TSLA is on a channel and if we break this we're going to 120.. What makes this different then the other bounces is that the 50MA has broken the 200MA which signals more weakness then just a bounce.. Keep a close eye on this one or if you have $400 laying around you can buy the May put option at 120 now..

BKNG is known for making some huge candles. I like this set up as the chart seems weak for a nice pull back to some support. I like the 10 EMA on the weekly as that support.

All these people are trapped short here. Anyone that is short is going to be forced to sell to get out which will make this a great swing trade higher from here. I love love love the EMAs breaking out also.

I like this break for a swing trade back to current highs. I like the EMAs back to 10 20 50's over each other for the swing trade. Let it break and then get in. One to put on your watch list.

If we can beak this entry line we have a chance to catch a nice bill paying trade for some small traders out there. Exit would be the weekly 50 EMA as the nearest support. For smaller accounts just buy the put option closes to the exit as you can get it.. Always wait for the break of the entry line.

I like this head and shoulders on the monthly chart here.. If we break the shoulders the nearest support is the 100MA on the monthly. This could be fast with the market or over a few months so go out a few on the options..

I like the break higher if we can get over this resistance. It should travel to the 100MA on the daily chart. Wait till we break then get in.

We have another money drop coming if we can break this entry line. I don't see any support until the monthly 100MA. Market is still weak and recession is coming.

I like the break from Friday and if the open is below the entry today then I'm taking this to the next support which is the 10EMA on the monthly chart. Great trade of smaller accounts because you can buy the exit level ($500 put) for cheaper then at the money.

We got another pretty solid setup on CMG. If we can break this support there is a nice pot of gold at the end of the rainbow. Not a cheap option play, but also makes a lot of money. This could bounce here and retest, so put this one on your watch list and set alarm so you don't forget it.

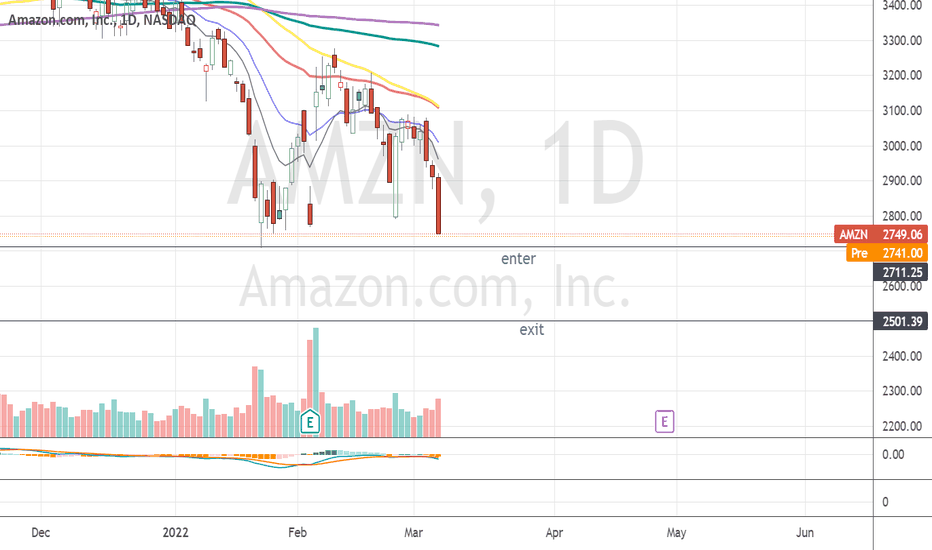

Another big move on AMZN still to come. If we can break this very strong support I like this monthly support on the 50 EMA. It wouldn't surprise me if we hold this support for a few days before it breaks. But with this market anything can happen. Fantastic bill paying trade for new traders out there.

Very nice strong support that could be broken here. If we break this support I see this going to the 50ema on Monthly chart. This would be a great little trade. Again, news on the war, oil and inflation can make any trade tuff today. We have seen some whipsaw movement. One to put on your Alert for sure.

SBUX getting hit hard right now.. I like this strong support break to the 100MA on the monthly chart. Will be a swing trade so if using options give yourself some time.

Another great time to look at BKNG again. Here we are again at the same resistance that we have made so much money off in the past. Another great setup for some nice cash. Wait till it breaks to get in.

Nice little day trade set up here.. Nice gap down today that trapped some people at open. Should break and find support below.

I love this strong support breaking and going lower from here. If we can break this entry line we should drop to the 20EMA on the monthly for next support. Not a huge money maker trade, but a pretty safe one from the setup. Put options at the money are only about $500 so cheaper for the smaller accounts

This is a nice one to watch in the coming days. Might take a few days or maybe just tomorrow to break this entry line. If we break the enter line, (and strong support 3 times in the past) this is a pretty safe short. I have made a lot of money of this Stock already..

This will be a nice run down to support if we can open below this enter line. I will only take this trade if it opens below this line because of the instability of the market over Ukraine and to trap longs on that one buying candle. I will only take a gap down below this enter line as my key to get it. If it runs without us that's fine, will find another one. We...