01-JUN-2034Yield to maturity

4.82%

Maturity date

Jun 1, 2034

US70450YAL7

PayPal Holdings, Inc. 4.4% 01-JUN-2032Yield to maturity

4.47%

Maturity date

Jun 1, 2032

US70450YAH6

PayPal Holdings, Inc. 2.3% 01-JUN-2030Yield to maturity

4.22%

Maturity date

Jun 1, 2030

US70450YAE3

PayPal Holdings, Inc. 2.85% 01-OCT-2029Yield to maturity

4.12%

Maturity date

Oct 1, 2029

2PPA

PayPal Holdings, Inc. 2.65% 01-OCT-2026Yield to maturity

3.99%

Maturity date

Oct 1, 2026

PYPL6020597

PayPal Holdings, Inc. 4.45% 06-MAR-2028Yield to maturity

3.90%

Maturity date

Mar 6, 2028

See all PYPL bonds

Frequently Asked Questions

The current price of PYPL is 52.69 USD — it has decreased by −0.79% in the past 24 hours. Watch PayPal Holdings, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange PayPal Holdings, Inc. stocks are traded under the ticker PYPL.

PYPL stock has fallen by −7.28% compared to the previous week, the month change is a −10.74% fall, over the last year PayPal Holdings, Inc. has showed a −41.14% decrease.

We've gathered analysts' opinions on PayPal Holdings, Inc. future price: according to them, PYPL price has a max estimate of 105.00 USD and a min estimate of 50.00 USD. Watch PYPL chart and read a more detailed PayPal Holdings, Inc. stock forecast: see what analysts think of PayPal Holdings, Inc. and suggest that you do with its stocks.

PYPL reached its all-time high on Jul 26, 2021 with the price of 310.16 USD, and its all-time low was 30.00 USD and was reached on Aug 24, 2015. View more price dynamics on PYPL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PYPL stock is 2.02% volatile and has beta coefficient of 1.27. Track PayPal Holdings, Inc. stock price on the chart and check out the list of the most volatile stocks — is PayPal Holdings, Inc. there?

Today PayPal Holdings, Inc. has the market capitalization of 49.30 B, it has decreased by −0.68% over the last week.

Yes, you can track PayPal Holdings, Inc. financials in yearly and quarterly reports right on TradingView.

PayPal Holdings, Inc. is going to release the next earnings report on Feb 3, 2026. Keep track of upcoming events with our Earnings Calendar.

PYPL earnings for the last quarter are 1.34 USD per share, whereas the estimation was 1.20 USD resulting in a 11.43% surprise. The estimated earnings for the next quarter are 1.29 USD per share. See more details about PayPal Holdings, Inc. earnings.

PayPal Holdings, Inc. revenue for the last quarter amounts to 8.42 B USD, despite the estimated figure of 8.24 B USD. In the next quarter, revenue is expected to reach 8.79 B USD.

PYPL net income for the last quarter is 1.25 B USD, while the quarter before that showed 1.26 B USD of net income which accounts for −1.03% change. Track more PayPal Holdings, Inc. financial stats to get the full picture.

Yes, PYPL dividends are paid quarterly. The last dividend per share was 0.14 USD. As of today, Dividend Yield (TTM)% is 0.27%. Tracking PayPal Holdings, Inc. dividends might help you take more informed decisions.

PayPal Holdings, Inc. dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 1, 2026, the company has 24.4 K employees. See our rating of the largest employees — is PayPal Holdings, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PayPal Holdings, Inc. EBITDA is 7.32 B USD, and current EBITDA margin is 21.35%. See more stats in PayPal Holdings, Inc. financial statements.

Like other stocks, PYPL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PayPal Holdings, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PayPal Holdings, Inc. technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PayPal Holdings, Inc. stock shows the sell signal. See more of PayPal Holdings, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.