The Big Fed Rate Cut Is Here. How Did Markets Do & What’s Next?

“Best we can do is 25bps,” officials, probably, when they gathered to lower the federal funds rate. It wasn’t the 50 basis points some of you had expected. But you also didn’t expect to hear that two more trims are most likely coming by year end.

Let’s talk about that and what it means for your trading.

🎤 Powell Delivers

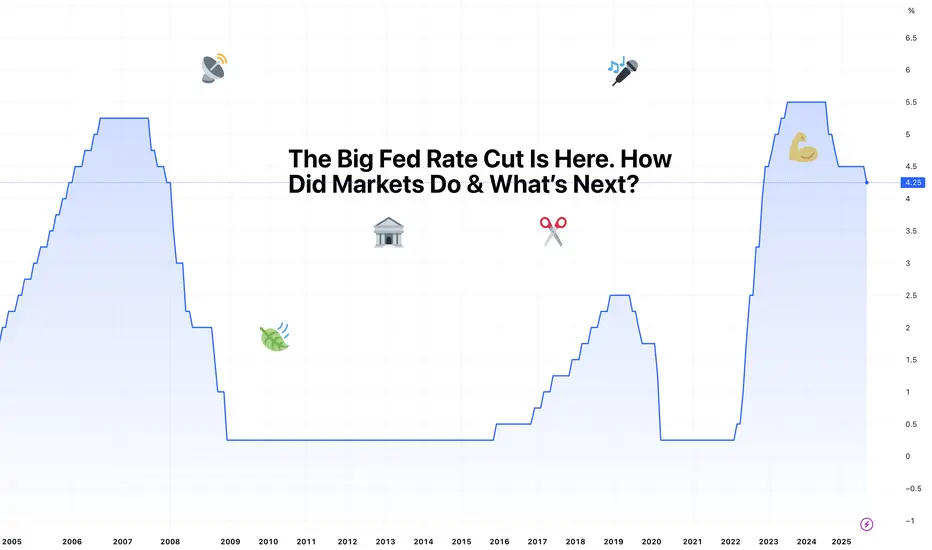

The Federal Reserve finally trimmed rates for the first time in nine months, cutting the federal-funds rate by 25 basis points to 4%–4.25%. This was hardly a surprise.

Markets had already fully priced in a quarter-point move. But the real twist was the Fed boss hinting at two more cuts this year. With just two FOMC meetings on the calendar, it’s pretty clear: unless something changes dramatically, traders should expect a cut at both.

The decision wasn’t unanimous. Newly minted, Trump-appointed Fed governor Stephen Miran wanted to go big or go home with a 50bps slash. Powell, though, balanced his message by saying risks to the labor market had grown while inflation was still running at 2.9% (way above target).

What does this mean? The Fed’s dual mandate of price stability and full employment is officially leaning toward protecting jobs at the risk of flaring up inflation.

💵 Dollar Takes a Dive

The immediate reaction was classic. A weaker dollar is the natural byproduct of lower rates, and the greenback obliged by sliding against major peers.

The

EURUSD pushed toward $1.19, its highest in four years, while the

EURUSD pushed toward $1.19, its highest in four years, while the

GBPUSD tested $1.37 and the

GBPUSD tested $1.37 and the

USDJPY sank below ¥146.

USDJPY sank below ¥146.

For forex traders, this was textbook: lower yields make the dollar less attractive, especially compared to rivals with steadier or higher returns. But that was a reaction to the initial shock.

By early Thursday the dollar bounced back, because markets love to overreact before correcting, but the broader trend is still tilted bearish.

📈 Stocks: Buy the Rumor, Sell the News

Stocks were less enthusiastic. The S&P 500 SPX hovered near flat, the Nasdaq Composite

SPX hovered near flat, the Nasdaq Composite  IXIC slipped 0.3% for a second straight loss, and the Dow Jones

IXIC slipped 0.3% for a second straight loss, and the Dow Jones  DJI managed to buck the trend with a 260-point climb.

DJI managed to buck the trend with a 260-point climb.

The takeaway? Traders had already bought the rumor of rate cuts, jammed their cash into equities, so when Powell delivered the expected 25bps, it wasn’t enough to light another fire.

The bigger hope lies in those promised future cuts, which could set the stage for another push higher – especially if Big Tech earnings hold up through the third quarter. (For the record, earnings season is almost here.)

Thursday's futures contracts were showing a big jump ahead of the opening bell with Nasdaq futures up by more than 1%.

🟡 Gold Shines, Then Stumbles

Gold XAUUSD did what gold usually does when the Fed loosens policy: it powered up. Bullion was surfing on the high point of its all-time record of $3,700, before sliding back under $3,640.

XAUUSD did what gold usually does when the Fed loosens policy: it powered up. Bullion was surfing on the high point of its all-time record of $3,700, before sliding back under $3,640.

What’s the logic behind rising gold prices and a falling dollar? In a low-yield environment, non-yielding assets like gold look more attractive, and a weaker dollar only sweetens the deal for overseas buyers.

Still, this week’s whipsaw reminded everyone that gold is no straight line up – momentum is there, but so are the bears guarding resistance.

🟠 Bitcoin Shrugs

Crypto was more muted. Bitcoin BTCUSD slipped 1.2% after the cut, dipping toward $115,000, only to bounce back above $116,000 the next morning.

BTCUSD slipped 1.2% after the cut, dipping toward $115,000, only to bounce back above $116,000 the next morning.

For the orange coin, the Fed story is just background noise. Institutional inflows and ETF demand remain the key drivers, and traders are still gauging whether crypto wants to behave like a risk asset or play its “digital gold” role.

Still, the OG coin remains off its $124,000 record from mid-August, the market seems caught between consolidation and correction.

⚖️ The Balancing Act

The Fed’s challenge is clear: unemployment is rising, job gains are slowing, and payrolls have been revised lower for months.

At the same time, inflation has crept back up, with core prices still well above target. Cutting too much risks reigniting price pressures; cutting too little risks a labor-market slide that could snowball into recession.

Powell chose the middle ground – a modest 25bps – and teased with two more to calm investor nerves.

👀 What’s Next?

Markets now have a new playbook: watch every jobs report USNFP, every CPI

USNFP, every CPI  USCPI release, and every Powell presser between now and December.

USCPI release, and every Powell presser between now and December.

If job creation continues to cool, the Fed will likely follow through with the cuts. If inflation heats up, those cuts may get scaled back. And if both trends stall, expect chop – the dreaded sideways trade that tests everyone’s patience.

What can you do in this situation? One message is to stay nimble. The dollar’s longer-term weakness is reshuffling the forex space, gold is on the cusp of a breakout, and stocks remain in record territory. And crypto is doing its usual unpredictable mood swinging.

In a nutshell, Powell gave markets a gift in the form of liquidity, but as history reminds us, the Fed giveth and the Fed taketh away.

👉 Off to you: What’s your strategy in this market? Now that you have the cut (and two more likely on the way), are you bullish or bearish? Share your thoughts in the comments!

Let’s talk about that and what it means for your trading.

🎤 Powell Delivers

The Federal Reserve finally trimmed rates for the first time in nine months, cutting the federal-funds rate by 25 basis points to 4%–4.25%. This was hardly a surprise.

Markets had already fully priced in a quarter-point move. But the real twist was the Fed boss hinting at two more cuts this year. With just two FOMC meetings on the calendar, it’s pretty clear: unless something changes dramatically, traders should expect a cut at both.

The decision wasn’t unanimous. Newly minted, Trump-appointed Fed governor Stephen Miran wanted to go big or go home with a 50bps slash. Powell, though, balanced his message by saying risks to the labor market had grown while inflation was still running at 2.9% (way above target).

What does this mean? The Fed’s dual mandate of price stability and full employment is officially leaning toward protecting jobs at the risk of flaring up inflation.

💵 Dollar Takes a Dive

The immediate reaction was classic. A weaker dollar is the natural byproduct of lower rates, and the greenback obliged by sliding against major peers.

The

For forex traders, this was textbook: lower yields make the dollar less attractive, especially compared to rivals with steadier or higher returns. But that was a reaction to the initial shock.

By early Thursday the dollar bounced back, because markets love to overreact before correcting, but the broader trend is still tilted bearish.

📈 Stocks: Buy the Rumor, Sell the News

Stocks were less enthusiastic. The S&P 500

The takeaway? Traders had already bought the rumor of rate cuts, jammed their cash into equities, so when Powell delivered the expected 25bps, it wasn’t enough to light another fire.

The bigger hope lies in those promised future cuts, which could set the stage for another push higher – especially if Big Tech earnings hold up through the third quarter. (For the record, earnings season is almost here.)

Thursday's futures contracts were showing a big jump ahead of the opening bell with Nasdaq futures up by more than 1%.

🟡 Gold Shines, Then Stumbles

Gold

What’s the logic behind rising gold prices and a falling dollar? In a low-yield environment, non-yielding assets like gold look more attractive, and a weaker dollar only sweetens the deal for overseas buyers.

Still, this week’s whipsaw reminded everyone that gold is no straight line up – momentum is there, but so are the bears guarding resistance.

🟠 Bitcoin Shrugs

Crypto was more muted. Bitcoin

For the orange coin, the Fed story is just background noise. Institutional inflows and ETF demand remain the key drivers, and traders are still gauging whether crypto wants to behave like a risk asset or play its “digital gold” role.

Still, the OG coin remains off its $124,000 record from mid-August, the market seems caught between consolidation and correction.

⚖️ The Balancing Act

The Fed’s challenge is clear: unemployment is rising, job gains are slowing, and payrolls have been revised lower for months.

At the same time, inflation has crept back up, with core prices still well above target. Cutting too much risks reigniting price pressures; cutting too little risks a labor-market slide that could snowball into recession.

Powell chose the middle ground – a modest 25bps – and teased with two more to calm investor nerves.

👀 What’s Next?

Markets now have a new playbook: watch every jobs report

If job creation continues to cool, the Fed will likely follow through with the cuts. If inflation heats up, those cuts may get scaled back. And if both trends stall, expect chop – the dreaded sideways trade that tests everyone’s patience.

What can you do in this situation? One message is to stay nimble. The dollar’s longer-term weakness is reshuffling the forex space, gold is on the cusp of a breakout, and stocks remain in record territory. And crypto is doing its usual unpredictable mood swinging.

In a nutshell, Powell gave markets a gift in the form of liquidity, but as history reminds us, the Fed giveth and the Fed taketh away.

👉 Off to you: What’s your strategy in this market? Now that you have the cut (and two more likely on the way), are you bullish or bearish? Share your thoughts in the comments!

Share TradingView with a friend:

tradingview.com/share-your-love/

Read more about the new tools and features we're building for you: tradingview.com/blog/en/

tradingview.com/share-your-love/

Read more about the new tools and features we're building for you: tradingview.com/blog/en/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Share TradingView with a friend:

tradingview.com/share-your-love/

Read more about the new tools and features we're building for you: tradingview.com/blog/en/

tradingview.com/share-your-love/

Read more about the new tools and features we're building for you: tradingview.com/blog/en/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.