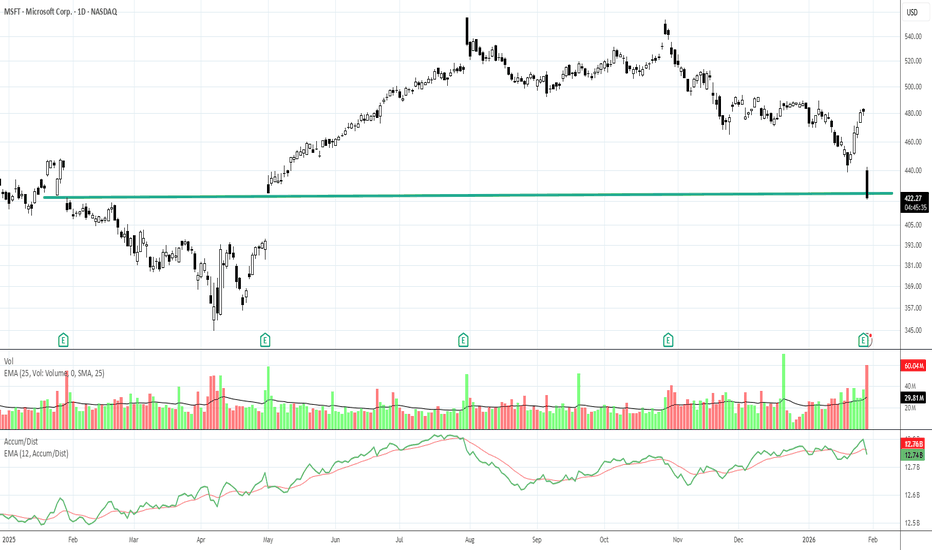

MICROSOFT on a short-term rebound before drop to $410.Around 3 months ago (November 06 2025, see chart below) we gave a Sell Signal on Microsoft (MSFT) targeting $450:

The signal was confirmed and the target got hit last week, with the price immediately rebounding as it hit the 0.5 Fibonacci retracement level from the April 07 2025 Low.

This Low

Key facts today

Microsoft (MSFT) reported Q2 2026 earnings with revenue of $81.3 billion, up 17% year-on-year, and earnings per share of $4.14, a 24% increase.

Microsoft shares dropped about 3% amid rising competition in software from AI advancements. This decline followed a broader tech selloff after its earnings report, raising margin concerns.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

16.05 USD

101.83 B USD

281.72 B USD

7.32 B

About Microsoft Corp.

Sector

Industry

CEO

Satya Nadella

Website

Headquarters

Redmond

Founded

1975

IPO date

Mar 13, 1986

Identifiers

3

ISIN US5949181045

Microsoft Corp engages in the development and support of software, services, devices, and solutions. It operates through the following business segments: Productivity and Business Processes; Intelligent Cloud; and More Personal Computing. The Productivity and Business Processes segment comprises products and services in the portfolio of productivity, communication, and information services of the company spanning a variety of devices and platform. The Intelligent Cloud segment refers to the public, private, and hybrid serve products and cloud services of the company which can power modern business. The More Personal Computing segment encompasses products and services geared towards the interests of end users, developers, and IT professionals across all devices. The firm also offers operating systems; cross-device productivity applications; server applications; business solution applications; desktop and server management tools; software development tools; video games; personal computers, tablets; gaming and entertainment consoles; other intelligent devices; and related accessories. The company was founded by Paul Gardner Allen and William Henry Gates III in 1975 and is headquartered in Redmond, WA.

Related stocks

Microsoft - The worst day in 5 years!🚀Microsoft ( NASDAQ:MSFT ) remains bullish despite the crash:

🔎Analysis summary:

Today Microsoft created its worst day in five years. But at the same time, Microsoft is also approaching a significant confluence of support. And if we soon see bullish confirmation, Microsoft will just create an

MSFT Near a Decision Area — How I’m Approaching Feb 21-Hour View — Setting the Context

On the 1-hour timeframe, MSFT is still in a bearish structure. Price has been making lower highs, and the recent bounce doesn’t change that yet. It looks more like a pause after selling rather than a confirmed reversal.

As long as price stays below the downward chan

Microsoft Flash Crash. What comes next?In this tutorial, you will learn how retail news distorts and provides misinformation and false information that IF you listen to it, you will perpetuate your losses and lower profits.

Dark Pools have established the fundamental level months ago that they determined was appropriate for the current c

$MSFT: Correction Just Getting Started?NASDAQ:MSFT on the monthly chart really looks like the party might be over for a while. It’s tempting to step in here: price is tagging the 0.618 retracement from the April 2025 low, and today alone it’s down nearly 12%.

But what if that top (5) actually marked the end of Elliott wave 5?

In that

Microsoft (MSFT) Shares Post a Record DeclineMicrosoft (MSFT) Shares Post a Record Decline

On Wednesday, after the close of the regular trading session, Microsoft (MSFT) released its quarterly earnings report, which exceeded analysts’ expectations:

→ Earnings per share: actual $4.14, forecast $3.90;

→ Gross revenue: actual $81.2bn, forecas

Microsoft: The "Bull Trap" & The Fortress TestThe market played a trick on the bulls today.

Microsoft closed the regular session at $481, seemingly confirming a breakout above the $475 resistance.

The post-market drop to $452 invalidates that breakout. It suggests the $481 move was a "Bull Trap" designed to suck in late buyers before flushing

$MSFT I expect further downsideI see a lot of investors buying NASDAQ:MSFT , but in my view it’s far too early. The technical structure is still bearish, and I expect further downside.

On the fundamental side, Microsoft Office will become far less essential as AI increasingly automates these tasks. Despite the Copilot narrative

Microsoft (NASDAQ: $MSFT) Sheds ~$360 Billion in Market ValueMicrosoft (NASDAQ: NASDAQ:MSFT ) took a shocking tumble this week after reporting its second-quarter earnings for fiscal 2026, wiping out roughly $360 billion in market value in a single session as shares plunged about 10–12% amid heavy selling. This huge decline not only hit Microsoft’s valuation

Spatial Pattern Recognition Skills SPRS Learn Spatial Pattern recognition skills to hone your trading using both candlestick patterns, support and resistance and Hybrid leading Indicators that track all the market activity. MSFT reports after the market closes today.

Once you learn the basics of candlesticks it is important to increase yo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ATVI5026499

Activision Blizzard, Inc. 2.5% 15-SEP-2050Yield to maturity

6.39%

Maturity date

Sep 15, 2050

ATVI4499883

Activision Blizzard, Inc. 4.5% 15-JUN-2047Yield to maturity

6.31%

Maturity date

Jun 15, 2047

See all MSFT bonds

Frequently Asked Questions

The current price of MSFT is 411.21 USD — it has decreased by −2.26% in the past 24 hours. Watch Microsoft Corp. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Microsoft Corp. stocks are traded under the ticker MSFT.

MSFT stock has fallen by −12.65% compared to the previous week, the month change is a −14.57% fall, over the last year Microsoft Corp. has showed a −0.09% decrease.

We've gathered analysts' opinions on Microsoft Corp. future price: according to them, MSFT price has a max estimate of 730.00 USD and a min estimate of 450.00 USD. Watch MSFT chart and read a more detailed Microsoft Corp. stock forecast: see what analysts think of Microsoft Corp. and suggest that you do with its stocks.

MSFT reached its all-time high on Jul 31, 2025 with the price of 555.45 USD, and its all-time low was 0.09 USD and was reached on Mar 13, 1986. View more price dynamics on MSFT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MSFT stock is 3.62% volatile and has beta coefficient of 0.94. Track Microsoft Corp. stock price on the chart and check out the list of the most volatile stocks — is Microsoft Corp. there?

Today Microsoft Corp. has the market capitalization of 3.14 T, it has decreased by −7.05% over the last week.

Yes, you can track Microsoft Corp. financials in yearly and quarterly reports right on TradingView.

Microsoft Corp. is going to release the next earnings report on Apr 28, 2026. Keep track of upcoming events with our Earnings Calendar.

MSFT earnings for the last quarter are 4.14 USD per share, whereas the estimation was 3.91 USD resulting in a 6.00% surprise. The estimated earnings for the next quarter are 4.03 USD per share. See more details about Microsoft Corp. earnings.

Microsoft Corp. revenue for the last quarter amounts to 81.27 B USD, despite the estimated figure of 80.31 B USD. In the next quarter, revenue is expected to reach 81.30 B USD.

MSFT net income for the last quarter is 38.46 B USD, while the quarter before that showed 27.75 B USD of net income which accounts for 38.60% change. Track more Microsoft Corp. financial stats to get the full picture.

Yes, MSFT dividends are paid quarterly. The last dividend per share was 0.91 USD. As of today, Dividend Yield (TTM)% is 0.80%. Tracking Microsoft Corp. dividends might help you take more informed decisions.

Microsoft Corp. dividend yield was 0.67% in 2025, and payout ratio reached 24.34%. The year before the numbers were 0.67% and 25.42% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 3, 2026, the company has 228 K employees. See our rating of the largest employees — is Microsoft Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Microsoft Corp. EBITDA is 184.76 B USD, and current EBITDA margin is 57.74%. See more stats in Microsoft Corp. financial statements.

Like other stocks, MSFT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Microsoft Corp. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Microsoft Corp. technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Microsoft Corp. stock shows the sell signal. See more of Microsoft Corp. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.