TCW Trican Bullish thesis around this company revolves around the continuing pick up in drilling and well activities throughout alberta, saskatchewan leading to increases demand for their services which they have already talked about in most recent earnings filed.

They also highlighted having issues finding en

Next report date

Report period

Q1 2024

EPS estimate

0.12USD

Revenue estimate

209.86 MUSD

0.42USD

91.30 MUSD

733.89 MUSD

206.32 M

About TRICAN WELL SERVICE

Sector

Industry

CEO

Bradley P. D. Fedora

Website

Headquarters

Calgary

Employees (FY)

1.2 K

Founded

1979

FIGI

BBG000CF9654

Trican Well Service Ltd. engages in the provision of products, equipment, services, and technology used in drilling, completion, stimulation, and reworking of oil and gas wells primarily through its continuing pressure pumping operations in Canada. The company was founded on April 11, 1979 and is headquartered in Calgary, Canada.

Trican, a compelling opportunity.Trican Well Service has come along way since they were last trading at lowly levels in 2016. The company has sold some overseas divisions and paid off mostly all their debt, acquired their largest Canadian competitor in 2017, Canyon Tech. For the past few years they have been re-purchasing their o

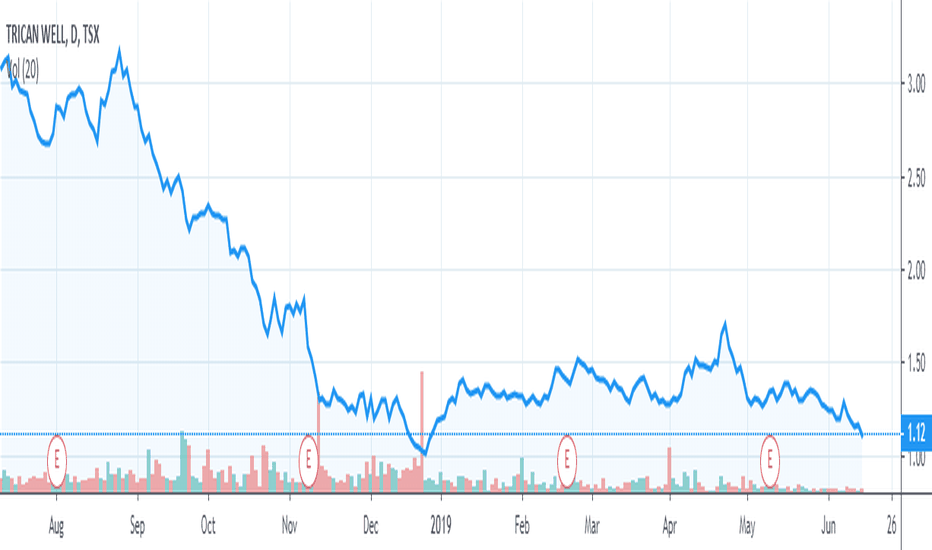

$Oil rallies on positive API - Long order filled for $TCWA buy order that I placed months ago for Trican Well Services ($TCW) was triggered at today's open. API numbers for Oil appears to have been released. I have set my s/l around $3.00 for the time being. I plan to hold this trade for a few weeks, possibly longer. Parabolic SAR has turned Bullish but w

TCW Counter Trend OpportunityThe price of this stock is inside a descending channel. The lower black line is the support while the 50 MA is the acting resistance level.

I think the price would hit around $2.83 being its support level. I will buy with 2 confirming candles and sell once it hits the resistance level which is the

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of TOLWF is 3.16 USD — it has increased by 1.28% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Trican Well Service Ltd. stocks are traded under the ticker TOLWF.

Trican Well Service Ltd. is going to release the next earnings report on May 13, 2024. Keep track of upcoming events with our Earnings Calendar.

TOLWF stock is 1.27% volatile and has beta coefficient of 0.13. Check out the list of the most volatile stocks — is Trican Well Service Ltd. there?

TOLWF earnings for the last quarter are 0.13 USD per share, whereas the estimation was 0.13 USD resulting in a −4.21% surprise. The estimated earnings for the next quarter are 0.10 USD per share. See more details about Trican Well Service Ltd. earnings.

Trican Well Service Ltd. revenue for the last quarter amounts to 185.87 M USD despite the estimated figure of 198.38 M USD. In the next quarter revenue is expected to reach 184.02 M USD.

Yes, you can track Trican Well Service Ltd. financials in yearly and quarterly reports right on TradingView.

TOLWF stock has risen by 0.64% compared to the previous week, the month change is a 5.69% rise, over the last year Trican Well Service Ltd. has showed a 34.47% increase.

TOLWF net income for the last quarter is 21.70 M USD, while the quarter before that showed 26.78 M USD of net income which accounts for −18.96% change. Track more Trican Well Service Ltd. financial stats to get the full picture.

Today Trican Well Service Ltd. has the market capitalization of 660.09 M, it has decreased by 0.67% over the last week.

Yes, TOLWF dividends are paid quarterly. The last dividend per share was 0.03 USD. As of today, Dividend Yield (TTM)% is 3.81%. Tracking Trican Well Service Ltd. dividends might help you take more informed decisions.

Like other stocks, TOLWF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Trican Well Service Ltd. stock right from TradingView charts — choose your broker and connect to your account.

As of Apr 27, 2024, the company has 1.20 K employees. See our rating of the largest employees — is Trican Well Service Ltd. on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Trican Well Service Ltd. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Trican Well Service Ltd. stock shows the buy signal. See more of Trican Well Service Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on Trican Well Service Ltd. future price: according to them, TOLWF price has a max estimate of 4.97 USD and a min estimate of 3.32 USD. Read a more detailed Trican Well Service Ltd. forecast: see what analysts think of Trican Well Service Ltd. and suggest that you do with its stocks.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Trican Well Service Ltd. EBITDA is 177.43 M USD, and current EBITDA margin is 24.18%. See more stats in Trican Well Service Ltd. financial statements.