United Health - Losing $60bln in one day!📢United Health ( NYSE:UNH ) still overall remains bullish:

🔎Analysis summary:

Just within a couple of hours, United Health wiped out $60bln. And despite this massive -20% drop, United Health is approaching a major confluence of support. After we see bullish confirmation, a rejection higher is

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12.06 B USD

447.57 B USD

904.05 M

About UnitedHealth Group Incorporated

Sector

Industry

CEO

Stephen J. Hemsley

Website

Headquarters

Eden Prairie

Founded

1977

IPO date

Oct 17, 1984

Identifiers

3

ISIN US91324P1021

UnitedHealth Group, Inc. engages in the provision of health care coverage, software, and data consultancy services. It operates through the following segments: UnitedHealthcare, OptumHealth, OptumInsight, and OptumRx. The UnitedHealthcare segment utilizes Optum's capabilities to help coordinate patient care, improve affordability of medical care, analyze cost trends, manage pharmacy benefits, work with care providers more effectively, and create a simpler consumer experience. The OptumHealth segment provides health and wellness care, serving the broad health care marketplace including payers, care providers, employers, government, life sciences companies, and consumers. The OptumInsight segment focuses on data and analytics, technology, and information to help major participants in the healthcare industry. The OptumRx segment offers pharmacy care services. The company was founded by Richard T. Burke in January 1977 and is headquartered in Eden Prairie, MN.

Related stocks

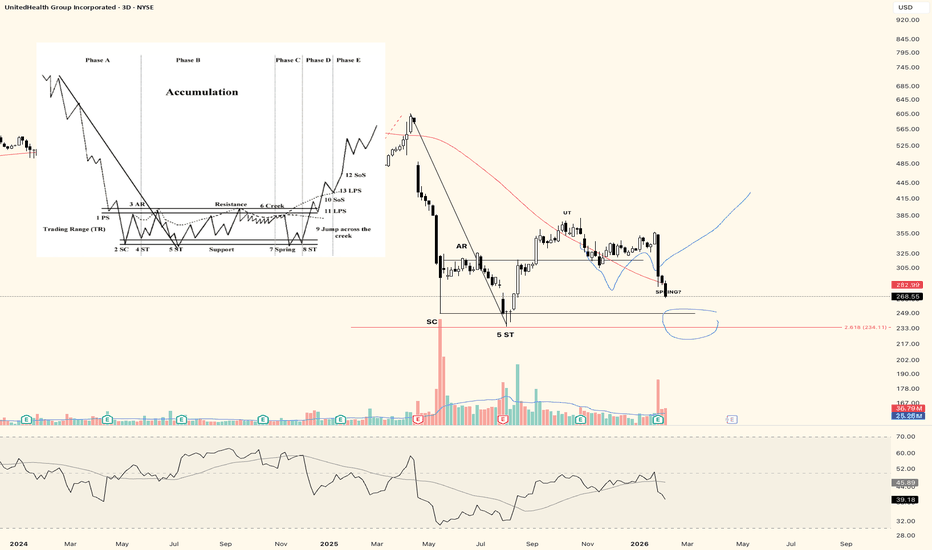

UNH heading for spring-phase to finish the accumulation?Seems like UNH is currently undergoing a spring-phase. Which, if true, means we're heading towards the last phases of the accumulation range.

After spring-phase, we can slowly move back to top of range and eventually start a mark-up phase.

For now, I don't know where the bottom is. I personally d

UnitedHealth (UNH) at $286: Oversold Bounce Setup Into EarningsCurrent Price: 286.93 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 61%(Price is sitting near widely cited $280 support with oversold RSI and bullish skew in recent X trading chatter, but limited professional trader video coverage keeps confidence moderate.)

Targets

UNH trade idearelated to my last post if tech gets the much-needed correction healthcare should catch some wind in its sails and UNH just looks to juicy not to build a long position willing to take my time and sit on this don't mind collecting a nice little DIV while i wait $464 is my major take profit target

UNH - C Wave Nearing it's endIf you look at this stock from a price-to-book ratio perspective, it hasn't been on sale like this since 2013. Warren Buffet bought a decent sized stake in this company mid last year, fundamentals here are solid, just waiting for the rest of the market to catch up. This is essentially free long-term

Golden Cross (MA50 > MA200)The historical data shows a significant statistical edge, particularly for mid-term holding periods.

Key Statistics:

* Signal: Golden Cross (MA50 > MA200)

* Historical Win Rate (6 Months): 80.95%

* Average Return (6 Months): +17.14%

* Backtest Period: 1984 – 2026

Analysis:

The data suggests t

You will ask, "how did he know UNH would do that"?On Sept 29th, I suggested that UNH was topping and would retrace to my "probable" target T1.

As of yesterday, that target was hit as anticipated. In my opinion, this T1 target is a good entry long term. The only question that remains is will UNH swipe the lows (T2). It is "possible" but not probab

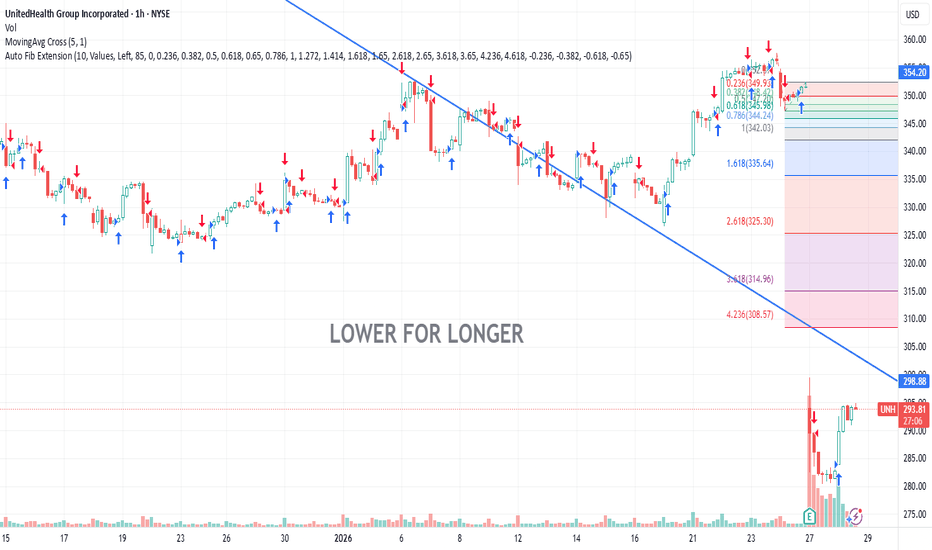

LOWER FOR LONGER! UNH fails to SCALE Running the Numbers: UnitedHealth Group (UNH)

Now let’s pretend we’re serious adults for a moment and talk UnitedHealth Group (UNH)—because if you’re going to suffer, you might as well suffer with spreadsheets.

Cash Flow: The Part That Actually Matters

UNH reported ~$19.7 billion in operating cash

UNH: adding into fear after a completed ABC correctionThesis

NYSE:UNH has completed its corrective ABC structure and is stabilizing within Wave 2, offering long-term accumulation opportunities in a proven cash-flow compounder.

Context

- Daily and weekly timeframes

- Deep corrective phase already completed

- Long-term uptrend remains intact on the

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UNH5856557

UnitedHealth Group Incorporated 5.75% 15-JUL-2064Yield to maturity

5.90%

Maturity date

Jul 15, 2064

UNH5494738

UnitedHealth Group Incorporated 6.05% 15-FEB-2063Yield to maturity

5.87%

Maturity date

Feb 15, 2063

UNH5415944

UnitedHealth Group Incorporated 4.95% 15-MAY-2062Yield to maturity

5.84%

Maturity date

May 15, 2062

UNH5776243

UnitedHealth Group Incorporated 5.5% 15-APR-2064Yield to maturity

5.83%

Maturity date

Apr 15, 2064

UNH5559766

UnitedHealth Group Incorporated 5.2% 15-APR-2063Yield to maturity

5.83%

Maturity date

Apr 15, 2063

UNH5494737

UnitedHealth Group Incorporated 5.875% 15-FEB-2053Yield to maturity

5.75%

Maturity date

Feb 15, 2053

UNH4987619

UnitedHealth Group Incorporated 3.125% 15-MAY-2060Yield to maturity

5.75%

Maturity date

May 15, 2060

UNH5856556

UnitedHealth Group Incorporated 5.625% 15-JUL-2054Yield to maturity

5.74%

Maturity date

Jul 15, 2054

UNH4779905

UnitedHealth Group Incorporated 4.45% 15-DEC-2048Yield to maturity

5.73%

Maturity date

Dec 15, 2048

UNH4862956

UnitedHealth Group Incorporated 3.875% 15-AUG-2059Yield to maturity

5.73%

Maturity date

Aug 15, 2059

UNH5776242

UnitedHealth Group Incorporated 5.375% 15-APR-2054Yield to maturity

5.72%

Maturity date

Apr 15, 2054

See all UNH bonds

Frequently Asked Questions

The current price of UNH is 283.24 USD — it has increased by 2.08% in the past 24 hours. Watch UnitedHealth Group Incorporated stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange UnitedHealth Group Incorporated stocks are traded under the ticker UNH.

UNH stock has fallen by −1.10% compared to the previous week, the month change is a −18.31% fall, over the last year UnitedHealth Group Incorporated has showed a −47.53% decrease.

We've gathered analysts' opinions on UnitedHealth Group Incorporated future price: according to them, UNH price has a max estimate of 440.00 USD and a min estimate of 255.00 USD. Watch UNH chart and read a more detailed UnitedHealth Group Incorporated stock forecast: see what analysts think of UnitedHealth Group Incorporated and suggest that you do with its stocks.

UNH stock is 3.01% volatile and has beta coefficient of 0.23. Track UnitedHealth Group Incorporated stock price on the chart and check out the list of the most volatile stocks — is UnitedHealth Group Incorporated there?

Today UnitedHealth Group Incorporated has the market capitalization of 252.65 B, it has decreased by −2.98% over the last week.

Yes, you can track UnitedHealth Group Incorporated financials in yearly and quarterly reports right on TradingView.

UnitedHealth Group Incorporated is going to release the next earnings report on Apr 22, 2026. Keep track of upcoming events with our Earnings Calendar.

UNH earnings for the last quarter are 2.11 USD per share, whereas the estimation was 2.10 USD resulting in a 0.27% surprise. The estimated earnings for the next quarter are 6.78 USD per share. See more details about UnitedHealth Group Incorporated earnings.

UnitedHealth Group Incorporated revenue for the last quarter amounts to 113.22 B USD, despite the estimated figure of 113.77 B USD. In the next quarter, revenue is expected to reach 109.65 B USD.

UNH net income for the last quarter is 10.00 M USD, while the quarter before that showed 2.35 B USD of net income which accounts for −99.57% change. Track more UnitedHealth Group Incorporated financial stats to get the full picture.

Yes, UNH dividends are paid quarterly. The last dividend per share was 2.21 USD. As of today, Dividend Yield (TTM)% is 3.13%. Tracking UnitedHealth Group Incorporated dividends might help you take more informed decisions.

UnitedHealth Group Incorporated dividend yield was 2.64% in 2025, and payout ratio reached 65.97%. The year before the numbers were 1.62% and 52.75% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, UNH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade UnitedHealth Group Incorporated stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So UnitedHealth Group Incorporated technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating UnitedHealth Group Incorporated stock shows the sell signal. See more of UnitedHealth Group Incorporated technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.